What is a power of attorney?

A power of attorney for real estate is a legal document that gives one person the power to manage, purchase, or sell real estate on behalf of another. The individual granted this power is called the agent or attorney-in-fact. The person giving the authority is called the principal. Solve My Problem. Get Started.

When Does a Power of Attorney for Real Estate End?

A power of attorney for real estate becomes effective on the date specified in the document. It can end in the following circumstances:

What happens to a POA when the principal becomes incapacitated?

The principal becomes incapacitated. While a general POA will automatically end in this event: A springing power of attorney comes into effect in this situation. A durable POA remains effective even if the principal becomes mentally or physically disabled. The agent cannot perform. A POA ends if the agent: Steps down.

What type of POA letter automatically ends if the principal dies or becomes incapacitated?

General POA —This type of a POA letter automatically ends if the principal dies or becomes incapacitated

What is POA document?

Build, reconstruct, or remove structures on the principal’s property. A POA document can limit the powers granted to an agent by listing all allowed and not allowed activities. For instance, a principal could state that their agent has the authority to manage the property but cannot sell or mortgage it.

What is POA in real estate?

A POA for real estate gives an agent the authority to act on the principal’s behalf in various property matters. Among other things, an agent can: A POA document can limit the powers granted to an agent by listing all allowed and not allowed activities.

What does a POA agent need to do?

If you’re worried about how much authority an attorney-in-fact will have, you should know that a POA agent needs to: Act in the principal’s best interests. Represent the principal in an honest, accurate, and timely manner.

Power of Attorney to Sell Property in California

In residential real estate transactions, the individuals who enter the contracts and sign the checks are commonly the buyers and sellers.

Attorney-in-fact Real Estate

For convenience or other practical reasons, you may give legal authority to another person to act on your behalf. That authority is known as “power of attorney.” The person given power of attorney over another person is referred to as an “attorney-in-fact” and does not have to be a legal professional.

Statutory Power of Attorney

The powers of an attorney-in-fact may be as broad or as narrow as the principal (person granting the authority) specifies it to be. For instance, a seller can designate an attorney-in-fact to act on his behalf for a specific real property or a specific real estate transaction.

What is POA in real estate?

A person who has been given a Power of Attorney (“POA”) may execute a Purchase Agreement for the sale or purchase of real estate, so long as very specific required conditions are met. The POA must expressly empower the representative to execute a sales contract for a specific piece of property.

What happens to a durable power of attorney after a principal dies?

The judgement of incapacity may require resolution by a physician, an attorney or a judge. On the other hand, a Durable Power of Attorney remains in force even after the principal becomes mentally incapacitated. A Durable POA ends automatically when the principal dies or the POA is revoked. Whether the POA should include a durable power is ...

How does a POA terminate?

A POA can terminate by express revocation by the Principal, by the appointment of a new agent or by the death of either the Principal or the Representative. Durable or Non-Durable. A POA can be Durable or Non-Durable. A Non - Durable Power of Attorney is only valid as long as the principal is capable of acting for him or herself.

What happens if you sign a POA without a POA?

If that happens, the contract is void and unenforceable.

When does a POA end?

A Durable POA ends automatically when the principal dies or the POA is revoked. Whether the POA should include a durable power is the Principal’s choice. A Principal may choose not to include the power in a business situation or may choose to include it in a family situation. Or vice versa.

What to do if client asks to be a representative under a POA?

If a client asks that you be a representative under a POA, usually to sign documents at closing, you should immediately call a member of the Broker Team for guidance..

Can a person who has a POA execute a purchase agreement?

Thanks for pointing out that a person who has been given a POA may execute a purchase agreement for real estate. My husband and I are planning to buy a bungalow house near the beach in September so this is really helpful. I guess we should look for a real estate attorney on Monday who can help us review all the documents for easier buying process.

What is the power of attorney in fact?

Generally, the law of the state in which you reside at the time you sign a power of attorney will govern the powers and actions of your agent under that document.

Why is a power of attorney important?

A power of attorney allows you to choose who will act for you and defines his or her authority and its limits, if any.

Who Should Be Your Agent?

You may wish to choose a family member to act on your behalf. Many people name their spouses or one or more children. In naming more than one person to act as agent at the same time, be alert to the possibility that all may not be available to act when needed, or they may not agree. The designation of co-agents should indicate whether you wish to have the majority act in the absence of full availability and agreement. Regardless of whether you name co-agents, you should always name one or more successor agents to address the possibility that the person you name as agent may be unavailable or unable to act when the time comes.

