Portfolio Return refers to the loss or gains realized by a portfolio of investment containing several types of investments. Portfolio Return aims to meet the preferred benchmarks, meaning a well-diversified portfolio of stock/bond holdings or a given mix of the two asset classes.

What is'portfolio return'?

What is 'Portfolio Return'. Portfolio return refers to the gain or loss realized by an investment portfolio containing several types of investments. Portfolios aim to deliver returns based on the stated objectives of the investment strategy, as well as the risk tolerance of the type of investors targeted by the portfolio. Next Up.

What is the difference between expected portfolio return and portfolio return?

Portfolio return can be defined as the sum of the product of investment returns earned on the individual asset with the weight class of that individual asset in the entire portfolio. It represents a return on the portfolio and just not on an individual asset. Expected return can be calculated with a product...

How to calculate portfolio return based on asset class?

Weight (Asset Class 1) = 50,000.00 / 1,50,000.00 =0.33 Now for the calculation of portfolio return, we need to multiply weights with the return of the asset, and then we will sum up those returns. W i R i ( Asset Class Asset Class Assets are classified into various classes based on their type, purpose, or the basis of return or markets.

What is the mean return in investing?

Investing Portfolio Management. Reviewed by James Chen. Updated Aug 22, 2018. Mean return, in securities analysis, is the expected value, or mean, of all the likely returns of investments comprising a portfolio. A mean return is also known as an expected return or how much a stock returns on a monthly basis.

How is portfolio returns calculated?

The basic expected return formula involves multiplying each asset's weight in the portfolio by its expected return, then adding all those figures together. In other words, a portfolio's expected return is the weighted average of its individual components' returns.

What is a good return on a portfolio?

According to conventional wisdom, an annual ROI of approximately 7% or greater is considered a good ROI for an investment in stocks. This is also about the average annual return of the S&P 500, accounting for inflation. Because this is an average, some years your return may be higher; some years they may be lower.

What is the average return on a portfolio?

about 10% per yearThe average stock market return is about 10% per year for nearly the last century. The S&P 500 is often considered the benchmark measure for annual stock market returns. Though 10% is the average stock market return, returns in any year are far from average.

How do I calculate the mean return?

Mean returns are calculated by adding the product of all possible return probabilities and returns and placing them against the weighted average of the sum.

What is a safe portfolio return?

Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market. However, keep in mind that this is an average. Some years will deliver lower returns -- perhaps even negative returns. Other years will generate significantly higher returns.

How do I get a 10% return on my portfolio?

HOW TO EARN A 10% ROI: TEN PROVEN WAYSPaying Off Debts Is Similar to Investing. ... Stock Trading on a Short-Term Basis. ... Art and Similar Collectibles Might Help You Diversify Your Portfolio. ... Junk Bonds. ... Master Limited Partnerships (MLPs) ... Investing in Real Estate. ... Long-Term Investments in Stocks. ... Creating Your Own Company.More items...•

How do you find 12% return on investment?

Assuming an annual return of 12%, you need to invest around Rs 43,000 every month to create a corpus of Rs 1 crore in 10 years. If you want to make Rs 1 crore in 15 years, you need to invest Rs 19,819 every month. Assuming you have 20 years, you need to invest around Rs 10,000 every month.

What is a good portfolio ratio?

Balanced Portfolio: 40% to 60% in stocks. Growth Portfolio: 70% to 100% in stocks. For long-term retirement investors, a growth portfolio is generally recommended.

What is a good portfolio yield?

A good dividend yield is high enough to meet your current income needs. But low enough to suggest a company's dividend is not at risk. Dividend yields that meet these requirements will typically fall between 2% and 5%. Since a stock with a yield of less than 2% may not provide the investor with enough current income.

What is mean return in mutual fund?

Like other asset classes, Mutual Funds returns are calculated by computing appreciation in the value of your investment over a period as compared to the initial investment made. Net Asset Value of Mutual Fund indicates its price and is used in calculating returns from your Mutual Fund investments.

How do you calculate mean return in Excel?

Returns the average (arithmetic mean) of the arguments. For example, if the range A1:A20 contains numbers, the formula =AVERAGE(A1:A20) returns the average of those numbers.

What is the mean return for investment 1?

Return on investment (ROI) is calculated by dividing the profit earned on an investment by the cost of that investment. For instance, an investment with a profit of $100 and a cost of $100 would have an ROI of 1, or 100% when expressed as a percentage.

