What is a lookback period for payroll taxes?

A lookback period is the timeframe used to calculate an employer’s total payroll tax liability. The IRS then uses that info to determine your deposit schedule, which is how often you’ll remit The lookback period runs from July 1 to June 30 of the previous year. For example, the lookback period for 2020 is

What is the lookback period for Form 941?

The lookback period for Form 941 filers comprises 12 months — covering four quarters, starting on July 1 and ending on June 30. For example, the period for 2019 comprises:

How long is the look back period for Medicaid in California?

In 49 of the 50 states, the length of the look-back period is 5 years (60 months). As of 2020, the one exception to this rule is California, which has a 2.5 year (30 month) look-back period. The look-back period begins the date that one applies for Medicaid.

What is the look-back period for long-term care insurance?

The reason for this penalty period is that these assets could have been used to help cover the cost of long-term care, had they not been gifted or transferred. In 49 of the 50 states, the length of the look-back period is 5 years (60 months).

What is the IRS lookback period?

The lookback period is the five-year period before the excess benefit transaction occurred. The lookback period is used to determine whether an organization is an applicable tax-exempt organization.

What is the lookback period for 2022?

If you will file Form 944 for the current year, or if you filed it in either of the previous two years, your lookback period is the second preceding calendar year. For example, the IRS lookback period for 2022 is calendar year 2020.

What is the 941 lookback period?

If you've filed only Form 941, the lookback period is the 12 months (covering four quarters) ending on June 30th of the prior year.

Is the lookback period always a calendar year?

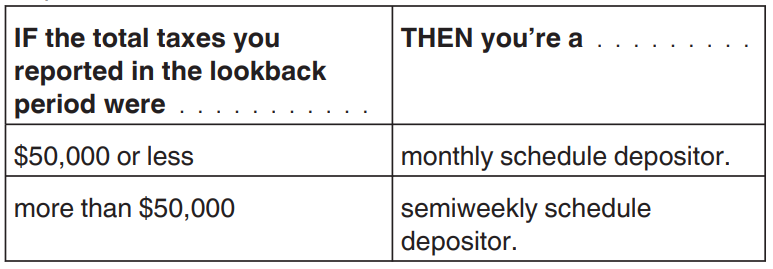

For annual returns (Forms 943, 944, 945, and CT-1), the lookback period is the calendar year preceding the previous year. For example, the lookback period for 2023 is 2021. You're a monthly schedule depositor for a calendar year if the total tax reported for your lookback period was $50,000 or less.

What is a lookback adjustment?

Filed on IRS Form 8697, “Interest Computation Under the Look-Back Method for Completed Long-Term Contracts,” the look-back is a hypothetical recalculation of a contractor's taxable income based on the actual performance of its completed jobs.

How many years does Medicaid look back in New York?

Under the federal statute, the transfer of assets lookback period is 60 months prior to the month the individual is applying for Medicaid. New York is seeking approval to impose a lookback period of 30 months for non-institutionalized individuals seeking coverage of CBLTC services.

When can the IRS go back 6 years?

How far back can the IRS go to audit my return? Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years.

How often do I have to make 941 deposits?

For taxes reported on Forms 941, 943, 944, or 945, there are two deposit schedules: monthly and semi-weekly. Before the beginning of each calendar year, you must determine which of the two deposit schedules you are required to use.

How long do you have to deposit payroll taxes?

Federal Employment Tax Schedules — Deposits and ReportingMonthlyDeposit Dates*You must deposit monthly payroll taxes by the 15th day of the following month.Reporting DatesReport your total taxes deposited for the quarter, using Form 941, by April 30, July 31, October 31 and January 31.1 more row

Can you use your 2019 taxes for 2022?

The Lookback Provision You will need your 2019 tax return to take advantage of the lookback. If you earned less in 2021 than in 2019, then you can choose which income to use. If your 2021 earnings were higher than in 2019, you must use your 2021 income.

Who qualifies for lookback rule?

Anyone with a higher earned income in 2019 than 2021 (or 2020) can qualify for the lookback. Clients that received unemployment benefits or earned less income in 2021 than in 2019, may qualify.

What is lookback rule?

The American Rescue Plan of 2021 has a “lookback” provision that allows you to use your 2019 earned income instead of your 2021 earned income to calculate the Earned Income Credit (EIC) or Additional Child Tax Credit (ACTC) on your 2021 tax return if doing so makes the credit larger.

What is a semi weekly depositor 941?

Semiweekly Depositor Deposit taxes for payments made on Saturday, Sunday, Monday and/or Tuesday, by the following Friday. If you're a semiweekly depositor ,you must complete Form 941 Schedule B, Report of Tax Liability for Semiweekly Schedule Depositors, and submit it with a Form 941.

