Full Answer

What gives the highest return on investment?

#

- On average, home renovations provide a 70% ROI.

- Home renovations are one of the only investments that can improve the quality of life in your living space and increase the value of your home for the future.

- The home improvements with the best ROI are projects that add functional space and square footage. ...

What is considered to be a good return on investment?

- Acquisition of stabilized asset – 10% IRR

- Acquisition and repositioning of ailing asset – 15% IRR

- Development in established area – 20% IRR

- Development in unproven area – 35% IRR

What investments give the best return?

Top 10 Ways to Earn a 10% Rate of Return on Investment

- Easily Invest In Real Estate with Little Money. Real estate is a great way to earn over 10% rate of return on investments. ...

- Paying Off Your Debt Is Like An Investment. Paying off a debt with a high-interest rate is the same as having earned that exact same rate of return on ...

- Stocks For The Long-Term. Make investing in stocks for the long-term automatic. ...

What is the best investment for quick return?

Overview: Top short-term investments in December 2021

- Savings accounts. A savings account at a bank or credit union is a good alternative to holding cash in a checking account, which typically pays very little interest on ...

- Short-term corporate bond funds. Corporate bonds are bonds issued by major corporations to fund their investments. ...

- Money market accounts. ...

- Cash management accounts. ...

- Short-term U.S. ...

What is a high return on investment?

What Is a Good ROI? According to conventional wisdom, an annual ROI of approximately 7% or greater is considered a good ROI for an investment in stocks. This is also about the average annual return of the S&P 500, accounting for inflation.

What are the reasons for high return on investment?

Factors that influence your rate of return include the mix of assets, the business's strategy and operations, the state of the economy, political stability, fiscal policy and regulations.

What type of investment has highest return?

The U.S. stock market has long been considered the source of the greatest returns for investors, outperforming all other types of investments including financial securities, real estate, commodities, and art collectibles over the past century.

What is return on investment with example?

Return on investment (ROI) is calculated by dividing the profit earned on an investment by the cost of that investment. For instance, an investment with a profit of $100 and a cost of $100 would have an ROI of 1, or 100% when expressed as a percentage.

What are the factors that determine return?

The five factors driving returnsMarket risk (beta): The riskiness of a stock compared with that of its benchmark. ... Size: The market capitalization of a stock. ... Value: The measurement of a stock by its price-to-book ratio or other ratios.Profitability: The operating profitability of a stock's underlying company.More items...

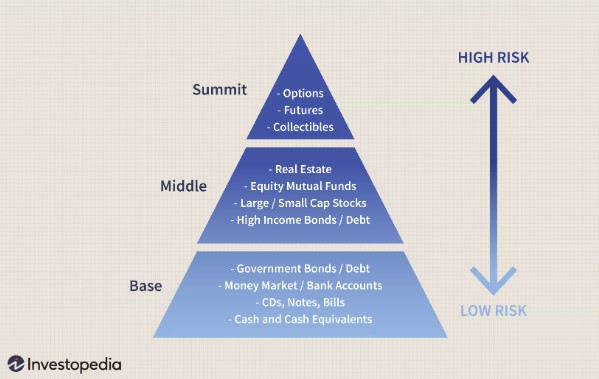

Which investments belong to high risk/high return?

What Are High-Risk Investments? High-risk investments include currency trading, REITs, and initial public offerings (IPOs). There are other forms of high-risk investments such as venture capital investments and investing in cryptocurrency market.

What are the 4 types of investments?

Types of InvestmentsStocks.Bonds.Mutual Funds and ETFs.Bank Products.Options.Annuities.Retirement.Saving for Education.More items...

What investments return fast?

Here are a few of the best short-term investments to consider that still offer you some return.High-yield savings accounts. ... Short-term corporate bond funds. ... Money market accounts. ... Cash management accounts. ... Short-term U.S. government bond funds. ... No-penalty certificates of deposit. ... Treasurys. ... Money market mutual funds.

