What Is a Cash Disbursement Journal?

What information is included in a cash disbursement journal?

Why do we need a journal for cash disbursement?

Why do journal managers need to record every transaction?

See 1 more

About this website

What type of entry is recorded in the cash disbursements journal?

The cash disbursement journal is a detailed record of the cash payments made by a business. The journal itemizes when check and other types of payments are made, as well as the amounts paid, the names of the recipients, and the accounts charged.

How do you record a disbursement journal?

The cash disbursement journal includes the columns of date, check number, and name of the payee. The amount of disbursement is recorded in the cash column, and the title is recorded in the corresponding account debited column. Each account has a reference number shown in the posting reference (PR) column.

What is a cash disbursement in accounting?

Key Takeaways. A disbursement is the actual delivery of funds from one party's bank account to another. In business accounting, a disbursement is a payment in cash during a specific time period and is recorded in the general ledger of the business.

What document or documents are used and recorded in the cash disbursement journal?

Information is recorded in the cash disbursement journal from the appropriate source documents such as check book stubs, bank statements, and cash purchase invoices. The cash disbursements journal line items are used to update the subsidiary ledgers, such as the accounts payable ledger.

Who maintains the cash disbursements record?

The Disbursing OfficerThe Disbursing Officer shall maintain the Cash Disbursements Record (CDRec) (Appendix 39) to monitor the cash advances/payroll, current operating expenses, and special purpose/time-bound undertakingsand prepare the Report of Cash Disbursements (RCDisb) (Appendix 40)toreport its utilization.

How do you record cash disbursement on bank reconciliation?

Record all of your cash disbursements as well as your cash receipts on your ledger. Include the date of each disbursement and receipt so that when you reconcile with your bank statement, the items match up. Write down check numbers or other notable information as needed.

Is cash disbursement an expense?

What's the difference between cash disbursement and expenses? Cash disbursements are money paid out that is credited to the cash account of the general ledger. Expenses are payments made to cover the costs of operating a business. Expenses can be cash disbursements, but not all cash disbursements are for expenses.

What is the difference between cash receipt journal and cash disbursement journal?

A cash receipt is any transaction where physical cash is received by the firm and a debit is made to the cash account. Any transaction resulting in a credit to the cash account for a payment is a cash disbursement.

Are cash disbursements debit or credit?

A cash disbursement journal typically includes double-entry bookkeeping debit and credit entries. Cash paid is recorded as a credit to a cash account. Once invoices are paid, they are recorded as a debit to accounts payable to reduce the credit balance in that account.

Which of the following is recorded in the cash payment journal?

The cash payments journal records all the cash payments or disbursements made during a particular period. It has two credit columns, cash and purchase discounts, and two debit columns, accounts payable and other accounts.

Which source documents provides evidence that cash was disbursed?

A credit card receipt can be used as evidence for a disbursement of funds from petty cash.

What is recorded in the CPJ?

Cash Payments Journal (CPJ) is a journal that records all cash (cheques, coins, bank notes, credit cards, debit cards, EFT) payments that a business pays.

Is a disbursement an expense?

A disbursement is a different kind of expense that is incurred as part of the delivery of a service. It is an expense that arises specifically within the delivery of the service and is a cost that should be properly borne by the client.

Is a disbursement a debit or credit?

All disbursements are payments, but not all payments are disbursements. A disbursement is a finalized payment that has been officially recorded as a debit by the payer and as a credit by the payee.

How do I record disbursements in Quickbooks?

How to record disbursements (charging back the client for the expenses we paid on their behalf)Go to the + New icon.Choose Bill.Enter the necessary information. From the Amount column, enter the item and the amount.Click Save & Close.

What are the three examples of disbursements?

Some examples of disbursements are payroll expenses, rent, taxes or insurance premiums. In organizational structures, the Finance Department is often the one that handles the disbursement program where all the company's financial commitments are scheduled to be paid at certain moment.

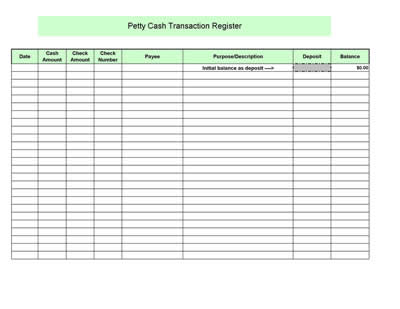

Information Listed in The Cash Disbursement Journal

The cash disbursement journal format is usually multi-column. The information in the journal is taken from source documents such as check stubs, ca...