How The Agent Should Sign?

Catherine, as agent, must sign as follows: Michael Douglas, by Catherine Zeta-Jones under POA or Catherine Zeta-Jones, attorney-in-fact for Michael Douglas. If you are ever called upon to take action as someone’s agent, you should consult with an attorney about actions you can and cannot take and whether there are any precautionary steps you should take to minimize the likelihood of someone challenging your actions. This is especially important if you take actions that directly or indirectly benefit you personally.

What Kinds of Powers Should I Give My Agent?

In addition to managing your day-to-day financial affairs, your attorney-in-fact can take steps to implement your estate plan. Although an agent cannot revise your will on your behalf, some jurisdictions permit an attorney-in-fact to create or amend trusts for you during your lifetime, or to transfer your assets to trusts you created. Even without amending your will or creating trusts, an agent can affect the outcome of how your assets are distributed by changing the ownership (title) to assets. It is prudent to include in the power of attorney a clear statement of whether you wish your agent to have these powers.

What to do if you are called upon to take action as someone's agent?

If you are ever called upon to take action as someone’s agent, you should consult with an attorney about actions you can and cannot take and whether there are any precautionary steps you should take to minimize the likelihood of someone challenging your actions.

How long does a power of attorney last?

Today, most states permit a "durable" power of attorney that remains valid once signed until you die or revoke the document.

What is a POA in real estate?

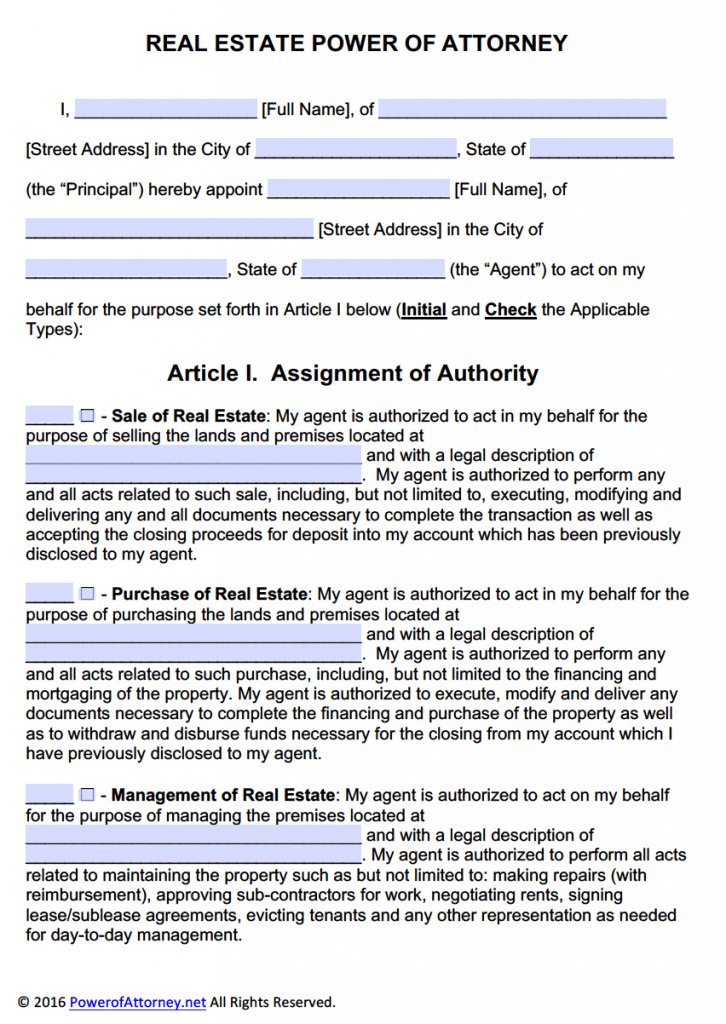

A Real Estate Power of Attorney (POA) details an arrangement whereby a party called the Principal will bring on another individual or entity called the Agent to aid them with their real estate affairs . It is a type of Limited POA, meaning that the decision making powers granted to the Agent are only applicable in the limited contexts provided in the form.

What can a Real Estate POA be used for?

A Real Estate POA is a versatile legal contract that can be used to help the Principal complete a variety of real estate tasks. One of the most substantial benefits of this form is that it can be adapted to suit the particular needs of the Principal. While some Principals only require their Agent to complete one real estate task, others require their Agent to complete multiple tasks.

How can a POA be revoked?