Is a high rate of return good?

However, many investors probably wouldn't view an average annual ROI of 8% as a good rate of return for money invested in small-cap stocks over a long period because such stocks tend to be risky....What is a good rate of return?Asset TypeCompound Annual Growth Rate (CAGR)Treasury bills3.3%4 more rows

What investments return fast?

Here are a few of the best short-term investments to consider that still offer you some return.High-yield savings accounts. ... Short-term corporate bond funds. ... Money market accounts. ... Cash management accounts. ... Short-term U.S. government bond funds. ... No-penalty certificates of deposit. ... Treasurys. ... Money market mutual funds.

What Is Return on Investment (ROI)?

Return on investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment’s cost.

How to calculate return on investment?

Return on investment (ROI) is calculated by dividing the profit earned on an investment by the cost of that investment. For instance, an investment with a profit of $100 and a cost of $100 would have a ROI of 1, or 100% when expressed as a percentage. Although ROI is a quick and easy way to estimate the success of an investment, it has some serious limitations. For instance, ROI fails to reflect the time value of money, and it can be difficult to meaningfully compare ROIs because some investments will take longer to generate a profit than others. For this reason, professional investors tend to use other metrics, such as net present value (NPV) or the internal rate of return (IRR).

What Industries Have the Highest ROI?

Historically, the average ROI for the S&P 500 has been about 10% per year. Within that, though, there can be considerable variation depending on the industry. For instance, during 2020, many technology companies generated annual returns well above this 10% threshold. Meanwhile, companies in other industries, such as energy companies and utilities, generated much lower ROIs and in some cases faced losses year-over-year. 2 Over time, it is normal for the average ROI of an industry to shift due to factors such as increased competition, technological changes, and shifts in consumer preferences.

How to calculate ROI on slice pizza?

To calculate the return on this investment, divide the net profits ($1,200 - $1,000 = $200) by the investment cost ($1,000), for a ROI of $200/$1,000, or 20%.

When was social return on investment developed?

Recently, certain investors and businesses have taken an interest in the development of a new form of the ROI metric, called " social return on investment ," or SROI. SROI was initially developed in the late 1990s and takes into account broader impacts of projects using extra-financial value (i.e., social and environmental metrics not currently reflected in conventional financial accounts). 1

What is SROI in investing?

SROI helps understand the value proposition of certain environmental social and governance (ESG) criteria used in socially responsible investing (SRI) practices. For instance, a company may decide to recycle water in its factories and replace its lighting with all LED bulbs.

What is ROI in finance?

ROI can be used in conjunction with the rate of return (RoR), which takes into account a project’s time frame. One may also use net present value (NPV), which accounts for differences in the value of money over time, due to inflation.

What is return on investment?

Return on Investment, one of the most used profitability ratios, is a simple formula that measures the gain or loss from an investment relative to the cost of the investment.

How to calculate return on investment?

In this case, the ROI for Investment A is ($500-$100)/ ($100) = 400%, and the ROI for Investment B is ($400-$100)/ ($100) = 300%. In this situation, Investment A would be a more favorable investment.

What is ROI in investing?

ROI can be used for any type of investment. The only variation in investments that must be considered is how costs and profits are accounted for. Below are two examples of how return on investment can be commonly miscalculated. Stocks: Investors commonly fail to incorporate transaction costs and dividend payouts.

What is ROA in business?

Return on Assets (ROA) is a type of return on investment (ROI) metric that measures the profitability of a business in relation to its total assets.

What is ROE in accounting?

Return on Equity (ROE) Return on Equity (ROE) is a measure of a company’s profitability that takes a company’s annual return (net income) divided by the value of its total shareholders' equity (i.e. 12%). ROE combines the income statement and the balance sheet as the net income or profit is compared to the shareholders’ equity.

What is gross profit?

Gross Profit Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue. It's used to calculate the gross profit margin. of an investment. ROI is easy to calculate and can be applied to all kinds of investments.

