Gain or Loss on Extinguishment of Debt

- Gain It happens when the Net Carry amounts greater than the repurchase price. ...

- Loss It happens when the company pays higher than the net carry amount of debt. ...

- Example of debt extinguishment For example, Company A issue the bond with majority amount of $ 100,000 and 5% interest rate for 10 years. ...

- The journal entries for bond extinguishment should be:

Does the extinguishment of debt cause a gain or loss?

In most cases, the extinguishment of debt does not cause a gain or loss. However, it may occur in some cases. For example, when the net carrying amount of the debt and the settlement or repurchase price differ. The former value comes from the amount payable at the maturity of the debt.

How is early extinguishment of debt recorded in income statement?

Early extinguishment of debt. When a borrower extinguishes a debt, the difference between the net carrying amount of the debt and the price at which the debt was settled is recorded separately in the current period in income as a gain or loss. The net carrying amount of the debt is considered to be the amount payable at maturity of the debt,...

How do you calculate loss on extinguishment of debt?

Therefore, using the formula to calculate the gain (or loss) on extinguishment of debt: Gain (or Loss) on Extinguishment of Debt = Carrying Amount – Repurchase Price = 200000 – 205000 Therefore, Loss on Extinguishment of Debt is -$5000. This means that it would be beneficial for them to hold on to the bond.

What happens to accrued interest upon extinguishment of debt?

It also includes fees (which may include noncash fees) the reporting entity pays the original lender in connection with the extinguishment. Typically, accrued interest payable is settled in cash upon extinguishment (i.e., the issuer pays the investor the accrued interest in cash).

How are gains and losses from extinguishment of debt classified?

Gains and losses from extinguishment of debt include the write-off of unamortized debt issuance costs, debt discount, and/or premium. ASC 470-50-40-2 requires an extinguishment gain or loss to be identified as a separate item.

Where does gain on extinguishment of debt go?

Any gain on extinguishment of debt will be included as a reconciling item and reduce net income in arriving at the company's cash flows from operating activities.

How do you record an early extinguished debt?

Early extinguishments of debt are generally recognized on an earnings statement as extraordinary items. When there is a gain, it will be shown under other income; and when there is a loss, it will be shown as either extraordinary loss or another expense (see also extraordinary items).

What is loss of extinguishment of debt?

A loss on extinguishment of debt mainly occurs when there is a difference between the repurchase price and the carrying amount of debt at the time of extinguishment.

Is gain on extinguishment of debt taxable?

In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the amount you must pay, the amount of the canceled debt is taxable and you must report the canceled debt on your tax return for the year the cancellation occurs.

How do you record PPP forgiveness on a balance sheet?

Record the PPP loan deposit as a Loan Payable within the liabilities section on your balance sheet. This can also be considered a long-term liability, but since most or all of it can be forgiven within the year, we recommend putting it under current liabilities.

Is gain on debt extinguishment an extraordinary item?

Conversely, in other circumstances, a debt extinguishment can be deemed an extraordinary event (with any resulting gain or loss reported as an extraordinary item) if the transaction qualified as both Page 2 unusual in nature and infrequent in expected occurrence.

What is a debt extinguishment cost?

Existing Debt Extinguishment Costs means the dollar amount required to repay, satisfy and discharge the Existing Indebtedness and pay any fees, expenses or other costs to be paid by the Company or the Company Subsidiaries in connection with the repayment in whole of the Existing Debt Extinguishment.

How do you extinguish a liability?

A debtor and creditor might renegotiate the terms of a financial liability with the result that the debtor extinguishes the liability fully or partially by issuing equity instruments to the creditor. These transactions are sometimes referred to as 'debt for equity swaps'.

Is loss on extinguishment of debt interest expense?

The loss on extinguishment of debt was recorded as interest expense in the Consolidated Statements of Income.

What is extinguishment of bonds?

What is Debt Extinguishment? Debt extinguishment occurs when a debt instrument is terminated. This occurs when the borrower repays the lender or bonds are retired by the issuer.

How do you account for debt modification?

A debt modification may be accounted for as (1) the extinguishment of the existing debt and the issuance of new debt, or (2) a modification of the existing debt, depending on the extent of the changes. Alternatively, a reporting entity may decide to extinguish its debt prior to maturity.

Is loss on extinguishment of debt interest expense?

The loss on extinguishment of debt was recorded as interest expense in the Consolidated Statements of Income.

