See more

How old was John Bogle?

89 years (1929–2019)John C. Bogle / Age at death

When did Jack Bogle retire?

Nevertheless, Mr. Bogle, to use a pet phrase, “pressed on regardless.” After retiring as Vanguard's chairman and CEO in 1996 and its senior chairman in 2000, he became president of the Bogle Financial Markets Research Center, quartered in the Victory Building on the Vanguard campus.

Is Jack Bogle of Vanguard still alive?

January 16, 2019John C. Bogle / Date of death

Who is the largest shareholder of Vanguard?

BlackRock Fund AdvisorsTop 10 Owners of American Vanguard CorpStockholderStakeShares ownedBlackRock Fund Advisors13.69%4,219,499Dimensional Fund Advisors LP7.51%2,312,686The Vanguard Group, Inc.5.65%1,741,890T. Rowe Price Associates, Inc. (I...4.77%1,468,7866 more rows

What was Jack bogles net worth?

about $80 millionBogle's net worth was about $80 million when he died, a fraction of what his peers in finance had amassed.

Is BlackRock better than Vanguard?

BlackRock manages nearly $10 trillion in investments. Vanguard has $8 trillion, and State Street has $4 trillion. Their combined $22 trillion in managed assets is the equivalent of more than half of the combined value of all shares for companies in the S&P 500 (about $38 trillion).

What was Jack Bogle worth when he died?

$80 million“Jack” Bogle died this week at the age of 89. While his personal fortune was valued at a whopping $80 million and “he regularly gave half his salary to charities,” the New York Times reports, he wished he had done one thing differently.

Who is Vanguard owned by?

Vanguard is owned by the funds managed by the company and is therefore owned by its customers. Vanguard offers two classes of most of its funds: investor shares and admiral shares.

Where was John Bogle born?

Early life and education. John Bogle was born on May 8, 1929, in Montclair, New Jersey to William Yates Bogle, Jr. and Josephine Lorraine Hipkins. His family was affected by the Great Depression.

What did Bogle do after graduating from Princeton?

After graduating from Princeton, Bogle narrowed his career options to banking and investments. He was hired at Wellington Fund and promoted to an assistant manager position in 1955, where he obtained a broader access to analyze the company and the investment department. Bogle demonstrated initiative and creativity by challenging the Wellington management to change its strategy of concentration on a single fund, and did his best to make his point in creating a new fund. Eventually, he succeeded, and the new fund became a turning point in his career. After successfully climbing through the ranks, in 1970 he replaced Morgan as chairman of Wellington, but was later fired for an "extremely unwise" merger that he approved. It was a poor decision that he considers his biggest mistake, stating, "The great thing about that mistake, which was shameful and inexcusable and a reflection of immaturity and confidence beyond what the facts justified, was that I learned a lot."

What did Bogle argue for?

Bogle argued for an approach to investing defined by simplicity and common sense. Below are his eight basic rules for investors:

What did Bogle do at Princeton?

In 1947, Bogle graduated from Blair Academy cum laude and was accepted at Princeton University, where he studied economics and investment. During his university years, Bogle studied the mutual fund industry.

Why is Bogle important?

Bogle believed this is an important analysis to be taken into account as short-term, risky investments have been flooding the financial markets. Bogle was known for his insistence, in numerous media appearances and in writing, on the superiority of index funds over traditional actively managed mutual funds.

What was Bogle's thesis?

Bogle spent his junior and senior years working on his thesis "The Economic Role of the Investment Company". Bogle graduated magna cum laude from Princeton in 1951 and was soon hired by Walter L. Morgan, reportedly as a result of Morgan reading his 130-page thesis paper.

When did Bogle have a heart transplant?

Bogle, who was then 66 and "considered past the age for a healthy heart transplant", had a successful heart transplant in 1996. His subsequent return to Vanguard with the title of senior chairman led to conflict between Bogle and Brennan.

