A subsidiary account is an account that is kept within a subsidiary ledger, which in turn summarizes into a control account in the general ledger

General ledger

A general ledger contains all the accounts for recording transactions relating to a company's assets, liabilities, owners' equity, revenue, and expenses.

What is the difference between a subsidiary and general ledger?

What is a General Ledger (GL)?

- General ledger account. A general ledger account (GL account) is a primary component of a general ledger. ...

- Controlling Accounts vs. Subsidiary ledger. ...

- General Ledgers and Double-Entry Bookkeeping. ...

- Link to Balance Sheet and Income Statement. ...

- Decentralized Ledger – Blockchain Technology. ...

- Additional Resources. ...

What is a sub ledger account?

Subledger examples include the following:

- Customer accounts

- Vendor accounts

- Bank accounts

- Sales accounts

- Fixed asset accounts

What is difference between general ledger and sub ledger?

Here are the functions of subledgers that are used for reporting a company's financial records:

- A subledger's total amount is included as part of the general ledger.

- A subledger reports summary amounts to the general ledger.

- A subledger represents smaller categories within a company's financial information.

- A subledger does not have its own trial balance report.

What is a subledger account?

The subledger should include: 1

- The date of the transaction

- The price of the services rendered or products sold

- The balance owed in case partial payment has been collected

- The name of the customer

- The payment terms, which are usually 30, 60, or 90 days

- Any notes that pertain to the transaction

What is subsidiary ledger?

A subsidiary ledger stores the details for a general ledger control account. Once information has been recorded in a subsidiary ledger, it is periodically summarized and posted to a control account in the general ledger, which in turn is used to construct the financial statements of a company.

What is subsidiary account in accounting?

A subsidiary account is an account that is kept within a subsidiary ledger, which in turn summarizes into a control account in the general ledger. A subsidiary account is used to track information at a very detailed level for certain types of transactions, such as accounts receivable and accounts payable.

What is the difference between general ledger and subsidiary ledger?

A sub-ledger has no chart of accounts. A general ledger has a few accounts in the following categories; assets, liabilities, income, expenses, and equity. They also have a few sub-accounts, such as accounts payable and accounts receivable. Accounts are often created as needed.

What is the purpose of subsidiary account?

A subsidiary ledger contains the details to support a general ledger control account. For instance, the subsidiary ledger for accounts receivable contains the information for each of the company's credit sales to customers, each customer's remittance, return of merchandise, discounts, and so on.

What are the three types of subsidiary ledger?

Subledger eliminates the chances of fraud and errors, and it can be segregated into three types- fixed asset sub-ledger, accounts receivable sub-ledger, and accounts payable sub-ledger.

Which accounts most likely use a subsidiary ledger?

Common examples of subsidiary ledgers that businesses typically maintain are the following:Account Receivable Ledger.Accounts Payable Ledger.Purchases Ledger.Inventory Ledger.Fixed Assets Ledger.

What are the advantages of using a subsidiary ledger?

The advantages of using subsidiary ledgers are that they: Permit transactions affecting a single customer or single creditor to be shown in a single account, thus providing necessary up-to-date information on specific account balances.

Why do businesses need to prepare subsidiary ledgers?

The purpose of keeping subsidiary ledgers is for accuracy and efficiency. They aid us in keeping accurate records. Since the total of the accounts receivable subsidiary ledger must agree with the balance shown in the accounts receivable general ledger account, the system helps us find mistakes.

What are the two common kinds of subsidiary ledgers?

Two common subsidiary ledgers:Accounts receivable subsidiary ledger where data relating to individual buyers are kept.Accounts payable subsidiary ledger is due where data relating to individual creditors are kept.

Does the business use subsidiary ledgers?

Large business organizations often use subsidiary ledgers because they have large numbers of financial transactions. The general ledger includes information that does not meet the specific requirements of subsidiary ledgers.

What is an example of a subsidiary?

Subsidiaries are either set up or acquired by the controlling company. In cases where the parent company holds 100% of the voting stock, the subsidiary company structure is referred to as a wholly owned subsidiary. For example, Walt Disney Entertainment owns 100% of Marvel Entertainment which produces movies.

Is a subsidiary an asset?

A subsidiary is a legal entity that issues its own stock and is a separate and distinct operating business that is owned by a parent company. The stock of the subsidiary is an asset on the balance sheet of the parent company.

