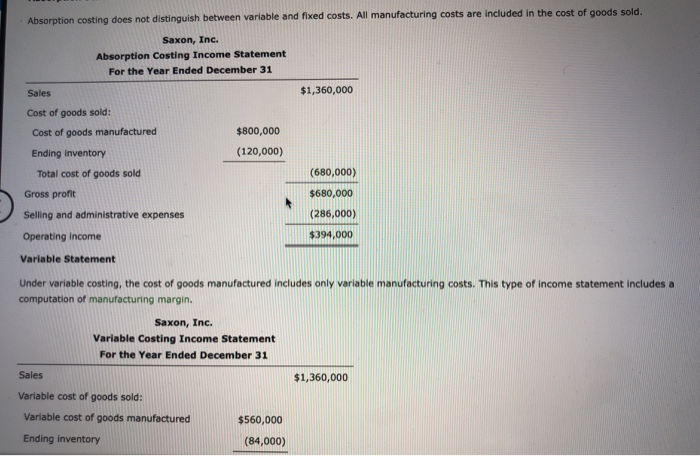

Absorption costing, also referred to as full costing or the full costing method, is an accounting method that you can use to capture all of the manufacturing costs associated with the production of one unit of goods. It includes the cost of materials and labour The Labour Party is a centre-left political party in the United Kingdom that has been described as an alliance of social democrats, democratic socialists and trade unionists. The party's platform emphasises greater state intervention, social justice and strengthening workers' rights.Labour Party

What is an example of absorption costing?

Here are some examples of absorption costing: Example 1 A company produces 10,000 units of its product in one month. Of the 10,000 units produced, 8,000 are sold that month with 2,000 left in inventory. Each unit requires $5 of direct materials and labor. Additionally, the production facility requires $20,000 of monthly fixed overhead costs.

How is absorption costing treated under GAAP?

Under usually accepted accounting rules (GAAP), absorption costing is required for exterior reporting. Absorption costing is an accounting technique that captures the entire prices concerned in manufacturing a product when valuing stock. The technique consists of direct prices and oblique prices and is useful in figuring out the price to provide one unit of products.

What is total absorption costing?

Unsourced material may be challenged and removed. Total absorption costing (TAC) is a method of Accounting cost which entails the full cost of manufacturing or providing a service. TAC includes not just the costs of materials and labour, but also of all manufacturing overheads (whether ‘fixed’ or ‘variable’).

What is the absorption of manufacturing costs?

Definition: Absorption costing is a cost accounting method for valuing inventory. Absorption costing includes or “absorbs” all the costs of manufacturing a product including both fixed and variable costs. What is cost absorption with example?

How do you calculate absorption costing?

The finance manager can use the absorption costing formula (materials + labor + variable production overhead + fixed production overhead) ÷ (number of completed units) to get an idea of how much the company may take on in production expenses.

What costs are normally included in product costs under absorption costing?

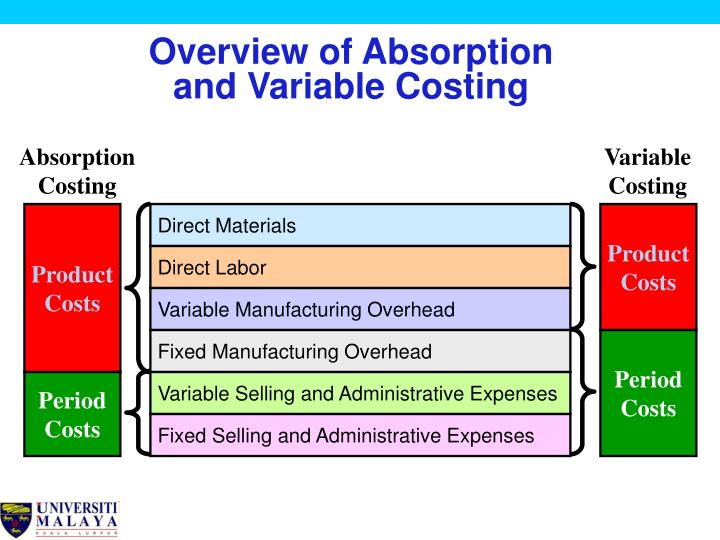

Product costs under absorption costing include both manufacturing costs. Product costs under variable costing include only variable manufacturing costs. Absorption costing accounts for fixed manufacturing overhead as a product cost.

