Key Takeaways

- The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do.

- The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

- The rule is a template that is intended to help individuals manage their money and save for emergencies and retirement.

How many days to save money?

What is the 30 Day Impulse Spending Rule?

How to make saving money easier?

How to avoid impulse purchases?

What happens if you buy something after 30 days?

How to do 30 day savings?

How to increase savings?

See 4 more

About this website

What is the general rule for saving money?

It's our simple guideline for saving and spending: Aim to allocate no more than 50% of take-home pay to essential expenses, save 15% of pretax income for retirement savings, and keep 5% of take-home pay for short-term savings.

What is the 50 30 20 budget rule?

One of the most common percentage-based budgets is the 50/30/20 rule. The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings. Learn more about the 50/30/20 budget rule and if it's right for you.

What is the 80/20 Rule saving money?

It directs individuals to put 20% of their monthly income into savings, whether that's a traditional savings account or a brokerage or retirement account, to ensure that there's enough set aside in the event of financial difficulty, and use the remaining 80% as expendable income.

Does the 50 30 20 rule include retirement savings?

The savings category in the 50/30/20 rule covers a lot: retirement investments, emergency fund savings, and any extra debt payments above those minimum payments. That's just 20% of your income to get you feeling safe and secure with money for today, tomorrow, and down the line in retirement.

Is saving 1000 a month good?

If you start saving $1000 a month at age 20 will grow to $1.6 million when you retire in 47 years. For people starting saving at that age, the monthly payments add up to $560,000: the early start combined with the estimated 4% over the years means that their investments skyrocketed nearly $1.

How much savings should I have at 40?

You may be starting to think about your retirement goals more seriously. By age 40, you should have saved a little over $175,000 if you're earning an average salary and follow the general guideline that you should have saved about three times your salary by that time.

Is the 4 percent rule safe?

In recent years, some have questioned whether the 4% rule remains valid. They point to low expected returns from stocks given high valuations. They also point to low yields on fixed income securities. While both concerns are real, the 4% rule has been proven reliable through a wide range of difficult markets.

Is the 30% rule outdated?

The 30% Rule Is Outdated The 30% Rule has roots in 1969 public housing regulations, which capped public housing rent at 25% of a tenant's annual income (it inched up to 30% in the early 1980s).

Is the 50 30 20 rule weekly or monthly?

What is the 50/30/20 budget? The 50/30/20 rule is a popular budgeting method that splits your monthly income among three main categories.

What is the 5% retirement rule?

The sustainable withdrawal rate is the estimated percentage of savings you're able to withdraw each year throughout retirement without running out of money. As an estimate, aim to withdraw no more than 4% to 5% of your savings in the first year of retirement, then adjust that amount every year for inflation.

How much does Dave Ramsey say to save?

Dave Ramsey: 6 months of expenses in an emergency fund In spring 2022, personal finance expert Dave Ramsey said his general rule of thumb for emergency savings is now roughly six months of income. In his blog, he writes, “The more stable your income and household are, the less you need in your emergency fund.

What is the 3% retirement rule?

Some conservative retirees choose to follow the 3% rule instead. This is the same as the 4% rule, except you limit yourself to 3% of your savings in your first year.

What is 50 20 30 Rule explain how are you going to apply it?

The 50-30-20 rule works like this: 50% of your income goes to things you must have/need to spend on (rent, electricity, food, taxes), 30% goes to things you want to buy (that new iPhone, eating out, relaxing and watching a movie), and 20% goes to savings (bank savings, insurance, college funds, you name it). There.

What are the benefits of 50-30-20 budget rule?

For those who don't know, the 50-30-20 budget plan is an American concept that seeks to save money and budget your money smartly. After taxes, your income should be divided into: 50% on essential needs; 30% on wants; and 20% on paying off your debt or setting aside funds in case of an emergency.

Is the 50-30-20 rule weekly or monthly?

What is the 50/30/20 budget? The 50/30/20 rule is a popular budgeting method that splits your monthly income among three main categories.

What is the 90 10 budget rule?

What Is the 90/10 Strategy? Legendary investor Warren Buffett invented the “90/10" investing strategy for the investment of retirement savings. The method involves deploying 90% of one's investment capital into stock-based index funds while allocating the remaining 10% of money toward lower-risk investments.

Free Budget Planner Worksheet - NerdWallet

A successful budget planner helps you decide how to best spend your money while avoiding or reducing debt. Our free budget worksheet can get you started.

