Benefits of the weighted average costing method

- Track inventory value. The weighted average cost method makes it easy to understand the value of your inventory. ...

- Less record-keeping. When you use the weighted average method, you don’t have to be precise about which items were bought when, and how much they cost.

- Save money. ...

What are the disadvantages of average costing method?

Major disadvantages of simple average method are as follows: 1. If the quantity in each lot varies widely, the average price will lead to erroneous costs. 2. Costs are not fully recovered. 3. Closing stock is not valued at the current assets. You May Like .

What is the formula for average cost?

What is the WACC Formula?

- E = Market value of the business’s equity

- V = Total value of capital (equity + debt)

- Re = Cost of equity

- D = Market value of the business’s debt

- Rd = Cost of debt

- T = Tax rate

Should I use weighted average?

The weighted average is one of those things that is used to more accurately portray a sample in relation to a population. There are some particulars when you want to use it, like outliers and variance, but overall it is a pretty well-rounded way to account for differences in the data.

How do you calculate weighted average LIFO and FIFO?

What are FIFO, LIFO, and Weighted Average?

- First-In, First-Out (FIFO) Under FIFO rules, COGS is calculated using the cost of your inventory at the beginning of the period.

- Last-In, First-Out (LIFO) LIFO flips FIFO on its head and calculates COGS using the cost of inventory at the end of the period.

- Weighted Average. ...

- Choosing the Right Inventory Management Approach. ...

How do you calculate the weighted average cost?

To calculate the weighted average cost, divide the total cost of goods purchased by the number of units available for sale. To find the cost of goods available for sale, you'll need the total amount of beginning inventory and recent purchases.

How do you calculate the weighted average cost of capital?

WACC is calculated by multiplying the cost of each capital source (debt and equity) by its relevant weight by market value, and then adding the products together to determine the total. The cost of equity can be found using the capital asset pricing model (CAPM).

What is WACC and why is it important?

The weighted average cost of capital (WACC) is an important financial precept that is widely used in financial circles to test whether a return on investment can exceed or meet an asset, project, or company's cost of invested capital (equity + debt).

How do you calculate WACC for a private company?

The WACC for a Private Company is calculated by multiplying the cost of each source of funding – either equity or debt – by its respective weight (%) in the capital structure.

Why use weighted average cost method?

A significant advantage of using the weighted average cost method that it is the simplest way to track inventory expense. You can store inventory stock without the need to designate which batch it belongs to and you don’t need to trace the original cost before pricing items, simply marking up the average price of the stock units.

What is weighted average cost?