What are the types of absorption costing?

Meaning of Absorption Costing#1. Direct costs. ... #2. Fixed costs. ... #3. Variable overhead costs. ... #1. Job order costing. ... #2. Activity-based costing. ... #3. Process costing. ... #1. Direct and indirect costs – ... #2. Direct costs are allocated –More items...•

Does absorption costing include fixed and variable costs?

Absorption costing includes all of the direct costs associated with manufacturing a product. Variable costing can exclude some direct fixed costs. Absorption costing entails allocating fixed overhead costs to all units produced for an accounting period.

Which cost is not charged to the product under absorption costing?

Fixed manufacturing costs are not charged to the product under variable costing. Fixed manufacturing overhead is a period cost under absorption costing.

Which of the following is not a type of absorption costing?

absorption costing does not include selling and administrative expenses as part of inventoriable cost. 10. Which method gives the lowest inventory cost per unit?

What are the 4 types of costing?

Types of Costs1) Fixed costs. Costs that are unaffected by the quantity of demand. ... 2) Variable costs. Costs associated with a company's output level. ... 3) Operating costs. ... 4) Direct costs. ... 5) Indirect costs. ... 1) Standard Costing. ... 2) Activity-Based Costing. ... 3) Lean Accounting.More items...•

What are the objectives of absorption costing?

Absorption costing determines the cost of the inventory at the end of an accounting period. The closing inventory also consists of fixed costs, thus increasing the value of the inventory. This method of inventory valuation increases the profit of the company.

What item is not included in cost accounting?

An item that cannot be included in cost accounting is the profit or loss on the sale of fixed assets. Cost accounting means recording all the business transactions which are related to the cost or the cost incurred in a business.

Does absorption costing include selling and administrative expenses?

What Not to Include in an Absorption Costing System. You should charge sales and administrative costs to expense in the period incurred; do not assign them to inventory, since these items are not related to goods produced, but rather to the period in which they were incurred.

What is the difference between direct costing and absorption costing?

Variable costing consists of direct material costs, direct labor costs, and variable manufacturing overheads. read more, whereas, Absorption costing consists of direct material costs, direct labor costs, variable manufacturing overheads, and fixed manufacturing overheads.

What is difference between marginal costing and absorption costing?

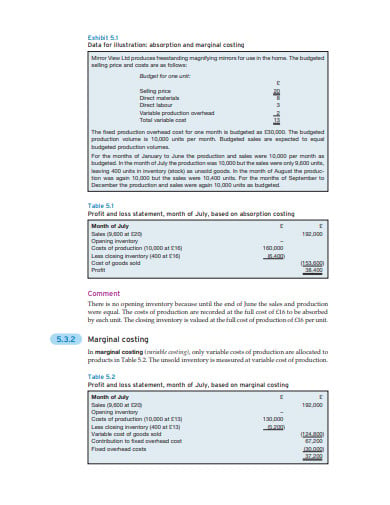

Marginal costing is a method where the variable costs are considered the product cost, and the fixed costs are considered the period's costs. On the other hand, absorption costing is a method that considers both fixed and variable costs as product costs. read more.

Which of the following costs expenses is included in product costs under both absorption costing and variable costing?

A cost that would be included in product costs under both absorption costing and variable costing is: supervisory salaries.

Which of the following is not included in the product cost under variable costing?

Which of the following is not a product cost under variable costing? Fixed manufacturing overhead.

Does product cost includes fixed overhead?

In economics, production costs involve a number of costs that include both fixed and variable costs. Fixed costs are costs that do not change when output changes. Examples include insurance, rent, normal profit, setup costs and depreciation. Another name for fixed costs is overhead.

Which of the following costs is always expensed on the income statement under absorption costing as well as variable costing?

