What score do you need to pass CFP?

[FREE] What Score Do You Need To Pass The Cfp Exam. The most CFP Board says on the passing score for the exam is that it is based on a minimal competency level required to pass the exam, which is determined by CFP® professionals. In 2018, the overall pass rate was 60 percent, and the pass rate for first-time exam takers was … 4

Do you need a 70 to pass the CFP exam?

What is a passing grade on CFP? Generally, two exams are given for each course. Students will take an online midterm and final exam for each course. The midterm is 40% of the final grade and the final exam is 60%. Students must achieve a 70% for each course in order to receive a passing grade.

How long does it take to get CFP exam results?

Receiving Your CFP® Exam Results. Preliminary results are provided to you immediately after taking the exam. Official results are provided to candidates by email approximately 4 weeks following the close of the testing window. If you do not pass, you'll receive a diagnostic report of your exam performance across the Principal Knowledge Topics, with indications of your relative strengths and weaknesses so that you know where to focus your studies for the next time you take the exam.

How to pass the CFP exam?

How to Study

- Learn the CFP board's reasoning. Many first-time test-takers will be surprised by the way the CFP Board grades exam answers. ...

- Aim to achieve the best grade possible. It probably goes without saying, but candidates taking the CFP exam should work towards the highest score possible.

- Enroll in a review course. ...

How hard is it to pass the CFP exam?

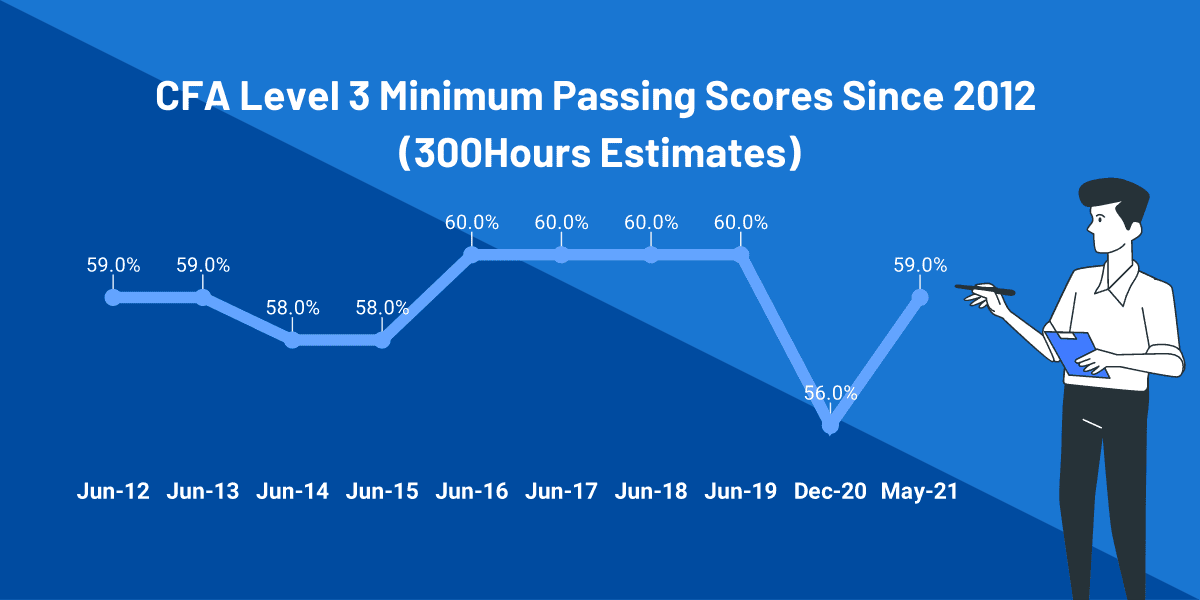

The overall pass rate for the CFP® exam in 2020 was 63%. That pass rate has remained relatively consistent since CFP Board introduced a new exam blueprint prior to the March 2016 CFP® exam. The new blueprint was based on the 8 Principal Knowledge Topics that were defined in CFP Board's 2015 Job Task Analysis Study.

Do you have to pass each section of CFP?

The CFP® certification exam is a pass-or-fail exam. Each test question counts for 1 point each. Passing is based on the candidate's total score across all sections of the exam.

How many people pass the CFP the first-time?

The overall pass rate of the CFP Exam typically hovers between 60%-65%, with first-time test takers faring slightly better. The exam is typically offered at Prometric testing centers in March, July, and November.

What happens if you fail CFP exam?