Cash Disbursement Journal Example

The use of the cash disbursement journal is a three step process. 1. Information is recorded in the cash disbursement journal from the appropriate...

Cash Disbursement Journal Proof of Postings

The are two checks which can be made following the posting of the cash disbursement journal at the end of an accounting period to prove that the in...

Cash Disbursement Journal: Definition & Examples - FreshBooks

Stay Organized with a Cash Disbursement Journal . An organized accounting method is a vital aspect of your business. Whether using cash for business expenses, managing merchandise inventory, or looking to add detail to your general ledger, an accounting journal is a helpful asset to any small business owner. Use your payment journal in reference with your other accounting strategies for clear ...

What is a Cash Disbursements Journal? - Definition | Meaning | Example

Management can use this journal to not only see how much cash has been disbursed, it can also track what cash is being used for. In other words, management can look through the cash disbursements journal and see what ratio of cash is being spend on inventory compared to the amount of cash being spent on paying other bills.

What is Cash Disbursement in Accounting? | Blog

Related Accounting Tasks. Cash disbursements aren’t the only repetitive accounting tasks you can automate. Accounting Seed users can also create custom management reports with custom rows and columns detailing cash disbursements by batch.

What is a cash disbursement journal?

Cash Disbursement Journal is a special journal used to record all payments of cash, also called Cash Payment Journal. This is a journal that we could use if we were to set up the accounting process by hand rather than having a computer system, like QuickBooks. The Cash Disbursement Journal will work best when there are just a few transactions ...

How to check if everything was posted to the journal correctly?

To ensure that everything was posted to the journal correctly, the total in the Bank column must equal the total of all other columns. For example, Bank = Creditors Control + Stock Control + Other Special Columns + GST. We usually check this at the end of the period. If this is not true, and you have added all the numbers correctly, then some transaction was not allocated correctly to all the columns. Another way to check that everything was transferred right is to see if the total debits are equal to the total credits in the general ledger.

Why record Evergreen payments?

We record the payment to the Evergreen under the Accounts Payable because purchases on account might be something that is done regularly. If the company purchased supplies with cash regularly, such transactions might fall under the Landscaping Supplies.

Why do we use special journals?

If we are setting up the process by hand, we may want to use special journals so we can record normal transactions. The special journal will be shorter than recording journal entries for every transaction at the end of the period (month, week, day). This way, our General Ledger will not be as cluttered.

Do you need a debit or other account for cash disbursement?

Since the cash is decreased, we will need the other account besides our Cash account to reflect it. In other words, this will be the debit side of the cash disbursement transaction. Since the four transactions are not something a company has regularly, we will record them under the Other column. If, for example, gas is a regular expense, it might make sense to break down the Other column and add a Gas expense column.

Is it good to know how different accounting systems work?

It is good to know how different accounting systems work, so we can see the similarities and the differences that are helping us to understand whatever system we are using.

Does a discount get recorded in the Cash Payment Journal?

Some companies include discounts received column in the Cash Payment Journal. So purchase from a supplier will be recorded in the accounts payable ledger by crediting Cash and Discounts allowed accounts and debiting the Accounts payable.

When to create a cash disbursement journal?

Create and update a cash disbursement journal whenever you purchase something with cash or a cash equivalent.

What information do you need to record a disbursement journal?

When recording your disbursement journal, pull information from purchase receipts, checkbook stubs, or invoices.

What is cash disbursement?

A cash disbursement is a payment that a business makes with cash or a cash equivalent. Cash disbursement payments show how much money is flowing out of a business. You can compare your company’s disbursements to the money coming into your business to determine whether you have a positive or negative cash flow.

What happens if you miss a journal entry?

Missing a journal entry can throw off your running balance and cause you to misread your financial health. Keep in mind that cash disbursements are just one half of the coin. You must also record cash receipts when you collect money from your customers. Record incoming cash payments in a separate cash receipts journal.

What are disbursements in business?

Purchasing inventory or office supplies, paying out dividends, or making business loan payments with cash or cash equivalents are examples of disbursements.

Do you need to decrease cash equivalents?

Because you’re spending cash or cash equivalents, you will need to decrease the cash or cash equivalents account. You can do this by crediting it. You must also debit the corresponding expense account. Here’s an example of how your journal entries may look. Date.

