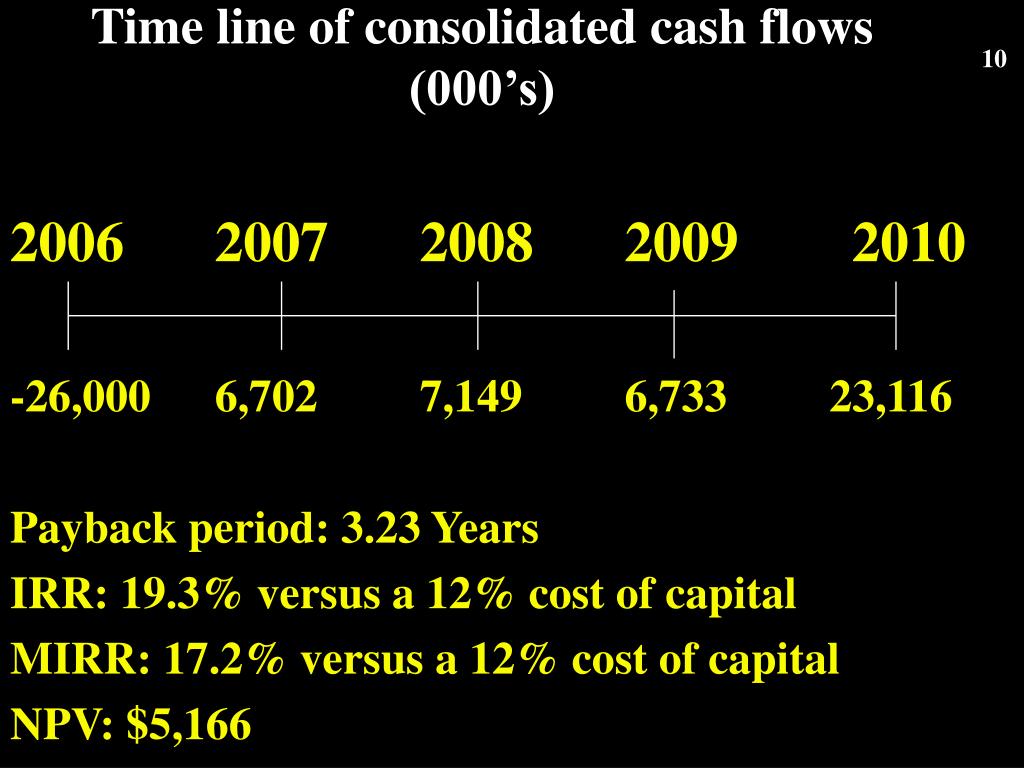

The points given below are substantial so far as the difference between IRR and MIRR is concerned:

- Internal Rate of Return or IRR implies a method of reckoning the discount rate considering internal factors, i.e. ...

- The internal rate of return is an interest rate at which NPV is equal to zero. ...

- IRR is based on the principle that interim cash flows are reinvested at the project’s IRR. ...

Does MIRR solve all of IRR's shortcomings?

Advantage: MIRR is a better and improved method for project evaluation as it prevents all the shortcomings of normal IRR and NPV methods. It takes into consideration the practically possible reinvestment rate. The calculation is also not rocket science.

Why is NPV is better than IRR?

Why npv is the best method? Using NPV. The advantage to using the NPV method over IRR using the example above is that NPV can handle multiple discount rates without any problems.Each year’s cash flow can be discounted separately from the others making NPV the better method.

What are the disadvantages of the IRR method?

List of the Disadvantages of the internal Rate of Return Method

- It can provide an incomplete picture of the future. When using the IRR calculation, the cost of capital is not required to be part of the equation. ...

- It ignores the overall size and scope of the project. ...

- It ignores future costs within the calculation. ...

- It does not account for reinvestments. ...

- It struggles to keep up with multiple cash flows. ...

What are the advantages of IRR over NPV?

Advantages: With the NPV method, the advantage is that it is a direct measure of the dollar contribution to the stockholders. With the IRR method, the advantage is that it shows the return on the original money invested. Disadvantages: With the NPV method, the disadvantage is that the project size is not measured.

Are MIRR and IRR equal?

IRR and MIRR are two capital budgeting techniques that measure the investment attractiveness....Comparison Chart.Basis for ComparisonIRRMIRRAssumptionProject cash flows are reinvested at the project's own IRR.Project cash flows are reinvested at the cost of capital.AccuracyLowComparatively high2 more rows•May 19, 2017

Why is MIRR lower than IRR?

MIRR calculates the return on investment based on the more prudent assumption that the cash inflows from a project shall be re-invested at the rate of the cost of capital. As a result, MIRR usually tends to be lower than IRR.

Is MIRR more realistic than IRR?

MIRR is invariably lower than IRR and some would argue that it makes a more realistic assumption about the reinvestment rate. However, there is much confusion about what the reinvestment rate implies. Both the NPV and the IRR techniques assume the cash flows generated by a project are reinvested within the project.

What does the MIRR tell you?

The modified internal rate of return (commonly denoted as MIRR) is a financial measure that helps to determine the attractiveness of an investment and that can be used to compare different investments.

Is a higher MIRR better?

If the MIRR is higher than the expected return, the investment should be undertaken. If the MIRR is lower than the expected return, the project should be rejected.

How do you get MIRR from IRR?

How to Calculate Modified Internal Rate of Return?MIRR = (Terminal Cash inflows/ PV of cash out flows) ^n – 1.MIRR = (PVR/PVI) ^ (1/n) × (1+re) -1.MIRR = (-FV/PV) ^ [1/ (n-1)] -1.

Which one of these is a weakness of MIRR?

What is the one weakness with MIRR? When mutually exclusive project's sizes are unequal, you can't trust MIRR to choose the project that will add the most value.

Is MIRR better than NPV?

When the investment and reinvestment rates are the same as the NPV discount rate, MIRR is the equivalent of the NPV in percentage terms. When they are different, MIRR will be the better measure because it directly accounts for reinvestment of the cash flows at the different rate.

Why the MIRR is a better measurement than the IRR?

Key Takeaways MIRR improves on IRR by assuming that positive cash flows are reinvested at the firm's cost of capital. MIRR is used to rank investments or projects a firm or investor may undertake. MIRR is designed to generate one solution, eliminating the issue of multiple IRRs.

What does the modified internal rate of return MIRR assume?

The MIRR assumes that cash flows will be reinvested at the cost of capital.

Which one of these is a weakness of MIRR?

What is the one weakness with MIRR? When mutually exclusive project's sizes are unequal, you can't trust MIRR to choose the project that will add the most value.

How does the modified internal rate of return include concepts from both the traditional rate of return and the net present value methods?

The modified internal rate of return calls for the determination of the interest rate that equates future inflows to the investment as does the traditional internal rate or return. However, it incorporates the reinvestment rate assumption of the net present value method.

What is the IRR in business?

When they're considering whether to undertake a new project, business managers consider its internal rate of return (IRR). This metric is an estimate of the potential annual profit of the project after its costs.

What is modified internal rate of return?

Modified Internal Rate of Return (MIRR) vs. Regular Internal Rate of Return (IRR): An Overview 1 The standard internal rate of return calculation may overstate the potential future value of a project. 2 It can distort the cost of reinvested growth from stage to stage in a project. 3 Modified internal rate of return allows for adjusting the assumed rate of reinvested growth for different stages of a project.

Why is internal rate of return important?

The internal rate of return metric is popular among business managers, but the truth is that it tends to overstate the potential profitability of a project and can lead to capital budgeting mistakes based on an overly optimistic estimate. A variation, the modified internal rate of return, compensates for this flaw and gives managers more control ...

Can internal rate of return be overstated?

The standard internal rate of return calculation may overstate the potential future value of a project.

What is the difference between IRR and MIRR?

On the other hand, MIRR alludes to the method of capital budgeting, which calculates the rate of return taking into account cost of capital. It is used to rank various investments of the same size.