What is the IRR?

Internal Rate of Return (IRR) The Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of a project zero. In other words, it is the expected compound annual rate of return that will be earned on a project or investment.

Why is it important to match your risk profile with the company and product you’re considering?

It’s important to match your risk profile with the company and product you’re considering. Investment options are truly limitless, and it can be difficult to figure out where to put your money. A comprehensive risk and goal assessment can help you narrow your options.

Why invest in corporate bonds?

Invest in Corporate Bonds. Corporate bonds provide a predictable financial benefit without soph isticated strategies. They are issued by large corporations to fund capital investments and business expansions. When you buy corporate bonds, you lend out money to the issuing company.

What is crowdfunding in real estate?

When a developer identifies an investment opportunity, he or she might not have the ability to fund the investment entirely, so contribute some capital to execute your plan. You don’t need a large amount of money to join a crowdfunding scheme. Should the company go public through an IPO, there may be a huge potential for investment gains.

What is dividend stock?

Invest in High Dividend Stocks. Dividends are a form of profit-sharing through which a corporation makes regular payments to its shareholders. The payment of dividends isn’t required by law, but corporations choose to pay stockholders a share of the money earned through a reinvestment plan or as a cash option.

What is savings bond?

U.S. savings bonds are one of the lowest risk investment types. These securities are issued by the U.S. Treasury and you provide a loan to help the government fund operations. Savings bonds offer a fixed interest rate paid by the government over a specific period of time.

What is CD investment?

Certificates of deposits (CDs) are a great low-risk, long-term investment option. A CD account is available at your credit union or bank, and just like a savings account, you can earn interest on money deposited.

Is a savings account a good investment?

Savings Accounts. A savings account is among the few safe investments with high returns — you can earn interest for every dollar stashed outside bonds and stocks. Unlike other investment options, savings accounts are incredibly liquid, so you can access your cash when you need it.

CAN AN INVESTMENT BE SAFE?

To be perfectly transparent, no investment is 100% safe from all risk. Because of fluctuating markets and a sometimes unpredictable economy, it’s hard to say which single investment is the safest. However, there are some investment categories that are much safer than others.

WHAT IS A SAFE INVESTMENT?

A few safe investment options include certificates of deposit (CDs), money market accounts, municipal bonds and Treasury Inflation-Protected Securities (TIPS). That’s because investments like CDs and bank accounts are backed by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000.

HOW & WHERE TO INVEST MONEY TO GET GOOD RETURNS IN 2022

There are many investments where you can get good returns, including dividend-paying stocks, real estate and businesses. While these investments can produce high returns, some are much safer than others.

20 SAFE INVESTMENTS WITH HIGH RETURNS

Next, I’ll break down 20 safe investment options with good or decent returns.

WHAT'S NEXT? GROW & PROTECT YOUR MONEY

Finding safe investments with high returns is one of the best ways to protect and grow your money to build lasting wealth. You may want to keep most of your money into super safe investments, like high-yield savings accounts, CDs and US Treasury securities.

Why is real estate the lowest risk?

One could argue that buying real estate is one of the lowest-risk investment vehicles out there, for two reasons. First, real estate has generally appreciated in value over time. Second, you can control a lot of the outcome by conducting a lot of your own research and making wise decisions. Here are some strategies to follow to make sure you’re maximizing your returns on real estate investments:

What are some examples of medium level risk?

Here are four examples of investments with medium-level risk. Dividend Stocks . Dividend stocks come from publicly-traded companies that pay dividends to their shareholders. When profits are earned, the company will pay its stockholders in either cash or reinvestment plans.

What is crowdfunding in real estate?

When investors pool their resources together to buy real estate, it’s called crowdfunding. Typically, crowdfunding opportunities pop up when a real estate investor or developer finds a great deal but need capital to help execute their plan. Investors can get involved in crowdfunding real estate without having a ton of money. In more recent years, crowdfunding platforms have helped connect investors with developers more efficiently than ever.