Impulse Spending and Materialism

Fewer than one in four Generation Z Americans have a budget, and a staggering 65% of all Americans have no idea how much they spent last month. This is no doubt how Americans overspend by an average of $7,500 every year. The worst part? They couldn’t tell you what they spent the money on.

What Is The 30-Day Savings Rule?

The 30-day Savings Rule is perhaps the most practical and sensible spending rule in existence. The rule doesn’t bar a person from spending money on things they want, it just ensures they really want it.

Why Is It Important?

We live in a time and place where instant gratification is the order of the day. In just the last few years, Amazon has gone from delivering items in a few days, to guaranteeing an arrival in two days, in some cities, one day, in some neighborhoods within just hours.

The Money Is Good Too

The 30-Day Savings Rule forces delayed gratification with an additional benefit – participants save money. Everyone should have a savings goal, usually an amount tied to monthly earnings that automatically transfers from your checking account to savings account each month or on payday.

Why automate mortgage payments?

Many of us will automate our mortgage payments to ensure we are not late on these payments, but not all of us will automate our savings to ensure we are always saving for our future self. Automating your savings ensures the money is taken out before you even have time to spend it. It also ensures that you save first and then you spend, not the other way around.

What is the saving rate?

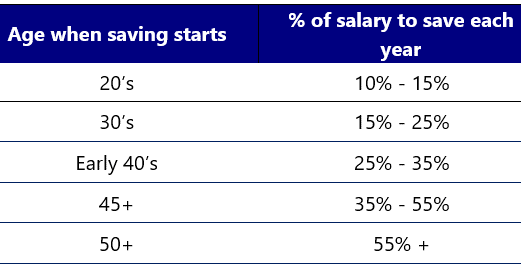

A saving rate is the percentage you have decided to set aside and save from all sources of income. The most common rates used is 10%-15% of income and more ambitious savers can go as high as 30%-50%. A savings amount is just that, a dollar amount set aside each month towards long-term savings/investing. For example, deciding to save $200/month would be setting a savings amount.

What is the average inflation rate?

Inflation causes the cost of goods and services to go up year after year. The average inflation rate is around 1.5%-2% a year . This is important to remember because the money sitting in your account today will be worth less next year and the year after and so on and so forth. That is of course, unless deflation occurs, but that is another story altogether.

What is liquidity in accounting?

In accounting, liquidity is defined as the ease in which an asset can be converted into cash. So, if we are talking about personal finance, cash would be the most liquid asset because it is already in cash. Your savings account might be next, followed by CD’s (as you would need to close them to collect your money), financial investments (stocks, bonds), real property (real estate, land).

Why is my purchasing power reduced year after year?

This is because the interest rate offered on basic savings account and CD’s won’t even cover the cost of inflation (2%) so every year, even though your making money by saving, their purchasing power is reduced year after year because the rate of return can’t keep up with the rising cost of goods and services.

How to save money when you don't have a reason?

Start with the end in mind. Many people get deflated about saving money because they don’t have a reason for why they are saving. Starting with the end in mind means, giving yourself a big enough ‘why’ and making this why as clear and as vivid as possible that you feel encouraged to save.

Why is it important to have rules of guidelines?

In master any area of our life, it is important to have certain rules of guidelines to help us navigate and be successful, saving money is no different. Many of us may be saving money, but without guidelines on how to do it well. Over the years, I have developed little reminders, or rules if you like, to ensure I am always saving money and growing my net worth.

How many times did Allen pitch in the postseason?

In Allen's 10 postseason appearances, he pitched more than an inning six times. Miller pitched more than one inning in all 10 of his appearances. Miller was the superweapon -- Francona used him at various times in the fifth, sixth, seventh, eight and ninth innings.

What is the exception to the rule for a pitcher to save?

Exception 1: A relief pitcher does qualify for a save if he comes in with a two-run lead in the final inning and pitches a perfect inning. Exception 2: A relief pitcher does qualify for a save if he come in with a three-run lead and pitches two or more innings and finishes the game without giving up the lead.

What did Holtzman develop through his developing years?

What Holtzman had developed through his developing years was an instinct for a fight and a furious sense of right and wrong. In later years, for instance, he would rail against the correction of historic baseball stats. To him, the numbers had become canonized, they were supposed to be left alone.

How many straight outs can a pitcher get with a two run lead?

