How do you calculate absorption cost?

Absorption Costing Formula. Mathematically, Absorption Costing Formula is represented as, Absorption cost formula = Direct labor cost per unit + Direct material cost per unit + Variable manufacturing overhead cost per unit + Fixed manufacturing overhead per unit.

How is absorption costing treated under GAAP?

Under usually accepted accounting rules (GAAP), absorption costing is required for exterior reporting. Absorption costing is an accounting technique that captures the entire prices concerned in manufacturing a product when valuing stock. The technique consists of direct prices and oblique prices and is useful in figuring out the price to provide one unit of products.

How do you calculate absorption in manufacturing?

How do you calculate absorption in manufacturing? It is calculated as ( overhead cost/ Labour hours required for production ) if the labour hour required is 1000 and the overhead to be absorbed is 250 then the rate is . 25 per labour hour. if 20 labour hours are required to complete a job then the overhead will be 5.

What is income statement under absorption costing?

What is an absorption costing income statement? The traditional income statement, also called absorption costing income statement, uses absorption costing to create the income statement. This income statement looks at costs by dividing costs into product and period costs. How do you calculate gross profit from absorption costing?

When should absorption costing be used?

Hence, absorption costing can be used as an accounting trick to temporarily increase a company's profitability by moving fixed manufacturing overhead costs from the income statement to the balance sheet. For example, recall in the example above that the company incurred fixed manufacturing overhead costs of $300,000.

What are the benefits of using absorption costing?

The main advantage of absorption costing is that it complies with GAAP and more accurately tracks profits than variable costing. Absorption costing takes into account all production costs, unlike variable costing, which only considers variable costs.

What is absorption costing with example?

Examples include insurance and rent. Absorption costing is an inventory valuation, which means that it is not a regular expense but rather a capitalized cost that is tracked on the balance sheet until the product is sold.

What kind of companies use absorption costing?

1 Although any company can use both methods for different reasons, public companies are required to use absorption costing due to their GAAP accounting obligations.

Why is absorption costing used for external reporting?

Absorption costing also account for the expenses of unsold products, this is important for external reporting as required by GAAP. This method achieves a better and higher net income estimation. This is because it helps to achieve less fluctuation in net profits.

Why does GAAP use absorption costing?

Absorption costing is in accordance with GAAP, because the product cost includes fixed overhead. Variable costing considers the variable overhead costs and does not consider fixed overhead as part of a product's cost.

What are the major characteristics of absorption costing?

Features of Absorption Costing In the absorption costing a product, the cost is determined on the basis full cost, i.e., variable and fixed manufacturing cost. The cost of inventory will be higher in absorption costing as product cost includes fixed factory overhead.

Why is absorption costing better than marginal costing?

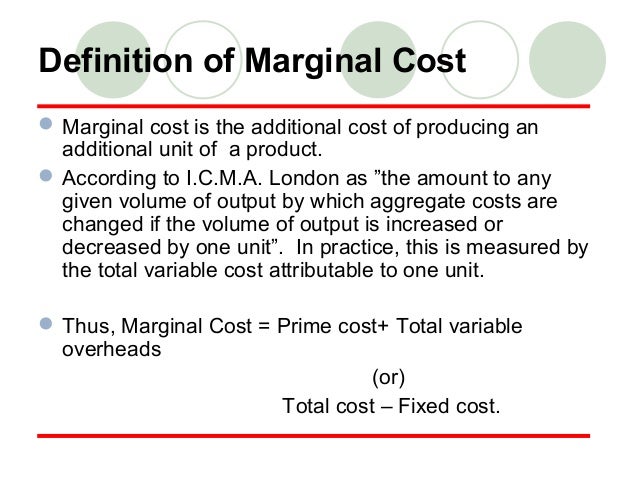

The key differences between marginal and absorption costing are: Purpose – marginal costing enables well informed short-term decision making, and absorption costing calculates the cost of output as well as providing the closing inventory valuation for inclusion in the financial statements.

What are the 4 types of costing?

Costs are broadly classified into four types: fixed cost, variable cost, direct cost, and indirect cost.

What is difference between marginal costing and absorption costing?