What is penny stock?

Any stocks trading at $5 or less are called penny stocks. These shares belong to companies that have less-than-stellar financial histories. Investors buy up penny stocks when they want to have a large volume of shares of a company. Doing so creates a lot of risk, but they might be willing to do that if they think that the company will suddenly perform well. Investors have experienced winning big through penny stocks. Just make sure that you can tolerate a lot of volatility and risk before getting started.

Is it better to make low risk or high risk investments?

Let’s start with some low-risk, high-return investments. To be clear, your returns will pale in comparison to high-risk investments. However, making conservative, steady investments can help you earn a lot of money in the long-run. Many would argue making modest earnings at a steady pace is a much better strategy than possibly blowing all of your money in a high-stakes gamble.

Is it true that the reward is promised within a short timeframe?

This is especially true when the reward is promised within a short timeframe. As an investor, you’re gambling all of your invested money for the possibility of a lucrative reward. With so many investment options out there, it can be hard to decide where to put your money.

Is a savings bond a good investment?

U.S. savings bonds are one of the lowest-risk investments available on the market. A savings bond is a security issued by the Treasury. You’re providing a loan to the government by purchasing the bond. The funds from bonds are used to fund government projects and operations. Savings bonds are one of the safest investment options available. You’ll be paid a fixed rate over a predetermined period. You’ll know exactly what you’re signing up for, how much you’ll be getting, over what length of time.

Why are higher interest rates beneficial?

Higher interest rates are advantageous for a myriad of reasons, the most simple and logical one being that higher rates will earn you a whole lot more money over time. With the Fixed Income Fund, our strategic investment strategy offers the highest interest rates possible.

How much money do you need to invest in a fixed income fund?

An investment in the Fixed Income Fund requires a $50,000 minimum. However, you are allowed to invest any amount above that minimum per note, which is certainly a good way to go if you’re looking to take advantage of our high, unparalleled fixed interest rates.

Is the return on a compounded investment lower?

While those rates would indeed provide a stream of reliable income, the returns would be significantly lower, especially when compounded or locked into a long-term investment, than those offered by our strategic investment at Tactical Wealth.

Is it good to have a high investment requirement?

Well, with such a high investment requirement, you’ll be getting a reliable stream of income which can actually make a difference – particularly if you’re searching for peace of mind during retirement.

Is tactical wealth an investment company?

Tactical Wealth has received an A+ rating as an investment company, thanks in large part to the unmatched interest rates we are able to offer with our Fixed Income product. Simply put, our interest rates are better than any other option you will find, whether you’re looking for steady revenue in the short term or you want to take a more long-term approach. Starting at three years, the Fixed Income Fund offers interest rates that are significantly higher than other accredited investment companies, even those that are at or near our A+ rating. Here’s where our rates begin, as of August 2017:

What is the return on investment?

The return on an investment is expressed as a percentage and considered a random variable that takes any value within a given range. Several factors influence the type of returns that investors can expect from trading in the markets.

What is ‘Risk and Return’?

Different types of risks include project-specific risk, industry-specific risk, competitive risk, international risk, and market risk. Return refers to either gains and losses made from trading a security.

What is default risk?

On investments with default risk, the risk is measured by the likelihood that the promised cash flows might not be delivered. Investments with higher default risk usually charge higher interest rates, and the premium that we demand over a riskless rate is called the default premium.

What are the benefits of diversification?

The benefits of diversification can also be shown mathematically: Other things remaining equal, the higher the correlation in returns between two assets, the smaller are the potential benefits from diversification.

Is a portfolio positive or negative?

in a portfolio can be either positive or negative for each asset for any period. Thus, in large portfolios, it can be reasonably argued that positive and negative factors will average out so as not to affect the overall risk level of the total portfolio. The benefits of diversification can also be shown mathematically: