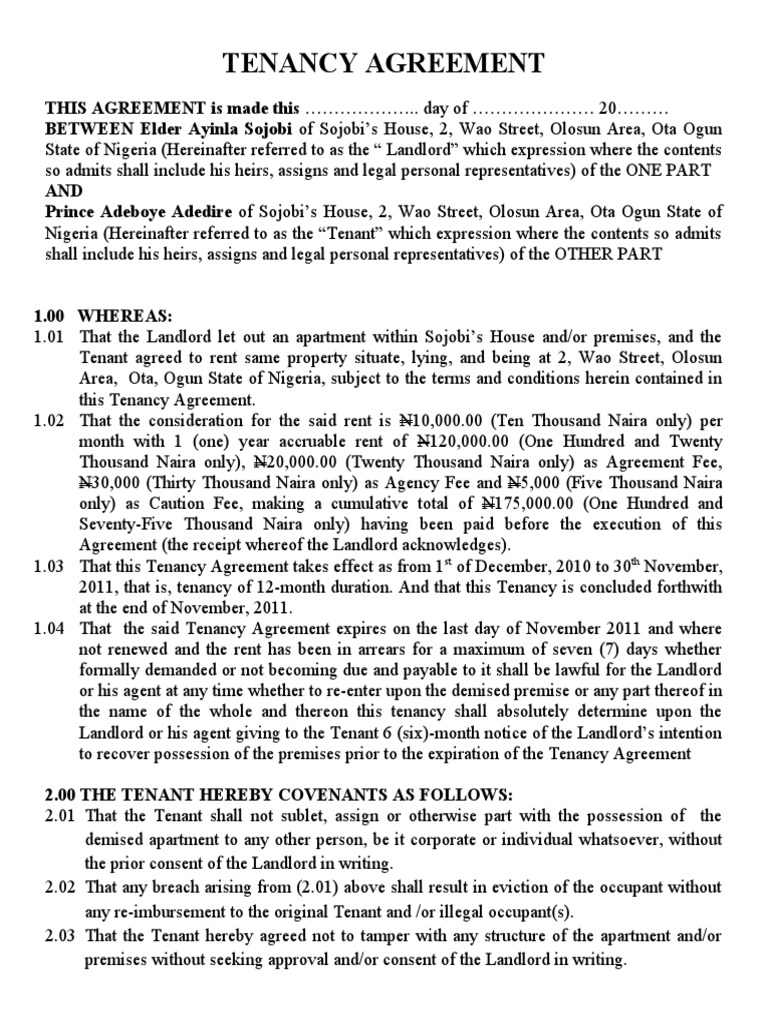

What happens when all owners in a joint tenancy?

When purchasing property, joint tenancy provides all parties with equal rights to and responsibilities for the real estate purchased. Although joint tenants receive the same amount of interest in the property, there are limitations to using their shares.

Can someone with a tenancy in common sell their portion?

Each person owns an undivided portion of the land. Ownership occurs either voluntarily or involuntarily. It is not to be confused with joint tenancy with right of survivorship or tenancy by the entirety which only applies to husband and wife. A tenant in common is able to sell his portion of the property. That right, however, has practical limitations.

Why does tenants in common have no rights of survivorship?

While tenants in common partners do not have rights of survivorship because of the structure of a tenants in common agreement, there is a possible way around the issue. In some cases, each partner specifies in a will that the remaining partners are to inherit his or her percentage of the property.

How a tenant can end their tenancy?

To serve a valid Notice of Termination

- Ensure the notice is in writing

- Ensure you give the required notice period

- Include the ground for the termination of the tenancy in the notice

- If subletting please refer to the checklist for landlords as you take on the role

- Ensure the notice is served on the party

Is a tenancy in common a partnership?

Tenancy in common (TIC) is an ownership arrangement in which two or more parties jointly own property, and title is held individually to the extent of each party's interest. Unlike a partnership interest, TIC interest, can be exchanged in a tax deferred exchange.

What is a partnership in real estate?

A real estate partnership is an investment strategy that integrates the strengths of two or more investors into a single investment property.

How does a partnership hold property?

The partners in a partnership hold title over property in a partnership business as if they were “tenants in common.” Under business law principles, this name will change from tenants in common to “tenants in a partnership.” What these terms mean is that each separate partner will retain equal rights to use the ...

Can a partnership own property in California?