Is a ROI of 50% good?

Is 50% a good ROI? ROI of 50% can be considered good, but there are other factors to consider to understand if your investment was a good one. You should also compare your ROI from previous years to get a better understanding.

How do you find 12% return on investment?

Assuming an annual return of 12%, you need to invest around Rs 43,000 every month to create a corpus of Rs 1 crore in 10 years. If you want to make Rs 1 crore in 15 years, you need to invest Rs 19,819 every month. Assuming you have 20 years, you need to invest around Rs 10,000 every month.

Is 4% a good Roa?

What Is a Good ROA? An ROA of 5% or better is typically considered good, while 20% or better is considered great. In general, the higher the ROA, the more efficient the company is at generating profits.

What is the average annual return of a 60/40 portfolio?

Since emerging from the Financial Crisis, a 60/40 portfolio of U.S. stocks and bonds has earned a whopping 11.5% average annual return. However, 2022 has been a particularly challenging year for the 60/40, which declined 16.1% in the first half of the year.

What is portfolio return?

Portfolio return can be defined as the sum of the product of investment returns earned on the individual asset with the weight class of that individual asset in the entire portfolio. It represents a return on the portfolio and just not on an individual asset.

How to calculate portfolio return?

Portfolio return formula is used in order to calculate the return of the total portfolio consisting of the different individual assets where according to the formula portfolio return is calculated by calculating return on investment earned on individual asset multiplied with their respective weight class in the total portfolio and adding all the resultants together.

How to calculate weights of an asset?

Calculate the weights of the individual asset in which funds are invested. This can be done by dividing the invested amount of that asset by total fund invested.

Can an investor make use of the expected return formula?

Also, an investor can make use of the expected return formula for ranking the individual asset and further eventually can invest the funds per the ranking and then finally include them in his portfolio. In other words, he would increase the weight of that asset class whose expected return is higher.

What is portfolio return?

Portfolio Return refers to the loss or gains realized by a portfolio of investment containing several types of investments. Portfolio Return aims to meet the preferred benchmarks, meaning a well-diversified portfolio of stock/bond holdings or a given mix of the two asset classes. Portfolios aim to deliver returns based on the promised investment strategy objectives, and the risk tolerance.

What is an efficient portfolio?

An efficient portfolio consists of assets providing the greatest return for the greatest amount of risk, or — alternatively stated — the least risk for a given return. To create an efficient portfolio, one needs to know how to calculate the returns and risks of a portfolio, and how to lower the risks through diversification.

What is growth oriented portfolio?

A growth-oriented portfolio is a set of investments selected for their price appreciation potential, while an income-oriented portfolio is made up of investments selected for their currently generated income of dividends or interest.

What is the weight of 25% of an asset?

For example, if an asset has 25% of the portfolio, its weight will be 0.25. The most notable fact to consider here is that the sum of all the asset percentages will be equal to 100%, and the sum of all asset weighs will be 1. The returns considered here are single period returns with the returns in the same period for the assets.

Can you apply the same calculation for more assets in a portfolio?

The same calculation can be applied for more number assets in a portfolio .

What Is Mean Return?

Mean return, in securities analysis, is the expected value, or mean, of all the likely returns of investments comprising a portfolio. A mean return is also known as an expected return and can refer to how much a stock returns on a monthly basis. In capital budgeting, a mean return is the mean value of the probability distribution of possible returns.

Why do investors use mean returns?

For this reason, the prudent investor will use a mean returns analysis as just one tool in the investment decision-making process. An investor doing a stock analysis should also review the company's financial statements and evaluate management's strategies for future growth.

How to calculate mean return?

Mean returns are calculated by adding the product of all possible return probabilities and returns and placing them against the weighted average of the sum . When calculating a mean return through the return probability formula to display portfolio return, it is often referred to as a geometric mean return since it evokes the formula for means used in geometry.

What is mean return in capital budgeting?

In capital budgeting, a mean return is the mean value of the probability distribution of possible returns.

Why is stock analysis important?

An important component of stock analysis is to project a stock's future worth. Investors and analysts will attempt to estimate future revenue and growth as a way of determining if a particular investment is worth the risk involved.

Is mean return the same as average monthly return?

Mean returns are not the same as average monthly returns, because a mean return would only reflect the average return if the time period used in the calculation was exactly a year and if all the probable weights happened to be precisely the same, which is improbable. Thus, mean return is more of a broad term instead of an average monthly statistic ...