The POA can be revoked by the Principal at any time using a legal document known as a Revocation of Power of Attorney. This form acts to formalize the Principal’s decision to revoke the POA by making a written, legally-binding record of it.

What are the tasks of a real estate POA?

The four (4) primary tasks a Real Estate POA may cover are: Purchasing a property, Selling a property, Managing a property, and. Refinancing a property. A number of more specific tasks are associated ...

What to do if an agent leaves the POA?

The Agent should be mindful of any state laws regarding the Agent leaving the POA and abide by them as appropriate. If the contract nor state laws provide any guidelines about what to do, in most cases, the Agent will be able to give the Principal a formal letter of resignation.

What happens if the principal names a successor agent?

If the Principal has named one or more successor Agents in the form, it will endure in spite of the Agent’s death. In such circumstances, the successor Agent will take over the role of the original Agent, and the contract will continue as usual.

What are the tasks associated with selling a property?

A number of more specific tasks are associated with these primary tasks, as the table below outlines: 1. Purchasing a property. Executing the purchase. Handling any associated contracts.

When is a power of attorney granted?

The continuing power of attorney of property is often granted when the principal has reached a stage when they no longer possess the long-term capacity to make and enact their own decisions. There are other instances when power of attorney of property might be conferred.

What is POA in real estate?

In real estate, POA of property may be used by individuals who are selling a home but are living overseas and unable to be present during the sale. Assets like real estate, stocks, bonds, and bank accounts owned by a principal are included under power of attorney of property.

What is a POA?

Power of attorney (POA) of property is a legal document transferring the legal right to the attorney or agent to manage and access the principal's property in the event the principal is unable to do so themselves.

How old do you have to be to get a power of attorney?

To grant power of attorney of property, the principal must be at least 18 years old, be in full control of their mental faculties, understanding of the value of assets being put into the agent’s care, and be aware of the authority being granted to the agent.

How many witnesses are needed to sign a power of attorney?

For power of attorney of property to be invoked and valid, two witnesses must be present at the signing of the document.

Can an agent bestow control to another person?

Bestowing such control to another individual comes with an expectation that the agent will act according to the instructions and best interests of the principal. There is no guarantee beyond the terms stated in the document to ensure that those wishes will be honored.

Why is a power of attorney important?

Because it’s limited in both time and scope, it’s a great tool when you want to give someone a very specific responsibility. A medical power of attorney gives an agent (often a family member) authority over someone’s medical care once a doctor determines they are unable to make decisions on their own.

Who is the principal of a power of attorney?

The principal is the person granting the power of attorney to someone else.

How to get a power of attorney?

How to get power of attorney if you need it 1 Understand the obligations of being an agent in a POA arrangement. 2 Evaluate that the principal has the capacity to sign a power of attorney agreement. 3 Discuss the issue with the financial institutions (mortgage holders) and physicians (whenever there may be questions about capacity). 4 Hire an attorney or contact a legal website like Legal Zoom, online on-demand legal services with a 100% satisfaction guarantee on all their filings. 5 Be supportive. Giving up control of a real estate transaction can be a hard adjustment for an elder family member. 6 Ask a lot of questions and make sure you understand the obligations for all parties under the document. 7 Make sure that the document outlines actions with as much detail as possible to avoid any gray areas that can be misinterpreted. 8 Get the final document notarized or witnessed — depending on your state’s requirements if they haven’t enacted the Uniform Power of Attorney act of 2006. 9 Record the power of attorney with the county clerk office where the home is located — depending on your state or county requirements. 10 Make authenticated copies of the document for safekeeping. 11 Always present yourself correctly as someone’s agent.

What is a springing POA?

A springing power of attorney is a special feature you can add to a limited or a durable POA agreement that makes it “spring” into action once a certain event occurs, like a trigger.

What is an agent in fact?

The agent or attorney-in-fact is the person who receives the power of attorney to act on someone else’s behalf. The agent will have a fiduciary responsibility to always act in the best interest of the principal for as long as the power of attorney is valid. A fiduciary, according to the Consumer Financial Protection Bureau (CFPB), ...

What is a POA in real estate?

“Power of attorney” (POA) is a flexible legal tool that grants permission for someone to act on another’s behalf on a temporary or permanent basis. In real estate, this can be an incredibly useful option for all sorts of situations, like if you had to sell your house but couldn’t be there due to a job relocation or deployment.

When does a power of attorney kick in?

This type of power of attorney kicks in as soon as the principal is incapacitated and stays valid until the principal’s death. However, incapacitation puts both the principal and agent at risk of a variety of scams that target elderly or infirm people.