Understanding Revocable Beneficiary

- Understanding Revocable Beneficiary. It is standard to designate children and spouses as beneficiaries of the benefits from a life insurance or trust product.

- Naming Multiple Beneficiaries. A policyholder may name multiple revocable beneficiaries. ...

- Irrevocable Beneficiary. A revocable beneficiary is the opposite of an irrevocable beneficiary. ...

What does an irrevocable beneficiary mean?

An irrevocable beneficiary is someone who is named in a life insurance policy, and it is different from the traditional revocable beneficiary, because if the owner of the policy wants to change the beneficiary, the irrevocable beneficiary needs to sign off.

Can I remove a beneficiary from an irrevocable?

The point of irrevocable beneficiary status is its permanency. Generally speaking, an irrevocable beneficiary can only be removed if the beneficiary agrees to be displaced, voluntarily surrendering their status. Investopedia requires writers to use primary sources to support their work.

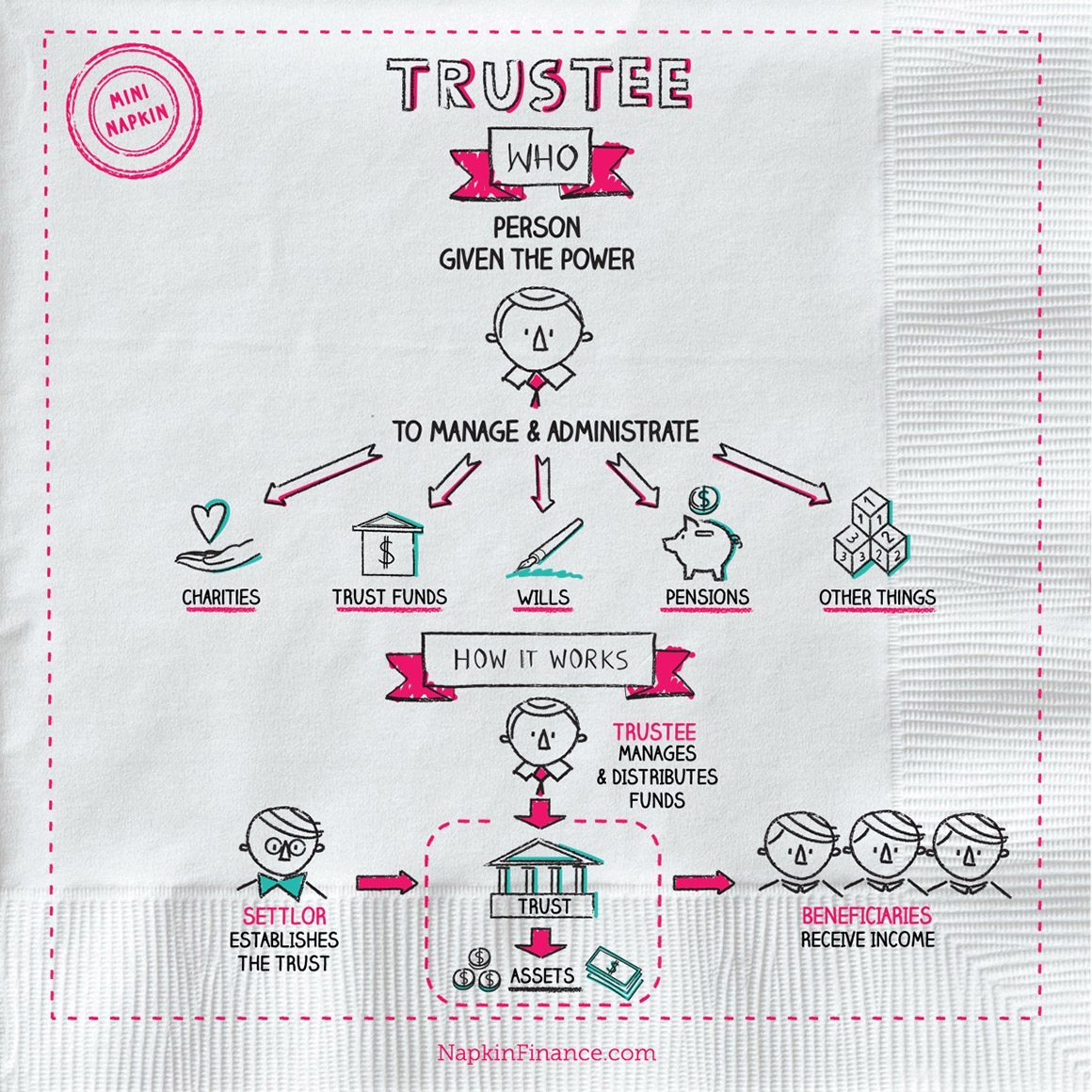

What is the difference between a trustee and a beneficiary?

- The trustee has a fiduciary obligation to act in the best interests of the beneficiary

- The trust beneficiary has certain rights, including petitioning the court to remove the trustee

- Someone can be both the trustee and beneficiary of a trust

Can an executor change the beneficiary?

Yes, an executor can override a beneficiary’s wishes as long as they are following the will or, alternative, any court orders. Executors have a fiduciary duty to the estate beneficiaries requiring them to distribute estate assets as stated in the will.

Who is irrevocable beneficiary?

An irrevocable beneficiary is a person or entity designated to receive the assets in a life insurance policy or a segregated fund contract. An irrevocable beneficiary is a more ironclad version of a beneficiary. Their entitlements are guaranteed, and they often must approve any changes in the policy.

What is the primary difference between a revocable and an irrevocable beneficiary?

Most beneficiaries are revocable beneficiaries, which means you can change who you name as the beneficiary later. An irrevocable beneficiary is a person who cannot be easily changed or removed from your life insurance policy.

How do you know if a beneficiary is irrevocable?