One of the primary areas in which a partnership is viewed as an entity is with respect to ownership of property. California Corporations Code section 15008 specifically provides that a partnership may hold title to real property.

Who owns the property in a partnership?

Because a partnership is not a legal person, it cannot acquire or hold a registered interest in real property. In order to acquire and hold real property, the partnership requires an individual or corporation to become a registered owner.

What are the 4 types of partnership?

These are the four types of partnerships.General partnership. A general partnership is the most basic form of partnership. ... Limited partnership. Limited partnerships (LPs) are formal business entities authorized by the state. ... Limited liability partnership. ... Limited liability limited partnership.

How do you divide property in a partnership?

How can you divide commercial property with your partners? One of the ways to divide the commercial property is with an even split. If you have one partner, then you can have 50% ownership of the commercial property. If you have three other partners, you might split the property into 25% interests.

Who owns what in a partnership?

A general partnership is a company owned by two or more individuals who agree to run the business as partners or co-owners. Unless otherwise agreed, each partner has an equal share of profits and losses. Partnership agreements play a major role in general partnerships that don't evenly split duties and shares.

Can a partnership own property in its name?

A firm can buy , but only in the name of partners , because firm has no legal existence on its own. A partnership firm can own property in its own name. Section 14 of the Indian Partnership Act 1932 deals with properties which are deemed to be the properties of the firm.

Do partnerships pay taxes in California?

Partners. Each partner must use a Partner's Share of Income Deductions, Credits, etc. (Schedule K-1 565) to report share of partnership's income, deductions, credits, property, payroll, and sales. General partnerships do not pay annual tax; however, limited partnerships are subject to the annual tax of $800.

Can a partner sell partnership property?

If the partnership deed contains the recital about any of the partner can sell the property purchased n behalf of the firm, it will be valid as the property is being sold on behalf of the firm and not on any individual name.

Which of the following is an advantage of partnerships?

Advantages of a partnership include that: two heads (or more) are better than one. your business is easy to establish and start-up costs are low. more capital is available for the business.

Can a partnership buy a property?

Unlike a limited liability partnership, a general partnership has no separate legal personality, which means that it cannot own property in its own name. As a result, business or partnership property is normally purchased in the names of the individual partners.

What is the difference between an investor and a partner?

An investor will basically put money in the business in hopes getting some returns on his/her investment. On the other hand, business partners co-own a business. They raise the capital for the business as per agreement with each other.

Can partnerships have investors?

Answer: No. This is because of the different ownership interests of a partnership and a company structure. Owners of a company are shareholders as they purchase their interest in the company by buying shares or stocks.

What is a partnership agreement contract?

A partnership agreement is a legal document that dictates how a small for-profit business will operate under two or more people. The agreement lays out the responsibilities of each partner in the business, how much of the business each partner owns, and how much profit and loss each partner is responsible for.

What is a tenancy in a partnership?

A tenancy in partnership is a form of co-ownership in which all partners have an undivided interest in the property, but no rights to transfer their interests outside of the partnership. A partnership is a legal arrangement that can be formed between two or more different parties. People form partnerships for ...

What is partnership in real estate?

A partnership is a legal arrangement that can be formed between two or more different parties. People form partnerships for a wide range of different reasons, from starting a business or creating a professional practice to owning or investing in real estate. In world of real estate, partners may join together to own property.

What happens when a partnership holds a property?

When property is held by a tenancy in partnership, each party’s interest in the property is equal to their interest in the partnership that owns the property. This is because the real estate asset is fundamentally the partnership’s asset. It is not an individual asset. As a consequence of this, an individual partner cannot transfer their interests ...

Can a partnership own a title to a property?

There are several different ways in which a partnership can own the title to property. One of these ways is known as a tenancy in partnership.

Can a business partner own a property?

In world of real estate, partners may join together to own property. Business partners could collectively own dozens of different pieces of property in states all across the country, or they could even form a partnership to a single parcel of land. When owning real property, it is imperative that partners have a clear and comprehensive ...

Can an individual partner transfer their interests in property held in a partnership?

It is not an individual asset. As a consequence of this, an individual partner cannot transfer their interests in property that is held via a tenancy in partnership to someone outside of the partnership.

Is property ownership a technical distinction?

In real estate, defini ng the terms of property ownership is not merely a technical distinction that is only of interest to professionals. Quite the contrary; there are important, entirely practical real-world implications. When property is held by a tenancy in partnership, each party’s interest in the property is equal to their interest in ...

