How do you use the percentage of sales method?

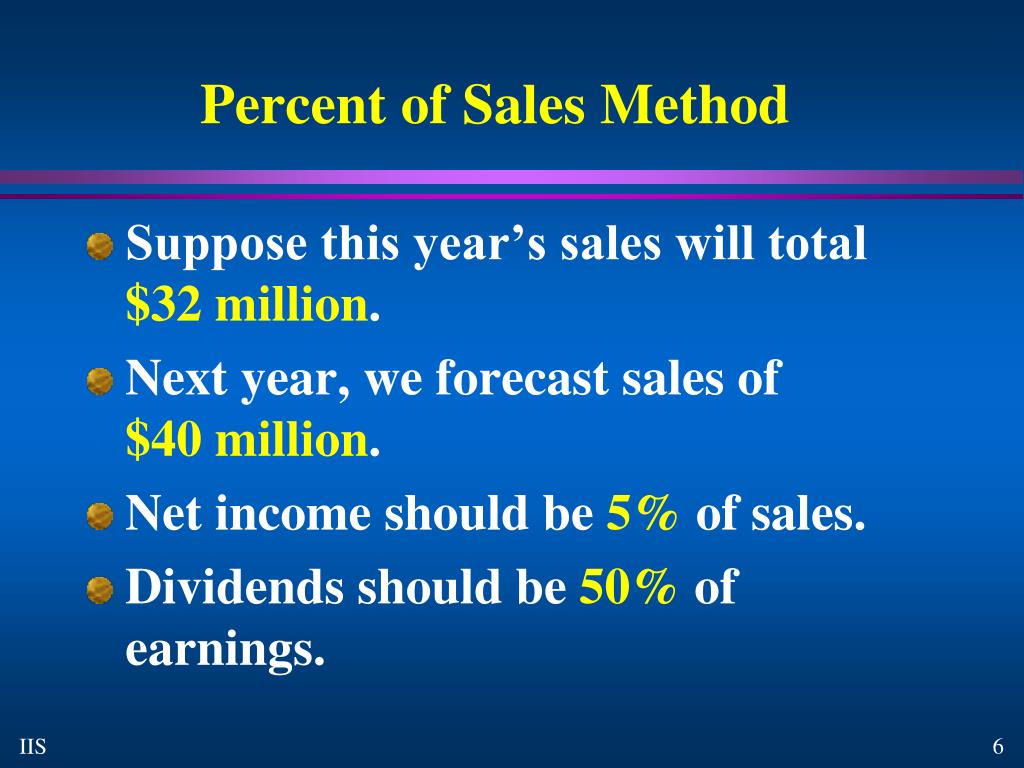

Feb 22, 2021 · What is the percentage of sales method? The percentage of sales method is a forecasting model that makes financial predictions based on sales. Financial statement items like the cost of goods sold and accounts receivable are represented as a percentage of sales. Companies then use this data to assess their financial future.

What is the formula for percentage of sales method?

May 05, 2020 · The percent of sales method is a financial forecasting model in which all of a business's accounts — financial line items like costs of goods sold, inventory, and cash — are calculated as a percentage of sales. Those percentages are then applied to future sales estimates to project each line item's future value.

How to calculate sales percentage?

Mar 06, 2022 · The percentage-of-sales method is used to develop a budgeted set of financial statements. Each historical expense is converted into a percentage of net sales, and these percentages are then applied to the forecasted sales level in the budget period. For example, if the historical cost of goods sold as a percentage of sales has been 42%, then the same percentage …

How to calculate bad debt expense/ percent of sales method?

Nov 22, 2021 · What is the percentage of sales method? The percentage of sales method is a forecasting tool that makes financial predictions based on previous and current sales data. This data encompasses sales and all business expenses related to sales, including inventory and cost of goods. The company then uses the results of this method to make adjustments for the …

What is the percentage of sales method formula?

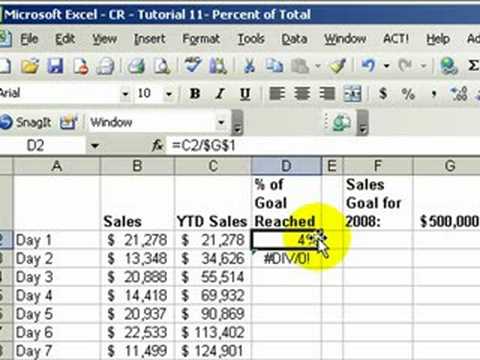

Calculate the percentage of sales to expenses Divide your expenses by your total sales. Multiply your result by 100.Feb 22, 2021

What is the percentage of sales method example?

Each historical expense is converted into a percentage of net sales, and these percentages are then applied to the forecasted sales level in the budget period. For example, if the historical cost of goods sold as a percentage of sales has been 42%, then the same percentage is applied to the forecasted sales level.Mar 6, 2022

What is the percent of sales method?

The percent of sales method is one of the quickest ways to develop a financial forecast for your business — specifically for items closely correlated with sales. That's its major advantage.

What does Barbara have to know before she can put her forecast together?

Before she can put her forecast together, Barbara has to see which financial line items are correlated with her sales figures. These are the accounts the percent of sales method applies to. Those accounts often include:

Can fixed expenses be projected with the percent of sales method?

Even then, you have to bear in mind that the method only applies to line items that correlate with sales. Any fixed expenses — like fixed assets and debt — can't be projected with the percent of sales method.

