- The accounting equation acts as a basis for accounting and uses the dual aspect principle of accounting.

- It is also known as the Balance Sheet Equation.

- According to the balance sheet equation, total assets are always equal to the sum of capital and external liabilities.

How to calculate accounting equation?

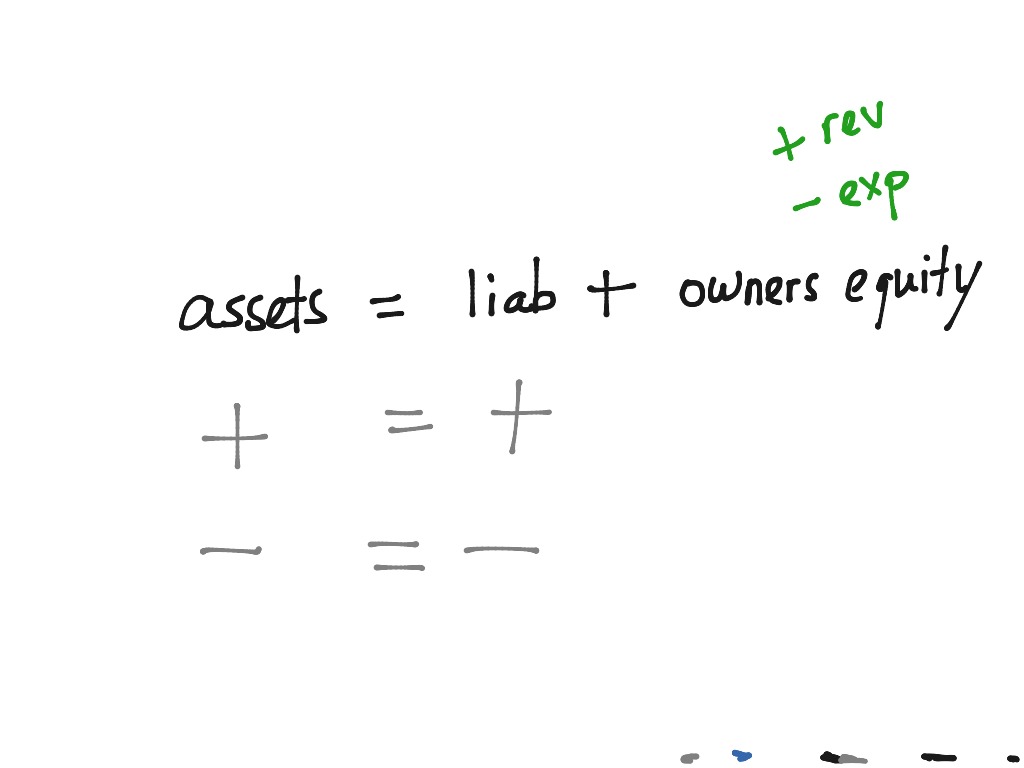

Formula 1: The Accounting Equation The accounting equation equates assets with liabilities and owners’ equity: Assets = Liability + Owners' Equity Assets are things owned by the company — such as cash, inventory, and equipment — that will provide some future benefit.

What are the six major elements of the accounting equation?

The six major elements of the accounting equation are assets , liabilities , owner ’s equity , revenues , expenses , and withdrawals . Assets represent the positives in the accounting equation because they increase an owner ’s net worth by the amount posted in each record , or by the amount that flows in ( cash inflow ) .

Why you should know the accounting equation?

Why you should know the accounting equation statementThe accounting equation is important because it can give you a clear picture of the financial health of your business. It is a financial reporting standard and a double entry accounting framework. Without a balance sheet comparison, you will not be able to read your balance sheet properly or ...

What does the accounting equation tell us?

What is the Accounting Equation?

- Assets. Assets are resources owned by your business. They can be tangible or intangible. ...

- Liabilities. Liabilities are the existing obligations and debt that your company owes. ...

- Owners’ Equity. Owners' equity represents what you (and other owners and stockholders) have invested into the business.

What Is the Accounting Equation?

The accounting equation states that a company's total assets are equal to the sum of its liabilities and its shareholders' equity.

Why is accounting equation important?

The accounting equation is important because it captures the relationship between the three components of a balance sheet: assets, liabilities, and equity. All else being equal, a company’s equity will increase when its assets increase, and vice-versa.

What Are the 3 Elements of the Accounting Equation?

The three elements of the accounting equation are assets, liabilities, and shareholders' equity . The formula is straightforward: A company's total assets are equal to its liabilities plus its shareholders' equity. The double-entry bookkeeping system, which has been adopted globally, is designed to accurately reflect a company's total assets.

How to calculate total equity?