Retake Policy If you fail the CFP® exam and elect to retest, you are required to retake the entire exam and to pay the applicable exam fee for each retake.

How long does it take to pass CFP?

Here are some of the most common paths to CFP® certification. Typically, it takes 18-24 months to become a CFP® professional, but the certification process offers flexibility so you can make it work for you.

Is the CFP harder than the CPA?

The CFP program is also less-rigorous overall than the CPA program. CFPs do not require the same specific education and experience requirements that CPAs must have.

Is CFP easy?

CFP is easy as compared to chartered accountancy. It can easily be completed within 1 year while you have to devote 3–5 years to become a CA. Also the course structure is less in CFP . To find more information about the course , you can visit the Fpsb website.

Can you get a CFP without experience?

The CFP Board will allow professionals to sit for their national Board exam and pass without having the work experience. However, prior to issuing the CFP marks for a person's business and/or marketing purposes, the CFP Board requires a work experience requirement to have been met.

How many questions is the CFP exam?

170-questionExam Format The CFP® exam is a 170-question, multiple-choice test that consists of two 3-hour sections during one day. Each section is divided into two distinct subsections. The exam includes stand-alone questions, as well as questions associated with case studies.

How many times can you fail CFP?

You may attempt the CFP® exam a lifetime maximum of 5 times. (If you attempted the exam 4 or more times prior to January 1, 2012, you will be permitted a maximum of 2 additional attempts.) Also, you may attempt the exam a maximum of 3 times within a 24-month period.

How hard is CFP compared to CFA?

The multiple choice exam uses real-life situations to assess an applicant's ability to use broad financial planning knowledge. Overall, the CFP program is shorter and less-rigorous than the CFA program. If you think this could be the program for you, you can learn more about CFP certification requirements here.

How long is CFP certificate valid?

FPSB requires CFP professionals in good standing to renew their CFP certification at least every three years.

How many hours should you study for the CFP?

If you are considering taking the CFP exam, you've probably wondered how many hours are required to study, in order to be ready to pass the CFP exam. Well, to be truly “exam ready”, you should expect to study about 200 hours to prepare for the exam.

How is the CFP exam structure?

The CFP® exam is a computer-based exam consisting of 170 multiple-choice questions over the course of two 3-hour sessions. Each section of the exam is divided into two distinct subsections. The CFP® exam consists of 170 multiple-choice questions addressing areas included in the Principal Knowledge Topics.

How many levels are in CFP?

CFP Certification Course Structure : The Certified Financial Planner course in India is a 4 level program where you study for each level one by one and take exams to qualify them.

How many CFP exams are there?

About the Exam The CFP® exam is offered three times per year: March, July and November. Test topics include the financial planning process and principles, tax planning, income and retirement planning, estate planning, risk management and insurance, among other important topics.

What are the cognitive levels required to pass the CFP exam?

According to the CFP Board, the cognitive levels required to pass the CFP exam include knowledge, application, analysis, and evaluation.

How long does it take to pass the CFP exam?

According to the study, individuals who take the exam within six months of graduation are more likely to pass the CFP exam than those who wait. Recent studies by the CFP Board show that the majority of students opt to skip the exam for fear that their inexperience will prevent them attaining a CFP exam passing score.

What is the chance of passing the CFP exam for repeaters?

Did you know that the chance of passing the CFP exam for repeaters is much lower than for first timers? According to the Certified Financial Planner Board of Standards, the repeat test takers have a 30 to 50 percent chance of passing the exam, compared to first-time test takers’ 55 to 68 percent.

What are the motivations for passing the CFP?

The majority of the best performers in the CFP exam were those who listed personal marketability and peer recognition as their primary motivators to passing the CFP exam.

What happens if you wait too long to take the CFP exam?

The longer you wait before taking the exam, the higher the chances that you forget the key concepts and risk getting marks below the CFP passing score. Your motivation will affect your performance. When it comes to selecting and undertaking any professional accreditation course, people have different motivations.

How to sit for CFP exam?

To be eligible to sit for the exam, you must complete a college or university level course of study through a CFP Board-registered program. The course work should address all the key areas of personal financial planning as specified in the recent CFP Board job analysis study.

How long is the Financial Planning exam?

For an average student, the course takes a study time of at least 1,000 hours for the six-hour of exam. The test includes a financial planning case study, supervised client meetings, a multiple choice test, and a detailed experience analysis. It covers key areas such as: Risk management and insurance planning.

