What is accrual based net income? Accruals are the non-cash net income earned by a business as a result of accrual based accounting. Mathematically, they are Net Income less Cash Flows from Operations.

Is accrual basis more reliable than cash basis accounting?

indicated that accrual basis accounting is more reliable than cash basis accounting because it could fulfill his needs. Cash basis accounting is more reliable than accrual basis accounting according to theory, however, this is different from what the professional (C.F.O.) suggested.

What does accrual base mean in accounting?

Simple Explanation of Accrual Basis Accounting

- Definition. Accrual basis is the accounting method that recognizes and records revenues and expenses in the period they occur.

- Accrual Basis for Revenues. ...

- Accrual Basis for Expenses. ...

- Benefits of Accrual Basis. ...

How to convert cash basis to accrual basis?

Convert from cash basis to accrual basis by adjusting cash net income to accrual net income using the accounting formula (cash net income adjustment = (+) ch...

Is accrual accounting better than cash accounting?

While the accrual basis of accounting provides a better long-term view of your finances, the cash method gives you a better picture of the funds in your bank account. This is because the accrual method accounts for money that’s yet to come in.

See 3 key topics from this page & related content

See 4 key topics from this page & related content

What is accrual based net income?

Accruals are the non-cash net income earned by a business as a result of accrual based accounting. Mathematically, they are Net Income less Cash Flows from Operations. Businesses with large positive accruals generally have large non-cash earnings like sales on account that have not yet been paid by customers.

How do you calculate accrual basis income?

0:575:27How to Compute Cash and Accrual Accounting Income ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipWhen using the accrual basis of accounting the revenues and expenses are recorded in the particularMoreWhen using the accrual basis of accounting the revenues and expenses are recorded in the particular period they pertain to irrespective of whether cash has been actually received or paid in that

When accrual basis accounting Do you use net income?

When accrual basis accounting is used, net income equals the amount of cash generated by the business. False! Accrual basis net income is the excess of revenues earned over expenses incurred. Revenues do not necessarily equal cash receipts and expenses that do not necessarily equal cash disbursements.

What is an accrual basis income statement?

Accrual basis of accounting attempts to match the revenues a company has earned in the period with the expenses that were incurred to generate the revenue. Simply put, if the revenue was earned in June, it is recorded to the income statement in June, regardless of when the company received payment from the customer.

What is net income formula?

Net income is calculated by subtracting all expenses from total revenue/sales: Net income = Total revenue - total expenses.

How does accrual basis net income differ from cash basis net income?

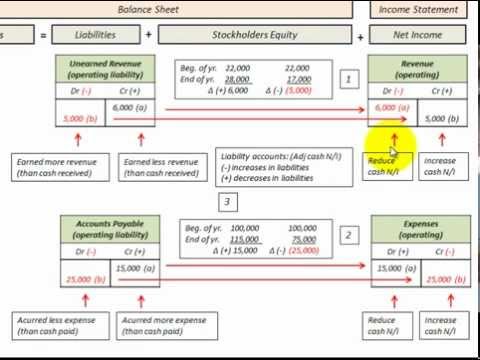

The cash basis method generally recognizes income when cash is received and expenses when cash is paid. The accrual method recognizes income when it is earned (the creation of assets such as accounts receivable) and expenses when they are incurred (the creation of liabilities such as accounts payable).

How do you calculate net income from cash basis accounting?

How to Calculate Cash Basis IncomeCalculate the total of all sources of business revenue you receive from customers or clients. ... Calculate the total of all the business expenses you pay during the same period you calculate your income for. ... Subtract your total cash-basis expenses from your cash-basis income.

What is net income in accounting?

Net income represents the overall profitability of a company after all expenses and costs have been deducted from total revenue. Net income also includes any other types of income that a company earned, such as interest income from investments or income received from the sale of an asset.

How do you treat an accrual on an income statement?

If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account (which appears in the balance sheet).