Also a pitcher could get eight straight outs with a two-run lead and not get a save, while a pitcher could pitch "effective" baseball for three innings with a 20-run lead and get the save. That version only lasted one year. Then, finally, in 1975, the modern save rule was put into place:

How many seasons did baseball keep the save rule?

Baseball stuck with this rule for five seasons. Then in 1974, the rule was changed -- but still not to the rule we know today. The 1974 version of the save rule stated that for a pitcher to get a save he had to either. 1. Enter a game with the tying or go ahead run on the bases or at the plate and preserve the lead. 2.

Did Holtzman explain the save rule?

Holtzman only rarely explained his rules for the save -- after doing it a couple of times, he expected his readers to know it. He felt like his save rule was so simple and logical that it sold itself. It was a two-part rule, with two exceptions to the second part.

What happened after the 1968 season?

After the 1968 season, the famed Year of the Pitcher, there was a bit of a panic that baseball was losing its mojo. Rules were changed and amended in a furious attempt to pump some life back into the game. Mounds were lowered. The strike zone was adjusted. Talk of a designated hitter began.

What is the 50/15/5 rule?

Does anyone like that word? How about this instead—the 50/15/5 rule? It’s our simple rule of thumb for saving and spending: allocating no more than 50% of take-home pay to essential expenses, 15% of pretax income to retirement savings, and 5% of take-home pay to short-term savings. (Your situation may be different, but you can use our rule of thumb as a starting point.)

What are the expenses of a home?

Some expenses simply aren’t optional—you need to eat and you need a place to live. Consider allocating no more than 50% of take-home pay to “must-have” expenses, such as: 1 Housing—mortgage, rent, property tax, utilities (electricity, etc.), homeowner’s/renter’s insurance, and condo/home association fees 2 Food—groceries only; do not include takeout or restaurant meals, unless you really consider them essential, i.e., you never cook and always eat out 3 Health care—health insurance premiums (unless they are made via payroll deduction) and out-of-pocket expenses (e.g., prescriptions, co-payments) 4 Transportation—car loan/lease, gas, car insurance, parking, tolls, maintenance, and commuter fares 5 Child care—day care, tuition, and fees 6 Debt payments and other obligations—credit card payments, student loan payments, child support, alimony, and life insurance

Why is it important to save for retirement?

It’s important to save for your future—no matter how young or old you are. Why? Pension plans are rare. Social Security probably won’t provide all the money a person needs to live the life he or she wants in retirement. In fact, we estimate that about 45% of retirement income will need to come from savings. That’s why we suggest people consider saving 15% of pretax household income for retirement. That includes their contributions and any matching or profit sharing contributions from an employer.

What to do with a sufficient emergency fund?

Once a sufficient emergency fund is in place, it’s a good idea to turn to saving for short-term expenses that pop up unexpectedly. Who hasn’t been invited to a wedding—or several? Cracked the screen on a smartphone? Gotten a flat tire? Setting aside 5% of monthly pay can also help with these “one-off” expenses.

How much of your take home pay should you allocate to essential expenses?

Allocating no more than 50% of take-home pay to essential expenses. Trying to save 15% of pretax income (including employer contributions) for retirement. Keeping 5% of take-home pay in short-term savings for unplanned expenses.

Why is it important to keep expenses below 50%?

Keeping it below 50%: Just because some expenses are essential doesn’t mean they’re not flexible. Small changes can add up, such as turning the heat down a few degrees in the winter (and up in the summer), buying—and stocking up on—groceries when they are on sale, and bringing lunch to work .

What is a high deductible health plan?

Consider a high-deductible health plan (HDHP), with a health savings account (HSA) to reduce health care costs and taxable income. If you need to significantly reduce your living expenses, consider a less expensive home or apartment. There are many other ways you can save.

How to stop getting stuck in a debt cycle?

Pay off the most damaging debt first , and then concentrate on paying off the rest as quickly as possible to stop yourself getting stuck in a damaging cycle of paying-off only the interest, without making a dent in the debt itself.

What is the 70/20/20/20 rule?

The 70/20/10 rule and how it can help you save. The 50/30/20 rule is a well established savings rule first put forward by American senator, Elizabeth Warren. However, many people feel that although it is simple in its premise, it’s actually far too ambitious to live on unless you earn a substantial income. Because of this, there are still ...

What is living expenses?