What is initial and subsidiary accounts?

The initial and subsidiary accounts rules relieve the Comptroller and Auditor-General from the responsibility of maintaining accounts of a specified class or character without derogating from his power to prescribe the form in which such accounts shall be rendered to him and in which the initial accounts from which the ...

What is subsidiary book with example?

Solved Examples on Subsidiary BooksSubsidiary BooksLedgerIt does not have a chart of accounts.It has a chart of accounts.It is a part of the ledger accounts.It controls the Subsidiary books.It is optional for the purpose of recording transactions.It is compulsory for the purpose of recording transactions.3 more rows

What is a subsidiary ledger in accounting?

A subsidiary ledger in accounting is a storage and reference ledger for a general ledger main account. The subsidiary ledger will have a more detai...

Which accounts have subsidiary ledgers?

Controlling accounts have subsidiary ledgers. Controlling accounts are usually the main accounts a business tracks financial information like gener...

What is the purpose of a subsidiary ledger?

The purpose of a subsidiary ledger is to back up data from the general ledger's controlling account. This ledger is used to correct any discrepanci...

What are the two common examples of a subsidiary ledger?

Common examples of subsidiary ledgers are anytime a business wants to backup or reference information from the control account. This can be invento...

What is a subsidiary ledger?

Subsidiary Ledger is a list of individual accounts that bears a similar nature. It can also be regarded as an expansion of the conventional general ledger that is separately used to record all the transactions related to the accounts payable and accounts receivables in a detailed manner.

What are the advantages of a subsidiary ledger?

The different advantages related to the Subsidiary Ledger are as follows: 1 Elimination of Frauds and Errors – It uses only a control account, which ultimately eliminates even the slightest possibility of frauds and errors. 2 Balances remain Updated- The balances remain updated since all the transactions concerning buyers and creditors are recorded in detail in their respective accounts. 3 Minimal Error and Enhanced Efficiency – The responsibility to prepare and maintain every single ledger is entrusted upon one person only. It helps in minimizing errors and enhances the efficiency of the ledger. 4 Easy Movement- The size of the ledger remains small since the same is segregated into numerous parts. It allows the ledger to have an easy movement.

What is a subledger in accounting?

Small or medium-scale businesses or entities that have a small number of transactions may not benefit from the subsidiary ledger. Subledger eliminates the chances of fraud and errors, and it can be segregated into three types- fixed asset sub-ledger, accounts receivable sub-ledger, and accounts payable sub-ledger.

What is general ledger?

, discounts, etc. to provide support to the general ledger. General Ledger A general ledger is a book of accounts that records the everyday business transactions in separate ledger accounts.

What is a general account?

A General Account General Account is a deposit account where an insurance company puts all its premiums collected from the policies it underwrites.

Do subsidiary ledgers have errors?

It may contain undetected errors. Subsidiary ledgers do not assure the accuracy of ledger accounts. The items may be posted to irrelevant accounts, which may add to errors in the individual ledgers and ultimately impact the overall accuracy of the subsidiary ledger.

Can a general ledger have multiple accounts?

In a general ledger, there can be just ledger accounts , while in a subsidiary ledger, there can be multiple ledger accounts. The general ledger contains minimal data, while subsidiary ledger contains extensive data. It is just a part of the general ledger while the latter controls the former.

What Does Subsidiary Ledger Mean?

A subsidiary ledger is useful to accountants and bookkeepers for a variety of reasons. First, it groups related accounts into one ledger that can be easily totaled and analyzed. It is much easier to review data when it is organized and grouped together. Take the accounts payable ledger for example.