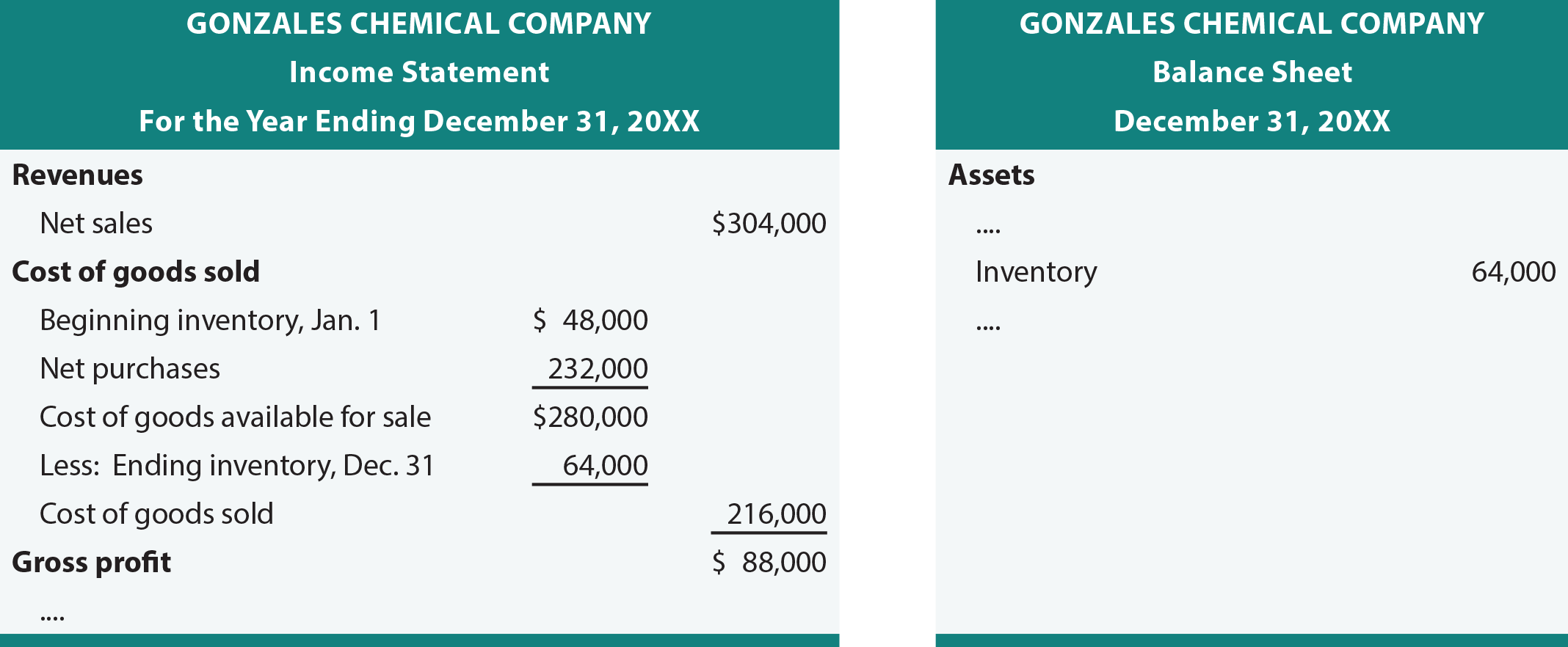

The weighted average cost method in accounting is one of three approaches of valuing your businesses inventory stock and determines the average cost of all inventory items based on the individual costs and the quantity of each item held in stock. Businesses use the weighted average to determine the amount that goes into the inventory and the cost of goods sold (COGS).

Why do businesses use the weighted average?

Businesses use the weighted average to determine the amount that goes into the inventory and the cost of goods sold (COGS). When a business purchases items of inventory, they may pay different prices due to diversity in the types of inventory stock or the same stock items, purchased at different times. In the weighted average cost method, the cost ...

How to calculate weighted average?

When using the weighted average method, you divide the cost of goods available for sale by the number of units available for sale, which yields the weighted-average cost per unit. In this calculation, the cost of goods available for sale is the sum of beginning inventory and net purchases. This weighted average figure is then used to assign a cost to both ending inventory and the COGS.

What is stocktake in accounting?

A stocktake is a record of the inventory a business has on hand, which is commonly done at the end of the year. However, some businesses may perform s...

What method does Corporation A use?

Corporation A uses the weighted average method and during the month of June it records the following transactions:

Is average cost retrospective?

This is particularly problematic when a supplier replaces a product with a new version, giving it the same name as the previous version. Finally, the average cost method is retrospective, in that it looks back over a purchasing period to see what was paid per unit.

What is weighted average cost?

The term 'weighted average cost' in accounting refers to the method of determining expenses associated with a business's cost of goods sold (COGS) and inventory. It is common for businesses to pay different prices when ordering inventory because certain types of stock are not always available. This may be confused with individual pricing later.

Why is it important to know the average cost of inventory?

Businesses who keep inventory in stock must understand the average cost of all inventory items in relation to individual costs and the total quantity of units being held. This information helps employees and business owners make better buying decisions. In this article, we discuss why weighted average cost is important and how to calculate it, plus see multiple examples.

What inventory system is used to calculate WAC?

Businesses may use the periodic inventory system or the perpetual inventory system when calculating the WAC method. The allocation of inventory costs differs depending on the system.

What is WAC in inventory?