How do you account for debt modification?

A debt modification may be accounted for as (1) the extinguishment of the existing debt and the issuance of new debt, or (2) a modification of the existing debt, depending on the extent of the changes. Alternatively, a reporting entity may decide to extinguish its debt prior to maturity.

How do I account for debt refinance?

Debt is often refinanced with a new lender, and the rules are quite simple. This refinance is deemed to be an extinguishment; all prior debt issuance costs should be written off, and any new costs incurred in connection with such refinancing should be capitalized and amortized over the new loan's term.

How do you extinguish a liability?

A debtor and creditor might renegotiate the terms of a financial liability with the result that the debtor extinguishes the liability fully or partially by issuing equity instruments to the creditor. These transactions are sometimes referred to as 'debt for equity swaps'.

What is gain or loss on extinguishment of debt?

Gain or loss on extinguishment of debt is the difference between fair value and the carrying amount of debt on the date it paid off. Debt extinguishment happens when the debt issuer recalls the securities before the maturity date.

What is net carry on a debt?

Net Carry amount of debt is the amount payable at the maturity date adjusted with unamortized premium or discount and transaction cost.

When should a reporting entity derecognize a debt instrument?

A reporting entity should also derecognize a debt instrument (and recognize a new one) when a debt modification or exchange is deemed an extinguishment. See FG 3.4 for information on modifications and exchanges of term loans and debt securities, and FG 3.6 for information on modifications and exchanges of loan syndications and participations.

Who pays the creditor?

a. The debtor pays the creditor and is relieved of its obligation for the liability. Paying the creditor includes the following:

What is net carrying amount?

Net Carrying Amount of Debt: Net carrying amount of debt is the amount due at maturity, adjusted for unamortized premium, discount, and cost of issuance.

Is the difference between the reacquisition price of the debt and the net carrying amount of the extinguished?

A difference between the reacquisition price of the debt and the net carrying amount of the extinguished debt shall be recognized currently in income of the period of extinguishment as losses or gains and identified as a separate item. Gains and losses shall not be amortized to future periods. If upon extinguishment of debt the parties also exchange unstated (or stated) rights or privileges, the portion of the consideration exchanged allocable to such unstated (or stated) rights or privileges shall be given appropriate accounting recognition. Moreover, extinguishment transactions between related entities may be in essence capital transactions.

Is an extinguishment recognized prior to occurrence?

An extingu ishment should not be recognized prior to its occurrence; therefore, a debtor’s announcement of its intent to call its debt should not result in an extinguishment. See FG 3.8 for information on debt defeasance. PwC.

Is an extinguishment a nonrecognized event?

An extinguishment occurring subsequent to the end of a fiscal period but prior to the issuance of the financial statements should be accounted for as a nonrecognized subsequent event, which is not recorded in the financial statements , but may require disclosure. See FSP 28 for information on subsequent events.

What is early extinguishment of debt?

What is the Early Extinguishment of Debt? Early extinguishment of debt occurs when the issuer of debt recalls the securities prior to their scheduled maturity date. This action is usually taken when the market rate of interest has dropped below the rate being paid on the debt.

What happens when a borrower extinguishes a debt?

When a borrower extinguishes debt, the difference between the net carrying amount of the debt and the price at which the debt was settled is recorded separately in the current period in income as a gain or loss.

What is debt modification?

The debt modification either adds or eliminates a substantive conversion option. If a debt extinguishment involves the payment of fees between the debtor and creditor, associate the fees with the extinguishment of the old debt instrument, so they are included in the calculation of any gains or losses from that extinguishment.

What is net carrying amount?

The net carrying amount of the debt is considered to be the amount payable at maturity of the debt, netted against any unamortized discounts, premiums, and costs of issuance. If there is an exchange or modification of debt that has substantially different terms, treat the exchange as a debt extinguishment.

What is debt extinguishment?

Debt extinguishment is the elimination of a debt by paying the full balance owed or by replacing it with another debt instrument. While this term is more commonly used in describing the process through which businesses eliminate debt, it may also refer to personal finances.

How to get rid of debt?

There are basically two ways to extinguish your debts: You can pay a loan off or refinance it with a new one. Paying off debts is obviously the best way to eliminate them. However, getting lower interest rates or reducing monthly payments by refinancing to a better loan definitely has benefits.

What are the two types of debt?