Which is better, MIRR or IRR?

The decision criterion of both the capital budgeting methods is same, but MIRR delineates better profit as compared to the IRR, because of two major reasons, i.e. firstly, reinvestment of the cash flows at the cost of capital is practically possible, and secondly, multiple rates of return don’t exist in the case of MIRR . Therefore, MIRR is better regarding measurement of the true rate of return.

What is the difference between MIRR and internal rate of return?

The internal rate of return is an interest rate at which NPV is equal to zero. Conversely, MIRR is the rate of return at which NPV of terminal inflows is equal to the outflow, i.e. investment.

What is MIRR in accounting?

MIRR expands to Modified Internal Rate of Return, is the rate that equalizes the present value of final cash inflows to the initial (zeroth year) cash outflow. It is nothing but an improvement over the conventional IRR and overcomes various deficiencies such as multiple IRR is eliminated and addresses reinvestment rate issue and generates outcomes, which are in reconciliation with net present value method.

What is MIRR in investment?

On the other hand, Modified Internal Rate of Return, or MIRR is the actual IRR, wherein the reinvestment rate does not correspond to the IR R.

What is the purpose of MIRR?

MIRR is a capital budgeting technique, that calculate rate of return using cost of capital and is used to rank various investments of equal size.

What is the IRR?

Definition of IRR. The internal rate of return, or otherwise known as IRR, is the discount rate that brings about equality between the present value of expected cash flows and initial capital outlay. It is based on the assumption that interim cash flows are at a rate, similar to the project which generated it.

What is MIRR?

The modified internal rate of return (MIRR) presumes that constructive cash flows are reinvested to the company’s cost of capital and that the inceptive outlays are funded at the company’s financing cost. It is a development over IRR and changes many things like: it deletes the different IRRs, checks the reinvestment price issues and initiates outcome, which is in a link with the present value method.

What is IRR in finance?

What is IRR? Internal rate of return or IRR is a measure in capital budgeting parlance, which is used to estimate the profit that can be obtained from the investments. Internal rate of return is a type of discount rate that is used to make the net present value of all the cash flows from any project equal to zero.

Which is better, MIRR or IRR?

The conclusion measure of both the operating budgeting methods is the same, but MIRR describes better profit in respect of the IRR, because of two main reasons, i.e., firstly, reinvesting of the cash flows at the expense of capital is actually possible, and secondly, numerous rates of return don’t subsist in the case of MIRR.

What is MIRR in finance?

MIRR (Modified internal rate of return) intends that positive cash flows reintegration at the firm’s cost of capital and that the opening expenses financed at the firm’s financing cost. The MIRR, therefore, more exactly deems the cost and profitability of a project. The MIRR is used to grade investments or projects of unequal size. With the MIRR, only a single solution occurs for a given project, and the reinvesting rate of positive cash flows is much more legitimate in practice. The MIRR enables project managers to change the supposed rate of reinvested growth from phase to phase in a project. The most usual method is to input the ordinary estimated cost of capital, but there is resilience to add any specific anticipated reinvestment rate. MIRR improves on IRR by the assumption that positive cash flows reinvested at the firm’s cost of capital. MIRR tends to rank investments or projects a firm or inventors may undertake. MIRR is designed to produce one solution, eliminating the issue of multiple IRRs.

What is the IRR?

Internal Rate of Return (IRR) is an economic resource for cash flow analysis , popular for assessing the performance of investments, capital attainment, project proposals, programs, and business case sceneries. IRR analysis begins with a revenue or cash flow stream, a series of net cash flow results expected from the capital (or action, acquisition, or business case scenario). Most people in business have at the least heard of “internal rate of return.” The name is common because financial officers often need an IRR estimate to support budget requests or action proposals. IRR is a favorite metrics of many CFOs, Controllers, and other financial specialists. Also, some businessmen know of IRR because many organizations define an obstacle rate as an IRR. They define, that is, an IRR rate that ingoing proposals must reach or overcome to qualify for approval and funding.