How often do I have to remit payroll taxes?

monthlyIn general, you must deposit federal income tax withheld as well as both the employer and employee social security and Medicare taxes. There are two deposit schedules, monthly and semi-weekly. Before the beginning of each calendar year, you must determine which of the two deposit schedules you are required to use.

What form must be completed annually by all employers regardless of liability?

Employers are also generally required to file Form 940 annually. See Topic 759 for more information about Form 940. Employers must also file a Form W-2, Wage and Tax Statement annually for each employee along with a Form W-3, Transmittal of Wage and Tax Statements, and furnish a copy of the Form W-2 to the employee.

Which taxes are considered 941 taxes?

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.

How to figure out payroll tax deposit schedule?

To help you figure out your payroll tax deposit schedule, review Form 941 for each quarter in the lookback period. You’ll want to look at your total taxes after adjustments on Line 12. Then, add all four amounts together to determine your total tax liability for the lookback period. From there, you can typically determine your deposit schedule.

What is the look back period for payroll?

A lookback period is the timeframe used to calculate an employer’s total payroll tax liability. The IRS then uses that info to determine your deposit schedule, which is how often you’ll remit. The lookback period runs from July 1 to June 30 of the previous year. For example, the lookback period for 2020 is.

What is Workful editorial team?

Each contributor on the Workful Editorial Team holds an advanced degree in business-related studies and/or communication and has written for other small business publications, including SmallBizDaily, HR.com, and Business.com. The information in this article is based on thorough research and has been edited for accuracy and timeliness by Workful’s Human Resources experts. While this blog is meant to inform and educate small business owners, it is not intended to provide legal, financial, accounting, or tax advice.

When do you deposit taxes based on payday?

Semi-weekly – If your total liability for the lookback period was more than $50,000, you’ll deposit your taxes based on your payday. If your payday is on. Next day – If your tax liability is $100,000 or more during a single payroll run, you must remit taxes by the next business day.

When are taxes due for lookback period?

For example, October taxes are due by November 15.

When is lookback period for Medicare?

employee and employer portions of Medicare. federal income tax withheld from your team’s paychecks. The lookback period runs from July 1 to June 30 of the previous year. For example, the lookback period for 2020 is. Quarter 3: July 1, 2018 to September 30, 2018.

Is a 944 a quarterly or annual deposit?

Annually – If your total tax liability is less than $1,000, you’ll typically be an annual depositor. You’ll also probably file Form 944 each year, instead of Form 941 each quarter. For annual depositors, your lookback period will be the second prior calendar year – 2018 for tax year 2020. Quarterly – If your tax liability for ...

What is irrevocable trust?

With Irrevocable Funeral Trusts, a specific amount of money, which is limited by state, is set aside for the sole purpose of funeral and burial costs. This not only helps applicants “spend down” excess assets without violating Medicaid’s look-back period, it also provides peace of mind knowing that these expenses are already covered. An irrevocable funeral trust can be purchased for both the applicant and their spouse. Learn more about irrevocable funeral trusts here.

How long is the Great Aunt's period of ineligibility for Medicaid?

This means the great aunt’s period of Medicaid ineligibility will be for 5 months ($35,000 / $7,000 = 5 months ). The penalty period begins on the date that one becomes eligible for Medicaid, not the date that the transfer or gift resulting in penalization was made.

What is an annuity for medicaid?

Annuities, also referred to as Medicaid Annuities or Medicaid Compliant Annuities, are a common way to avoid violating the Medicaid look-back period. With an annuity, an individual pays a lump sum in cash.

When does the penalty period start for Medicaid?

The penalty period begins on the date that one becomes eligible for Medicaid, not the date that the transfer or gift resulting in penalization was made. For example, if you transferred your home to your child on August, 5th, 2019, but didn’t become eligible for Medicaid until March 16th, 2018, your period of ineligibility will begin on March, 16th, 2018.

What is look back penalty for Medicaid?

The penalty for violating the Medicaid look-back is a period of time that one is made ineligible for Medicaid. This period of ineligibility, called the penalty period, is determined based on the dollar amount of transferred assets divided by either the average monthly private patient rate or daily private patient rate of nursing home care in the state in which the elderly individual lives. (This is called the penalty divisor or private pay rate, which increases each year with the increase in the cost of nursing home care). Please note, there is no maximum penalty period.

What happens if you violate the look back period?

If a transaction is found to be in violation of the look-back period’s rules, the applicant will be assessed a penalty. Penalties come in the form of a period of time that the applicant is made ineligible for Medicaid.

How long is a gift of $60,000 for Medicaid?

This means you will be ineligible for Medicaid for 15 months. ($60,000 gifted divided by $4,000 average monthly cost = 15 months). Over the past five years, a grandmother gave her granddaughter $8,000 / year, which equals $40,000 in violation of the 5-year look-back period.

What is a look back period?