Do small businesses use cash?

Does your small business work with cash? More than likely, the answer is yes. And when you have cash expenses, you should record them in a cash disbursement journal. Creating journal entries for small business transactions should be like second nature. But with so many types of entry types, it can be hard to keep up.

Why should a cash disbursement journal have an other column?

The cash disbursement journal should always have an ‘other’ column to record amounts which do not fit into any of the main categories. It is important to understand that if any cash is paid, even if it relates only to a part of a larger transaction, then the entire transaction is entered into the cash disbursements journal.

When recording cash payments to suppliers, is it quite common for the cash disbursement journal to include a answer?

When recording cash payments to suppliers it is quite common for the cash disbursement journal to include a discounts received column. By using a discounts received column, the business can use the cash disbursement journal to record the invoiced amount, the discount received, and the cash payment. In this way, the line item postings to the accounts payable ledger are for the full invoiced amount, and only the discounts received column total is posted to the general ledger.

What is the total of all the subsidiary ledger balances?

The total of all the subsidiary ledger balances (in this case the supplier account balances in the accounts payable ledger) should be equal to the balance on the subsidiary ledger control account in the general ledger.

What is debit entry in general ledger?

In this case the debit entry is to the accounts payable control account in the general ledger, and represents the reduction in the amount outstanding to suppliers. Had the cash disbursement journal recorded other items such cash purchases etc. then the debit would have gone to the appropriate purchases or expense account.

How many steps are there in cash disbursement journal?

The use of the cash disbursement journal is a three step process.

What is transaction date?

Transaction date – the date the cash is received.

Do you need a cash payment column in a journal?

The cash payment type columns will depend on the nature of business. Some businesses simply have one column to record the cash amount whereas others need additional columns for accounts payable, discounts received, cash purchases etc. The cash disbursement journal should always have an ‘other’ column to record amounts which do not fit into any of the main categories.

What is a cash disbursement journal?

The cash disbursements journal (also known as cash payments journal) is a special journal that is used by a business to manage all cash outflows. In other words, a cash disbursements journal is used to record any transaction that includes a credit to cash. All cash inflows are recorded in another journal known as cash receipts journal.

When are cash, inventory and accounts payable posted?

The totals of cash, inventory and accounts payable columns are posted at the end of the period (usually one month) to the relevant accounts in the general ledger. The total of other accounts column is not posted to any account.

What is cash column?

Cash column: The amount of cash paid is entered in cash column. This amount must be net of any purchases discount received from suppliers of inventory etc.

What is the account debit column?

Account debited column: Every cash transaction results in a credit to cash account and a debit to some other account. Account debited column is used to enter the title of the account to be debited in the accounts payable subsidiary ledger or general ledger as a result of the payment of cash.

What is payment of cash for previous credit purchases?

Payment of cash for previous credit purchases i.,e. payment to accounts payable or creditors

What is the check number column?

Check number column: In large businesses, the payments are mostly made by checks. If the payment is made by a check, this column is used to enter the check number belonging to the payment.

What Does Cash Disbursements Journal Mean?

Bookkeepers and accounting systems record transactions in the cash disbursements journal before the transactions are posted to the general ledger, accounts payable ledger, and other ledgers.

Example

For instance, a retailer would have many payments for inventory, accounts payable, and salaries expenses. A manufacturer might have entries for raw materials and production costs. The journal shows the accounts that are debited and credited in each transaction as well as the effect on the overall cash balance.

What Is a Cash Disbursement Journal?

A cash disbursement journal is a record kept by a company's internal accountants that itemizes all financial expenditures a business makes before those payments are posted to the general ledger. On a monthly basis, these journals are reconciled with general ledger accounts, which are then used to create financial statements for regular accounting periods.

What information is included in a cash disbursement journal?

The information included in a cash disbursement journal is the disbursement amount, the check number, the transaction type, the payee, and any other pertinent information. Cash disbursement journals can help business owners with cash management by providing clear pictures of inventory expenses, wages, rental costs, and other external expenses.

Why do we need a journal for cash disbursement?

Furthermore, cash disbursement journals can help business owners with cash management by providing clear pictures of inventory expenses, wages, rental costs, and other external expenses. This data can be crucial to making sound business decisions moving forward.

Why do journal managers need to record every transaction?

Journal managers must be detail-oriented and they must fastidiously record every transaction to help prevent cash from being misdirected or misappropriated.