What's the accrual method for 10000?

Under the cash method, you'd record only that $10,000 once you receive the money in hand. Under the accrual method, you'd record that $10,000 as revenue the day the sale is made. It doesn't matter when you receive the money; you're obligated to report it as earned revenue as soon as you become aware of the sale.

How do you calculate accruals on a balance sheet?

Total Accrual= Net profit - Net Cash from Operating Activities. when I use first method, i am getting negative total accruals for most of the companies, because depreciation is usually high.

What is accrual entry example?

For example, a company pays its February utility bill in March, or delivers its products to customers in May and receives the payment in June. Accrual accounting requires revenues and expenses to be recorded in the accounting period that they are incurred.

What Are Accruals?

Accruals are revenues earned or expenses incurred which impact a company's net income on the income statement, although cash related to the transaction has not yet changed hands. Accruals also affect the balance sheet, as they involve non-cash assets and liabilities. Accrual accounts include, among many others, accounts payable, accounts receivable, accrued tax liabilities, and accrued interest earned or payable.

How are accruals created?

Accruals are created via adjusting journal entries at the end of each accounting period.

What is offset to accrued expense?

In double-entry bookkeeping, the offset to an accrued expense is an accrued liability account, which appears on the balance sheet. The offset to accrued revenue is an accrued asset account, which also appears on the balance sheet. Therefore, an adjusting journal entry for an accrual will impact both the balance sheet and the income statement.

How do accruals improve financial statements?

Accruals improve the quality of information on financial statements by adding useful information about short-term credit extended to customers and upcoming liabilities owed to lenders.

What is accrual on a balance sheet?

Accruals are revenues earned or expenses incurred which impact a company's net income on the income statement, although cash related to the transaction has not yet changed hands. Accruals also affect the balance sheet, as they involve non-cash assets and liabilities.

Why do we use accrual accounts?

The use of accrual accounts greatly improves the quality of information on financial statements. Before the use of accruals, accountants only recorded cash transactions. Unfortunately, cash transactions don't give information about other important business activities, such as revenue based on credit extended to customers or a company's future liabilities. By recording accruals, a company can measure what it owes in the short-term and also what cash revenue it expects to receive. It also allows a company to record assets that do not have a cash value, such as goodwill .

What is an example of revenue accrual?

Let's look at an example of a revenue accrual for an electric utility company. The utility company generated electricity that customers received in December. However, the utility company does not bill the electric customers until the following month when the meters have been read. To have the proper revenue figure for the year on the utility's financial statements, the company needs to complete an adjusting journal entry to report the revenue that was earned in December.

What is accrual basis accounting?

Under accrual basis accounting, you would report income for the time period when it is earned, even though you may not be paid during the same fiscal period. ...

When is income earned?

Income is earned when services have been provided or goods have been sold to a customer. Income must be counted as earned even if payment for goods and services has not yet been received. Calculate all incurred expenses. Expenses are incurred when services are purchased or utilized, and a bill is received from the vendor.

What is accounting method?

Accounting methods are the ways that business owners and companies determine how they will list income and expenses on their income tax return. Two types of accounting methods exist for businesses -- cash and accrual. Once a business chooses a method for tax-filing purposes, the business must continue using the chosen method unless permission is ...

When are expenses deducted?

Expenses are deducted during the period when they are incurred, even though you may not pay them during that time. Compared to the cash basis method, the accrual accounting method has a vastly different effect on the profits or losses of a business.

Can a business acquire additional costs at the end of the year?

Similarly, a business may purposefully acquire additional costs at the end of the year to increase expense deductions . For more information about accrual basis accounting, contact a professional who can provide appropriate help and advice for your business. References.

What is accumulated depreciation?

Accumulated depreciation is a contra account (negative asset) that reduces the asset and reports the cumulative cost of using the physical asset for the time that has already passed.

What is depreciation expense?