Does mean return guarantee future rate of return?

However, a mean return does not guarantee a future rate of return and is only one tool that an investor should consider when evaluating an investment before purchasing it.

What is mean return?

The Mean Return, very simply refers to the average total return of the portfolio. You simply add together all the returns and divide by the number of them.

What is periodic returns?

The periodic returns, as the name suggests is the returns for each of our periods that we had captured the portfolio valuation for.

What does minus mean in portfolios?

We also collate the portfolios inflows and outflows of capital. Note that minus represents the inflows here and not the outflows.

What is TWRR in investment?

The TWRR is another way of calculating portfolio returns, which better takes into consideration the risk associated with the portfolio (or standard deviation of returns). Moreover, this method of calculation does not assume that each holding period is of the same size. This method is also Global Investment Performance Standards (GIPS) compliant.

How to calculate total cash flow?

The Total Cash Flows can be calculated by adding together the Cashflows where an associated weight is present. In excel, we can use the transpose function to do this easily:

What is gross period return?

The Gross Periodic Returns are essentially the Periodic Returns but shown as a percentage of the portfolio value. All we need to do, is add 1 to the Periodic Returns.

Does capital investment change during investment period?

However, more often than not the capital investments in the portfolio change during the investment period. The capital invested can either increase or decrease. Either way, the return of the portfolio will be impacted and if one was to use the above formula, the results would be wrong.

What Is Portfolio Return?

Portfolio return is the gain or loss from an investment portfolio, typically made up of multiple asset types. Investors will choose assets based on their financial goals and risk tolerance and attempt to maximize their overall returns. The purpose of looking at portfolio return is to ensure a balanced, high-yielding investment portfolio. Sample assets include stocks, bonds, ETFs, real estate, and more.

Why is portfolio return important?

The formula for portfolio return can help investors estimate their annual gains and compare the performance of different assets. This is an invaluable skill, no matter where you are in your investing career. Keep reading to learn more about how to calculate portfolio return and start practicing today.

How to ensure a successful investment portfolio?

With that being said, the best way to ensure you are building a successful portfolio is through consistent evaluation. The key to this practice can be found by learning how to calculate portfolio return.

What is the best way to analyze portfolio returns?

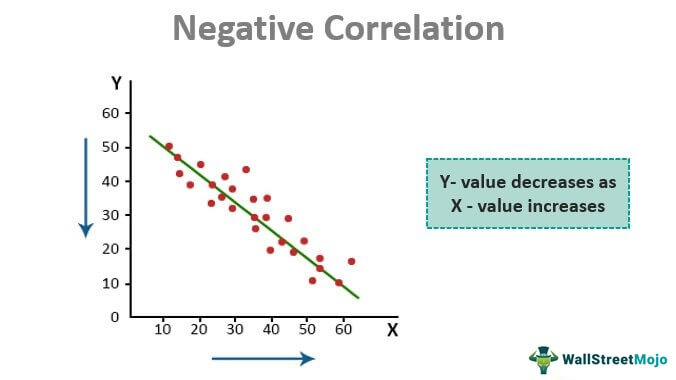

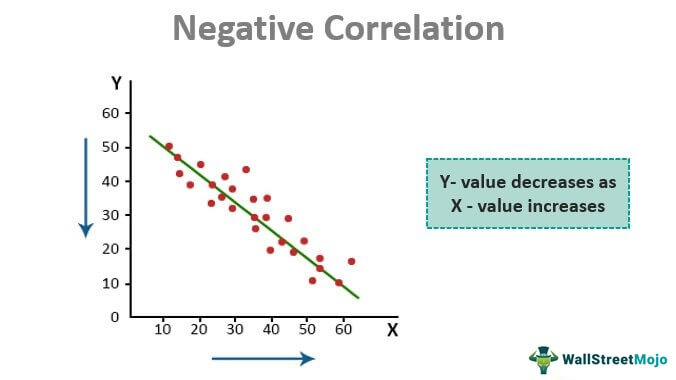

When analyzing portfolio returns, a common strategy is to choose investment types that move in opposite directions, such as stocks and bonds. This is one way to use portfolio return to balance your investments and reduce overall risk. There are numerous other ways to use this calculation to your benefit.

What is holding period return?

Holding period return (HPR) is one of the simplest methods for calculating investment returns. It builds on NAV and takes income from interest or dividends into account. The HPR formula is as follows:

What does W mean in investing?