Which of the following costs is always expensed on the income statement under absorption costing as well as variable costing? (Selling and administrative expenses are never included in product costs. They are always expensed on the income statement and never appear on the balance sheet.)

Why is absorption costing not useful?

Disadvantages. Since absorption costing includes allocating fixed manufacturing overhead to the product cost, it is not useful for product decision-making. Absorption costing provides a poor valuation of the actual cost of manufacturing a product. Therefore, variable costing is used instead to help management make product decisions.

How does absorption costing affect profit?

Absorption costing can skew a company’s profit level due to the fact that all fixed costs are not subtracted from revenue unless the products are sold. By allocating fixed costs into the cost of producing a product, the costs can be hidden from a company’s income statement in inventory.

Why is full costing important?

Its main advantage is that it is GAAP-compliant. It is required in preparing reports for financial statements and stock valuation purposes.

What is a company A?

Company A is a manufacturer and seller of a single product. In 2016, the company reported the following costs:

What is absorb costing?

Absorption costing is one of approach which is used for the purpose of valuation of inventory or calculation of the cost of the product in the company where all the expenses incurred by the company are taken into the consideration i.e., it includes all the direct and indirect expenses incurred by the company during the specific period.

How to calculate total product cost?

As per this method, the total product cost is calculated by the addition of variable costs, such as direct labor cost per unit, direct material cost per unit and variable manufacturing overhead Manufacturing Overhead Manufacturing Overhead is the total of all the indirect costs involved in manufacturing a product like Property Tax on the production premise, Remunerations of maintenance personnel, Rent of the manufacturing building, etc. read more per unit, and fixed costs, such as fixed manufacturing overhead per unit.

How to determine direct labor cost?

The direct labor cost. can be determined based on the labor rate, level of expertise, and the no. of hours put in by the labor for production. However, the labor cost can also be taken from the income statement.

Is selling and administrative costs a periodic cost?

It is to be noted that selling and administrative costs (both fixed and variable costs) are periodic costs in nature and, as such, are expensed in the period in which it occurred. However, these costs are not included in the calculation of product cost as per the AC. Therefore, the calculation of AC is as follows,

Can labor cost be taken from income statement?

However, the labor cost can also be taken from the income statement. Secondly, identify the material type required and then determine the amount of the material required for the production of a unit of product to calculate the direct material cost per unit.

Is selling and administrative costs included in the product cost calculation?

It is to be noted that selling and administrative costs (both fixed and variable costs) are periodic costs in nature and, as such, are expensed in the period in which it occurred. However, these costs are not included in the calculation of product cost as per the AC.

What is absorption costing?

Absorption costing is a management costing technique in which both variable and fixed costs are allocated to the product cost for the purposes of inventory valuation. Since the method includes both variable and fixed costs for the calculation of product manufacturing cost, it is also known as the full costing method.

What are the advantages of absorption costing?

The advantages of using the absorption costing method are as follows: It allocates fixed overheads as well to each unit of product manufactured, therefore, gives a fair presentation of the total manufacturing cost of the products. It helps in determining the appropriate selling price of manufactured products.

What is the difference between absorption costing and variable costing?

The main difference between absorption costing and variable costing is regarding the recognition of fixed costs.

What are the two methods of cost accounting?

There are two techniques used in cost accounting namely marginal costing and absorption costing. Absorption costing or full costing method is different from the variable costing method because it also allocates the fixed cost to each unit of the product manufactured. The allocation of fixed costs to each produced unit is done based on an absorption rate derived from the budgeted fixed overheads and budgeted production. This leads to over and under absorption of fixed costs because the actual production may vary from the budgeted production.

What is direct material cost?

Direct Material Cost: Materials that are used in the production of the finished goods inventory.

Do fixed and variable sales and administration expenses go in the product manufacturing cost calculation?

While fixed and variable selling and administration expenses are considered as period costs and thus do not go in the product manufacturing cost calculation. They are expensed in the income statement in the same period.

How does absorb costing work?

Absorption costing is not only used variable cost but also allocates fixed cost into the product to ensure a more accurate cost of product. When all costs are included in each product, the company can easily tract its profit by-product as well as the total profit.

