What is a zero coupon yield curve?

This would represent the return on an investment in a zero coupon bond with a particular time to maturity. The zero coupon yield curve shows in graphical form the rates of return on zero coupon bonds with different periods to maturity.

What is a zero coupon bond?

The fixed interest rate is tied to a zero coupon bond, or a bond that pays no interest for the life of the bond, but is expected to make one single payment at maturity. In effect, the amount of the fixed-rate payment is based on the swap's zero coupon rate.

What is the difference between a par and zero coupon curve?

Loading... Par and zero coupon curves are two common ways of specifying a yield curve. Par coupon yields are quite often encountered in economic analysis of bond yields, such as the Fed H.15 yield series. Zero coupon curves are a building block for interest rate pricers, but they are less commonly encountered away from such uses.

What is a zero-coupon rate?

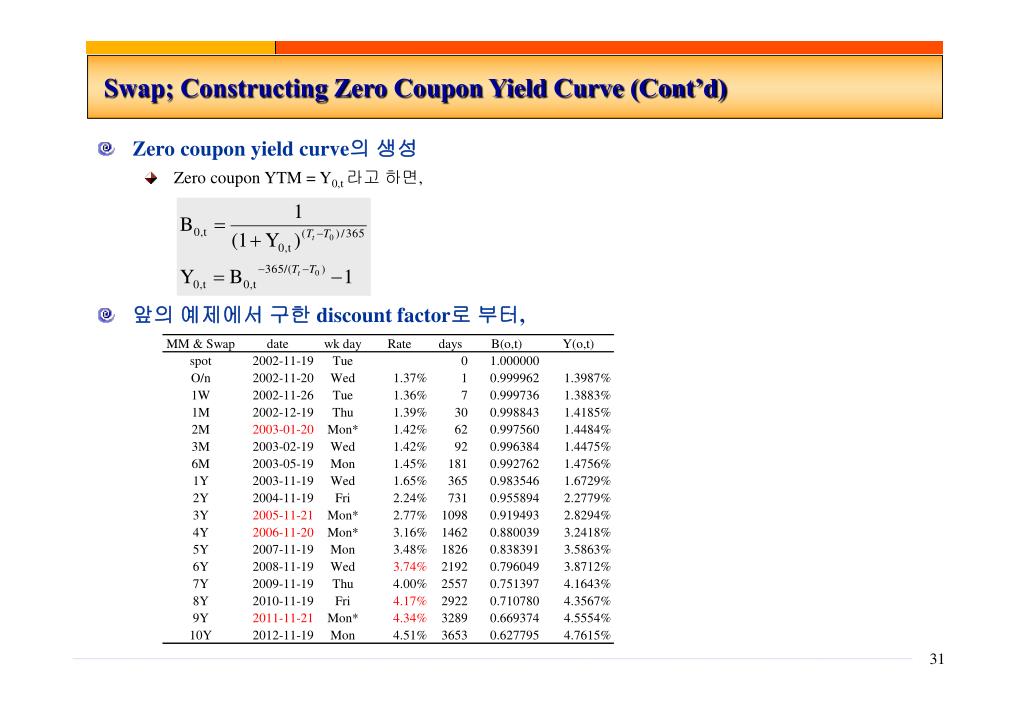

As a reminder, the zero-coupon rate is the yield of an instrument that does not generate any cash flows between its date of issuance and its date of maturity. The technique used to achieve this is called bootstrapping, a term which describes a self-contained process that is supposed to proceed without external input.

What is a zero-coupon rate curve?

The zero coupon curve represents the yield to maturity of hypothetical zero coupon bonds, since they are not directly observable in the market for a wide range of maturities. The yields must therefore be estimated from existing zero coupon bonds and fixed coupon bond prices or yields.

What is the meaning of zero-coupon?

Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

What is the difference between the zero-coupon curve and the yield curve?

A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. With a normal yield curve, long-term bonds have higher yields than short-term bonds.

How do you make a zero-coupon curve?

The zero-coupon yield curve can be constructed using a series of coupon-paying bonds using an iterative technique known as 'bootstrapping'. This works on the premise that the investor 'borrows' money today, the day that the bond is purchased, to compensate for not receiving any coupons over the life of the bond.

What is a zero-coupon bond example?

A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond.

What is another name for zero-coupon bond?

A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

What are the benefits of zero-coupon bonds?

A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs at a foreseeable time.

Why is a zero-coupon bonds more sensitive to interest rates?

Unique Advantages of Zero-Coupon U.S. Treasury Bonds Thus, the most responsive bond has a long time to maturity (usually 20 to 30 years) and makes no interest payments. Therefore, long-dated zero-coupon bonds respond the most to interest rate changes.

Why would a company issue zero-coupon bonds?

After 20 years, the issuer of the bond pays you $10,000. For this reason, zero-coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement. Federal agencies, municipalities, financial institutions and corporations issue zero-coupon bonds.

How do you find the zero-coupon rate?

The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i)^n where: M = maturity value or face value. i = required interest yield divided by 2.

How do you calculate the yield on a zero-coupon bond?

To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods.

What do forward rates tell you?

A forward rate is the settlement price of a transaction that will not take place until a predetermined date. In bond markets, the forward rate refers to the effective yield on a bond, commonly U.S. Treasury bills, and is calculated based on the relationship between interest rates and maturities.

What is the par curve?

A par yield curve represents bonds that are trading at par. In other words, the par yield curve is a plot of the yield to maturity against term to maturity for a group of bonds priced at par. It is used to determine the coupon rate that a new bond with a given maturity will pay in order to sell at par today.

WHAT IS curve bootstrapping?

Bootstrapping is a method for constructing a zero-coupon yield curve from the prices of a set of coupon-bearing products.As you may know Treasury bills offered by the government are not available for every time period hence the bootstrapping method is used mainly to fill in the missing figures in order to derive the ...

What Is a Zero-Coupon Swap?

A zero-coupon swap is an exchange of cash flows in which the stream of floating interest-rate payments is made periodically , as it would be in a plain vanilla swap, but where the stream of fixed-rate payments is made as one lump-sum payment at the time when the swap reaches maturity, instead of periodically over the life of the swap.

What is the bondholder responsible for in a zero-coupon swap?

The bondholder on the end of the fixed leg of a zero-coupon swap is responsible for making one payment at maturity, while the party on the end of the floating leg must make periodic payments over the contract life of the swap. However, zero-coupon swaps can be structured so that both floating and fixed rate payments are paid as a lump sum.

Does the variable side of a swap make regular payments?

The variable side of the swap still makes regular payments, as they would in a plain vanilla swap.

Can zero-coupon swaps be structured?

However, zero-coupon swaps can be structured so that both floating and fixed rate payments are paid as a lump sum. Since there’s a mismatch in the frequency of payments, the floating party is exposed to a substantial level of default risk.

What is zero coupon interest?

The interest earned on a zero-coupon bond is an imputed interest, meaning that it is an estimated interest rate for the bond and not an established interest rate. For example, a bond with a face amount of $20,000, that matures in 20 years, with a 5.5% yield, may be purchased for roughly $6,855. At the end of the 20 years, the investor will receive $20,000. The difference between $20,000 and $6,855 (or $13,145) represents the interest that compounds automatically until the bond matures. Imputed interest is sometimes referred to as "phantom interest."

What Is a Zero-Coupon Bond?

A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

How Does the IRS Tax Zero-Coupon Bonds?

The imputed interest on the bond is subject to income tax. The IRS uses an accretive method when calculating the imputed interest on Treasury bonds and has applicable federal rates that set a minimum interest rate in relation to imputed interest and original issue discount rules. 1

How long does a zero coupon bond last?

The maturity dates on zero coupon bonds are usually long term, with initial maturities of at least 10 years.

What is the $80 bond return?

For example, an investor who purchases a bond at a discount for $920 will receive $1,000. The $80 return, plus coupon payments received on the bond, is the investor's earnings or return for holding the bond. But not all bonds have coupon payments. Those that do not are referred to as zero coupon bonds. These bonds are issued at a deep discount and ...

Why do zero coupon bonds fluctuate?

Because they offer the entire payment at maturity, zero-coupon bonds tend to fluctuate in price, much more so than coupon bonds. 1. A bond is a portal through which a corporate or governmental body raises capital. When bonds are issued, investors purchase those bonds, effectively acting as lenders to the issuing entity.

What is the par value of a corporate bond?

The par or face value of a corporate bond is typically stated as $1,000. If a corporate bond is issued at a discount, this means investors can purchase the bond below its par value. For example, an investor who purchases a bond at a discount ...

What is zero coupon bond?

Quick Summary: A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds.

How to calculate the price of a zero-coupon bond?

To calculate the price of a zero-coupon bond, use the following formula: n is the number of years until maturity. Interest Rate An interest rate refers to the amount charged by a lender to a borrower for any form of debt given, generally expressed as a percentage of the principal. is compounded annually.

Why do zero-coupon bonds have to be discounted?

Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond.

What is continuous compounded return?

Continuously Compounded Return Continuously compounded return is what happens when the interest earned on an investment is calculated and reinvested back into the account for an infinite number of periods. The interest is calculated on the principal amount and the interest accumulated over the given periods

Does a zero coupon bond pay periodic coupons?

As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. Time Value of Money The time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future.

What is a par coupon?

Par and zero coupon curves are two common ways of specifying a yield curve. Par coupon yields are quite often encountered in economic analysis of bond yields, such as the Fed H.15 yield series. Zero coupon curves are a building block for interest rate pricers, but they are less commonly encountered away from such uses.

What is the discount factor of $1 at a future date?

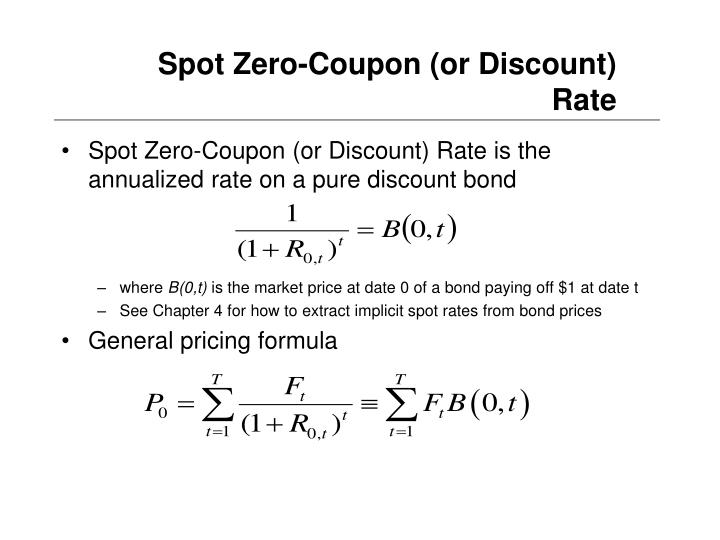

The interpretation of the discount factor is that it is the present value of receiving $1 at a future date. or example, the zero rate at t=10 is 6%, and the associated discount factor is equal to 1/ (1.06)^10 = 0.5584. This means that we would be willing to pay $0.5584 now to receive $1 in 10 years (and receive a rate of return of 6%.)

Can you buy zero coupon bonds?

It is possible to buy zero coupon bonds, which only pay a cash flow at maturity (these are known as strips ). The price of a zero coupon bond would correspond to the discount factor. However, this market is not particularly liquid, and so is of limited interest to institutional investors.

Can you compare yield curves with zero rates?

Therefore, the only safe way of comparing the two yield curves is by using the discount factor curve, and not the zero rates.

Is the par coupon the same as the zero rate?

For the first 2 years, the zero rate and the par coupon yield are the same, as the curve was flat at 5%. (This is the result of my choice of calculation conventions; if we look at bonds that pay semi-annually, the par coupon yield differs from the zero rate, even if the curves are flat.)

How to calculate coupon rate for bond?

It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more. The coupon details are as below:

How long to interpolate zero rates?

Now, if one needs the zero-coupon rate for 2-year maturity, he needs to linearly interpolate the zero rates between 1 year and 3 years.

What is a bootstrapping yield curve?

Bootstrapping is a method to construct a zero-coupon yield curve Yield Curve A yield curve is a plot of bond yields of a particular issuer on the vertical axis (Y-axis) against various tenors/maturities on the horizontal axis (X-axis). The slope of the yield curve provides an estimate of expected interest rate fluctuations in the future and the level of economic activity. read more. The following bootstrapping examples provide an overview of how a yield curve is constructed. Although not every variation can be explained as there are many methods in bootstrapping because of differences in conventions used.

Is a bootstrapping yield curve a direct example?

Although this is not a direct example of a bootstrapping yield curve, sometimes one needs to find the rate between two maturities. Consider the zero-rate curve for the following maturities.

What are the two types of curves?

One can broadly distinguish two types of curves: Observed curves or market curves that are built directly from quotations on the markets (e.g. swap curves, government bond yield curves) Implicit curves, which are derived from market quotes, but are obtained via transformation (e.g. zero-coupon yield curves, par yield curves) ...

What are yield curves?

In financial markets, there is, at any given time, not just one, but a multitude of yield curves.#N#One can broadly distinguish two types of curves: 1 Observed curves or market curves that are built directly from quotations on the markets (e.g. swap curves, government bond yield curves) 2 Implicit curves, which are derived from market quotes, but are obtained via transformation (e.g. zero-coupon yield curves, par yield curves)

Why are yield curves always constructed?

