What is the cash to cash cycle?

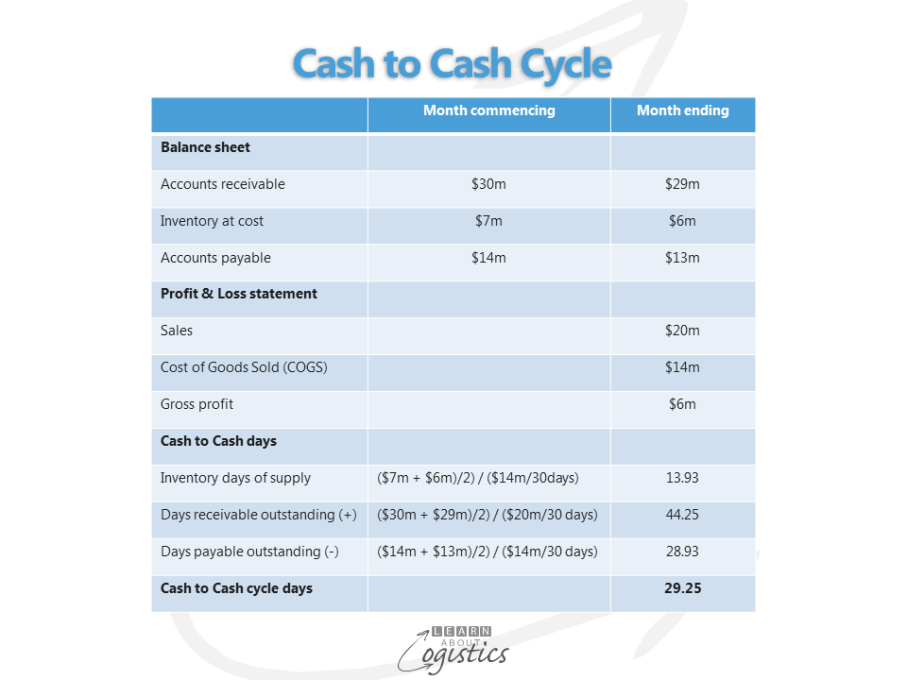

The cash to cash cycle. The cash to cash cycle is the time period between when a business pays cash to its suppliers for inventory and receives cash from its customers. The concept is used to determine the amount of cash needed to fund ongoing operations, and is a key factor in estimating financing requirements. The cash to cash calculation is:

What is cash management?

The process of collecting and managing cash flows from the operating, investing, and financing activities of a company What is Cash Management? Cash management, also known as treasury management, is the process that involves collecting and managing cash flows from the operating, investing, and financing activities of a company.

What is cash conversion cycle (CCC)?

The Cash Conversion Cycle (CCC) is a metric that shows the amount of time it takes a company to convert its investments in inventory to cash. The cash conversion cycle formula measures the amount of time, in days, it takes for a company to turn its resource inputs into cash.

How does the cash conversion cycle affect cash flow?

As with other cash flow calculations, the shorter the cash conversion cycle, the better the company is at selling inventories and recovering cash from these sales while paying suppliers. The cash conversion cycle should be compared to companies operating in the same industry and conducted on a trend.

What is the meaning of cash cycle?

The cash conversion cycle (CCC) – also known as the cash cycle – is a working capital metric which expresses how many days it takes a company to convert cash into inventory, and then back into cash via the sales process.

What is cash cycle with example?

The time from when you go to the market and collect gold to the time you receive the cash from selling the gold again is called the cash conversion cycle. It is one of the best ways to check the company's sales efficiency. It helps the firm know how quickly they can buy, sell, and receive cash.

Why is the cash cycle important?

The cash conversion cycle is an important business metric that shows how efficient a business is. Tracking it allows a business to see how quickly it is converting cash in sales and back into cash. It also assists business owners to have a clear picture of their cash flow position.

What is the cash cycle formula?

Cash Conversion Cycle = DIO + DSO – DPO DIO stands for Days Inventory Outstanding. DSO stands for Days Sales Outstanding. DPO stands for Days Payable Outstanding.

How long is the cash cycle?

To calculate your cash conversion cycle, you'll first need to determine the period you wish to calculate it for (i.e., for the quarter, the year, etc.). We typically recommend a period of 13 weeks since most businesses will have enough cash flow data to make an accurate calculation for that timeframe.

What is a good cash conversion cycle?

What's a good cash conversion cycle? A good cash conversion cycle is a short one. If your CCC is a low or (better yet) a negative number, that means your working capital is not tied up for long, and your business has greater liquidity.

How can a company improve its cash conversion cycle?

What Can Companies Do To Improve Cash Conversion Cycle Times?Invest in Real-Time Analytics.Encourage Earlier Payments.Speed Up the Delivery Time.Make It Easier To Pay.Simplify Your Invoices.