The difference between the two is significant. An irrevocable beneficiary must agree to any changes made to a policy, and they can't be removed from a policy without consent. A revocable beneficiary on the other hand, has no say in whether they remain a beneficiary or as to the payouts of an insurance policy.

What are the 3 types of beneficiaries?

There are different types of beneficiaries; Irrevocable, Revocable and Contingent.

Who has the right to change a revocable beneficiary?

A revocable beneficiary is a more flexible option. It allows the policy owner to change the beneficiary on their policy without restriction. To make a change, the policy owner simply submits the request to the insurance company, and there's no need to notify or ask the current beneficiaries before proceeding.

When can a policy owner change revocable beneficiary?

When can a policyowner change a revocable beneficiary? With a revocable beneficiary designation, the policyowner may change the beneficiary at any time without notifying or getting permission from the beneficiary.

Can policy owner change irrevocable beneficiary?

Even if you want to change the beneficiary on your policy, an irrevocable beneficiary will still be able to receive the death benefit because of the terms of the contract. The only way to remove an irrevocable beneficiary from your policy is for them to agree to forfeit their rights to the money.

What is the order of beneficiary?

It is only necessary to designate a beneficiary if you want payment to be made in a way other than the following order of precedence: To your widow or widower. If none, to your child or children equally, and descendants of deceased children by representation. If none, to your parents equally or to the surviving parent.

Can a beneficiary be removed from a life insurance policy?

In general, only the policyholder (the owner of a life insurance policy) can change a designated beneficiary. Once they pass away, it's usually impossible to remove or add someone new.

Who you should never name as your beneficiary?

Whom should I not name as beneficiary? Minors, disabled people and, in certain cases, your estate or spouse. Avoid leaving assets to minors outright. If you do, a court will appoint someone to look after the funds, a cumbersome and often expensive process.

How long does a beneficiary have to claim a life insurance policy?

Is there a time limit for making a claim? Yes there is. Please submit claims (including loss of life) within 90 days of the event that you're claiming for.

