A negative covenant contrasts with a positive covenant, which is a clause in a loan agreement that requires the firm to take certain actions. For example, a positive covenant might require the issuer to disclose audit reports to creditors periodically or to insure its assets adequately.

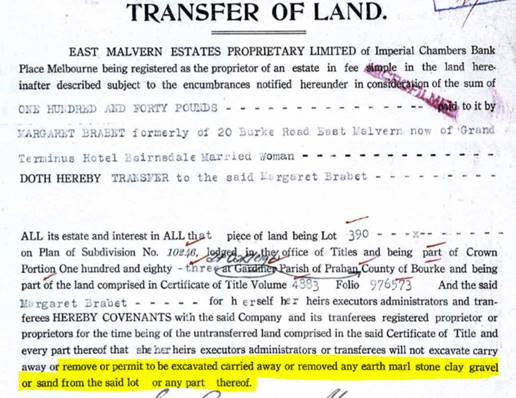

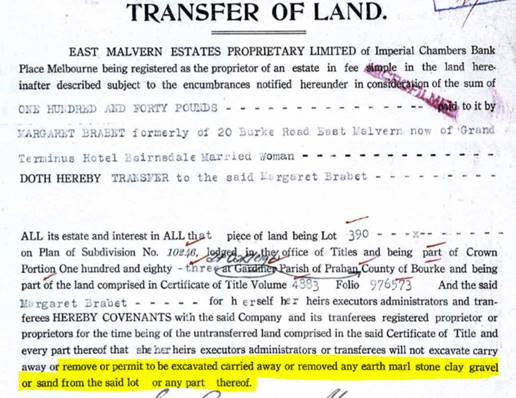

What is a negative covenant in real estate?

Negative covenants are often referred to as "restrictive covenants." In the real estate context, a positive covenant refers to a promise by the owner of a parcel of land to do something (e.g., to pay money) in respect of that land or to use it in a specified way.

What is an example of a positive covenant?

For example, a positive covenant might require the issuer to disclose audit reports to creditors periodically or to insure its assets adequately. While positive or affirmative covenants do not limit the operations of a business, negative covenants materially limit a business’ operations.

What is the difference between restrictive and positive covenants?

In contrast, an obligation which requires expenditure of money or maintaining a fence or any structures on the property is called a positive covenant. Restrictive covenants usually run with the land which means they bind anyone who becomes the legal owner.

What is the difference between affirmative and negative covenants?

Affirmative covenants essentially require the issuer to adhere to certain terms. These may include: obligating the issuer to comply with laws and regulations, insure assets adequately, or deliver timely audit reports. Negative covenants state what issuers are forbidden from doing (or simply, should not do).

What is an example of a positive covenant?

Examples of positive covenants include those requiring: Expenditure of money. Works of repair or maintenance. Erection of buildings or boundary fences.

What is the meaning of negative covenant?

A negative covenant is an agreement that restricts a company from engaging in certain actions—it is a promise not to do something. For example, a covenant entered into with a public company might limit the amount of dividends the firm can pay its shareholders.

What does a positive covenant?

A positive covenant is a promise or contract that requires a party to do something. It obligates the buyer/purchaser to take certain actions prior to closing, such as filing necessary documents and obtaining required consents, or drafting proxy materials.

Which one of the following is an example of a negative covenant?

What are examples of Negative Covenants? Examples of commonly used negative covenants include the following: Indebtedness Limitations . These provisions restrict the ability of the borrower to take on additional debt other than the loans made under the loan agreement.

Is a covenant positive or negative?

A covenant can be either positive or negative. A negative obligation is often referred to as a restrictive covenant. Positive covenants are obligations to do something, such as keep contribute to a maintenance fund or maintain a wall.

Do positive covenants run with the land?

Positive covenants, by contrast, differ from the restrictive covenants in two respects. Firstly, they do not run with the land which means unless there is a chain of indemnity or a renewed covenant between the parties, the burden of the positive covenant (such as repairing a fence) does not pass on to the new owner.

What is the burden of a positive covenant?

The burden of a positive covenant (such as to repair a fence or contribute to the cost of maintaining shared facilities) will not bind successors in title to freehold land. The original covenantor remains bound under the doctrine of privity of contract. This is an unsatisfactory state of affairs.

What happens if you breach positive covenant?

If it's a big enough breach you could approach the Court (Upper Tribunal (Lands Chamber) yourself or with your solicitor to make an application to remove the covenant. It's a murky area so you probably do want professional support to deal with this. It can be complex.

Can a positive covenant pass at common law?

A positive covenant does not run with the land at common law or in equity. A restrictive covenant can bind successors in title.

What are some common examples of negative covenants in an indenture?

Negative covenants include:Restrictions on financing activities – covenants that limit further issuance of debt and sale-leaseback transactions. ... Restrictions on payouts – covenants that restrict the amount of payouts.More items...