The balance sheet holds the basis of the accounting equation: 1 Locate the company's total assets on the balance sheet for the period. 2 Total all liabilities, which should be a separate listing on the balance sheet. 3 Locate total shareholder's equity and add the number to total liabilities. 4 Total assets will equal the sum of liabilities and total equity.

What is the third section of the balance sheet?

Owners’ equity, or shareholders' equity, is the third section of the balance sheet. The accounting equation is a representation of how these three important components are associated with each other. The accounting equation is also called the basic accounting equation or the balance sheet equation. While assets represent ...

What is the difference between assets and liabilities?

Assets represent the valuable resources controlled by the company. The liabilities represent their obligations.

Does the balance sheet always balance out?

Although the balance sheet always balances out, the accounting equation doesn't provide investors information as to how well a company is performing. Instead, investors must interpret the numbers and decide for themselves whether the company has too many or too few liabilities, not enough assets, or perhaps too many assets, or is financing the company properly to ensure long term growth.

How Does the Accounting Equation Differ from the Working Capital Formula?

The accounting equation uses total assets, total liabilities, and total equity in the calculation. This formula differs from working capital, based on current assets and current liabilities.

What is the Expanded Accounting Equation?

The expanded accounting equation lengthens the basic accounting equation (Assets = Liabilities + Shareholders’ Equity). It shows items within the shareholders’ equity section of the balance sheet in the formula.

What is Double-Entry Accounting (Bookkeeping)?

In double-entry accounting or bookkeeping, total debits on the left side must equal total credits on the right side. That’s the case for each business transaction and journal entry. As a result, the financial statements are in balance.

What is accounting equation?

Accounting Equation is the primary accounting principle stating that a business’s total assets are equivalent to the sum of its liabilities & owner’s capital. This is also known as the Balance Sheet Equation & it forms the basis of the double-entry accounting system. Below is the Accounting Equation.

What is the equation for assets?

Assets = Liabilities + Shareholders Equity. Accounting Equation is based on the double-entry bookkeeping system, which means that all assets should be equal to all liabilities in the book of accounts. All the entries which are made to the debit side of a balance sheet should have a corresponding credit entry in the balance sheet.

What is double entry bookkeeping?

The concept of a double-entry bookkeeping system helps us understand the flow of any particular transaction from the source to the end. Let’s take another basic, expanded accounting equation example.

What is the rule of accounting?

Rule Of Accounting Accounting rules are guidelines to follow for registering daily transactions in the entity book through the double-entry system. Here, every transaction must have at least 2 accounts (same amount), with one being debited & the other being credited. read more.

What is income statement?

An income statement is prepared to reflect the company’s total expenses and total income to calculate the net income to be used for further purposes. This statement is also prepared in the same conjunction as the balance sheet. However, a little differently applied. Here, we do not have total assets and liabilities.

What is ownership percentage?

The ownership percentage depends on the number of shares they hold against the company's total shares. read more. invest their money in the company, they are required to be paid with some amount of returns, which is why this is a liability in the company’s account books. Hence, the total assets.

What is the value of the items that a company owns?

Assets: This is the value of the items that a company owns; they may be tangible or intangible but belong to the company.

How to Calculate the Accounting Equation?

Following are the steps which need to be followed to calculate the accounting equation

Why do we use accounting equations?

It is also known as an Accounting Equation balance sheet since it tells us the relation between balance sheet items i.e. Assets, Liabilities, and Equity.

Why is accounting equation important?

If we want to explain the importance of the accounting equation, we can say that it is the foundation of the double-entry accounting system. This system ensures that the equation always remains balanced which essentially means that assets should always be equal to the sum of liabilities and shareholder’s equity. In a Fundera article, Heather D. Satterley, founder of Satterley Training & Consulting, LLC, explains:

What is the left side of the balance sheet called?

Before finding the equation, keep in mind that left side of the balance sheet is the assets side and also known as “Debit side” and the right side is Liability and equity side also called “Credit side”.

What is equity in business?

Equity is the ownership of the stakeholders in the business. So if you have started a business of your own, you are the stakeholder of the company. The general rule of this equation is the Total assets of the company will always be equals to the sum of its Total liabilities and Total equity.

What is the difference between assets and liabilities?

Assets are basically the things which a business owns. For example, cash, inventory, property, and equipment, etc. all form part of assets. Liabilities are basically the money which business owes to others. For example, payables, debt, etc. are a type of liabilities. Equity is the ownership of the stakeholders in the business.

What happens if the expanded accounting equation formula is not balanced?

The two sides of the equation must equal each other. If the expanded accounting equation formula is not balanced, your financial reports are inaccurate.

How to calculate the Accounting Equation?

The accounting equation on the basis of a balance sheet can be calculated as.