Is your spouse automatically your beneficiary on life insurance?

Does the Surviving Spouse Automatically Become the Beneficiary of a Life Insurance Policy? Usually, there is no requirement in the policy itself that only a spouse be named as the beneficiary. The policy owner has the right to choose any beneficiary they wish.

What is the difference between revocable and irrevocable?

A revocable trust can be changed at any time by the grantor during their lifetime, as long as they are competent. An irrevocable trust usually can't be changed without a court order or the approval of all the trust's beneficiaries. This makes an irrevocable trust less flexible.

What happens when an irrevocable beneficiary dies?

If the beneficiary dies first, then it is paid to the estate of the policy owner. If the beneficiary dies after, then the death benefit is paid to the estate of the beneficiary. The best way to ensure that someone you choose gets your policy's death benefit is by adding contingent beneficiaries.

What is the downside of an irrevocable trust?

The downside to irrevocable trusts is that you can't change them. And you can't act as your own trustee either. Once the trust is set up and the assets are transferred, you no longer have control over them.

Is irrevocable beneficiary taxable?

In this instance, it becomes tax-free. It is the only instance when life insurance proceeds are exempt from estate tax. Hence, designating your heirs as the irrevocable beneficiary exempts the proceeds from estate tax.

Why Might You Choose a Revocable Beneficiary?

Understanding life insurance options can help enable you to get the right coverage for your needs. So, why might you choose a revocable beneficiary or an irrevocable beneficiary?

What is a beneficiary of life insurance?

A life insurance beneficiary receives the death benefit from a policy. This money can help them continue to live comfortably, pay off debt and avoid making difficult financial sacrifices. It's common for spouses to name each other as their beneficiary.

What is the best way to choose a beneficiary for life insurance?

On the other hand, you might like the idea of choosing an irrevocable beneficiary. To help you decide which type of beneficiary might be best for you, consider discussing your situation and goals with a financial representative or a legal advisor.

Can you change a beneficiary without written permission?

With an irrevocable beneficiary, the policy owner cannot change the beneficiary without written permission from the current beneficiary. The beneficiary can choose to allow the change, but there's typically no requirement to do so. Therefore, it might be wise to view this as a permanent arrangement.

What is an irrevocable beneficiary?

An irrevocable beneficiary is a person who cannot be easily changed or removed from your life insurance policy.

What is a beneficiary in life insurance?

Beneficiaries are the people or entities that are entitled to receive a payout from your life insurance policy. When purchasing coverage, one of the key steps is to select beneficiaries.

What is the primary term for a death benefit?

The term primary (or secondary) refers to the order in which the death benefit is paid out at the time of the insured’s death. The irrevocable designation applies to the ability to change the terms of the policy.

How many beneficiaries do you need to have a health insurance policy?

As a policyholder, you’ll need to name at least one beneficiary, and you can name multiple beneficiaries.

Can you change a beneficiary on a revocable policy?

As a policyholder, you can change your revocable beneficiaries or change the percentage of the payout that goes to each beneficiary. Your beneficiaries don’t have a say in any changes you make, and changing your beneficiary is usually as simple as filling out a form. Going this route gives you the flexibility to change beneficiaries at any time during the policy as your situation and priorities change.

Can a spouse be removed from a life insurance policy?

That means that they can’t be removed from the policy without their consent and will receive proceeds from the death benefit.

Can you assign an irrevocable beneficiary to a life insurance policy?

If you want to assign an irrevocable beneficiary, let your insurance company know. You may be able to update an existing life insurance policy to include an irrevocable beneficiary.

What is a Revocable Beneficiary?

A revocable beneficiary is someone who the policy owner names to receive the benefit of a life insurance policy when the insured passes away. Moving forward, the policy owner can change both the policy and any beneficiaries without the revocable beneficiary’s consent. By default, life insurance beneficiaries are revocable.