A lookback period is the length of time that the IRS uses to measure the amount of taxes paid by an employer. The lookback period also helps the employer determine its deposit schedule.

What is the lookback period for Form 944?

The lookback period for Form 944 filers is the second preceding calendar year. For example, the period for 2019 is calendar year 2017.

How often do you have to file taxes for a small business?

However, small employers with a tax liability of $1,000 or less may be allowed to file annually via Form 944.

How long is the look back period for 941?

The lookback period for Form 941 filers comprises 12 months — covering four quarters, starting on July 1 and ending on June 30.

When are semi weekly deposits due?

In this case, deposits for paydays that fall on Saturday, Sunday, Monday or Tuesday are due by the following Friday. Deposits for paydays that fall on Wednesday, Thursday or Friday are due by the following Wednesday.

Do employers have to pay Social Security taxes?

Employers must withhold federal income tax, Social Security tax and Medicare tax from employees’ wages, plus pay their own share of Social Security and Medicare taxes. These taxes must be paid together to the IRS.

What is the lookback period for Form 944?

The lookback period for Form 944 filers is the second preceding calendar year. For example, the lookback period for 2019 is calendar year 2017.

What is a look back period?

A lookback period is the length of time that the IRS uses to measure the amount of taxes paid by an employer. The lookback period also helps the employer determine its deposit schedule.

How often do you have to file taxes for a small business?

However, small employers with a tax liability of $1,000 or less may be allowed to file annually via Form 944.

How long is the look back period for 941?

The lookback period for Form 941 filers comprises 12 months — covering four quarters, starting on July 1 and ending on June 30.

When are semi weekly deposits due?

In this case, deposits for paydays that fall on Saturday, Sunday, Monday or Tuesday are due by the following Friday. Deposits for paydays that fall on Wednesday, Thursday or Friday are due by the following Wednesday.

Do employers have to pay Social Security taxes?

Employers must withhold federal income tax, Social Security tax and Medicare tax from employees’ wages, plus pay their own share of Social Security and Medicare taxes. These taxes must be paid together to the IRS.

How to request a tax return via mail?

To request via mail, you’ll need your SSN or ITIN, date of birth, and mailing address from your latest tax return. Due to the coronavirus, the IRS has a large backlog of unopened mail. Online requests are strongly encouraged.

How to subtract income from Schedule 1?

For your earned income, subtract Line 14 of Schedule 1 (under “Adjustments”) from Line 3 of Schedule 1. Add this number to Form 1040 Line 1 from earlier. That’s your 2019 earned income.

How to do a look back on 2019 taxes?

There will be two main steps. First, identify where the lookback option is, and second, enter your 2019 earned income that you found earlier. 1. Find the lookback option.

How to file taxes for 2019?

If you file taxes with a tax preparer (at a VITA or Tax-Aide site, through GetYourRefund.org, or elsewhere): 1 Find your 2019 tax return. 2 Bring your 2019 return to your tax appointment. 3 You’re done!

What line is earned income for 2019?

If yes, find Line 6A. That’s your 2019 earned income. Skip down to how to fill out the lookback on your 2020 tax return.

How to get a transcript of my tax return?

Another option is to request a tax transcript from the IRS. You can request online or by mail. To request online, you’ll need your SSN, date of birth, filing status, mailing address from your latest tax return, access to your email account, personal bank account numbers, and a mobile phone.

Where is line 1 on 1040?

On Form 1040, find Line 1 on the middle of the first page. If you were NOT self-employed, and only received pay from your employer (s), that’s your 2019 earned income.

How Does The Medicaid Look Back Period Work?

The Centers for Medicare & Medicaid Services (CMS) explains that when applying for Medicaid to pay for nursing home care and other services associated with senior care while in a nursing home, the Medicaid eligibility worker asks if the individual recently gave away any assets such as vehicles or money. The representative also asks if the person sold property for less than its fair market value at the time of the sale within the past five years.

What Happened To The Three Year Medicaid Look Back Period?

The CMS reported on the new regulations, effective February 2006, after the passing of the Deficit Reduction Act of 2005.

Are There Ways To Avoid Medicaid Look Back Period Penalties?

There are several exceptions to penalties for transferring assets during the Medicaid look-back period. If your transferred asset is a home and you transferred title to your spouse, there is no penalty. If your child lived with you for at least two years before you enter the nursing home and that child provided care to you during that period so you could continue living at home, you also avoid the penalty. If you have a child under age 21 who is blind or totally and permanently disabled under state-specific guidelines or if you transferred the home to your sibling who has an equity interest in that home and lived there for at least a year prior to your entering a nursing home there is no penalty.

What does the Medicaid agency look back on?

The agency considers or “Looks back” over the previous five years to see if any assets were sold for less than true asset value, given away or otherwise transferred within the same time period when determining eligibility for Medicaid coverage and any violations that restrict or delay eligibility.