What is the absorption rate?

Absorption costing is the accounting method that allocates manufacturing costs based on a predetermined rate that is called the absorption rate. It helps company to calculate cost of goods sold and valuing inventory at the end of accounting period.

Is absorption costing good for SMEs?

Unlike the large company, SMEs only has few products type, absorption costing is a good option for them. Absorption costing does not require a huge human resource as well as a complicated accounting system, so it is the best option for start-ups and SMEs. Moreover, the cost is not very expensive to compare to other methods.

What Is Absorbed Cost?

Absorbed cost, also known as absorption cost, is a managerial accounting method that includes both the variable and fixed overhead costs of producing a particular product. Knowing the full cost of producing each unit enables manufacturers to price their products.

Why is absorbed cost important?

By including overhead, in addition to more direct costs like materials and wages, calculating absorbed cost helps companies determine the overall cost of making and bringing to market a single product line, brand, or item— and which of these are the most profitable.

Why does aborbed cost increase net income?

Also, net income increases as more items are produced, because fixed costs are spread across all units manufactured.

When is aborbed cost required?

Absorbed cost is required when it comes to recording your company’s financial statements and reporting corporate taxes.

Why is variable costing important?

While absorbed costs are needed to prepare financial statements for financial reporting, variable costing is more useful for making internal pricing decisions, because it only includes the extra costs of producing the next incremental unit of a product.

What is absorption costing?

Absorption costing is an accounting method that captures all of the costs involved in manufacturing a product when valuing inventory.

What is the purpose of cost pools?

Most companies use cost pools to represent accounts that are always used .

What are direct materials?

Direct materials, such as inventory or raw materials. Direct labor, such as workers directly involved production. Variable costs and overhead, such as the electricity needed for the building and production. Fixed costs that are involved in production, such as rent for the building. Under full absorption costing, ...

What is cost pool?

Most companies use cost pools to represent accounts that are always used. Once the cost pools have been determined, the company can calculate the amount of usage based on activity measures. Direct labor hours is an example of an activity measure.

Is period cost included in absorption costing?

It's important to note that period costs are not included in full absorption costing. Period costs are the overhead costs not involved in production. In other words, a period cost is not included within the cost of goods sold (COGS) on the income statement. COGS are the costs directly involved in production, such as inventory.

Does each unit of a produced good carry an assigned total production cost?

Each unit of a produced good can now carry an assigned total production cost. This eliminates the distinctions between fixed and variable costs, thereby reflecting the impact of overhead on manufacturing.

Does GAAP require external reporting?

GAAP only requires absorption costing for external reporting, not internal reporting. External reports are generated for public consumptions; in the case of publicly traded corporations, shareholders interact with external reports. External reports are designed to reveal financial health and attract capital.

Components of Absorption Costing

- Under the absorption method of costing (aka “full costing”), the following costs go into the product: 1. Direct material (DM) 2. Direct labor (DL) 3. Variable manufacturing overhead (VMOH) 4. Fixed manufacturing overhead (FMOH) Under absorption costing, the costs below are considered period costs and do not go into the cost of a product. They are, ...

Example of Absorption Costing

- Company A is a manufacturer and seller of a single product. In 2016, the company reported the following costs:

Advantages

- There are several advantages to using full costing. Its main advantage is that it is GAAP-compliant. It is required in preparing reports for financial statements and stock valuation purposes. In addition, absorption costing takes into account all costs of production, such as fixed costs of operation, factory rent, and cost of utilities in the factory. It includes direct costs such a…

Disadvantages

- Since absorption costing includes allocating fixed manufacturing overhead to the product cost, it is not useful for product decision-making. Absorption costing provides a poor valuation of the actual cost of manufacturing a product. Therefore, variable costing is used instead to help management make product decisions. Absorption costing can skew a company’s profit level du…

Related Reading

- Thank you for reading this guide to calculating the full costing of inventory. To keep learning and developing your knowledge base, please explore the additional relevant resources below: 1. Job Order Costing Guide 2. Activity-based Costing Guide 3. Cost of Goods Sold (COGS) 4. Fixed and Variable Costs