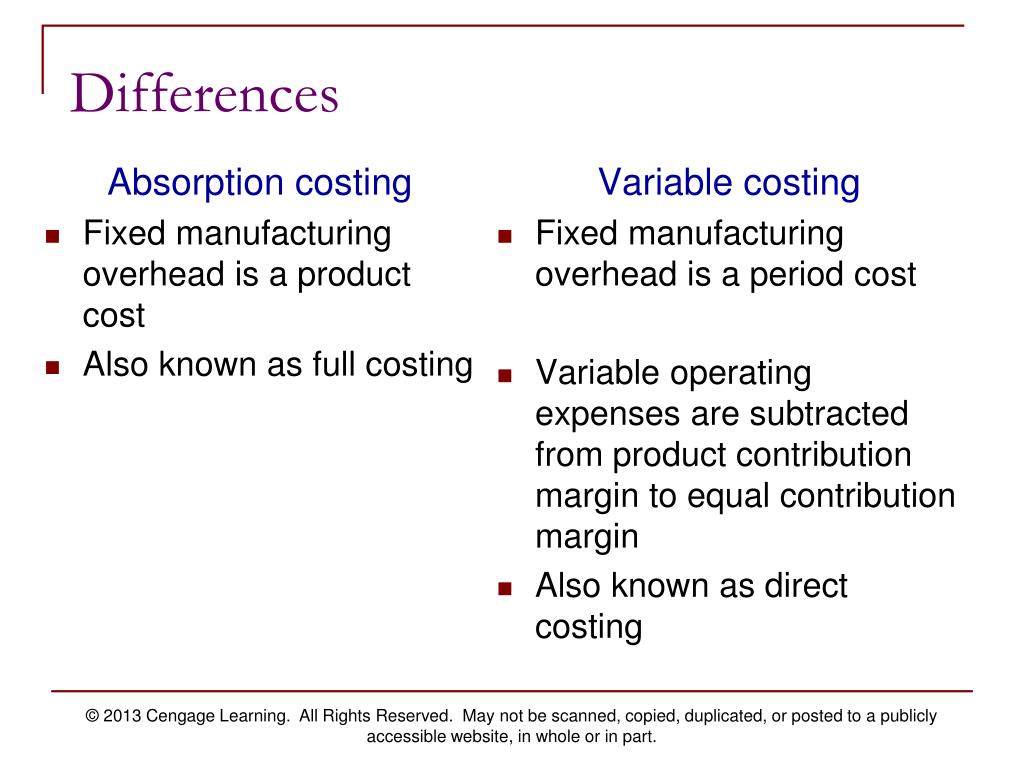

Marginal costing is a method where the variable costs are considered the product cost, and the fixed costs are considered the period's costs. On the other hand, absorption costing is a method that considers both fixed and variable costs as product costs. read more.

What is the basic difference between direct costing and absorption costing?

The fundamental difference between the two systems is one of timing. The direct costing model takes all the fixed cost to the income statement immediately. The absorption costing model assigns the fixed cost to units produced during the period.

Is absorption costing unethical?

One of the most obvious unethical practices on an income statement reflecting absorption costing is the misrepresentation of true costs.

Why is absorption costing higher than variable costing?

When units produced are greater than units sold, i.e., units in inventory increase, absorption income is greater than variable costing income because absorption costing defers a portion of fixed manufacturing costs in finished goods inventory.

What is absorption cost pricing?

Absorption pricing is the pricing strategy also known as full costing. It entails capturing variable cost and fixed costs associated with manufacturing a particular cost per unit of a product. As many other strategies, absorption pricing is directed toward determining the most cost to ensure a good profit margin.

What are the limitations of absorption costing?

Absorption costing is not very helpful in taking managerial decisions such as selection of suitable product mix, whether to buy or manufacture, whether to accept the export order or not, choice of alternatives, the minimum price to be fixed during the depression, number of units to be sold to earn a desired profit etc.

Does IFRS require absorption costing?

Absorption Costing is a management accounting method for accumulating all costs associated with production in the value of produced inventory. It is also called 'full costing' and is required for the external reporting of a company, for it to be GAAP or IFRS compliant.

Which of the following is true for absorption costing?

Correct answer: Option c. both variable and fixed manufacturing costs are considered product costs. Explanation: Under absorption costing, the variable manufacturing costs and the fixed manufacturing overhead are considered as product costs.

Is absorption costing mandatory?

Under generally accepted accounting principles (GAAP), absorption costing is required for external reporting. Absorption costing is an accounting method that captures all of the costs involved in manufacturing a product when valuing inventory.

Which costing method is allowed under GAAP?

One of the most basic differences is that GAAP permits the use of all three of the most common methods for inventory accountability—weighted-average cost method; first in, first out (FIFO); and last in, first out (LIFO)—while the IFRS forbids the use of the LIFO method.

Does unsold inventory increase COGS?

Starting with the beginning inventory and then adding the new inventory tells the cost of all inventory. At no point in time the inventory that remains unsold during the period should be included in the calculation of COGS.

What are the benefits of Activity Based Costing?

ABC enables effective challenge of operating costs to find better ways of allocating and eliminating overheads. It also enables improved product and customer profitability analysis. It supports performance management techniques such as continuous improvement and scorecards.

What are the benefits of marginal costing?

The following are advantages to using the marginal cost pricing method:Increases Profits. There will be customers who are extremely sensitive to prices. ... Gain Entry to Markets. ... Increase Sales of Accessories. ... Not Useful for Long-Term Pricing. ... Ignores Market Prices. ... Encourages Marginal Customers. ... Focuses on Costs.

What are the advantages of full costing method?

Advantages of full costing include compliance with reporting rules and greater transparency. Drawbacks include potential skewed profitability in financial statements and difficulties determining variations in costs at different production levels.

What are the advantages of standard costing?

Advantages of standard costingHelps with accurate budgeting. ... Simplifies inventory costing. ... Makes it easy to price products accurately. ... Provides efficient financial records management. ... Facilitates production benchmarking. ... Rate variance. ... Volume variance.More items...•

What is absorption costing?

Absorption costing is a management costing technique in which both variable and fixed costs are allocated to the product cost for the purposes of inventory valuation. Since the method includes both variable and fixed costs for the calculation of product manufacturing cost, it is also known as the full costing method.

What are the advantages of absorption costing?

The advantages of using the absorption costing method are as follows: It allocates fixed overheads as well to each unit of product manufactured, therefore, gives a fair presentation of the total manufacturing cost of the products. It helps in determining the appropriate selling price of manufactured products.

What is the difference between absorption costing and variable costing?

The main difference between absorption costing and variable costing is regarding the recognition of fixed costs.

What are the two methods of cost accounting?

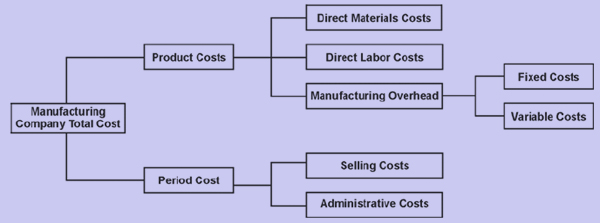

There are two techniques used in cost accounting namely marginal costing and absorption costing. Absorption costing or full costing method is different from the variable costing method because it also allocates the fixed cost to each unit of the product manufactured. The allocation of fixed costs to each produced unit is done based on an absorption rate derived from the budgeted fixed overheads and budgeted production. This leads to over and under absorption of fixed costs because the actual production may vary from the budgeted production.

What is direct material cost?

Direct Material Cost: Materials that are used in the production of the finished goods inventory.

Do fixed and variable sales and administration expenses go in the product manufacturing cost calculation?

While fixed and variable selling and administration expenses are considered as period costs and thus do not go in the product manufacturing cost calculation. They are expensed in the income statement in the same period.

Why is absorption costing not useful?

Disadvantages. Since absorption costing includes allocating fixed manufacturing overhead to the product cost, it is not useful for product decision-making. Absorption costing provides a poor valuation of the actual cost of manufacturing a product. Therefore, variable costing is used instead to help management make product decisions.

How does absorption costing affect profit?

Absorption costing can skew a company’s profit level due to the fact that all fixed costs are not subtracted from revenue unless the products are sold. By allocating fixed costs into the cost of producing a product, the costs can be hidden from a company’s income statement in inventory.

Why is full costing important?

Its main advantage is that it is GAAP-compliant. It is required in preparing reports for financial statements and stock valuation purposes.

What is absorb costing?

Absorption costing is one of approach which is used for the purpose of valuation of inventory or calculation of the cost of the product in the company where all the expenses incurred by the company are taken into the consideration i.e., it includes all the direct and indirect expenses incurred by the company during the specific period.

How to calculate total product cost?

As per this method, the total product cost is calculated by the addition of variable costs, such as direct labor cost per unit, direct material cost per unit and variable manufacturing overhead Manufacturing Overhead Manufacturing Overhead is the total of all the indirect costs involved in manufacturing a product like Property Tax on the production premise, Remunerations of maintenance personnel, Rent of the manufacturing building, etc. read more per unit, and fixed costs, such as fixed manufacturing overhead per unit.

How to determine direct labor cost?

The direct labor cost. can be determined based on the labor rate, level of expertise, and the no. of hours put in by the labor for production. However, the labor cost can also be taken from the income statement.

Is selling and administrative costs a periodic cost?

It is to be noted that selling and administrative costs (both fixed and variable costs) are periodic costs in nature and, as such, are expensed in the period in which it occurred. However, these costs are not included in the calculation of product cost as per the AC. Therefore, the calculation of AC is as follows,

Can labor cost be taken from income statement?

However, the labor cost can also be taken from the income statement. Secondly, identify the material type required and then determine the amount of the material required for the production of a unit of product to calculate the direct material cost per unit.

Is selling and administrative costs included in the product cost calculation?

It is to be noted that selling and administrative costs (both fixed and variable costs) are periodic costs in nature and, as such, are expensed in the period in which it occurred. However, these costs are not included in the calculation of product cost as per the AC.

What is absorption costing?

Absorption costing—also referred to as “full absorption costing" or "full costing"—is an accounting method designed to capture all of the costs that go into manufacturing a specific product. Absorption costing is necessary to file taxes and issue other official reports. Regardless of whether every manufactured good is sold, every manufacturing expense is allocated to all products. In other words, the company’s products absorb all the company’s costs.

Why is absorption costing important?

Absorption costing gives a company a more accurate picture of profitability especially if all of its products are not sold during the same period when they are manufactured. This is an important consideration if a company plans to ramps up production in anticipation of a seasonal sales increase.

How does pricing increase profitability?

That is because the fixed overhead is assigned to the total number of produced units, lowering the cost for each additional unit produced. Then, when units are left unsold, the fixed overhead costs aren't transferred to expense reports, increasing the profitability.

What is the data gathered for determining a product's cost through absorption costing?

The data gathered for determining a product's cost through absorption costing includes fixed overhead. This can inflate the actual cost of manufacturing and result in insufficient data to perform a comprehensive analysis.

What is product cost?

Product costs are more directly related to the manufacturing of the product. In absorption costing, expenses related to production are listed as an asset in inventory accounts until the product is sold, then they are allocated to the cost of sold goods.

How to calculate absorption cost?

Here are some steps for calculating and assigning absorption costing: 1. Develop cost pools. First, determine the costs associated with the production of a product and then assign them to different cost pools. A cost pool groups expenses by activity.

Why is it important to absorb costs?

Absorption costing makes it easier for small businesses to track since they probably do not have a large number of products. The companies can absorb fixed costs in advance and sell their products for a more realistic price and profit.

What Is Absorption Costing?

Absorption costing, or full absorption costing , captures all of the manufacturing or production costs, such as direct materials, direct labor, rent, and insurance.

Why is absorption costing important?

Absorption costing can cause a company's profit level to appear better than it actually is during a given accounting period. This is because all fixed costs are not deducted from revenues unless all of the company's manufactured products are sold. In addition to skewing a profit and loss statement, this can potentially mislead both company management and investors.

What are the advantages of absorption costing?

Some of the primary advantages of absorption costing are that it complies with generally accepted accounting principles (GAAP), recognizes all costs involved in production (including fixed costs), and more accurately tracks profit during an accounting period .

What is variable costing?

Variable costing, on the other hand, includes all of the variable direct costs in the cost of goods sold (COGS) but excludes direct, fixed overhead costs. Absorption costing is required by generally accepted accounting principles (GAAP) for external reporting.

Why is variable costing more useful than absorption costing?

Variable costing is more useful than absorption costing if a company wishes to compare different product lines' potential profitability. It is easier to discern the differences in profits from producing one item over another by looking solely at the variable costs directly related to production.

Why is it difficult to determine variations in costs?

If fixed costs are a substantial part of total production costs , it is difficult to determine variations in costs that occur at different production levels. This makes it more difficult for management to make the best decisions for operational efficiency .

Is absorption costing GAAP compliant?

One of the main advantages of choosing to use absorption costing is that it is GAAP compliant and required for reporting to the Internal Revenue Service (IRS). 1

Explanation

Example of Absorption Costing

- We have the following information relating to ABC Ltd and we need to calculate the product cost using absorption costing method: 1. Manufactured Units – 4000 2. Units Sold – 3000 3. Direct Labor Cost – $6000 4. Direct Material Cost- $8000 5. Fixed Overhead – $7000 6. Variable Overheads – $1000 Solution: Total Product Cost is calculated using the formula given below Tot…

Components of Absorption Costing

- The absorption costing method has the following components basis which the formula is also mentioned in earlier heading: 1. Direct Material Cost: Materials that are used in the production of the finished goods inventory. 2. Direct Labor Cost: Factory labor cost involved in the manufacturing of the product. 3. Variable Manufacturing Overhead:The cost involved in operatin…

Uses of Absorption Costing

- The uses are as follows: 1. It is used in the determination of the profitable selling price of the products as it includes all the costs involved in the manufacturing of the product. 2. It is used for inventory or stock valuation purposes.

Advantages

- The advantages of using the absorption costing method are as follows: 1. It allocates fixed overheads as well to each unit of product manufactured, therefore, gives a fair presentation of the total manufacturing cost of the products. 2. It helps in determining the appropriate selling price of manufactured products. 3. It helps in setting the recovery rate for fixed overheads as it involves …

Disadvantages

- The disadvantages of the absorption costing method in calculation of product cost are as follows: 1. As the method includes fixed overheads, therefore it does not help much in decisions regarding product mix or make or buy of products. 2. It is not helpful for cost control purposes as fixed overheads cannot be curbed or curtailed, they will always remain the same. 3. As it allocates fix…

Conclusion

- We can conclude from the above discussion that absorption costing is no doubt a very important method for the calculation of product cost. The main difference between absorption costing and variable costing is regarding the recognition of fixed costs.

Recommended Articles

- This is a guide to Absorption Costing. Here we also discuss the definition and Components of Absorption Costing along with advantages and disadvantages. You may also have a look at the following articles to learn more – 1. Marginal Costing vs Absorption Costing 2. Variable Costing Example 3. Job Costing vs Process Costing 4. Budgeting Examples

Components of Absorption Costing

Example of Absorption Costing

- Company A is a manufacturer and seller of a single product. In 2016, the company reported the following costs:

Advantages

- There are several advantages to using full costing. Its main advantage is that it is GAAP-compliant. It is required in preparing reports for financial statements and stock valuation purposes. In addition, absorption costing takes into account all costs of production, such as fixed costs of operation, factory rent, and cost of utilities in the facto...

Disadvantages

- Since absorption costing includes allocating fixed manufacturing overhead to the product cost, it is not useful for product decision-making. Absorption costing provides a poor valuation of the actual cost of manufacturing a product. Therefore, variable costing is used instead to help management make product decisions. Absorption costing can skew a company’s profit level du…

Related Reading

- Thank you for reading this guide to calculating the full costing of inventory. To keep learning and developing your knowledge base, please explore the additional relevant resources below: 1. Job Order Costing Guide 2. Activity-based Costing Guide 3. Cost of Goods Sold (COGS) 4. Fixed and Variable Costs