What is the best mortgage rate for 30 year?

Rates on a 30-year fixed rate mortgage (FRM) ran between 3.95% on the low end and 5.34% on the high. Take the first step toward the right mortgage. Apply online for expert recommendations with real interest rates and payments.

How are 30 year fixed mortgage rates calculated?

Want a Printable Report or to Email Your Results?

- View results online by clicking calculate,

- Save your results as a PDF by clicking let me print that, or

- Email yourself a printable PDF by entering your email address & clicking on the email PDF report button

How do I calculate a 30-year fixed mortgage?

How to Calculate a 30-Year Fixed Mortgage

- Divide the interest rate by 12 to figure the monthly rate. ...

- Add 1 to the monthly rate. In this example, add 1 to 0.003433 to get 1.003433.

- Raise the result to the 360th power, because you make 360 payments over a 30-year mortgage. ...

- Multiply the Step 3 result by the monthly interest rate. ...

- Subtract 1 from the Step 3 result. ...

Who has the best refinance rates?

There are several steps you can take to improve your chances:

- Get your credit rating and debt-to-income ratio in good shape. Working to improve your credit score and pay off existing debts can earn you a lower refinance rate and big ...

- Shop around among several different lenders. ...

- Factor in closing costs. ...

- Read your Loan Estimates carefully. ...

- Consider purchasing discount points. ...

What is the current refinance rate?

The average 30-year fixed-refinance rate is 5.79 percent, up 8 basis points from a week ago. A month ago, the average rate on a 30-year fixed refinance was higher, at 5.88 percent. At the current average rate, you'll pay $584.21 per month in principal and interest for every $100,000 you borrow.

What are today's 30-year refinance rates?

Today's average 30-year fixed refinance rate is: 5.69% 20-year fixed refinance rates are averaging 5.67% 15-year refinance rate: 4.93%

What is the lowest 30-year refinance rate ever?

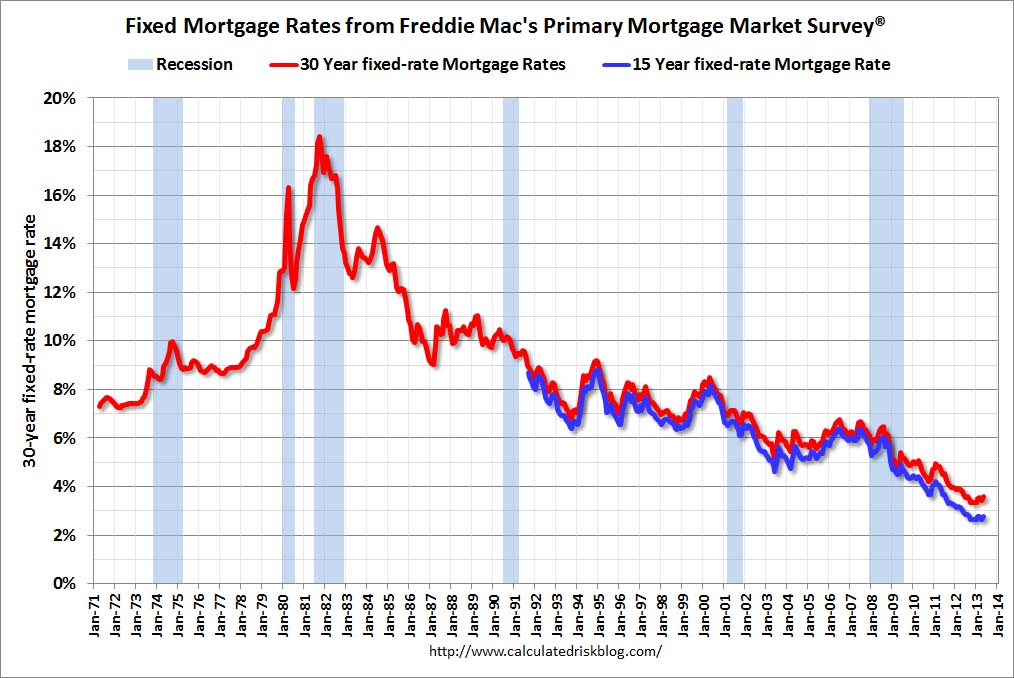

The lowest historical mortgage rates in history for 30-year FRMs were more recent than you might think. December 2020 saw mortgage rates hit 2.68%, according to Freddie Mac, due largely to the effects of COVID-19. The same goes for the lowest average, with an annual rate of 3.11% for 2020.