The basics of beneficiaries

A beneficiary gets a payout from a life insurance company when the person a life insurance policy covers dies.

Revocable vs. irrevocable beneficiaries and policy changes

Irrevocable beneficiaries aren’t just fixed without their express consent. They also get a measure of control over the policy. In many states, the policy owner will need an irrevocable beneficiary’s written permission to adjust a policy’s death benefit or to terminate coverage, for example.

What Does Revocable Beneficiary Mean?

A revocable beneficiary is a beneficiary to an insurance policy that the policyholder has the right to remove or replace. This also gives the policyholder the option of discontinuing the policy.

Insuranceopedia Explains Revocable Beneficiary

Listing a revocable beneficiary in a policy can be useful in case circumstances change. For instance, a policyholder could list their brother as the revocable beneficiary to their policy under the condition that the payout is shared with their other siblings.

What is a revocable beneficiary?

With a revocable beneficiary, the person or entity you choose has no guaranteed rights when it comes to receiving the death benefit. The policy owner is in total control.

What is a life insurance beneficiary?

A life insurance beneficiary is a person or entity you designate to receive your life insurance death benefits after you pass.

How to choose a beneficiary?

For example, make sure you list the full name and Social Security number of your designated beneficiary. Also, if you choose more than one beneficiary, list the percentage split between them. Finally, update your beneficiary, if necessary, when you experience any major life changes .

Does Protective Life offer tax advice?

Neither Protective Life nor its representatives offer legal or tax advice. We encourage you to consult with your financial adviser and legal or tax adviser regarding your individual situations before making investment, social security, retirement planning, and tax-related decisions. For information about Protective Life and its products and services, visit www.protective.com .

Can you name more than one person on a life insurance policy?

It's not as simple as switching out a name. With a life insurance policy, you're allowed to name more than one person or entity as your beneficiary. You can also designate primary, secondary and tertiary beneficiaries.

Revocable Beneficiary of Life Insurance

When the beneficiary designation is revocable, the policyholder may change the beneficiary designation at any time without the former beneficiary’s consent or even knowledge. They may even change the life insurance beneficiary just before they die. This is by far the most common type of beneficiary.

Irrevocable Beneficiary of Life Insurance

An irrevocable beneficiary designation is one that cannot be changed by the policyholder without the beneficiary’s consent.

Which Type of Beneficiary is Right for You?

Usually, policyholders opt to designate revocable beneficiaries to have the freedom to redesignate beneficiaries as life and relationships change. However, if you have minor children or are a support obligor, you may want to or be forced to name irrevocable beneficiaries.

What Happens if an Irrevocable Beneficiary Dies Before a Policyholder?

If an irrevocable beneficiary predeceases the policyholder, and there are no other irrevocable beneficiaries, the policyholder is free to designate a beneficiary of their choice. In the alternative, the payout goes to any secondary or contingent beneficiaries the policyholder names.

How a Life Insurance Lawyer Helps

If you are the beneficiary of a life insurance policy and someone claims to be the irrevocable beneficiary, or if you are the irrevocable beneficiary and someone else was named, call us. We have helped beneficiary clients across the nation get the payout their loved one intended. Let us help you too.

How Can I Remove an Irrevocable Beneficiary?

Generally speaking, an irrevocable beneficiary can only be removed if the beneficiary agrees to be displaced, voluntarily surrendering their status.

What are the disadvantages of having an irrevocable beneficiary?

The primary disadvantage of having an irrevocable beneficiary is inflexibility. You can’t make any changes without the beneficiary’s consent. Life has a way of surprising us, so you need to be very sure that circumstances won’t make you regret your choice.

How Often Should I Review My Beneficiaries?

Some financial planners, including insurance companies themselves, recommend that you review your beneficiaries annually. That might be unnecessary, especially if you have named irrevocable beneficiaries. However, whenever a major life change occurs—marriage, divorce, the birth of a child, or death—you definitely should look over your beneficiaries.