What is the difference between operating cycle and cash conversion cycle?

Differences between operating cycle and cash cycle An operating cycle differs from a cash cycle, and it is about how much time a business takes to operate its raw material to inventory, receivables, and cash. On the other hand, the cash conversion cycle is about the management of the cash flow.

What is a good cash to cash cycle?

Generally, the cash-to-cash cycle time benchmark is 30 to 45 days — and the fewer days, the better it is for small companies that do not have the cash flow to allow for longer payment periods.

What's the difference between operating cycle and cash cycle?

The operating cycle measures the time it takes a business to convert inventory into cash, while the cash cycle takes into account that a business doesn't have to pay its suppliers back right away.

What is the difference between a firm's cash cycle and its operating cycle give examples?

The cash conversion cycle includes the full cycle of cash: from the purchase of inventory to the collection of receivables to the payment of payables. However, the operating cycle only includes inventory days and the average collection period, not the amount of time it takes to pay for inventory (payables).

What Is Cash Management?

Cash management is the process of collecting and managing cash flows. Cash management can be important for both individuals and companies. In business, it is a key component of a company's financial stability. For individuals, cash is also essential for financial stability while also usually considered as part of a total wealth portfolio.

What is corporate cash management?

In corporate cash management, also often known as treasury management, business managers, corporate treasurers, and chief financial officers are typically the main individuals responsible for overall cash management strategies, cash-related responsibilities, and stability analysis. Many companies may outsource part or all of their cash management responsibilities to different service providers. Regardless, there are several key metrics that are monitored and analyzed by cash management executives on a daily, monthly, quarterly, and annual basis.

What are the two main liquidity ratios analyzed in conjunction with cash management?

The two main liquidity ratios analyzed in conjunction with cash management include the quick ratio and the current ratio.

What are the internal controls used to manage and ensure efficient business cash flows?

Some of a company’s top cash flow considerations include the average length of account receivables, collection processes, write-offs for uncollected receivables, liquidity and rates of return on cash equivalent investments, credit line management, and available operating cash levels.

What are the different types of working capital?

In general working capital includes the following: 1 Current assets: cash, accounts receivable within one year, inventory 2 Current liabilities: all accounts payable due within one year, short-term debt payments due within one year

What is the primary asset individuals and companies use to pay their obligations on a regular basis?

Cash is the primary asset individuals and companies use to pay their obligations on a regular basis. In business, companies have a multitude of cash inflows and outflows that must be prudently managed in order to meet payment obligations, plan for future payments, and maintain adequate business stability.

What is a cash flow statement?

The cash flow statement is a central component of corporate cash flow management. While it is often transparently reported to stakeholders on a quarterly basis, parts of it are usually maintained and tracked internally on a daily basis. The cash flow statement comprehensively records all of a business’s cash flows. It includes cash received from accounts receivable, cash paid for accounts payable, cash paid for investing, and cash paid for financing. The bottom line of the cash flow statement reports how much cash a company has readily available.

What is cash management?

Cash management is also known as treasury management, refers to the process of collection, management, and usage of cash flows for the purpose of maintaining a decent level of liquidity, and it involves financial instruments such as treasury bills, certificate of deposit, and money market funds making ...

What are the objectives of cash management?

The other objectives of cash management are maximizing liquidity, regulation of cash flows, maximizing the value of available funds, and lowering the costs pertaining to funds.

Why is cash investment important?

It is a process in which the cash is collected, disbursed, and invested so that there is maximum liquidity. It also helps in maximizing profitability by optimizing cash utilization. It also helps in creating provisions for future contingencies such as economic slowdown, bad debts, etc.

How long does a company have to be on a credit period to receive cash?

Receivables Management. A company focuses on raising its invoices so that sales can be boosted. The credit period with respect to receiving cash might range between a minimum of 30 and a maximum of 90 days.

What is net change in cash?

The Net Change in Cash: It refers to the movement in the total amount of cash flow from a particular accounting period to another.

Does cash flow from operating activities include investing?

Cash Flow from Operating Activities: It is found on an organization’s cash flow statement, and it does not include cash flow from investing.