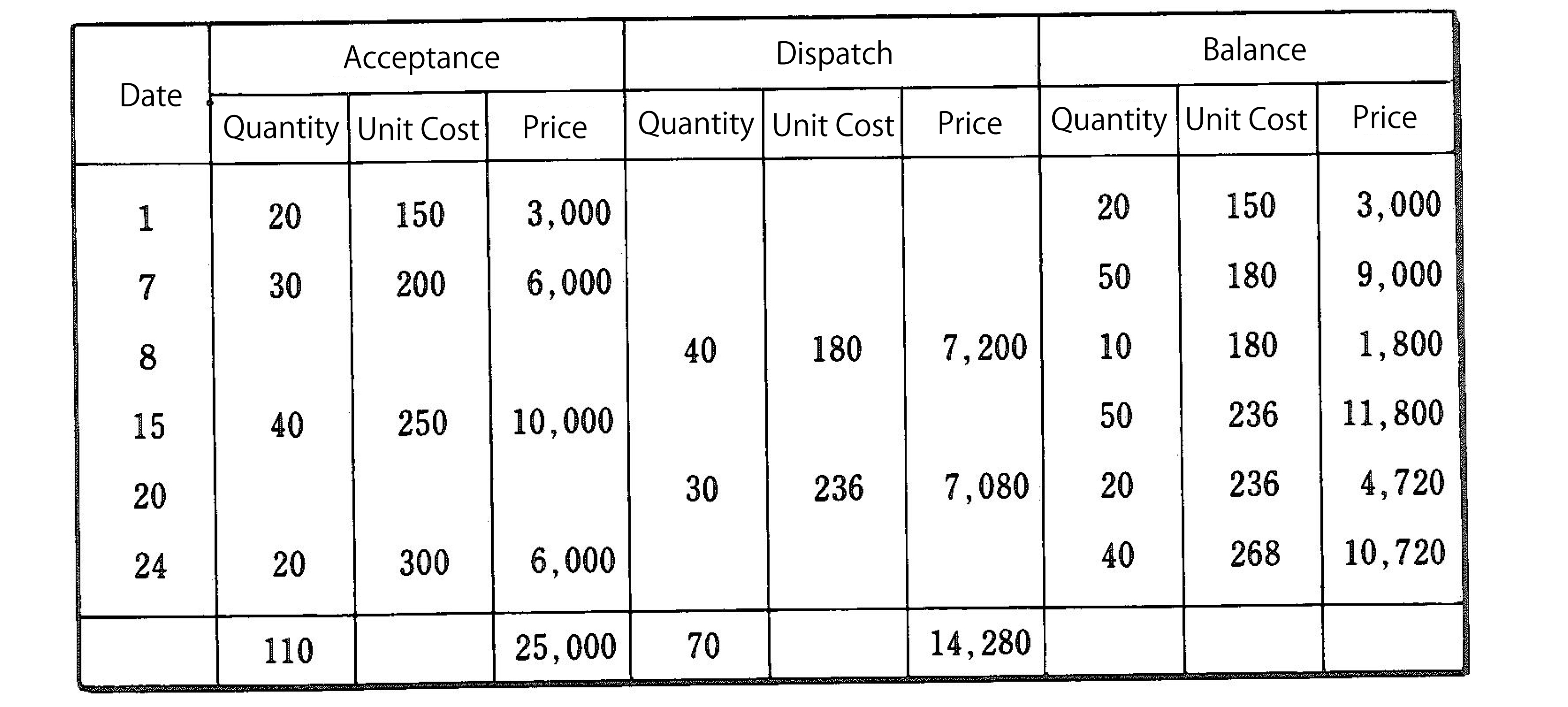

Perpetual inventory system. In this system, the WAC is also known as the 'moving average cost method' because companies continuously track inventory and COGS. New material purchased gets added to the material already in stock. The average price must be determined after each purchase.

Which accounting system calculates COGS?

The business's accountants prefer to use the periodic inventory system which calculates the COGS and units available for sale at the end of the first quarter:

Who calculated the WAC on a balance sheet?

The bookkeeper calculated the WAC on a balance sheet. He shared the following information with the business owner:

What is COGS in accounting?

To understand the formula, it helps to identify certain parts of the equation: COGS is the original inventory value plus purchases. Units available for sale is the same as the total number of units in inventory.

The formula for weighted average cost (WAC) method

In WAC, the cost of goods available for sale is divided by the number of products available for sale. Its formula is given by:

Example of applying weighted average cost (WAC) method for inventory control

In the below example, a company starts the month with 220 nos. of an item on the 1st of August, 2020, and it records the following sale and purchase (stock replenishment) figures.

Advantages of using weighted average cost (WAC) method

Without the weighted average cost method, you wouldn’t be able to manage inventory without assigning different costs to your incoming and stored inventory. WAC allows you to store your inventory without assigning separate costs to all identical items.

Disadvantages of using weighted average cost (WAC) method

As discussed earlier, you cannot use this method for items with very high price variations or completely dissimilar in nature. If they are commodities controlled by very different factors, using WAC isn’t a good choice in this case either.

Ending Note

You need to conclude the accounting process within the same accounting period i.e., COGS for an accounting period is reported against the revenue of the same period. The total costs remain the same in both perpetual and periodic inventory systems. Using WAC enables businesses to measure the prices for every batch procured against specific pricing.

What is weighted average?

What Is a Weighted Average? Weighted average is a calculation that takes into account the varying degrees of importance of the numbers in a data set. In calculating a weighted average, each number in the data set is multiplied by a predetermined weight before the final calculation is made.

How is a weighted average multiplied?

In any case, in a weighted average, each data point value is multiplied by the assigned weight which is then summed and divided by the number of data points.

How to calculate weighted average of shares?

In order to do so, multiply the number of shares acquired at each price by that price, add those values and then divide the total value by the total number of shares.

Why do investors use weighted averages?