Who is offering lowest refi rates?

Using average mortgage interest rates from 2021 — the most recent data available — the 10 lenders with the lowest refinance rates are:Village Capital and Investment*Navy Federal Credit Union*PennyMac.Bank of America.AmeriSave.loanDepot.Better.Home Point Financial.More items...

Is it worth to refinance .5 percent?

Refinancing to save 0.5% When you refinance a mortgage, a lower interest rate can reduce your payment and save you money on your home loan. To crunch the numbers, use a mortgage calculator. In general, refinancing for 0.5% only makes sense if you'll stay in your home long enough to break even on closing costs.

Is it worth refinancing?

Refinancing is usually worth it if you can lower your interest rate enough to save money month-to-month and in the long term. Depending on your current loan, dropping your rate by 1%, 0.5%, or even 0.25% could be enough to make refinancing worth it.

Can you negotiate mortgage rates?

Most homebuyers start their house hunt expecting to negotiate with sellers, but there's another question many never stop to ask: “Can you negotiate mortgage rates with lenders?” The answer is yes — buyers can negotiate better mortgage rates and other fees with banks and mortgage lenders.

Is a 2.75 interest rate good?

Is 2.875 a good mortgage rate? Yes, 2.875 percent is an excellent mortgage rate. It's just a fraction of a percentage point higher than the lowest-ever recorded mortgage rate on a 30-year fixed-rate loan.

What is the prime rate today 2021?

4.75%The prime rate is one of the main factors banks use to determine interest rates on loans. The prime rate is 4.75% today.

Is it smart to refinance your home right now?

For many homeowners, it's still a good time to refinance. Current mortgage rates are no longer at record lows. But they're still relatively low by historical standards. And, depending on when you closed on your current loan, you may be paying a higher interest rate than what you could lock in today.

Which bank has cheapest mortgage rates?

Banks with the best mortgage ratesVeterans United*Better.PennyMac.AmeriSave.Navy Federal Credit Union*Home Point Financial.loanDepot.Caliber Home Loans.More items...•

How do I get rid of my PMI?

The only way to cancel PMI is to refinance your mortgage. If you refinance your current loan's interest rate or refinance into a different loan type, you may be able to cancel your mortgage insurance.

Should I get multiple refinance quotes?

No lender will offer low rates to everyone who wants to refinance their mortgage — regardless of what their advertising says. So, to find the best refinance rates, you should get quotes from several lenders for the same type of loan (supply each mortgage lender with the same information).

Are all refinance rates the same?

Different mortgage types have different rates. Both purchase and refinance rates can differ from one another, even if they both have the same loan term. Mortgages that have different term lengths may also have different rates—usually, the shorter the term, the lower the rate.

What's the difference between APR and interest rate?

The interest rate is the cost you will pay each year to borrow the money, expressed as a percentage rate. It does not reflect fees or any other charges you may have to pay for the loan. An annual percentage rate (APR) is a broader measure of the cost of borrowing money than the interest rate.

What is a 30-year fixed mortgage?

A fixed-rate mortgage has an interest rate that doesn’t change over the full term of the loan, which, for a 30-year mortgage (as the name suggests)...

How are 30-year mortgage rates set?

Mortgage rates in general are influenced by a variety of factors, which means there’s no one specific rate available in the market at any time. Bro...

When to consider a 30-year fixed mortgage?

A 30-year fixed mortgage is best for those looking for predictable, relatively low monthly payments. You’ll wind up paying more in interest over th...

Comparing 15- and 30-year mortgages

During the height of the pandemic, 15-year mortgages had a bit of a renaissance, as low interest rates made them affordable to more borrowers than...

