What is the fundamental equation of accounting?

The accounting equation is a fundamental part of the balance sheet and one of accounting’s basic principles. The equation itself is easy to understand. It is; Assets = Liabilities + Shareholder’s Equity. The equation forms the foundation of double-entry accounting. This fundamental accounting equation highlights the structure of your balance sheet.

What are the basic accounting formulas?

Formula 1: Accounting Equation. The accounting formulas needed to produce the Accounting Balance Sheet are: Current Assets. Current assets are the sum of assets that will convert into cash in less than 12 months. Current Assets = Cash + Accounts Receivable + Inventory + Prepaid Expenses. Formula 2: Current Assets. Net Fixed Assets. Net fixed assets are the book value of fixed assets.

How to calculate accounting equation?

Formula 1: The Accounting Equation The accounting equation equates assets with liabilities and owners’ equity: Assets = Liability + Owners' Equity Assets are things owned by the company — such as cash, inventory, and equipment — that will provide some future benefit.

How to solve accounting equations with examples?

Accounting Equation Formula – Example #1. Suppose you have just started a new of selling cupcakes. Now, you invested $10,000 from your pocket. So that will be your equity investment and will become an asset for the company. So equation: Total Assets = Total Liabilities + Total Equity. $10,000 = 0 + $10,000.

How do you work out the basic accounting equation?

Also known as the balance sheet equation, the accounting equation formula is Assets = Liabilities + Equity. This equation should be supported by the information on a company's balance sheet.

What is the basic accounting equation and how is it changed?

Assets = Liabilities + Shareholder's Equity For every change there is in an asset account; there has to be an equal change to a related liability or shareholder equity account.

What is accounting equation and explain why the accounting equation will always work?

Profits retained in the business will increase capital and losses will decrease capital. The accounting equation will always balance because the dual aspect of accounting for income and expenses will result in equal increases or decreases to assets or liabilities.

What is the basic accounting?

In a nutshell, basic accounting records and reveals cash flows and operations. It divides all business transactions into credits and debits. The definitions of these are somewhat counterintuitive in financial accounting: Debits increase asset or expense accounts and decrease liability or equity accounts.

How do you explain accounting equation to a child?

0:294:58The ACCOUNTING EQUATION For BEGINNERS - YouTubeYouTubeStart of suggested clipEnd of suggested clipDo this the key principle behind the accounting equation is that stuff the business owns is equal toMoreDo this the key principle behind the accounting equation is that stuff the business owns is equal to the stuff that the business owes. And it is vitally.

What is the basic accounting equation briefly define the three primary elements in the equation?

There are three elements of the Accounting Equation; Assets, Liabilities and Owners Equity. The Assets of a company are things that are owned by a business; such as cash, property and equipment that is used to run the business. Liabilities are the financial obligations of a company.

What is accounting equation Grade 8?

It includes the capital the owner contributed to the business and any drawings that he or she takes from the business for his or her own use. The relationship between assets, liabilities and owner's equity is called the accounting. equation. The accounting equation looks like this: assets = owner's equity + liabilities.

What is accounting equation?

The accounting equation is used in double-entry accounting to show the relationship between assets, liabilities, and equity.

Why is accounting equation important?

The accounting equation is crucial since it may provide you with a comprehensive view of your company’s financial position.

What are the three sections of the balance sheet?

The balance sheet is divided into three sections which are assets, liabilities, and equity.

How to find break even point in accounting?

You can find your break-even point by dividing your fixed costs by the sale price of your goods, minus the amount it costs to create your product.

What is cash in finance?

Cash refers to the quantity of money you have on hand. This can include both real money and money equivalents (i.e. highly liquid investment securities).

What is variable cost per unit?

The variable cost per unit is the cost of producing your product.

What is fixed cost?

Fixed costs are costs that you must pay on a regular basis in order to conduct business. These expenses include things like insurance fees, rent, and employee compensation, among others.

What Is the Accounting Equation?

The accounting equation states that a company's total assets are equal to the sum of its liabilities and its shareholders' equity.

Why is accounting equation important?

The accounting equation is important because it captures the relationship between the three components of a balance sheet: assets, liabilities, and equity. All else being equal, a company’s equity will increase when its assets increase, and vice-versa.

What Are the 3 Elements of the Accounting Equation?

The three elements of the accounting equation are assets, liabilities, and shareholders' equity . The formula is straightforward: A company's total assets are equal to its liabilities plus its shareholders' equity. The double-entry bookkeeping system, which has been adopted globally, is designed to accurately reflect a company's total assets.