Why is Medicaid important?

Medicaid helps make sure money and assets are not simply transferred to avoid paying out-of-pocket when a person has the means to pay at least some of the costs associated with nursing home senior care and senior living services.

How long is the look back period for Medicaid?

California, which still abides by its 30-month look-back period, became the only state not to extend the look-back period from three years to five years.

Can you get Medicaid if you transfer assets to a nursing home?

This transferring of assets usually results in a penalty, meaning that the person seeking senior living at a nursing home is ineligible for Medicaid, “For as long as the value of the asset should have been used” to pay for the nursing home care.

Facts

My company started a brand new 401 (k) plan last year. We didn’t start the plan until July 1, and since we operate on the calendar year, our first “year” of the plan will only be the six-month period from the start date through December 31, 2019.

Question

What and when is a lookback year? Does it include a full twelve months even though our initial plan year is only six months? What if the company is also new and hasn’t been in existence for that long? What am I supposed to supply my TPA?

Answer

Welcome to the next installment in our series of all things short plan year! The fact that we have a series of questions on this topic should be reassuring in that you are definitely not the only person to have them. Before we answer yours, a quick review is in order.

What are some examples of transactions that could result in a penalty?

Examples of the type of transactions that could result in a penalty include money that was gifted to a granddaughter for her high school graduation, a house transferred to a nephew, collectors’ coins sold for half their value, or a vehicle donated to a local charity. Even payments made to a personal care assistant without a formal care agreement or assets that were gifted, transferred, or sold under fair market value by a non-applicant spouse can violate the look-back period and result in a period of Medicaid ineligibility.

What happens if you transfer assets before the look back period?

If one gifts or transfers assets prior to this look-back period, there is no penalization.

How does Medicaid violate the look back rule?

Lack of Documentation – Another way one may unknowingly violate Medicaid’s look-back rule is by not having sales documentation for assets sold during the look-back period. While the assets may have been sold for fair market value, if documentation is not available to provide proof, it may be determined one has violated the look-back period. This is particularly relevant for assets, such as automobiles, motorcycles, and boats, that have to be registered with a government authority.

How long is the look back period for Medicaid?

The date of one’s Medicaid application is the date from which one’s look-back period begins. In 49 states and D.C, the look back period is 60 months. In California, the look back period is 30 months. New York will also be implementing a 30-month look-back period for their Community Medicaid program, which provides long-term home ...

When are assets spent down?

When there are excess assets, they must be “spent down” in order to meet Medicaid’s asset limit for qualification. It is not unusual that they be spent on the cost of long term care, whether that be nursing home care or in-home care, until the spouse in need of long-term care meets the asset limit. Other ways in which excess assets can be “spent down” are discussed further below in this article.

Does Medicaid look back on nursing home transfers?

Therefore, if one is applying for nursing home Medicaid or for a Home and Community Based Services (HCBS) Medicaid Waiver, the state’s Medicaid governing agency will look into past asset transfers. Medicaid programs such as those for pregnant mothers and newborn children do not have a look-back period.

Do all 50 states have the same Medicaid look back period?

While the federal government establishes basic parameters for the Medicaid program, each state is able to work within these parameters as they see fit. Therefore, all 50 states do not have the same rules when it comes to their Medicaid programs nor do they have the same rules for their look-back period.

What is monthly schedule depositor?

Monthly schedule depositor. Deposit or pay the shortfall with your return by the due date of the return. You may pay the shortfall with your return even if the amount is $2,500 or more.

What is considered timely deposit?

If a deposit is due on a day that isn't a business day, the deposit is considered to have been made timely if it is made by the close of the next business day. A business day is any day other than a Saturday, Sunday, or legal holiday. For example, if a deposit is due on a Friday and Friday is a legal holiday, the deposit will be considered timely if it is made by the following Monday (if that Monday is a business day). The term "legal holiday" means any legal holiday in the District of Columbia. For a list of legal holidays, see section 11 of Pub. 15 orsection 7 of Pub. 51.

What is a CT-1?

CT-1. Generally, the deposit rules for quarterly filers of Form 941 also apply to annual filers of Form 943, Employer's Annual Federal Tax Return for Agricultural Employees; Form 944, Employer's ANNUAL Federal Tax Return; Form 945, Annual Return of Withheld Federal Income Tax; and Form CT-1, Employer's Annual Railroad Retirement Tax Return. However, the period used as your lookback period is different; see Lookback period for annual returns, later.For more information about deposit rules for annual returns, see section 11 of Pub. 15 (for Forms 944 and 945), section 7 of Pub. 51 (for Form 943), and the Instructions for Form CT-1.

When do you have to deposit 100% of your taxes?

You’re required to deposit 100% of your tax liability on or before the deposit due date. However, penalties won't be applied for depositing less than 100% if both of the following conditions are met.