Example

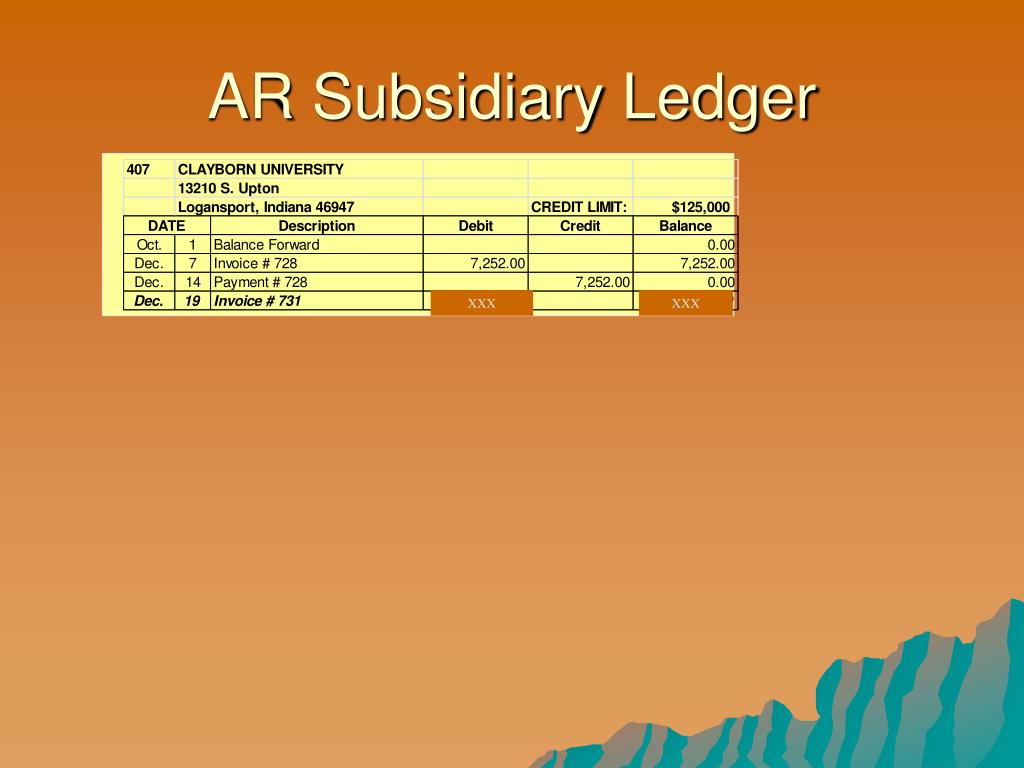

This sub ledger lists contains all of the account details for every credit customers including dates, balances, payments, and purchases made by each customer. Even a small company can have hundreds of customers who purchase goods on credit.

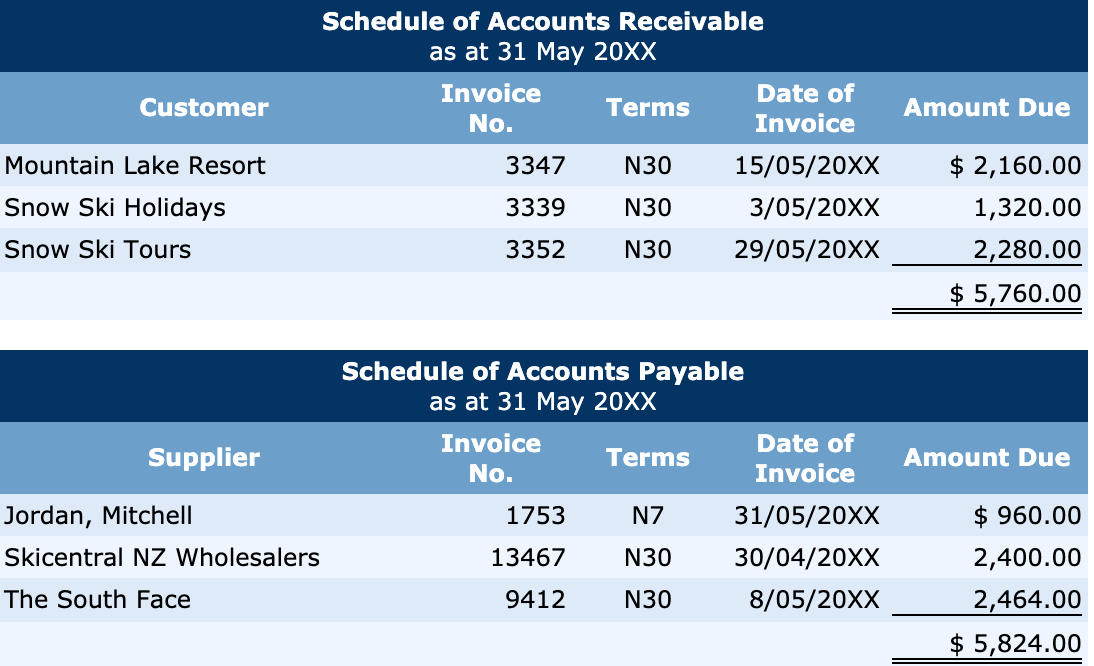

What is the schedule of accounts receivable called?