How to calculate total equity?

The balance sheet holds the basis of the accounting equation: 1 Locate the company's total assets on the balance sheet for the period. 2 Total all liabilities, which should be a separate listing on the balance sheet. 3 Locate total shareholder's equity and add the number to total liabilities. 4 Total assets will equal the sum of liabilities and total equity.

What is the third section of the balance sheet?

Owners’ equity, or shareholders' equity, is the third section of the balance sheet. The accounting equation is a representation of how these three important components are associated with each other. The accounting equation is also called the basic accounting equation or the balance sheet equation. While assets represent ...

What is the difference between assets and liabilities?

Assets represent the valuable resources controlled by the company. The liabilities represent their obligations.

Does the balance sheet always balance out?

Although the balance sheet always balances out, the accounting equation doesn't provide investors information as to how well a company is performing. Instead, investors must interpret the numbers and decide for themselves whether the company has too many or too few liabilities, not enough assets, or perhaps too many assets, or is financing the company properly to ensure long term growth.

Assets

Assets are basically possessions of the business. They are things that add value to the business and will bring it benefits in some form.

Owners Equity (or Equity)

Owners equity, or simply, equity, is the value of the business assets that the owner can lay claim to.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

What is The Accounting Equation in its Expanded Form?

If we combine all of the points above, we have the expanded accounting equation:

Which is better, accounting equation or double entry bookkeeping system?

The accounting equation is a better representation of the dreaded “double entry bookkeeping system”.

What is asset in finance?

Assets are things that we own, and expect to make money from.

What is the current asset?

A “Current Asset” on the other hand, is an asset that we expect to hold for twelve months or lesser. In other words, we expect to use these assets in the current period.

What is the left hand side of the equation?

In this form of the accounting equation, the left hand side (Assets) represents a company’s “resources”. The right hand side of the equation (Liabilities + Equity) shows that company’s “sources of finance”.

What does equity show in accounting?

In its simplest form, it shows us how much a firm owns (Total Assets), owes (Total Liabilities), and hence, how much it’s worth (Equity).

Does every transaction always have two sides?

Every single transaction always has two sides to it. Traditionally, this fact is represented in the “double entry bookkeeping” system. In more recent years, this is being taught by the accounting equation to make students’ lives easier.

What is the accounting equation?

Double-entry accounting uses the accounting equation to show the relationship between assets, liabilities, and equity. When you use the accounting equation, you can see if you use business funds for your assets or finance them through debt. The accounting equation is also called the balance sheet equation.

Why is accounting equation important?

But why is it essential for your bookkeeping? The accounting equation is important because it can give you a clear picture of your business’s financial situation. It is the standard for financial reporting, and it is the basis for double-entry accounting. Without the balance sheet equation, you cannot accurately read your balance sheet or understand your financial statements.

What is the equation for liabilities and equity?

In the basic accounting equation, liabilities and equity equal the total amount of assets. The accounting formula is: Because you make purchases with debt or capital, both sides of the equation must equal. Equity has an equal effect on both sides of the equation.

How to calculate business equity?

If your business has more than one owner, you split your equity among all the owners. Include the value of all investments from any stakeholders in your equity as well. Subtract your total assets from your total liabilities to calculate your business equity.

What is expanded accounting?

The expanded accounting equation shows the relationship between your balance sheet and income statement. Revenue and owner contributions are the two primary sources that create equity.

What is the difference between expenses and revenue?

Different transactions impact owner’s equity in the expanded accounting equation. Revenue increases owner’s equity, while owner’s draws and expenses (e.g., rent payments) decrease owner’s equity. Both sides of the equation must balance each other.

What is the balance sheet?

Your balance sheet is a financial statement that tracks your company’s finances. There are three parts to the balance sheet: assets, liabilities, and equity. Assets are any items of value that your business owns. Your bank account, company vehicles, office equipment, and owned property are all examples of assets.

What is the equation for accounting?

The accounting equation formula is: Assets = Liabilities + Owners’ or Stockholders’ Equity. This equation contains three of the five so called “accounting elements”—assets, liabilities, equity. The remaining two elements, revenue and expenses, are still important (and you still need to track them) because they indicate how much money you are ...

What Is the Accounting Equation Used for?

One of the main benefits of using the accounting equation is the fact that it provides an easy way to verify the accuracy of your bookkeeping. It also helps measure the profitability of your business. Are your liabilities significantly higher than your assets? This may indicate that you aren’t managing your money very well. On the other hand, if the equation balances, it is a good indication that your finances are on the right track.

