A mortgage verification form is a detailed account of an individual’s mortgage payment information.

Can you get a mortgage with no income verification?

You may still be able to get a no-doc mortgage if you have tricky self-employment income or don’t meet the income requirements of traditional loan programs. A no-doc mortgage (also called a no-income-verification mortgage or stated-income loan by lenders) requires less paperwork to get approved and may close faster than a fully documented loan, especially if you have complicated tax returns.

When is rental verification required by mortgage lenders?

The mortgage loan underwriter will require at least 12 months of timely rental payments to the landlord. Lenders do not accept cash-paid receipts by landlords as a valid verification of rent. Only 12 months of canceled checks paid to the landlord or 12 months of bank statements are valid as rental verification. In this article (Skip to…)

What information is needed for a mortgage application?

- Full name, birth date, Social Security number, and phone number

- Marital status, number of children and ages

- Residence history for at least two years. ...

- Employment history for at least two years, including company name (s), address (es), phone number (s), and your title (s).

- Income history for at least two years. ...

What items are needed for mortgage application?

Items Needed for the Loan Application. A full thirty days of your most recent paycheck stubs. Two months of bank statements, ALL PAGES (checking, savings, etc.) 401K, Thrift Savings Plans, IRA and Stock Investment statements (all pages) W-2s for last two years. Tax returns for last two years – ALL PAGES and schedules.

What is mortgage verification?

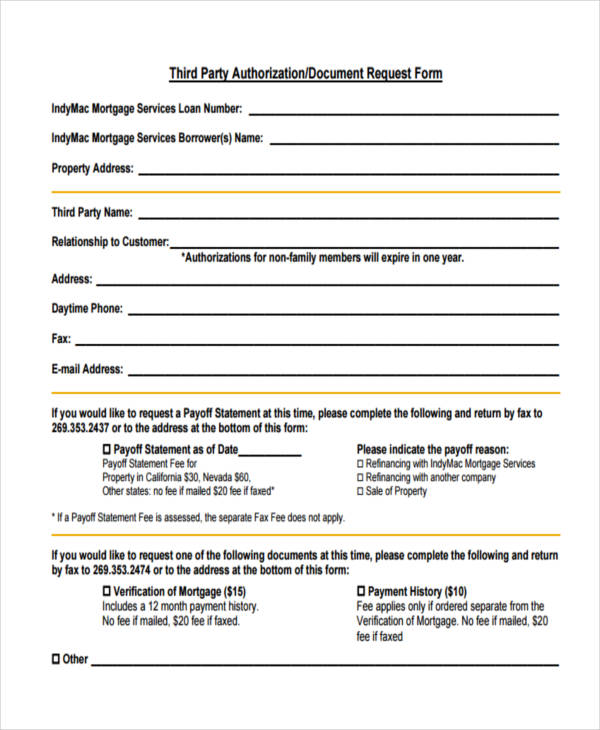

How to write a return form?

About this website

Why do I need a verification of mortgage?

Lenders want to know if you're a good risk for a mortgage and will want you to show them 12 – 24 months of mortgage history. Depending on the type of loan you're applying for, you'll want to show minimal or no late payments. For your lender, that's a good sign that you'll be able to repay your new mortgage.

How long does a verification of mortgage take?

The application package typically has between 26 and 38 documents for you to sign. These documents will include the interest rate, terms, and costs of your loan. We recommend that you closely review these documents. This process typically takes 1-4 days.

What is a 12 month verification of mortgage?

The mortgage company borrower has a loan with will verify that borrower has been timely with their payments for the past 12 months. New mortgage company borrower is applying for their new mortgage loan needs VOM with timely payments in past 12 months.

What is a loan verification letter?

Summary: This letter provides authorization for a borrower's current loan holder to release the borrower's loan information to consolidating lenders without sending current loan holder a Loan Verification Certificates (LVC) with the borrower's signature if certain condition are met.

Can I be denied a mortgage after being pre-approved?

Certainly the hope is the if a lender pre-approves a buyer that the buyer will successfully obtain the financing, however, it's possible a mortgage can get denied even after pre-approval. A mortgage that gets denied is one of the most common reasons a real estate deal falls through.

What is the possibility of getting denied after a pre approval letter?

If something negative hits your credit report and lowers your credit score, it could push you outside the lender's qualification guidelines. So they could deny you the mortgage loan even after you've been pre-approved. You could also face problems if your income changes in some way.

What is a VOM fee?

The fee for a VOM is $35.00.

How do mortgage lenders verify income?

Mortgage lenders verify employment by contacting employers directly and requesting income information and related documentation. Most lenders only require verbal confirmation, but some will seek email or fax verification. Lenders can verify self-employment income by obtaining tax return transcripts from the IRS.

What is a VOR form?

The landlord verification form is a document used by a landlord when verifying the previous rental information of an applicant for tenancy. The requesting landlord must send the form to the applicant's current or past landlord in order to obtain all details related to the tenancy of the individual.

What is the loan verification process?

The personal loan verification process includes validating all the details about an applicant, including meeting the eligibility criteria, documents provided, repayment capacity, CIBIL score and more. Our representative may visit your residence and your place of work to verify your details.

What is a bank verification form?

A bank verification form is a document used by financial institutions to verify account information. A bank or other financial institutions can use a bank verification form for account transactions. This form can help to confirm the borrower's related information along with the representative's verification.

How do I get my bank verification letter?

To obtain a bank confirmation letter from your bank you may request in-person at a bank branch from one of the bankers, by a phone call to the bank, and depending on the financial institution, through their online platform.

How long does mortgage Approval take after appraisal?

If you've made an offer on a home, you may wonder how long you have to wait from the appraisal to closing. If all goes well, the homebuying process — including getting a home appraised and obtaining final financing approval from your lender — can take about 30 to 45 days.

How long is a mortgage in underwriting?

Underwriting—the process by which mortgage lenders verify your assets, check your credit scores, and review your tax returns before they can approve a home loan—can take as little as two to three days. Typically, though, it takes over a week for a loan officer or lender to complete the process.

How long does pre approval letter take?

For mortgage preapproval, you'll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after you've provided all requested information.

How long does it take for underwriter to clear to close?

Final Underwriting And Clear To Close: At Least 3 Days Once the underwriter has determined that your loan is fit for approval, you'll be cleared to close. At this point, you'll receive a Closing Disclosure.

What Does Verification of Mortgage Mean?

Lenders want to know if you’re a good risk for a mortgage and will want you to show them 12 – 24 months of mortgage history. Depending on the type...

What Is Included in a Verification of Mortgage Form?

A VOM is a simple statement of facts, including: unpaid principal balance, payment amount with escrow, status of your mortgage, and payment history.

How Do I Request a Verification of Mortgage?

If you need to request a VOM, you’ll need to reach out to your lender or loan servicer. Start by calling your lender or servicer using the contact...

Mortgage Verification Form

MORTGAGE VERIFICATION FORM Date: _____ Please address replies to: _____ Mortgage Co.: _____ Name: _____

Verification Of Mortgage Form - Fill and Sign Printable Template Online

USLegal has been awarded the TopTenREVIEWS Gold Award 9 years in a row as the most comprehensive and helpful online legal forms services on the market today. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else".

Get Verification Of Mortgage Form - US Legal Forms

USLegal has been awarded the TopTenREVIEWS Gold Award 9 years in a row as the most comprehensive and helpful online legal forms services on the market today. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else".

What You Need To Know

Let’s say you recently sold your home and want to buy a new home. Or maybe you’ve decided to refinance your mortgage with a new lender. In either case, your new lender is going to want to know more about your history with your previous mortgage lender.

What Does Verification of Mortgage Mean?

Lenders want to know if you’re a good risk for a mortgage and will want you to show them 12 – 24 months of mortgage history. Depending on the type of loan you’re applying for, you’ll want to show minimal or no late payments. For your lender, that’s a good sign that you’ll be able to repay your new mortgage.

What Is Included in a Verification of Mortgage Form?

The good thing about a VOM is that it won’t mention that time you got into an argument with your loan officer or that you sent the wrong form to the underwriter during the approval process.

How Do I Request a Verification of Mortgage?

If you need to request a VOM, you’ll need to reach out to your lender or loan servicer. Start by calling your lender or servicer using the contact information on your monthly mortgage statement.

Is Mortgage Verification Necessary for Nontraditional Home Purchases?

Let’s say you bought your previous home (or bought the home you plan to refinance) using a nontraditional method like seller financing, which means you didn’t borrow money from a bank or other lending institution. In that case, instead of providing a VOM, you may need to provide 12 – 24 months of canceled checks.

Time To Get Your Paperwork in Order

Remember, when your lender requests a verification of mortgage, income or employment, it’s nothing personal. It’s just a part of the process.

In Case You Missed It

Lenders will want to see at least 2 years of employment history. If you’re new at your current job, you’ll need to list other recent employers

What is mortgage verification?

The mortgage verification form is a detailed account of an individual’s mortgage payment information. Financial institutions will often request this type of documentation from an individual when he or she is applying for credit or a large loan; the form indicates whether or not the person will be able make the necessary payments continuously ...

How to write a return form?

How to Write. Step 1 – To begin, download the form in Adobe PDF. Step 2 – The upper left portion of the form must be filled in with the following information: Step 3 – Move on to the upper right portion of the form and enter the return contact information (name, company, address, phone #, fax #).

How to verify a mortgage?

The only way to provide verification of mortgage is by providing 12 months canceled checks. Cash payments do not count even though the mortgage loan note holder provides a paid receipt. If you have been making your housing payment with cash some months and checks other months, that will not count as verification of mortgage ...

Why is it important to verify a mortgage?

One of the main factors why verification of mortgage is required is it shows the habit of a borrower in paying mortgage payments in the past 12 months.

What is a VOM mortgage?

A Verification of Mortgage, also referred to as VOM, is a mortgage documentation of borrower’s overall mortgage payment history. Verification of Mortgage on a prior mortgage payment history is important for lenders who are reviewing a borrowers new mortgage loan application request.

What does past performance mean for a mortgage?

Past performance is a good indicator for future performance.

When is VOM required for a mortgage?

Timely payments in the past 12 months on their prior mortgage is necessary for them to be eligible for a new mortgage. This is especially with a strong emphasis in the past 12 months. VOM is required when a mortgage loan applicant applies for a new mortgage.

Do you need a verification of mortgage to refinance a home?

If you purchased your home via seller financing and/or had other non-traditional financing to purchase your home and are now refinancing your mortgage loan, a verification of mortgage will still be required.

What are post closing documents?

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

What is mortgage verification?

The mortgage verification form is a detailed account of an individual’s mortgage payment information. Financial institutions will often request this type of documentation from an individual when he or she is applying for credit or a large loan; the form indicates whether or not the person will be able make the necessary payments continuously ...

How to write a return form?

How to Write. Step 1 – To begin, download the form in Adobe PDF. Step 2 – The upper left portion of the form must be filled in with the following information: Step 3 – Move on to the upper right portion of the form and enter the return contact information (name, company, address, phone #, fax #).