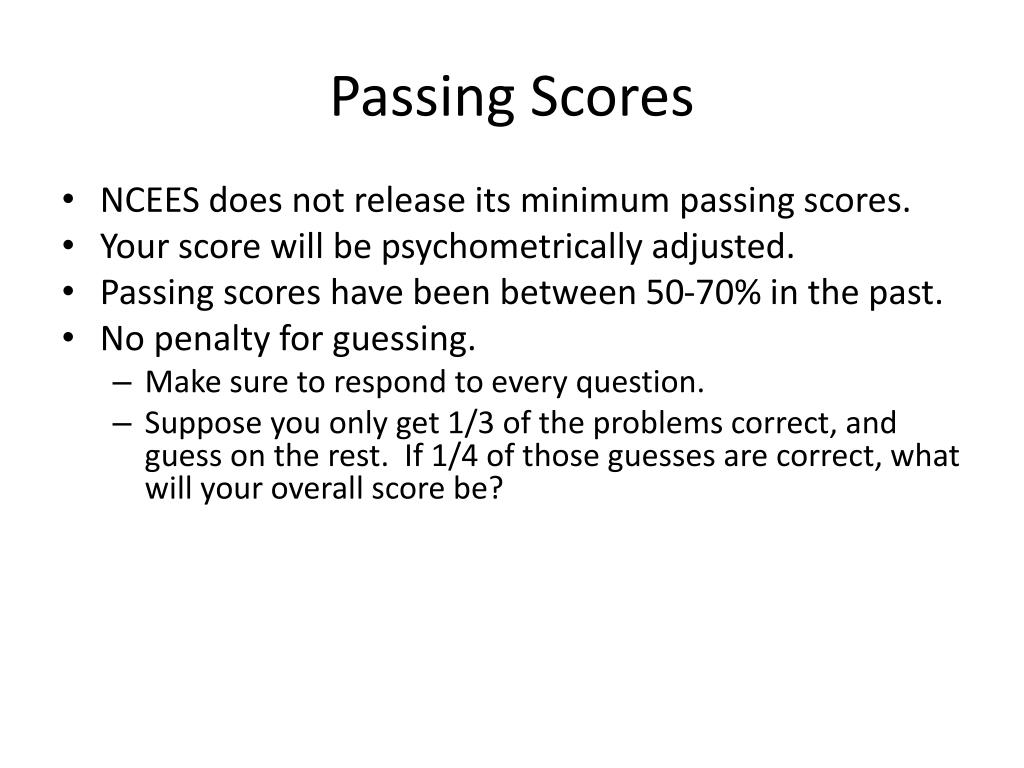

Why is the CFP scoring process so frustrating?

The CFP scoring process can be frustrating to test takers because there’s no clearly-articulated score you need to pass , he says. You find out if you passed or failed and if you failed, what areas you scored low in, “but there’s not a lot of detail and that’s to protect the integrity of the exam.”.

What is a CFP exam?

The CFP exam is a pass-or-fail exam. (Getty Images) The CFP exam is for the financial industry what the bar is for the legal industry. Being a certified financial planner (CFP) is largely considered the gold standard in financial planning. Of the approximately 270,000 financial advisors in the U.S., only about 83,000 are CFPs.

How to study for CFP exam?

CFP exam study tips: 1 Choose a good time to take the CFP exam. 2 Create a study schedule that plans for life events. 3 Study like you’re preparing for a marathon with adequate breaks. 4 Verbalize concepts as you study. 5 Get help. 6 Take as many practice questions as you can. 7 Build your own practice exam as you study. 8 Test drive the exam site. 9 Don’t try to be an "A" student; just try to pass.

How many days does the CFP exam take?

It’s offered for eight days, three times per year, in March, July and November, at 265 testing sites across the U.S.

What should a CFP study plan include?

Your study plan should include when you’ll work through each chapter and when you’ll review it . Most CFP study materials include end-of-chapter exams. Plan to take those but also to review the material in general, Dorsainvil says.

How many knowledge topics are there in CFP?

The latest survey revealed 72 essential knowledge topics to be a CFP. The CFP Board accumulated these topics into the below eight Principle Knowledge Topics so that the CFP exam is structured as follows:

How many multiple choice questions are there in the CFP?

Each of the 170 multiple-choice questions is linked to one or more of the CFP Board’s eight Principal Knowledge Topics. To determine these topics, the CFP Board surveys certified financial planners about their job and what you need to know to be a CFP.

What are the pass rates and passing scores for the CFP ® exam?

In 2018, the overall pass rate was 60 percent, and the pass rate for first-time exam takers was approximately 64 percent.

How hard is the CFP ® exam?