What are the advantages and disadvantages of costing?

However, these advantages are more than offset by several major disadvantages, which are: 1 Many expenses are fixed or have a fixed component, and so do not correlate with sales. For example, rent expense does not vary with sales. Many balance sheet items also do not correlate with sales, such as fixed assets and debt. 2 Step costing may apply, where a cost is variable but will change to a different percentage of sales when the sales level changes to a different volume level. For example, purchase discounts may apply to purchases once the unit count passes 10,000 per year.

What are the disadvantages of the percentage of sales method?

However, these advantages are more than offset by several major disadvantages, which are: Many expenses are fixed or have a fixed component, and so do not correlate with sales. For example, rent expense does not vary with sales.

Does rent expense vary with sales?

For example, rent expense does not vary with sales. Many balance sheet items also do not correlate with sales, such as fixed assets and debt. Step costing may apply, where a cost is variable but will change to a different percentage of sales when the sales level changes to a different volume level. For example, purchase discounts may apply ...

What is the percentage of sales method?

The percentage of sales method is a forecasting tool that makes financial predictions based on previous and current sales data. This data encompasses sales and all business expenses related to sales, including inventory and cost of goods.

The benefits of percentage forecasting

Business forecasting may not perfectly predict your company’s financial future, but it can give you a strong sense of where your company is headed and any changes you may need to make. Here are just some of the benefits of business forecasting:

Percentage of sales method formula

There are five basic steps to the percentage of sales method formula. We’ll go through each step and then walk through an example to see the formula in action.

Percentage of sales method example

We’ll walk through an example with a positive net income, but we will also point out spots where problems could occur and lead to a negative net income.

Other percentage methods

The percentage of sales method, while useful, doesn’t cover every financial aspect of a business. Because of this, there are two additional methods we want to look at when calculating financial health: the percentage of credit sales method and the percentage of receivables method.

Unlocking a measurable sales pipeline

Learn how to effectively build, maintain, and optimize your sales pipeline.

Percentage of Sales Method

Meet Mr. Weaver, owner of the Cushy Carpet Company. He would like to complete his financial forecast for next year and is wondering if he could use the percentage of sales method. He has determined that his sales will increase by 30% next year. Let's see if we can help Mr. Weaver with his forecast.

Percentage of Sales Calculations

The first step of the process is to determine the amount by which sales are expected to increase. In Mr. Weaver's case, we determined that this is 30%. The next step is to identify which accounts are closely related to sales. For example, when a sale is made, a customer could choose to pay with cash or credit.

Determining the Sales Forecast

Now, since many accounts will change based on sales, Mr. Weaver must calculate what his sales are forecast to be in the next year. The formula for calculating forecasted sales growth is:

Retained Earning Changes

Now let's take a look at how to calculate changes in retained earnings. Retained earnings represent the amount of earnings that have been retained in the business since the company started operating. In other words, they represent the earnings after dividends have been deducted.

Financial Forecasting

The effective activity of enterprises in a market economy largely depends on how reliably they foresee the long-term and short-term prospects of their development, that is, on forecasting.

Percentage of Sales Method

The percentage of sales method is one of the steps in financial planning. The essence of the method is that each of the elements of the financial documents is calculated as a percentage of the established sales value. It is one of the simplest and most effective methods of financial forecasting of an enterprise.

How It Works

When looking at your sales and projecting that out into next year, you can also easily project out many other Balance Sheet items. Common accounts that are calculated as a percentage of sales include Accounts Receivable, Fixed Assets, Inventory, Cost of Goods Sold, and Accounts Payable.

What is the percentage of sales method?

Define Percentage of Sales Method: The percent of sales method is a ratio analysis tool used by management and investors to compare items on the financial statements from year to year as well as companies’ performance within industries.

Why do creditors compare interest expense to sales?

For instance, creditors might compare interest expense to sales to identify whether the company is able to service its debt. If interest expense rises in relation to sales each year, creditors might assume the company isn’t able to support its operations with current cash flows and need to take out extra loans.

What Is the Percentage of the Net Sales Method? – Definition

Percentage of Net Sales is a method of estimating uncollectible accounts expense under which the amount of uncollectible accounts expense is determined by the analysis of the relationship between net credit sales and the prior year’s uncollectible accounts expense.

Explanation

The percentage-of-net-sales method determines the amount of uncollectible accounts expense by analyzing the relationship between net credit sales and the prior year’s uncollectible accounts expense.

What are variable expenses?

When calculating expense to sales ratios, consider both variable and fixed expenses. Variable expenses can include such items as commissions, cost of raw materials and shipping. Fixed expenses, including such items as rent of building, utilities and fixed salaries, often do not correlate with sales.

How to calculate percentage of sales?

Here are the steps: 1 Calculate your total sales in dollar amounts for the period. You can analyze data for any period of time, such as breaking it down daily, monthly, quarterly or annually. 2 Calculate your expenses for the same period of time for which you collect sales data. 3 Divide your expense total by the sales revenue total. 4 Multiply the result by 100. The result is the percentage of sales to expenses.

What is percentage of sales?

The percentage of sales method is a tool for forecasting and budgeting. A business looks at the historical cost of goods as a percentage of its sales and uses that figure for the forecasted sales amount. The percentage of sales method can also be used to forecast other balance sheet items that are closely associated with sales, such as inventory, accounts payable and accounts receivable.