What is owner's equity in accounting?

In terms of the accounting equation, owner’s equity is sometimes expressed as assets minus liabilities. In other words, assets – liabilities = owners’ equity. In terms of results, in double-entry accounting both sides of the accounting equation are required to balance out at all times.

What is double entry accounting?

The Accounting Equation is a Balancing Act. Double-entry accounting requires a clear understanding of the accounting equation because it is the foundation of your company’s balance sheet, which expresses your business’s assets, liabilities, and owner’s/shareholder’s equity in detail. While very small or simple businesses can sometimes make ...

What happens to your equity if you sell a house for $5,000?

If you make a $5,000 sale, your assets increase by $5,000. Likewise, the owner’s equity increases by $5,000 as well.

What is an asset?

The definitions are: Assets: An asset is anything your business owns outright. This includes tangible assets (e.g. receivables, inventory, equipment, vehicles and real estate), intangible assets (intellectual property, like a patent, a copyright, or a trademark — is an example of an intangible asset) and cash.

Why are revenue and expenses important?

The remaining two elements, revenue and expenses, are still important (and you still need to track them) because they indicate how much money you are bringing in and how much you are spending. However, revenue and expenses are not part of the accounting equation.

How to Calculate the Accounting Equation?

Following are the steps which need to be followed to calculate the accounting equation

Why do we use accounting equations?

It is also known as an Accounting Equation balance sheet since it tells us the relation between balance sheet items i.e. Assets, Liabilities, and Equity.

Why is accounting equation important?

If we want to explain the importance of the accounting equation, we can say that it is the foundation of the double-entry accounting system. This system ensures that the equation always remains balanced which essentially means that assets should always be equal to the sum of liabilities and shareholder’s equity. In a Fundera article, Heather D. Satterley, founder of Satterley Training & Consulting, LLC, explains:

What is the left side of the balance sheet called?

Before finding the equation, keep in mind that left side of the balance sheet is the assets side and also known as “Debit side” and the right side is Liability and equity side also called “Credit side”.

What is equity in business?

Equity is the ownership of the stakeholders in the business. So if you have started a business of your own, you are the stakeholder of the company. The general rule of this equation is the Total assets of the company will always be equals to the sum of its Total liabilities and Total equity.

What is the difference between assets and liabilities?

Assets are basically the things which a business owns. For example, cash, inventory, property, and equipment, etc. all form part of assets. Liabilities are basically the money which business owes to others. For example, payables, debt, etc. are a type of liabilities. Equity is the ownership of the stakeholders in the business.

What is the total assets for the period ending Mar 18?

If you see here, Total assets for the period ending Mar’18 is 331,350.51 Crores and for Mar’17 is 273,754.36 Crores. Same is the value for the sum of Liabilities and shareholder’s equity.

What is accounting equation?

Accounting equation. Accounting equation describes that the total value of assets of a business is always equal to its liabilities plus owner’s equity. This equation is the foundation of modern double entry system of accounting being used by small proprietors to large multinational corporations.

What is the equation for assets?

The basic accounting equation is: Assets = Liabilities + Owner’s equity. If liabilities plus owner’s equity is equal to $150,000, the assets must also be equal to $150,000.

Why are the total dollar amounts of two sides of an accounting equation always equal?

The total dollar amounts of two sides of accounting equation are always equal because they represent two different views of the same thing. In accounting equation, the liabilities are normally placed before owner’s equity because the rights of creditors are always given a priority over the rights of owners.

What are the equation elements impacted as a result of transaction 1?

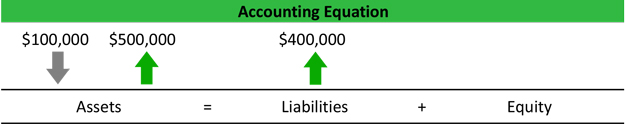

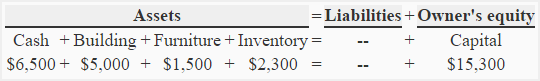

Equation element (s) impacted as a result of transaction 1: “Assets” & “Owner’s equity”. Transaction 2: The second transaction is the purchase of building which brings two changes. First, it reduces cash by $5,000 and second, the building valuing $5,000 comes into the business.

How does every transaction affect accounting?