The CFP ® exam is not easy, which is one reason the mark is among the most respected certifications in the financial services industry. It includes two case studies, multiple mini-case problem sets, and standalone questions designed to assess your knowledge of financial planning concepts and how to apply them to specific situations. It requires a significant investment of time to be successful. But most of the time, failing the exam is the result of not preparing properly. If you put together a stellar study plan and are willing to invest in your exam preparation, you can increase your odds of passing.

What is CFP ® certification?

CFP ® certification is a professional designation for financial planners. Also known as the CERTIFIED FINANCIAL PLANNER™ or CFP ® mark, its governing body, CFP Board , administers the credential. With financial advising and planning estimated to be one of the top 10 fastest growing occupations, getting your CFP ® mark can help set you apart in the industry.

What is the difference between the CFP ® certification and the CFA ® charter?

The CFP ® mark and CFA ® charter are both the most prestigious designations in their respective fields, and each is administered by a governing body. To earn CFP® certification, you must sit for and pass one exam; the CFA Program exam has three levels. CFA charterholders commonly help individuals and institutions invest and allocate assets. A CFP ® professional is likely to be a financial planner, wealth manager, or financial advisor. Our article about the CFP® mark vs the CFA charter has more details.

What is the difference between the CFP ® certification and a master’s in personal financial planning?

Both the CFP ® certification and a master’s degree in personal financial planning lead to unique professional opportunities for those with a bachelor’s degree who want a career in personal finance and planning. But their requirements, topics of study, and their benefits are slightly different. To make a decision, you need to think about what you want to do long-term. This article compares the two options in greater detail.

What is the CFP ® exam? Why should I take it?

The CFP® exam is a multiple-choice, computer-based exam. It consists of two 3-hour sessions that are divided into distinct subsections (two subsections within each session). The sessions are separated by a 40-minute scheduled break. You may also take an optional break between the subsections. It is offered three times a year in March, July, and November at almost 50 locations nationwide.

What are the requirements to sit for the CFP ® exam?

To sit for the CFP ® exam, you will need to complete a CFP Board-registered education program first. After you complete it, CFP Board must be notified. Usually, your coursework provider will do that for you. There are no degree requirements to sit for the CFP ® exam, but you will have to earn a bachelor’s degree within five years of passing the exam. You don’t need a sponsor to take the exam. Also, candidates often use a CFP® exam study package before they take the exam, but it’s not required.

What is the CFP exam?

The CFP® certification examination is a key requirement for achieving CFP® certification. By passing the exam, you demonstrate that you've attained the knowledge and competency necessary to provide comprehensive personal financial planning advice to your clients.

When is the next CFP exam?

The CFP® exam is typically offered during three 8-day testing windows per year — March, July and November. The next exam window is March 8-15, 2022 and the registration deadline is February 22.

How many questions are asked in the CFP exam?

The CFP® exam is a 170-question, multiple-choice test that consists of two 3-hour sections during one day. Each section is divided into two distinct subsections. The exam includes stand-alone questions, as well as questions associated with case studies. Exam Topics & Content.

Who is the CFP board?

CFP Board works with volunteer CFP® professionals to develop the exam. These volunteers include Subject Matter Experts (SMEs) who serve as item writers and reviewers, as well as members of the Council on Examinations, which is made up of SMEs with considerable experience with the CFP® exam who provide final review and approval of all exam questions.

Is the CFP exam a pass or fail?

It’s important that you feel comfortable when sitting for the exam and know what to expect. The CFP® exam is a pass-or-fail exam. As a test taker, you’ll want to understand how the exam is scored, how you’ll receive your test results and how to interpret those results.

Just received my official pass email!

Passed July 12. My official results on the CFP site still show pending. Maybe it will be updated tomorrow.

Is Anyone Else Shocked by the Fees

My fees after passing, and spending thousands on the education requirements/exam prep course/exam fee/etc. is the initial $200 fee plus another $708 for the annual certification.

Financial Consultant role at Charles Schwab

I’m looking to get some sort of insight into some of the details of this role. Can anyone highlight what is the typical compensation (base salary and guarantee)? From what I can tell you aren’t expected to prospect from outside the firm and are given warm leads and a book of business, is this correct?

CFP fees

I’m struggling to find this through the CFP board website. I feel like the fees for this certification are crazy.

Will I be able to get a job if I pass this test as someone with zero professional experience?

I have a bachelors degree in economics and I have been managing my family’s and my own finances for about 10 years now and I’m thinking about doing it professionally. Do you think passing this test will open any doors and allow me to get a job in the field?