What are the advantages of a beneficiary?

Estate-Planning Advantages. Beneficiaries can protect assets in other ways. A beneficiary designation trumps any sort of bequest made in a will—and doesn't have to go through probate. The recipient will get funds faster this way. Irrevocable beneficiaries can also play a role in estate planning.

What happens if you default on a loan and die before it is repaid?

The lender—like a bank—would become the irrevocable beneficiary of the policy, meaning it would be entitled to the cash value and/or the death benefit if you defaulted on the debt, or died before it was repaid. This process is called collateral assignment.

Why are children named irrevocable beneficiaries?

Children are often named irrevocable beneficiaries, to ensure their inheritance or secure child support payments. Naming an irrevocable beneficiary can also have estate-planning benefits, especially if the insurance policy is put in an irrevocable trust.

What does beneficiary designation mean?

A beneficiary designation means that the funds in question don’t have to go through probate, so the recipient gets them faster.

How to remove a revocable beneficiary?

Revocable beneficiaries can be removed by notifying the insurance company in writing. Irrevocable beneficiaries can’t be removed unless they agree.

What is an irrevocable beneficiary?

An irrevocable beneficiary designation can’t be changed without the beneficiary’s consent. In some states, the insurance company has to notify an irrevocable beneficiary if the policy has been canceled.

What is a beneficiary?

A beneficiary is a person named by the life insurance policy holder, who will receive the death benefit. It can be a specific person as the beneficiary, such as a spouse, a class of beneficiaries, such as children or grandchildren. You can also include future children or grandchildren as beneficiaries.

What happens when you name someone as an irrevocable beneficiary?

Naming someone as an irrevocable beneficiary impacts your rights as the life insurance policyowner. Some life insurance companies warn that the irrevocable beneficiary’s written consent is required for any policy changes. For example, if you wanted to take a policy loan or make changes to the premium, the irrevocable beneficiary has to sign the form.

What happens if you die on a term life insurance policy?

That person or persons will receive the death benefit when you die as long as the policy is still active. For instance, a term life insurance policy is only for a set time. If you outlive a term life policy, your beneficiaries don’t receive death benefits.

What is life insurance owned by?

Life insurance owned by a trust usually has the trust named as an irrevocable beneficiary as a way to make sure the death benefit stays out of the insured’s estate.

What is a primary beneficiary?

Beneficiaries can be a primary or contingent beneficiary. A primary beneficiary receives the proceeds if they’re alive. A secondary beneficiary receives the proceeds if the primary beneficiary has died.

What Is A Revocable Beneficiary?

- A revocable beneficiary is someone who the policy owner names to receive the benefit of a life insurance policy when the insuredpasses away. Moving forward, the policy owner can change both the policy and any beneficiaries without the revocable beneficiary’s consent. By default, life insurance beneficiaries are revocable.

The Basics of Beneficiaries

- A beneficiary gets a payout from a life insurance companywhen the person a life insurance policy covers dies. For example, an individual might buy life insurance on themselves and name their spouse as a beneficiary. That way, their spouse will get the policy benefit (i.e., a lump-sum payout from the life insurance company) should the insured individual die prematurely. The spouse/ben…

Flexibility with Revocable Beneficiaries

- Revocable beneficiaries are exactly what they sound like: beneficiaries that the policy owner can remove or adjust as they see fit. That juxtaposes with irrevocable beneficiaries. These beneficiaries are locked in; the policy owner will need their written permission to remove them from the policy or to make a broad range of policy adjustments. Revocable beneficiaries give th…

Revocable vs. Irrevocable Beneficiaries and Policy Changes

- Irrevocable beneficiaries aren’t just fixed without their express consent. They also get a measure of control over the policy. In many states, the policy owner will need an irrevocable beneficiary’s written permission to adjust a policy’s death benefit or to terminate coverage, for example. A revocable beneficiary, on the other hand, keeps the coverage’s full control in the hands of the po…