Stock investors use a weighted average to track the cost basis of shares bought at varying times.

When evaluating companies to discern whether their shares are correctly priced, investors use the weighted average cost of capital (?

When evaluating companies to discern whether their shares are correctly priced, investors use the weighted average cost of capital (WACC) to discount a company's cash flows. WACC is weighted based on the market value of debt and equity in a company's capital structure.

Why are values in a data set weighted?

However, values in a data set may be weighted for other reasons than the frequency of occurrence. For example, if students in a dance class are graded on skill, attendance, and manners, the grade for skill may be given greater weight than the other factors. In any case, in a weighted average, each data point value is multiplied by ...

Where do weighted averages show up?

Weighted averages show up in many areas of finance besides the purchase price of shares, including portfolio returns, inventory accounting, and valuation.

How to calculate WACC?

WACC is calculated by multiplying the cost of each capital source (debt and equity) by its relevant weight, and then adding the products together to determine the value. In the above formula, E/V represents the proportion of equity-based financing, while D/V represents the proportion of debt-based financing. The WACC formula thus involves the summation of two terms:

How to find cost of equity?

To find the cost of equity (Re) one can use the capital asset pricing model (CAPM). This model uses a company’s beta, the risk-free rate, and the expected return of the market to determine the cost of equity. The formula is risk-free rate + beta * (market return - risk-free rate). The 10-year Treasury rate can be used as the risk-free rate and the expected market return is generally estimated to be 7%. Thus, Walmart’s cost of equity is 2.7% + 0.37 * (7% - 2.7%), or 4.3%.

Why does WACC increase?

A firm’s WACC increases as the beta and rate of return on equity increase because an increase in WACC denotes a decrease in valuation and an increase in risk.

What is WACC in accounting?

The weighted average cost of capital (WACC) is a calculation of a firm's cost of capital in which each category of capital is proportionately weighted. All sources of capital, including common stock, preferred stock, bonds, and any other long-term debt, are included in a WACC calculation.

What is WACC used for?

WACC is commonly used as the discount rate for future cash flows in DCF analyses.

Why do companies use WACC?

Because of this, company directors will often use WACC internally in order to make decisions, like determining the economic feasibility of mergers and other expansionary opportunities . WACC is the discount rate that should be used for cash flows with a risk that is similar to that of the overall firm.

Is cost of equity a fixed value?

Cost of equity (Re) can be a bit tricky to calculate since share capital does not technically have an explicit value. When companies pay a debt, the amount they pay has a predetermined associated interest rate that debt depends on the size and duration of the debt, though the value is relatively fixed. On the other hand, unlike debt, equity has no ...

Understanding Costs of Goods Available For Sale

- The bundling of costs is referred to as the cost of goods available for sale. The costs of goods available for sale are either allocated to COGS or ending inventory. Allocating the costs of goods available for sale is referred to as a cost flow assumption. There are several cost flow assumptions, such as: 1. FIFO (first-in, first-out) 2. LIFO (last...

The WAC Method Under Periodic and Perpetual Inventory Systems

- Using the weighted average cost method yields different allocation of inventory costs under a periodic and perpetual inventory system. In a periodic inventory system, the company does an ending inventory count and applies product costs to determine the ending inventory cost. COGS can then be determined by combining the ending inventory cost, beginning inventory cost, and the purchases throughout the period. A perpetual inventory …

Example of The WAC Method

- At the beginning of its January 1 fiscal year, a company reported a beginning inventory of 300 units at a cost of $100 per unit. Over the first quarter, the company made the following purchases: 1. January 15 purchase of 100 units at a cost of $130 = $13,000 2. February 9 purchase of 200 units at a cost of $150 = $30,000 3. March 3 purchase of 150 units at a cost of $200 = $30,000 In addition, the company made the following sales: 1. End of F…

Comparing The WAC Method Under The Periodic and Perpetual Inventory Systems

- Comparing the costs allocated to COGS and inventory, we can see that the costs are allocated differently depending on whether it is a periodic or perpetual inventory system. However, notice that the total costs remain the same (as they should). In our example, the inventories purchased experienced a price appreciation. January purchase costs per unit were $130, February purchase costs per unit were $150, and March purchase costs per …

Related Reading

- Thank you for reading CFI’s guide to Weighted Average Cost. To keep learning and advance your career, the following CFI resources will be helpful: 1. Days Inventory Outstanding (DIO)Days Inventory OutstandingDays inventory outstanding (DIO) is the average number of days that a company holds its inventory before selling it. The days inventory 2. Inventory TurnoverInventory TurnoverInventory turnover, or the inventory turnover ratio, is the n…