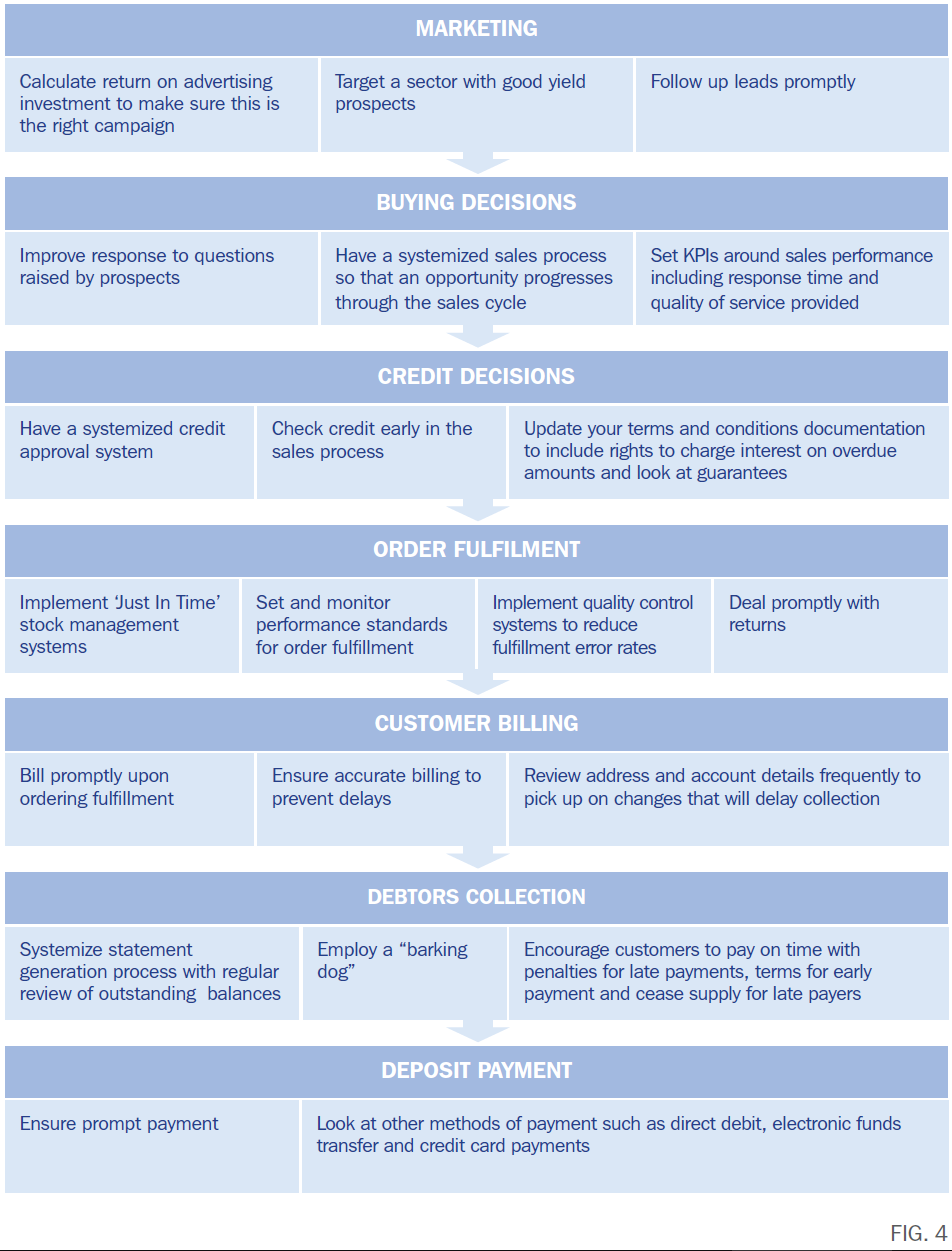

What is the purpose of the integration of cash cycle?

The integration of these cycles gives the visibility that the company requires for an efficient cash management of its operations.

What is the second cycle?

The second cycle refers to the outbound operation. The manufacturing-to-revenue cycle is quite extensive and includes production, storage, and distribution of finished goods and the fulfillment of customer orders until the receipt of the invoiced value.

Why is forecasting the annual purchasing budgeting a challenge?

Forecasting the annual purchasing budgeting is quite a challenge because it impacts the forecasted cash flow and therefore the P&L ( profit and loss) accounts. There is also the ordering, receiving, any discrepancy management, and invoicing processes prior to cash management that involves the accounts payable team.

What are the parameters of sales management?

Topics such as drop-size tail, order entry, customer channels, service level, and customer tail are highly complex because there are numerous parameterizations. Closely related to sales management, it is the management of contracts, usually led by the sales team but followed by the customer service team.

Why is cash management necessary?

A business with a working cash management structure collaborates with all of its internal stakeholders—usually financial officers, treasurers, or business managers. They strategize around the cash flow statement, which is a detailed record of all inbound and outbound transactions, as well as its cash used for investments.

What are the challenges of cash management?

When money moves at a high volume and a high scale, the complexity of managing it increases. It can be daunting for businesses to have to track hundreds of thousands of payments, at various times, using different payment types that settle at different speeds. There are a lot of moving parts and considerable room for error.

What is cash management?

Cash management is a process that involves organizing a business' cash flow. The term "cash flow" refers to the net amount of cash coming in and out of a business. Usually, high-level professionals like financial officers manage the cash flow of an organization. One of the key elements of this process is analyzing the cash flow statement.

What are cash management best practices?