Differences between a fixed- and adjustable-rate mortgage

Fixed-rate mortgages are the most common type of loan, and are popular because the steady interest rate means predictable monthly payments for the...

What is the rate of interest on mortgages in 2021?

Today, mortgage rates are near historic lows, around 3 percent — but most experts expect 2021 to be characterized by rising interest rates.

When was Bankrate founded?

Founded in 1976, Bankrate has a long track record of helping people make smart financial decisions. Along your homebuying journey, we'll pinpoint your best mortgage offers and provide next steps — all while protecting your privacy, personal information and credit score.

Is a 30 year fixed mortgage more affordable?

When 30-year fixed mortgage rates decline, getting a mortgage is more affordable for homebuyers and those looking to refinance. However, home prices, which have been rising for the last several years, can present a barrier for potential homeowners even when mortgage rates are low.

Does Homeside Financial offer jumbo loans?

Strengths: Homeside Financial offers not only conventional and jumbo loans but also FHA, VA and USDA loans. The lender has options for seamless communication throughout the process, either by call, email or text, if you have questions about your 30-year mortgage.

Is it better to pay off a mortgage over 30 years?

Pros. Lower monthly payment: Repaying a mortgage over 30 years means you’ll have lower, more affordable payments spread out over time compared to shorter-term loans like 15-year mortgages. Stability: Having a consistent principal and interest payment helps you better map out your housing expenses for the long term.

Is a 30 year mortgage more expensive than a 15 year mortgage?

You’ll wind up paying more in interest over the life of a 30-year mortgage than a 15- or 20-year one, but because of the longer repayment timeline, your monthly costs will be lower, so the more expensive loan may ultimately be easier on your budget. Pros and cons of a 30-year mortgage.

Does AmeriSave offer fast closing rates?

Strengths: If you’re looking to take out a 30-year mortgage (either to buy a home or refinance your current loan), AmeriSave Mortgage Corporation can offer competitive rates and fast closings. In fact, 50 percent of borrowers have closed in as little as 25 days, according to the lender.

What is the average mortgage rate for a 30 year mortgage?

Historically, 30-year mortgage rates have averaged around 8% . But they’ve been well below that in recent years, with average 30-year rates in 2016, 2017, 2019, and 2020 all coming in below 4%.

Why do you have to have a shorter term to refinance?

Opting for a shorter term could save you a bundle, because it means you pay less interest. Instead of borrowing over 30 years, you’d be borrowing for 20, 15, 10 or even fewer. And the less time you pay interest, the more you save. The same benefits apply when refinancing to a 15-year term instead of a new 30-year term.

How is interest rate determined?

How your interest rate is determined. In large part, mortgage rates are determined by the economy and overall interest rate market. Mortgage rates move up or down depending on how much investors will pay for mortgage bonds (“mortgage-backed securities”) in a secondary market. The economy is a big factor in that.

What is the difference between a 30 year and 15 year FRM?

A 30-year mortgage has lower monthly payments than a shorter-term loan (like a 15-year FRM) because your loan amount is repaid over a longer time.

What is APR in mortgage?

It’s important to look at annual percentage rate (APR) as well as current mortgage rates. APR estimates the total yearly cost of a home loan, including interest and added costs like mortgage insurance.

Why are short term loans lower than 30 year FRMs?

A shorter-term loan – Shorter-term home loans (like 10-, 15-, and 20-year FRMs) have lower rates than 30-year FRMs because investors don’t hold the “risk” of carrying your debt for as long. However these loans have much higher payments, since you’re repaying the same amount of money over a shorter time period.

What is the down payment for a 30 year mortgage?

Most home buyers can get a 30-year fixed home loan with a down payment of just 3% or 3.5%. And you don’t need a perfect credit score to qualify. Thanks to these perks — and today’s low interest rates — 30-year mortgages ...

What is a 30 year fixed rate refinance?

A 30-year fixed-rate refinance gives you a new home loan that maintains its interest rate and monthly principal-and-interest payment over the 30-year loan period. When refinancing, a good rate is the lowest rate you can get.