W: The weight of each asset, or the amount of your portfolio that asset makes up.

What are sample assets?

Sample assets include stocks, bonds, ETFs, real estate, and more. There are specific benchmarks used when looking at portfolio return, depending on the types of assets that are included. Most investors will calculate their portfolio returns annually to ensure they are meeting their financial goals. When analyzing portfolio returns, ...

How to calculate portfolio returns?

The last two sets of figures can be used in a simple way to estimate portfolio returns: simply multiply the ROI of each asset by its portfolio weight. The sum of these figures is the portfolio's estimated returns .

How Can I Calculate the Return on Investment for a Portfolio?

A portfolio's return on investment (ROI) can be calculated as follows:

What is return yield?

This return/yield is a useful tool to compare returns on investments held for different periods of time. It simply calculates the percentage difference from period to period of the total portfolio NAV and includes income from dividends or interest. In essence, it's the total return from holding a portfolio of assets—or a singular asset—over a specific period of time.

Why use holding period return?

You can use the holding period return to compare returns on investments held for different periods of time. You'll have to adjust for cash flows if money was deposited or withdrawn from your portfolio (s). Annualizing returns can make multi-period returns more comparable across other portfolios or potential investments.

What factors should investors consider when investing?

Not only do investors need to consider the expected gains of each asset, but they also have to consider factors such as downside risk, market conditions, and the length of time it will take for each investment to realize returns. They also need to consider opportunity costs: an asset with high potential returns might seem less attractive if the same money can be spent more profitably on other investments.

What is the main point of investing?

The main point of investing is to make money. Although you can't predict how your investment portfolio will do, there are different metrics that can help you determine how far your money may go. One of those is called the return on investment (ROI), which can measure an investment's success. This is an important metric for any investor ...

Does annualized return give an indication of volatility?

The annualized return does not give an indication of volatility experienced during the corresponding time period. That volatility can be better measured using standard deviation, which measures how data is dispersed relative to its mean.

What is expected return?

Expected return is based on historical data, so investors should take into consideration the likelihood that each security will achieve its historical return given the current investing environment. Some assets, like bonds, are more likely to match their historical returns, while others, like stocks, may vary more widely from year to year.

How to calculate expected return?

The basic expected return formula involves multiplying each asset's weight in the portfolio by its expected return, then adding all those figures together.

Why is expected return more guesswork than definite?

Since the market is volatile and unpredictable, calculating the expected return of a security is more guesswork than definite. So it could cause inaccuracy in the resultant expected return of the overall portfolio.

Is expected return a prediction?

Expected return is just that: expected. It is not guaranteed, as it is based on historical returns and used to generate expectations, but it is not a prediction.

Is expected return backwards looking?

Securities that range from high gains to losses from year to year can have the same expected returns as steady ones that stay in a lower range. And as expected returns are backward-looking, they do not factor in current market conditions, political and economic climate, legal and regulatory changes, and other elements.

What is the first objective of portfolio optimization?

Maximizing Return – The first and foremost objective of portfolio optimization is maximizing return for a given level of risk. The risk-return trade-off is maximized at the point on the efficient frontier

What is the ratio of risky assets to risk free assets?

The ratio of risky assets to the risk-free asset depends on how much risk the investor wants to take. The optimal portfolio does not give a portfolio that would generate the highest possible return from the combination. It just maximizes the return per unit of risk taken.

What is MPT investment?

MPT An investment model like modern portfolio theory or MPT allows investors to choose from a variety of investment options comprising of a single portfolio for earning maximum benefits and that too at a market risk which is way lower than the various underlying investments or assets. read more. ).

What is asset allocation?

Asset Allocation Asset Allocation is the process of investing your money in various asset classes such as debt, equity, mutual funds, and real estate, depending on your return expectations and risk tolerance. This makes it easier to achieve your long-term financial goals. read more

What is the assumption of normal distribution?

Normal Distribution – Another assumption under the modern portfolio theory is that the returns are normally distributed. It ignores the concepts of skewness, kurtosis

What is normal distribution?

Normally Distributed Normal Distribution is a bell-shaped frequency distribution curve which helps describe all the possible values a random variable can take within a given range with most of the distribution area is in the middle and few are in the tails, at the extremes. This distribution has two key parameters: the mean (µ) and the standard deviation (σ) which plays a key role in assets return calculation and in risk management strategy. read more