Is a partner's interest tax free?

However, a partner's interest is specifically excluded from a tax-free exchange transaction. In many cases, a partnership wished to dissolve and the owners desire to go separate directions.

Can a partner exchange like-kind?

By converting an interest in a partnership to real property that is distributed to a partner - who then completes the exchange - the partner may qualify for a like-kind exchange under section 1031. The article Partnership & Co-Ownership Issues Issues briefly explains two techniques used to accommodate a 1031 exchange where partners desire different directions.

What Is Partnership Deed One Word?

A partnership deed is an agreement that applies to both partners and sets forth the terms and conditions of a partnership agreement.

What Is Partnership Deed Very Short Answer?

Partners of a partnership sign a contract in which they agree to share the ownership of the company, in exchange for the right to make various decisions. As a rule, the document specifies various terms, such as profit-sharing or loss-sharing arrangements, salary, interest on capital, and drawings to obtain partners or new investors.

Can A Partnership Hold A Tenancy?

No matter how the partnership owns its freehold interest or how it leases its property , it is common for partnerships to use its property assets for their business. Partnerships do not have separate legal personality, so they cannot own property, and they will be shared among themselves by both partners.

What Are The Objectives Of Partnering?

Partnering aims to create a whole that is larger and better than its parts by bringing together the skills and resources of multiple business owners.

Are Tenants In Common A Partnership?

It is common for tenants to have several interests instead of one large ownership or partnership of interests (such as a sole proprietorship or joint partnership) in a tenancy in common. Court rulings are used to decide tenancy in common, not jointly.

What is the equitable principle of partnership law?

Underlying these provisions is the equitable principle of partnership law that all property, whether real or personal, is subject to sale on the dissolution of the partnership, with each partner, or representative of a deceased partner, having a right to insist on a sale. A partner’s share in a partnership consists of their proportion of the partnership assets after they have been turned into money and applied in liquidation of partnership debts. As between the partners, land owned by a partnership is deemed to have already converted into personal estate and it devolves as such: E.R. Hardy Ivamy and D.R. Jones, Underhill’s Principles of the Law of Partnership, 12th ed. (London: Butterworth’s, 1986) at 34; Lindley & Banks at 19-14.

What happens to a partnership after death?

The death of a partner in a two-person partnership dissolves the partnership: Partnership Act, s. 36 (1) (a ). On dissolution, every partner is entitled, pursuant to s. 42, to a proportionate share of the partnership assets after the payment of debts. Section 25 of the Partnership Act provides that where land becomes partnership property, it is to be treated as between the partners, including the representative of a deceased partner and their heirs and executors, as personal or movable and not real or heritable estate.

What was the objective of the parties in the joint bank account?

Their objective was to earn profit over time. They opened the joint bank account to manage the financial aspects of the business. The accounting records describe the arrangement as a partnership and individuals as partners, and the court found that there was in fact a partnership and that it was inconsistent with a joint tenancy with right of survivorship.

Can a right of survivorship apply to a partnership?

A right of survivorship is in consistent with the ordinary rules that govern the treatment of partnership assets on the dissolution of a partnership. This is not to say that the right of survivorship can never apply to partnership property. However, there must be evidence of a contrary agreement between the parties that is sufficiently clear and compelling to overcome the presumption that beneficial interest in partnership property does not transfer through the right of survivorship.

Tenancy in Partnership – Various Forms of Tenancy

- There are several commonly used forms of tenancy and they are most often found in real estate title. The basic premise with the modification of tenancy is the number of individuals involved. Two or more individuals requires a modified form of tenancy. There are three basic forms involvi…

Tenancy in Partnership – Legal Background

- As stated in the introduction paragraphs, a partnership is an association of two or more persons to carry on as a business for a profit. It is composed of partners and the partnership itself. A partner has an interest in the partnership assets and in the going concern of the partnership, i.e. his share of profits and surplus. Remember, this partnership existence is greater than the value …

Legal Interpretation of Tenancy in Partnership

- All the federal cases researched for this article concentrated on the ability of non partners to access the rights or assets of the partnership via a partner. In United States v. Silverstein, 210 F. Supp. 401; October 30, 1962 the Internal Revenue Service sought access to the books and records of several partnerships where Mr. Silverstein was a general partner. Mr. Silverstein denied acces…