What is a 30 year mortgage?

A 30-year fixed-rate mortgage is the most common term of mortgage — and suitable for refinancing, too. It provides the security of a fixed principal and interest payment, and the flexibility to afford a larger mortgage loan because, spread out over three decades, the payments are more affordable.

Why is the interest rate on a 30 year mortgage higher than on a 15 year mortgage?

Higher interest rate. Because the lender is tying up its money longer, the interest rate on 30-year fixed mortgage refinance is higher than on, say, a 15-year loan. More interest overall. You pay more interest over the life of a 30-year refi because you make more payments. You risk borrowing too much.

How are mortgage rates determined?

At a high level, mortgage rates are determined by economic forces that influence the bond market. You can't do anything about that, but it's worth knowing: bad economic or global political worries can move mortgage refinance rates lower. Good news can push rates higher.

What is APR calculation?

The APR calculation includes fees and discount points, along with the interest rate. APR is a tool used to compare loan refinance offers, even if they have different interest rates, fees and discount points.

Can you get a lower interest rate on a refinance?

Getting a lower interest rate could save you hundreds of dollars a year — and thousands of dollars over the life of the mortgage. The more lenders you check out when shopping for mortgage rates , the more likely you are to get a lower interest rate for your refinance.

Can you borrow more on a 30 year loan?

Bigger loan. The monthly payments on a 30-year loan are smaller than on a shorter loan (such as 20 or 15 years), so you may be able to borrow more.

Best Mortgage Refinance Lenders

Homeowners still have time to lower their monthly mortgage payments by refinancing, as mortgage rates are still relatively low.

3 Steps to Get the Lowest Refinance Rate

The main goal of most mortgage refinances is to lower your interest rate and maximize your savings. Naturally, the lower the rate the bigger the savings.

Pros and Cons of Refinancing

You should consider refinancing your mortgage if refinancing can lower your monthly mortgage payment by reducing your interest rate or increasing your loan term. Refinancing also can lower your long-run interest costs through a lower mortgage rate, shorter loan term or both. It also can help you get rid of mortgage insurance.

Types of Mortgage Refinancing

The three most common types of mortgage refinance options are: rate-and-term refinance, cash-out refinance and cash-in refinance.

Frequently Asked Questions (FAQs)

Mortgage refinancing is when you replace one home loan with another in order to access a lower interest rate, adjust the loan term or consolidate debt. Refinancing requires homeowners to complete a new loan application and may involve an appraisal and inspection of the home.

What is a 30 year fixed mortgage?

A 30-year fixed mortgage is a loan whose interest rate stays the same for the duration of the loan. For example, on a 30-year mortgage of $300,000 with a 20% down payment and an interest rate of 3.75%, the monthly payments would be about $1,111 (not including taxes and insurance).

Why is a 30 year fixed mortgage more expensive than a 15 year fixed mortgage?

The 30-year fixed mortgage is more expensive not only because the interest rate on a 30-year fixed loan is higher than a 15-year fixed loan, but also because you'll pay more interest over time since you're borrowing the money for twice as long.

What are the disadvantages of a 30 year fixed rate mortgage?

What are the disadvantages of 30-year fixed mortgages? The biggest disadvantage of a 30-year fixed rate mortgage is that it' s more expensive over time than a shorter term loan. Let's compare it to a 15-year fixed rate mortgage as an example.

Compare today's refinance rates

As of today, February 25, 2022, the average 30-year fixed mortgage refinance rate is 4.29%, FHA 30-year fixed is 4.36%, jumbo 30-year fixed is 3.92%; 15-year fixed is 3.52%, and 5/1 ARM is 3.25%.

Frequently Asked Questions (FAQs)

Refinancing a mortgage is what happens when you get a new mortgage and use it to pay off your existing mortgage.

Methodology

To find the best mortgage refinance rates, we averaged the lowest rate offered by more than 200 of the country's top lenders, assuming a loan-to-value ratio (LTV) of 80% and an applicant with a FICO credit score in the 700-760 range.