Here are some additional tips and best practices for effective cash management:

What is in a cash flow statement?

A cash flow statement is a major part of the process of cash flow management. This statement illustrates how cash moves in and out of an organization. Typically, cash flow statements include three main sections :

What Is the Cash Conversion CycleFormula?

Cash Conversion Cycle = days inventory outstanding + days sales outstanding - days payables outstanding.

How Does Inventory Turnover Affect the Cash Conversion Cycle?

A higher, or quicker, inventory turnover decreases the cash conversion cycle. Thus, a better inventory turnover is a positive for the CCC and a company's overall efficiency.

How does CCC work?

The CCC does this by following the cash, or the capital investment, as it is first converted into inventory and accounts payable (AP), through sales and accounts receivable (AR), and then back into cash.

What is the third stage of a business?

The third stage focuses on the current outstanding payable for the business. It takes into account the amount of money the company owes its current suppliers for the inventory and goods it purchased, and it represents the time span in which the company must pay off those obligations. This figure is calculated by using the Days Payables Outstanding (DPO), which considers accounts payable. A higher DPO value is preferred. By maximizing this number, the company holds onto cash longer, increasing its investment potential.

What is CCC in accounting?

CCC traces the lifecycle of cash used for business activity. It follows the cash as it's first converted into inventory and accounts payable, then into expenses for product or service development, through to sales and accounts receivable, and then back into cash in hand. Essentially, CCC represents how fast a company can convert the invested cash from start (investment) to end (returns). The lower the CCC, the better.

What is CCC used for?

CCC is also used internally by the company’s management to adjust their methods of credit purchase payments or cash collections from debtors.

What is the CCC cycle?

The cash conversion cycle (CCC) is a metric that expresses the length of time (in days) that it takes for a company to convert its investments in inventory and other resources into cash flows from sales.

Cash Cycle Explanation

Cash cycles are typically measured in days. A shorter cash cycle is better than a longer cash cycle. A company with a shorter cash cycle has more working capital and less cash tied up in inventory and receivable accounts, which means it is less dependent on borrowed money. Cash cycle depends largely on operational efficiency.

Cash Cycle Formula

Inventory to product conversion time + receivables collection time – Payables payment time

Cash Cycle Example

For example, Ronald owns a custom gun smithing service. As a sole proprietor, Ronald has never paid much attention to creating financial statements as long he could pay his bills. Due to the recent change in national administration and economic state, he has had to change this view to accommodate increased demand for his services.

What is the formula for the cash conversion cycle?

Recall that the Cash Conversion Cycle Formula = DIO + DSO – DPO. How do we interpret it?

What is the purpose of comparing the cash conversion cycle?

The cash conversion cycle should be compared to companies operating in the same industry and conducted on a trend. For example, measuring a company’s conversion cycle to its cycles in previous years can help with gauging whether its working capital management is deteriorating or improving. In addition, comparing the cycle of a company to its competitors can help with determining whether the company’s cash conversion cycle is “normal” compared to industry competitors.

How long does it take for a company to turn cash into cash?

Therefore, it takes Company A approximately 20 days to turn its initial cash investment in inventory back into cash.

What are financial modeling guidelines?

Financial Modeling Guidelines Financial modeling guidelines are a set of best practices to follow when building a model. See CFI’s financial modeling courses for all the primary guidelines.

What is the CCC?

What is the Cash Conversion Cycle? The Cash Conversion Cycle (CCC) is a metric that shows the amount of time it takes a company to convert its investments in inventory. Inventory Inventory is a current asset account found on the balance sheet, consisting of all raw materials, work-in-progress, and finished goods that a.

What is the Cash to Cash Cycle?

The cash to cash cycle is the time period between when a business pays cash to its suppliers for inventory and receives cash from its customers. The concept is used to determine the amount of cash needed to fund ongoing operations, and is a key factor in estimating financing requirements.

What is the term for the conversion of cash to cash?

Cash to cash is also known as the cash conversion cycle.

How long is inventory held?

The inventory held by a business averages being on hand for 40 days, and its customers usually pay within 50 days. Offsetting these figures is an average payables period of 30 days. This results in the following cash to cash duration:

Purchase-to-Pay Cycle

Manufacturing-To-Revenue Cycle

- This second cycle has a broader scope than the purchase-to-pay. It begins with the movement of materials for manufacturing areas and continues with the production of finished goods. Then it follows to the storage, order receiving and fulfillment, and the cycle of accounts receivable. The customer strategy is a fundamental area or role that defines ...

Integrated Perspective

- The integration of these cycles enables the company to visualize what is needed for (ideally we should preserve the word “visibility”) efficient cash management of its operations. Figure 1.12shows several knowledge management areas within the supply chain that influence the company’s cash-to-cash cycle. Therefore, it is clear that supply chain management is not only a…