Types of Debt. Home loans and auto loans are two major, long-term loans that many adults carry at any given point. Typical homeowners factor these loan payments into their monthly budget planning. Store financing on appliances, personal loans and credit cards are other types of consumer debt that usually carry shorter terms. ...

What Is The Extinguishment of Debt?

What Is A Gain Or Loss on Extinguishment of Debt?

- In most cases, the extinguishment of debt does not cause a gain or loss. However, it may occur in some cases. For example, when the net carrying amount of the debt and the settlement or repurchase price differ. The former value comes from the amount payable at the maturity of the debt. However, it will include deductions like unamortized discounts,...

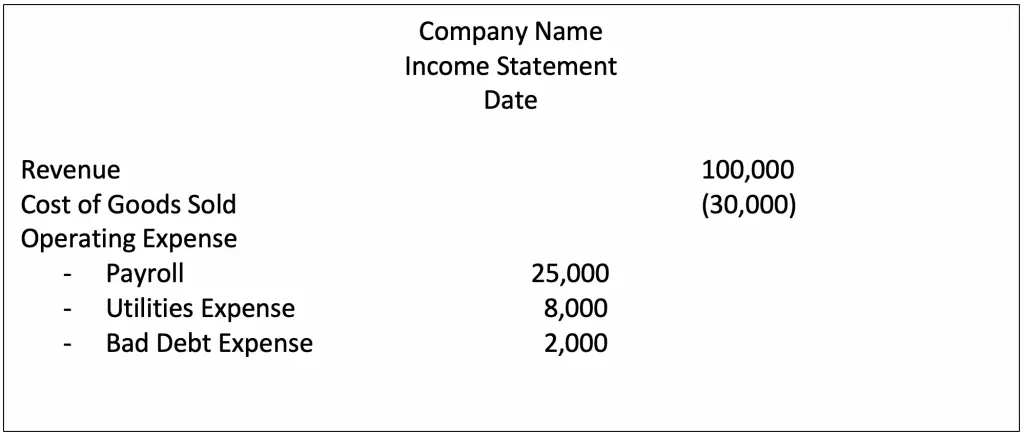

What Is The Journal Entry For Extinguishment of Debt?

- The journal entry for the extinguishment of debt is the opposite of when a company obtains it. When a company issues debt instruments, it records a liability in its books. Sometimes, it may also involve taking a loanfrom a lender. In either case, companies must create an obligation to record the liability in their accounts. The accounting treatment for the extinguishment of debtis t…

Example

- A company, Red Co., issues bonds to various lenders. In exchange, the company receives $20,000 in finance. Red Co. promises to repay bondholders at maturity after five years. It also promises them a coupon payment based on a 5% rate. After five years, Red Co. records the extinguishment of debt through cash as follows.

Conclusion

- When companies repay debt providers, it falls under the extinguishment of debt. This process occurs when a debt instrument reaches its maturity. In some cases, it will also cause a gain or loss on the extinguishment of debt. Companies must account for these accordingly. The journal entries for extinguishment of debt reflect losses and gains as well.

Further Questions

- What's your question? Ask it in the discussion forum Have an answer to the questions below? Post it here or in the forum

What Is Extinguishment of Debt?

Gain Or Loss on Extinguishment of Debt

- When debt is extinguished, the difference between the repurchase price and the amount of debt at the time of extinguishment will determine whether there will be a gain or a loss. A gain on extinguishment of debt occurs when the repurchase price is lower than the net carrying amount of debt, meaning the bond issuer pays less than what they expect to...

Formula and Example

- Let’s pretend Company ABC issues a bond with an amount of $500,000 at an interest rate of 7% for 10 years. It was issued at a premium of $520,000 and the issuing costs are $10,000. After 5 years, which is halfway to maturity, Company ABC would like to repurchase the bond for $510,000. What is the gain or loss on extinguishment of debt? The formula for calculating the ga…

How to Account For Debt Extinguishment

- To account for debt extinguishment, there will be a debit to bonds payable, debit to premiums payable, debit to loss on extinguishment of debt, credit to cost of bond issuance, and credit to cash. The journal entries for the above example would be as follows:

Debt Extinguishment Related to Paycheck Protection Program

- Another example of debt being eliminated from a company’s balance sheet is debt forgiveness. A recent example of this was PPP loan forgiveness. Due to the impacts of the coronavirus pandemic, businesses received PPP loans from the government to keep employees on payroll with the expectation that the loans would be fully forgiven. When the PPP loans were forgiven, th…