This schedule of accounts receivable often called an accounts receivable trial balance, is totaled, and the total should equal the balance in the related general ledger account.

Do you have to post to a subsidiary account?

Posting to Subsidiary Accounts. When subsidiary accounts are maintained, it is necessary to post journal entries to both the general ledger or controlling account and the subsidiary account. Thus, if an entry is made to record a sale on account, two postings must be made, one to the general ledger receivable account and the other to ...

What is a Subsidiary Ledger?

What is a subsidiary ledger? The subsidiary ledger in business accounting is a list of detailed accounts that serve as backup for the general ledger. The general ledger is the main list of accounts a business owns that lists all the transactions connected to each account.

Subsidiary Ledger Purpose

The purpose of a subsidiary ledger in a business is to help organize important financial information and monitor transactions. One way for a business to grow and increase sales is to allow customers to purchase products on credit. Credit purchases are tracked on subsidiary ledgers to forecast financial situations for a company.

Subsidiary Ledger Examples

ABC company starts the year off with an opening balance of $100,00 in their accounts payable. The company owes $25,000 to four different companies: Company D, Company E, Company F, and Company G. The transactions in the accounts payable on the general ledger look like this:

What is a subsidiary ledger?

A subsidiary ledger contains the details to support a general ledger control account. For instance, the subsidiary ledger for accounts receivable contains the information for each of the company's credit sales to customers, each customer's remittance, return of merchandise, discounts, and so on.

Can employees access accounts receivable without access to the general ledger?

By having the details of the accounts receivable activity in a subsidiary ledger, employees in a company's credit department of a company can access the credit sales information without having access to any information in the general ledger.

What is a subsidiary ledger?

Like other subsidiary ledgers, the accounts receivable subsidiary ledger merely provides details of the control account in the general ledger. Other subsidiary ledgers include the accounts payable subsidiary ledger, inventory subsidiary ledger, and property, plant, and equipment subsidiary ledger.

What is the account receivable subsidiary ledger?

The accounts receivable subsidiary ledger shows all the sales made on credit by a business. It provides details on these sales by showing invoice dates and numbers, credit memorandums, payments made against the credit sales, discounts, and returns and allowances. The sum of all invoices in the accounts receivable subsidiary ledger should equal that of the accounts receivables on the general ledger, also known as the control account.

Is a general ledger a subsidiary ledger?

The general ledger is not able to provide this much detail and so having an accounts receivable subsidiary ledger, or any other subsidiary ledger for that matter, is a real benefit to a company's operations.

What is a subsidiary ledger?

The subsidiary ledger is essentially a worksheet for all of the payables owed to suppliers. The accounts payable subsidiary ledger is helpful in providing internal accounting controls. The accounts payable subsidiary ledger amounts can be crosschecked with the aggregate amount reported on the general ledger to prevent errors in reporting.

What is an accounts payable subsidiary ledger?

An accounts payable subsidiary ledger is an accounting ledger that shows the transaction history and amounts owed to each supplier and vendor. An accounts payable (AP) is essentially an extension of credit from a supplier that gives a business (the buyer in the transaction) time to pay for the supplies. The subsidiary ledger records all of the ...

What is payable on the general ledger?

These payables are short-term debts or IOUs from one company to another company. The total amount of payables owed to suppliers is recorded as accounts payable on the general ledger.

What is an AP ledger?

An accounts payable (AP) is essentially an extension of credit from a supplier that gives a business (the buyer) time to pay for the supplies. The subsidiary ledger records all of the accounts payables ...

How much is Supplier A owed for tires?

Supplier A is owed $2 million for tires. Supplier B is owed $6 million for car mats. Supplier C is owed $98 million for steel. The accounts payable subsidiary ledger is similar to other subsidiary ledgers in that it merely provides details of the control account in the general ledger.

What is the purpose of a subsidiary ledger?

What Is the Purpose of Subsidiary Ledgers? Some general ledger accounts such as accounts receivable or accounts payable are made up of many sub-components, For example, a company may have many debtors (credit customers) and multiple transactions (credit sale, sale return, receipts) with each customer. All such transactions will be recorded in ...

Is the sum of balances of subsidiary ledgers always equal to the balance of main ledger account/ control

As a result, the sum of balances of subsidiary ledgers is always equal to the balance of main ledger account/ control account.