Living expenses are everything from; rent, to bills, to nights out, to petrol for your car. In short, everything it takes to get you from one end of the month to the other. By putting everything that it takes to “live” into one category you are creating a simple structure for yourself to build your savings around.

What is 20% savings?

Savings: 20%. Savings are (obviously) money you put aside for the future. 20% of your net salary should go towards these. Remember, though, that although this category puts savings all together into one, that there are actually a number of different savings you should be making.

What does it mean to put 50/30/20 in one category?

It also means that you don’t need to choose between “needs” and “wants” like you do with the 50/30/20 rule. By putting it all together in one category you are giving yourself permission to take control over what you spend your living allowance on without added unnecessary strings.

Can you save small amounts in oval?

However, if you start to set up a savings step in Oval, you will see that saving small amounts at a time can lead to great results.

Does oval provide financial advice?

Oval does not provide financial advice. If you need further information we suggest you look for expert advice.

What is the personal savings rate for 2019?

The personal savings rate in 2019 was 7.6%, down from 11% in 1960. The 50-20-30 rule is intended to help individuals manage their after-tax income, primarily to have funds on hand for emergencies and savings for retirement. Every household should prioritize creating an emergency fund in case of job losses, unexpected medical expenses, ...

What is the first allocation of additional income to replenish an emergency fund account?

If emergency funds are ever used, the first allocation of additional income should be to replenish the emergency fund account. Savings can also include debt repayment. While minimum payments are part of the "needs" category, any extra payments reduce the principal and future interest owed, so they are savings.

Why should every household have an emergency fund?

Every household should prioritize creating an emergency fund in case of job losses, unexpected medical expenses, or any other unforeseen monetary cost. If an emergency fund is used, then a household should focus on replenishing it. Saving for retirement is also a critical step as individuals are living longer.

What is the debt rule?

The rule is a template that is intended to help individuals manage their money and save for emergencies and retirement. Americans have significantly high debt levels, totaling $14.3 trillion as of March 2020.

What should half of your income be after taxes?

Half of your after-tax income should be all that you need to cover your needs and obligations. If you are spending more than that on your needs, you will have to either cut down on wants or try to downsize your lifestyle, perhaps to a smaller home or more modest car. Maybe carpooling or taking public transportation to work is a solution, or cooking at home more often.

What is a rule in retirement?

The rule is a template that is intended to help individuals manage their money and save for emergencies and retirement.

Is debt repayment considered savings?

Savings can also include debt repayment. While minimum payments are part of the "needs" category, any extra payments reduce the principal and future interest owed, so they are savings.

How many days to save money?

Thirty days is an ideal time frame to challenge yourself to save as much money as you can. Here are a few 30 day savings challenges you may want to consider in addition to the 30 day savings rule.

What is the 30 Day Impulse Spending Rule?

We all get tempted by impulse purchases. Perhaps you walk into a store and see something you’d like to buy. Or, maybe you come across an intriguing ad for a new product or service you want to try out.

How to make saving money easier?

So, what can you do to make saving money easier? For starters, you may want to consider the 30 day savings rule , a popular method to help you set aside more money. Here’s how it works: Instead of making an unplanned impulse purchase, you instead shelf that potential purchase for 30 days and deposit the money into your savings account instead. If you still want to buy that item after the 30 day period is up, go for it. Otherwise, the money stays in your savings account. This, in turn, will help you boost your savings over time.

How to avoid impulse purchases?

To avoid an impulse purchase, tell yourself you’re going to think about it for 30 days. Take a piece of paper and write down the name of the item, service, etc., where you found it, and how much it costs. Put this note on your fridge or somewhere prominent in your home. Commit to thinking about the purchase for the next 30 days. Consider if it’s a true need or want.

What happens if you buy something after 30 days?

If you still want to buy that item after the 30 day period is up, go for it. Otherwise, the money stays in your savings account. This, in turn, will help you boost your savings over time. But even before implementing the 30 day savings rule, it’s important to understand the 30 day impulse spending rule. Read on to learn more.

How to do 30 day savings?

How the 30 Day Savings Rule Ties In. While you’re thinking about your impulse purchase for the 30 day period, start placing money into a savings account. This is money that you would have spent on the purchase. If you decide to make the purchase, you can take the money out to do so. But, that money will come out of your savings account – meaning it ...

How to increase savings?

If you want to increase your savings, consider saving as often as you spend money. Every time you make a purchase, set aside a small amount of money to save. Saving your spare change may not sound like much, but it can certainly add up over time.