What are the types of covenants?

Generally, there are two types of primary covenants included in agreements: affirmative covenants and negative covenants. In addition, a third type of covenant—financial covenants—is sometimes separated into its own category.

What is the benefit of having negative covenants?

During mergers and acquisitions, the seller may be required to sign a negative covenant that prevents direct competition or disclosing vital information about the business.

What is a negative covenant land law?

A restrictive covenant (also known as a negative covenant) consists of an agreement in a deed that one party will restrict the use of its land in some way for the benefit of another's land.

What are the types of covenants?

Generally, there are two types of covenants included in loan agreements: affirmative covenants and negative covenants.

How does a negative pledge covenant bind a borrower?

A negative pledge clause is a type of negative covenant that prevents a borrower from pledging any assets if doing so would jeopardize the lender's security. This type of clause may be part of bond indentures and traditional loan structures.

What is a negative covenant in a trust?

Negative covenants are written directly into the trust indenture creating the bond issue, are legally binding on the issuer, and exist to protect the best interests of the bondholders. Negative covenants are also referred to as restrictive covenants .

What are the restrictions placed on borrowers through negative covenants?

Common restrictions placed on borrowers through negative covenants include preventing a bond issuer from issuing more debt until one or more series of bonds have matured. Also, a borrowing firm may be restricted from paying dividends over a certain amount to shareholders so as not to increase the default risk to bondholders, since the more money paid to shareholders the less available funds will be to make interest and principal payment obligations to lenders.

When do companies use negative covenants?

They are often used by companies when hiring new staff or independent contractors . During mergers and acquisitions, the seller may be required to sign a negative covenant that prevents direct competition or disclosing vital information about the business. The following are the main types of negative covenants: 1.

What are the different types of negative covenants?

The following are the main types of negative covenants: 1. Non-Compete Agreement. In an employment contract, a non-compete agreement restricts an employee from competing directly with the employer for a specific period and within a defined geographical area.

What is an Affirmative Covenant?

An affirmative covenant, also referred to as a positive covenant, is a promise that requires a party to adhere to specific terms of the agreement. It is the opposite of a negative covenant, which requires a party to avoid doing something.

What are negative covenants in employment contracts?

The most common negative covenants in employment contracts are non-compete. Non-Compete Agreement A non-compete agreement is a covenant between an employer and employee that prevents the employee from using information learned during employment. and non-disclosure agreements.

Why are covenants important?

The covenants are designed to prevent employers or businesses from losing their customers, employees, and proprietary information. However, when these acts are committed, the enforcement process takes a long time to complete as attorneys argue out the facts in a court of law, whereas the damage has already been done.

What is a non disclosure agreement?

Non Disclosure Agreement (NDA) A Non Disclosure Agreement (NDA) is a document that is exchanged between a prospective buyer and a seller in the initial stages of an M&A transaction.

What are negative covenants?

Negative covenants state what issuers are forbidden from doing (or simply, should not do). These covenants are legally binding on the issuer, are costly, and materially limit business decisions. Examples include: 1 barring the issuer from taking on additional debt; 2 imposing a maximum acceptable debt ratio (such as leverage or gearing ratios) or a minimum acceptable interest coverage ratio; 3 restricting asset disposals, distributions to shareholders, or engagement in (risky) investments; or 4 explicitly ruling out mergers and acquisitions of any form unless certain conditions are met.

Is insuring assets adequately a positive covenant?

Insuring assets adequately is a positive covenant, while options A and C are examples of negative covenants.

Do affirmative covenants limit the issuer's freedom?

Therefore, they do not materially limit the issuer’s freedom while executing day-to-day business operations. Affirmative covenants essentially require the issuer to adhere to certain terms. These may include: Outlining what the issuer can do with the proceeds from the bond issue;

What are Debt Covenants?

Debt Covenants are conditional terms in lending agreements to ensure the borrower’s financial performance remains steady and management continues to be responsible in corporate decisions.

Debt Covenants Definition

Debt covenants protect the interest of the lenders, but in exchange, borrowers obtain loans with more favorable terms since the risk to the lender is lower.

Affirmative (or Positive) Covenants

Affirmative covenants, otherwise called “positive” covenants, require the borrower to perform a certain specified activity – which essentially creates boundaries on the company’s actions.

Restrictive (or Negative) Covenants

While affirmative covenants force certain actions to be taken by the borrower, in contrast, negative covenants place restrictions on what the borrower can do – hence, the term is used interchangeably with “restrictive” covenants.

Financial Covenants

By requiring the borrower to maintain certain credit ratios and operational metrics, the lender confirms the company’s financial health is kept under control.

Breaches of Debt Covenants

Loans are contractual agreements, so violating a debt covenant represents a breach of a legal contract signed between the borrower and lender (s).

.jpg)