Why is IRR so popular?

Reasons for IRR’s Popularity 1 Firstly, many in the financial group see IRR as more “objective” than the net present value (NPV). They have this view because NPV results from randomly chosen discount rates while IRR, by contrast, results completely from the cash flow figures themselves and their timing. 2 Secondly, some also judge that IRR readily compares return rates with inflation, current interest rates, and financial investment alternates. Note especially in the discussions below that this belief is sometimes supportable and sometimes not.

What is MIRR rate of return?

The internal rate of return turns into a rate of yield or rate of return upon which NPV is equal to zero. Conversely, MIRR is the rate of return upon which NPV of terminal inflows is equal to the outflow, i.e., investment.

Why is IRR used in business?

The name is common because financial officers often need an IRR estimate to support budget requests or action proposals. IRR is a favorite metrics of many CFOs, Controllers, and other financial specialists.

What is the purpose of the MIRR?

The MIRR, therefore, more exactly deems the cost and profitability of a project. The MIRR is used to grade investments or projects of unequal size. With the MIRR, only a single solution occurs for a given project, and the reinvesting rate of positive cash flows is much more legitimate in practice.

How to calculate the MIRR?

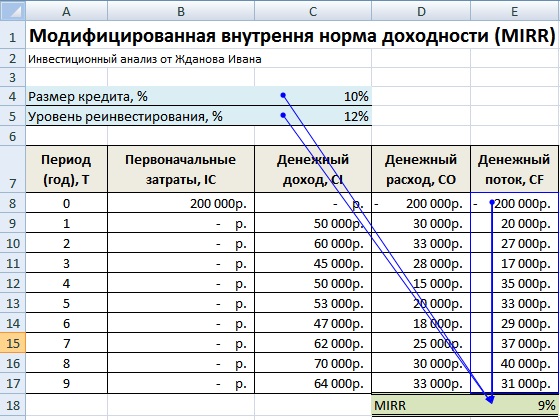

Alternatively, the MIRR can be easily calculated in spreadsheet applications such as Microsoft Excel. For example, in MS Excel, it can be calculated using the function called “ =MIRR (cash flows, financing rate, reinvestment rate) .”

What is modified internal rate of return?

The modified internal rate of return (MIRR) and the internal rate of return (IRR) are two closely-related concepts. The MIRR was introduced to address a few problems associated with the IRR. For example, one of the main problems with the IRR is the assumption that the obtained positive cash flows are reinvested at the same rate at which they were generated. Alternatively, the MIRR considers that the proceeds from the positive cash flows of a project will be reinvested at the external rate of return. Frequently, the external rate of return is set equal to the company’s cost of capital.

What is return on investment?

The return on the investment is an unknown variable that has different values associated with different probabilities. an investment is considered to be attractive. Conversely, it is not recommended to undertake a project if its MIRR is less than the expected return.

What is required rate of return?

Required Rate of Return The required rate of return (hurdle rate) is the minimum return that an investor is expecting to receive for their investment. Essentially, the required rate of return is the minimum acceptable compensation for the investment’s level of risk.

Is MIRR lower than IRR?

The common view is that the MIRR provides a more realistic picture of the return on the investment project relative to the standard IRR. The MIRR is commonly lower than the IRR.

Does IRR always return a single solution?

This fact creates ambiguity and unnecessary confusion regarding the correct outcome. Unlike the IRR, the MIRR calculations always return a single solution.

Which is better, IRR or MIRR?

MIRR valuation methods, MIRR is the better choice as it gives a much clearer view on what a company stands to either gain or lose in terms of an upcoming project or purchase. The IRR is more of an optimistic view of returns, while the MIRR is a realistic view.

What does MIRR do?

As seen in the picture above, the calculation for the MIRR combines both future value and that of the present value, allowing for finance rates and money flowing out of the business.

What is the IRR method?

The IRR is a very popular method in determining capitol budgeting that is used by many businesses ; however, it also has many flaws that skew a company’s projected numbers. The biggest problem is that it does not take into account the risk factors or other costs that could come from a company’s return.