Depreciation Expense: Long-term assets become expenses and move from the balance sheet to the income statement as they are used to produce revenues.

Why is depreciation reported on the balance sheet?

Accumulated depreciation is reported on the balance sheet to show how much has been used to date (cumulative).

What does balance sheet account mean?

Balance sheet accounts indicate when the cash occurs in a different period of time than the revenue or expense occurred.

Is depreciation expense spread over each year?

1) The depreciation expense occurs equal ly ( using straight- line) and is spread over each year the asset is used. The expense is for one period only.

Is an intangible asset reported the same as a physical asset?

The expense of using an intangible asset is reported the same way as the cost of using a physical asset.

What is the difference between cash basis and accrual basis?

The adage “timing is everything” captures the biggest difference between them . Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. Accrual accounting recognizes revenue when it’s earned and expenses when they’re incurred, regardless of when money actually changes hands. The difference in timing ripples through the company’s income statements and balance sheet, and subsequently affects its tax liability.

What is accrual accounting?

Accrual accounting recognizes revenue when it’s earned and expenses when they’re incurred, regardless of when money actually changes hands. The difference in timing ripples through the company’s income statements and balance sheet, and subsequently affects its tax liability. Each method has advantages and disadvantages.

Why is accrual accounting the gold standard?

The accrual basis of accounting is the gold standard because it gives a more accurate representation of a company’s finances. With accrual accounting, businesses can more easily keep track of credit transactions using an accounts receivable system, which shows the full transaction history of each customer.

What are the disadvantages of accrual accounting?

A disadvantage of accrual accounting is the additional bookkeeping. Rather than just look at cash coming in and out, businesses using accrual accounting monitor receivables, prepaid expenses, accounts payable and other accrued liabilities. It also requires more frequent closing of the company’s books.

Why do businesses use cash accounting?

Many businesses prefer to use cash accounting because the financial statements closely reflect their cash position, which is especially important for small business owners . The simplicity also makes bookkeeping easier and cheaper. And under cash-basis accounting a business doesn’t have to pay taxes on cash it hasn’t collected.

Why do companies use cash method accounting?

Companies usually use the cash method of accounting because they deal mostly with cash transactions.

What are the types of accounts in accrual accounting?

In accrual accounting, the five types of accounts—revenue, expense, asset, liability, and equity —are used to categorize transactions. The single-entry system looks a little more like a personal bank account where amounts are credited or debited in one table or ledger.

What is the difference between cash basis and accrual accounting?

The cash method is a more immediate recognition of revenue and expenses, while the accrual method focuses on anticipated revenue and expenses.

Which accounting method is more accurate, accrual or cash basis?

Cash basis accounting is easier, but accrual accounting portrays a more accurate portrait of a company's health by including accounts payable and accounts receivable.

Why do companies use accrual method?

One reason for the accrual method's popularity is that it smooths out earnings over time since it accounts for all revenues and expenses as they're generated instead of being recorded intermittently under the cash-basis method.

Why is accrual method used?

The reason for this is that the accrual method records all revenues when they are earned and all expenses when they are incurred. For example, a company might have sales in the current quarter that wouldn't be recorded under the cash method because revenue isn't expected until the following quarter. An investor might conclude the company is ...

When is revenue accounted for?

Revenue is accounted for when it is earned. Typically, revenue is recorded before any money changes hands. Unlike the cash method, the accrual method records revenue when a product or service is delivered to a customer with the expectation that money will be paid in the future.

When is a $5,000 bill recorded as revenue?

Under the accrual method, the $5,000 is recorded as revenue immediately when the sale is made, even if you receive the money a few days or weeks later. The same principle applies to expenses. If you receive an electric bill for $1,700, under the cash method, the amount is not added to the books until you pay the bill.

Is accrual method more accurate?

Meanwhile, the advantage of the accrual method is that it includes accounts receivables and payables and, as a result, is a more accurate picture of the profitability of a company, particularly in the long term .