In order to have a consistent set of data, yield curves are always constructed using the yield rates of a set of homogeneous instruments. For bond yield curves, for example, this means in particular that one always uses instruments from the same issuer or, if it is a sector curve, from issuers which belong to the same sector.

Can you build a yield curve from coupon bonds?

But building a yield curve from “classic” coupon bonds would create a curve which suffers from a number of inconsistencies. Thus, for example, two bonds with the same maturity but a very different duration, will not have the same yield.

Can you deduct zero coupon rates for 2 years?

We can then successively carry out the deduction of zero-coupon rates for the 2 and 3 year maturities . Already knowing the rate for one year maturity ( 2.1972 %) , we can deduce the rate two years as described hereafter.

Is a bond a zero-coupon?

Keeping in mind that a bond can be considered a set of zero-coupon instruments, its (theoretical) price is , therefore, equivalent to the sum of present values of the zero-coupons.

Do money market securities have zero coupons?

The first securities (A, B and C) actually are already zero coupons, since they generate no cash flows before maturity. This is generally the case for money market securities with a maturity of less than, or equal to, one year which remunerate their holders not through a coupon but through the difference between the issue price, which is below par, and the price at which they will be redeemed.

What is coupon interest?

Coupon is the annual interest rate paid to bondholders.

How to identify swap curve?

Swap curve helps to identify different characteristics of the swap rate versus time. The swap rates are plotted on the y-axis, and the time to maturity dates are plotted on the x-axis. So, a swap curve will have different rates for 1-month LIBOR, 3-month LIBOR, 6-month LIBOR, and so on. In other words, the swap curve shows investors the possible return that can be gained for a swap on different maturity dates. The longer the term to maturity on an interest rate swap, the greater its sensitivity to interest rates changes. In addition, since longer-term swap rates are higher than short-term swap

What are the two types of yield curves?

The two main types of yield curves are par curves and zero curves . The par yield curve gives the coupon rate of a theoretical bond that would sell at par for the given maturity. The zero coupon curve gives the yield of a theoretical zero-coupon bond. Without a modifier, a yield curve is usually assumed to be a par curve.

What is yield curve?

A yield curve is a less precise term, but for present purposes, is like a spot curve, except instead of plotting zero coupon treasury yields, the on the run couponed treasury yields and maturities are plotted. A par curve is like a spot curve, except implicit par couponed treasury yields are plotted.

What does the par curve mean?

When people quote the “par” curve they give you the yields of various maturity bonds. Each of the referred to bonds will usually have different yields and pay semi-annual interest payments and a bullet or single payment maturity. Since each “par” bond is a collection of payments the yield quoted on each bond is really the average return for several different term investments. Said anoth

What is the difference between yield curve and term structure?

However, the Yield Curve is the Yield To Maturity of the bonds in your curve, where YTM is an iterative calculator.

What is the yield curve of a 2 year bond?

You can think of this yield curve as having two pieces. It is a 2 year bond that is divided in half. The first year has an interest rate of 5%. The next year has some other interest rate, call it x%. This x% is the forward rate (basically the

What is zero coupon bond?

Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

How long does a zero coupon bond last?

The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child’s college education.

What is deep discount bond?

With the deep discount, an investor can put up a small amount of money that can grow over many years. Investors can purchase different kinds of zero coupon bonds in the secondary markets that have been issued from a variety of sources, including the U.S. Treasury, corporations, and state and local government entities.

Do zero coupon bonds pay interest?

Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

What Is A Zero-Coupon Bond?

- A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

Understanding Zero-Coupon Bonds

- Some bonds are issued as zero-coupon instruments from the start, while other bonds transform into zero-coupon instruments after a financial institution strips them of their coupons, and repackages them as zero-coupon bonds. Because they offer the entire payment at maturity, zero-coupon bonds tend to fluctuate in price, much more so than coupon bonds.1 A bond is a portal t…

Pricing A Zero-Coupon Bond

- The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r)n where: 1. M = Maturity value or face value of the bond 2. r = required rate of interest 3. n = number of years until maturity If an investor wishes to make a 6% return on a bond, with $25,000 par value, that is due to mature in three years, they will be willing to pay the following: If the debtor accepts this offer, the bond w…

Understanding Zero-Coupon Bonds

Pricing Zero-Coupon Bonds

Example of A Zero-Coupon Bonds

Reinvestment Risk and Interest Rate Risk

- Reinvestment risk is the risk that an investor will be unable to reinvest a bond’s cash flows (coupon payments) at a rate equal to the investment’s required rate of return. Zero-coupon bonds are the only type of fixed-income investments that are not subject to investment risk – they do not involve periodic coupon payments. Interest rate risk is the...

More Resources