What is the purpose of IRR?

The Internal Rate of Return, or IRR, is a measure of an investment that takes into account internal factors, but does not measure interest rates or inflation. It is used to indicate efficiently , quality, and/or the yield of an investment. This is important to a company or business' investors ...

What is modified internal rate of return?

The Modified Internal Rate of Return, or MIRR, is just as the name implies - it is a modified type of method that covers the limitations of

What is the term for the process of measuring the profitability of a project?

If you’re just starting out within project management, there may be a few things that you may not know or even understand. Valuation methods, for instance, are used to measure the profitability of certain projects that you’re company will complete for or come up with. This is called capital budgeting or investment appraisal.

How does MIRR improve on IRR?

MIRR improves on IRR by assuming that positive cash flows are reinvested at the firm's cost of capital.

What Is Modified Internal Rate of Return (MIRR)?

The modified internal rate of return (MIRR) assumes that positive cash flows are reinvested at the firm's cost of capital and that the initial outlays are financed at the firm's financing cost. By contrast, the traditional internal rate of return (IRR) assumes the cash flows from a project are reinvested at the IRR itself. The MIRR, therefore, more accurately reflects the cost and profitability of a project.

What is the problem with IRR?

The first main problem with IRR is that multiple solutions can be found for the same project. The second problem is that the assumption that positive cash flows are reinvested at the IRR is considered impractical in practice.

What is the MIRR in project management?

The MIRR allows project managers to change the assumed rate of reinvested growth from stage to stage in a project.

What is the IRR in finance?

Meanwhile, the internal rate of return (IRR) is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. Both MIRR and IRR calculations rely on the formula for NPV.

Why is the reinvestment rate higher than the safe rate?

The reinvestment rate is higher than the safe rate because it is not liquid (i.e., it pertains to another investment) and thus requires a higher-risk discount rate .

What is the purpose of the modified internal rate of return?

The modified internal rate of return (MIRR) compensates for this flaw and gives managers more control over the assumed reinvestment rate from future cash flow.

How To Calculate MIRR?

MIRR depicts the ROI in a clearer, more accurate, and realistic manner using evaluation parameters.

MIRR Formula

The MIRR formula used by firms and investors in capital budgeting is as follows:

Examples

Let us consider the following MIRR example with calculations to understand the concept better:

IRR vs MIRR – Which Is Better?

Both IRR and Modified Internal Rate of Return are interrelated terms when considering a new investment or project. However, a few things make one option better than the other. Let us look at them:

Uses Of MIRR

The regular IRR exaggerates the returns on investment, giving investors false hope. On the other hand, MIRR assesses different costs to conclude the returns one can expect from an investment. Thus, it prevents investors and firms/business managers from being misled.

Recommended Articles

This has been a guide to MIRR (Modified Internal Rate of Return) and its Definition. Here we explain how to calculate MIRR, along with its formula and examples. You may learn more about our articles below on accounting –

Why use XIRR vs IRR?

XIRR vs IRR Why use XIRR vs IRR. XIRR assigns specific dates to each individual cash flow making it more accurate than IRR when building a financial model in Excel.

Why is IRR used in finance?

The reason for this is that transactions are looked at in isolation and not with the effect of then another investment assumption layered in.

Can you look at both cases and play with different reinvestment rates in the MIRR scenario?

The answer is that it depends on what you’re trying to show and what the takeaway is. It can be helpful to look at both cases and play with different reinvestment rates in the MIRR scenario.

Is the reinvestment rate irrelevant in Project 1?

In Project #1, essentially all cash flow is received at the end of the project, so the reinvestment rate is irrelevant.

Is MIRR as widely used as IRR?

Additionally, it is not nearly as widely used as traditional IRR, so it will require more socializing, buy-in, and explaining at most corporations.

Is there a difference between MIRR and IRR?

As you can see in the image above, there is a major difference in the return calculated by MIRR and IRR in Project #2. In project #1, there is no difference.