Every transaction impacts accounting equation in terms of dollar amounts but the equation as a whole always remains in balance. Any increase in one side is balanced either by a corresponding decrease in the same side or by a corresponding increase in the other side and any decrease is balanced either by a corresponding increase in the same side or by a corresponding decrease in the other side. For better explanation, consider the impact of twelve transactions included in the following example:

What are the claims of a business entity?

The claims to the assets owned by a business entity are primarily divided into two types – the claims of creditors and the claims of owner of the business. In accounting, the claims of creditors are referred to as liabilities and the claims of owner are referred to as owner’s equity. Accounting equation is simply an expression ...

What is the impact of transaction 3?

Transaction 3: The impact of this transaction is similar to that of transaction number 2. Cash goes out of and furniture comes in to the business. On asset side, The reduction of $1,500 in cash is balanced by the addition of furniture with a value of $1,500.

The Accounting Equation: What Is It and How Does It Work?

- The accounting equation is used in double-entry accountingto show the relationship between assets, liabilities, and equity. Using the accounting also known as the balance sheet equation, you can determine if you are financing your assets with business funds or debt. You don’t utilize the balance sheet equation if your company implements single-entr...

What Is The Significance of The Accounting equation?

- The accounting equation is crucial since it may provide you with a comprehensive view of your company’s financial position. It is the basis for double-entry accounting and is the norm for financial reporting. You can’t read your balance sheet or understand your financial statements without knowing the balance sheet equation. Your accounting equation can assist you in answer…

Some Basics of The Accounting Equation

- Here are some basic accounting formulas to know if you own a small firm or even the latter category. These formulas are considered universal to any organization and will supply you with the data you need to determine your company’s viability and health.

Simplify Accounting Process by Using Software Such as Jurnal by Mekari

- Those are only some basic accounting equations that you need to know. There are more equations that are not mentioned yet. Accounting is not easy, therefore you can use an online accounting software such as Jurnal by Mekarito simplify the process. Jurnal features precise profit and loss estimations in their data. Jurnal accounting application and system reduces the …

What Is The Accounting equation?

Understanding The Accounting Equation

- The financial position of any business, large or small, is based on two key components of the balance sheet: assets and liabilities. Owners’ equity, or shareholders' equity, is the third section of the balance sheet. The accounting equation is a representation of how these three important components are associated with each other. Assets represent the valuable resources controlle…

Accounting Equation Formula and Calculation

- Assets=(Liabilities+Owner’s Equity)\text{Assets}=(\text{Liabilities}+\text{Owner's Equity})Assets=(Liabilities+Owner’s Equity) The balance sheet holds the elements that contribute to the accounting equation: 1. Locate the company's total assets on the balance sheet for the period. 2. Total all liabilities, which should be a separate listing on the balance sheet. 3. Locate t…

About The Double-Entry System

- The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet. Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders' equity. For a company keeping accurate accounts, every business transaction will …

Limits of The Accounting Equation

- Although the balance sheet always balances out, the accounting equation can't tell investors how well a company is performing. Investors must interpret the numbers and decide for themselves whether the company has too many or too few liabilities, not enough assets, or perhaps too many assets, or whether its financing is sufficient to ensure its long-term growth.

Real-World Example

- Below is a portion of Exxon Mobil Corporation's (XOM) balance sheet in millions as of Dec. 31, 2019: 1. Total assets were $362,597 2. Total liabilities were $163,659 3. Total equity was $198,9381 The accounting equation is calculated as follows: 1. Accounting equation= $163,659 (total liabilities) + $198,938 (equity) equals $362,597, (which equals the total assets for the perio…

Components of The Accounting Equation

Interpreting The Accounting Equation

- The accounting equation is a better representation of the dreaded “double entry bookkeeping system”. In reality, it is nothing but the double-entry accounting system. The only real difference is that it’s arguably easier to read! In its simplest form, the accounting equation shows us how much a firm owns (Total Assets), owes (Total Liabilities), and hence, how much it’s worth (Equity). In a…

What Is The Accounting Equation in Its Expanded form?

- If we combine all of the points above, we have the expanded accounting equation: (Non-current assets + Current assets) – (Current Liabilities + Non-current Liabilities) = Share Capital + Retained Earnings There are so many things to list, it just doesn’t fit in one line. And maybe that’s why we come up with annotations to make our life easier! Non-current assets are often written as “NCA”…

How Does The Accounting Equation Work?

- Every single transaction always has two sides to it. Traditionally, this fact is represented in the “double entry bookkeeping” system starting with journal entries. In more recent years, this is being taught by the accounting equation to make students’ lives easier. The best way to understand this is by an example.