Why is double entry accounting important?

It helps the company to prepare a balance sheet and see if the entire enterprise’s asset is equal to its liabilities and stockholder equity. It is the base of the double-entry accounting system. Double-entry accounting is a system that ensures that accounting and transaction equation should be equal as it affects both sides.

What is the accounting equation?

The accounting equation is the most fundamental equation of accounts. It is one of those equations from which a multitude of other equations is derived. It is the most fundamental equation upon which multitudes of other equations are based upon. It forms the primary principle of accounting, and it helps in maintaining the balance sheet of a company.

What falls under each section of the accounting equation?

There are three parts of an accounting equation: assets, liabilities, and shareholder’s equity. Each one of these three parts has a subclass.

What is the universal equation in accounting?

That is, assets must be equal to the sum of liabilities and shareholder’s equity or simply equity. The two sides must match. By manipulating this equation, balance sheets in the account books of a company are maintained.

Why is cash the first asset on a balance sheet?

This can be a serious asset to have when a company is experiencing a cash-flow problem. That is why in a balance sheet under assets, Cash is the first one declared.

Which side of the balance sheet goes up?

So, the assets side of the balance sheet went up, but the liabilities side of the balance sheet also went up. In the end, the liabilities side becomes equal to the assets side.

What is double entry bookkeeping?

Double-entry bookkeeping is when each financial transaction is noted two times, once on the debit side and once on the credit side, so books can be balanced. The books are balanced if both sides are equal to each other.

Is equipment based on depreciation?

Furthermore, the value of the equipment is based on depreciation. The older the equipment, the less the value it holds. This is why inventory and equipment are declared at the end of the asset side in the balance sheet.

Assets

Assets are basically possessions of the business. They are things that add value to the business and will bring it benefits in some form.

Owners Equity (or Equity)

Owners equity, or simply, equity, is the value of the business assets that the owner can lay claim to.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

What Is The Accounting equation?

Understanding The Accounting Equation

- The financial position of any business, large or small, is based on two key components of the balance sheet: assets and liabilities. Owners’ equity, or shareholders' equity, is the third section of the balance sheet. The accounting equation is a representation of how these three important components are associated with each other. Assets represent ...

Accounting Equation Formula and Calculation

- Assets=(Liabilities+Owner’s Equity)\text{Assets}=(\text{Liabilities}+\text{Owner's Equity})Assets=(Liabilities+Owner’s Equity) The balance sheet holds the elements that contribute to the accounting equation: 1. Locate the company's total assets on the balance sheet for the period. 2. Total all liabilities, which should be a separate listing on the balance sheet. 3. Locate t…

About The Double-Entry System

- The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet. Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders' equity. For a company keeping accurate accounts, every business transaction will …

Limits of The Accounting Equation

- Although the balance sheet always balances out, the accounting equation can't tell investors how well a company is performing. Investors must interpret the numbers and decide for themselves whether the company has too many or too few liabilities, not enough assets, or perhaps too many assets, or whether its financing is sufficient to ensure its long-term growth.

Real-World Example

- Below is a portion of Exxon Mobil Corporation's (XOM) balance sheet in millions as of Dec. 31, 2019: 1. Total assets were $362,597 2. Total liabilities were $163,659 3. Total equity was $198,9381 The accounting equation is calculated as follows: 1. Accounting equation= $163,659 (total liabilities) + $198,938 (equity) equals $362,597, (which equals the total assets for the perio…

Example #1

Example #2

- A double-entry bookkeeping system helps us understand the flow of any particular transaction from the source to the end. Let’s take another basic, expanded accounting equationExpanded Accounting EquationExpanded Accounting Equation refers to the expanded version of the basic accounting equation for a specific corporation or sole proprietor, providing information on the c…

Accounting Equation in An Income Statement

- Not only does the balance sheet reflect the basic accounting equation as implemented, but also the income statementIncome StatementThe income statement is one of the company's financial reports that summarizes all of the company's revenues and expenses over time in order to determine the company's profit or loss and measure its business activity ov...

Final Thoughts

- It is understood that the double-entry book-entry accounting system is followed globally and adheres to the rules of debitRules Of DebitDebit represents either an increase in a company’s expenses or a decline in its revenue. read more and credit entries. These entries should tally to each other at the end of a particular period, and if there is a gap in total balances, it needs to be i…

Recommended Articles

- This article has been a guide to the Accounting Equation and its definition. Here we discuss the accounting equation in detail, breaking it down along with practical examples. You may also have a look at the following basic accounting articles for gaining further knowledge – 1. Accounting Practices 2. Fund Accounting 3. Examples of Financial Statement 4. Shareholder’sEquity Formula