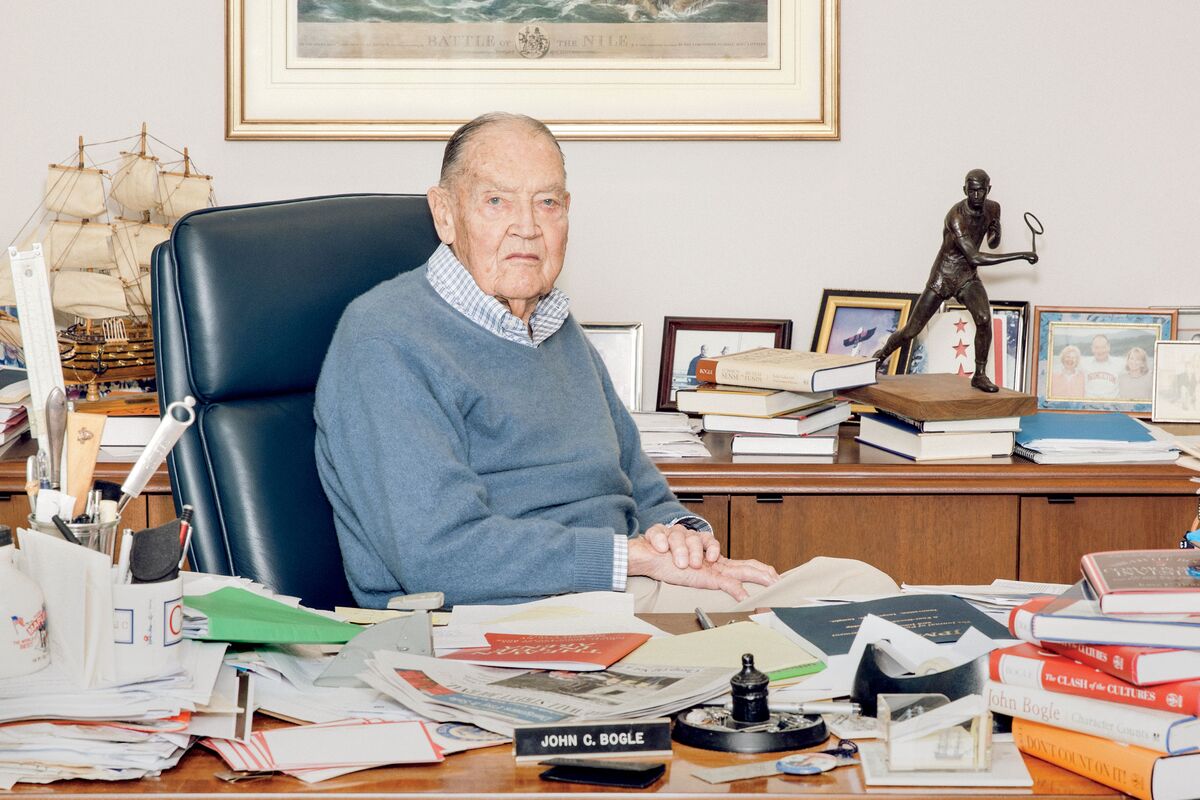

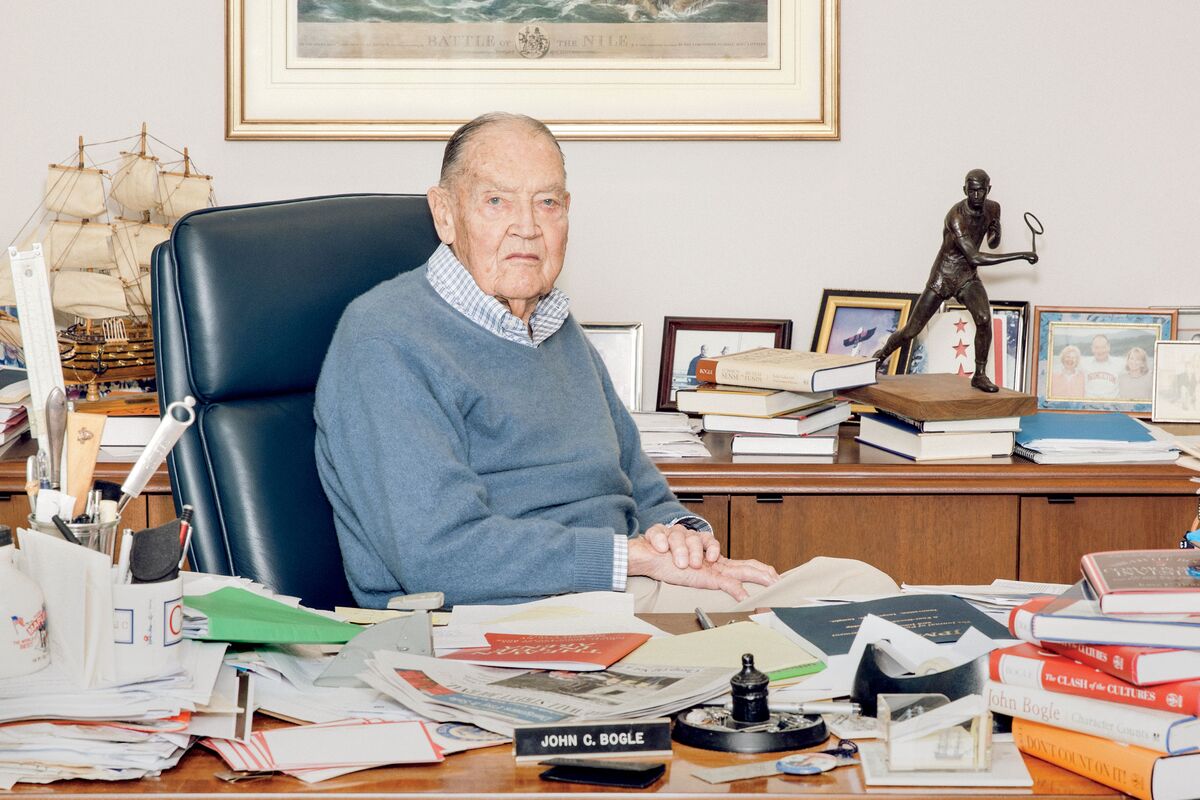

The George Washington Of Investing Wants You For The Revolution

To see the impact he has had, you need to look no further than your own retirement account — chances are you have more money in there because of Bogle.

3 Investment Gurus Share Their Model Portfolios

"We live in this mythical world where we kind of believe the American way is if you try harder, you will do better — that if you pay a professional to do something, it will pay off," Bogle told NPR in 2015. "And these things are true — except in investing!"

Your Cheat Sheet For Smarter Investing

Investing that way can be 10 to 20 times cheaper than traditional mutual funds with high fees. And Bogle showed with the index fund approach you're much more likely to make more money over time.

How To Not Run Out Of Money In Retirement

Buffett invited Bogle there to honor him. "I estimate that Jack at a minimum has left in the pockets of investors, he's put tens and tens of billions into their pockets and those numbers are going to be hundreds of billions over time," Buffett said. He called Bogle a "hero."

Who is John Bogle?

John Bogle, investing pioneer and founder of Vanguard Group, who brought index funds to millions of investors, dies at age 89, the company says

When did John Bogle retire?

He stepped down as senior chairman in 2000, but remained a critic of the fund industry and Wall Street, writing books, delivering speeches and running the Bogle Financial Markets Research Center.

What degree did Bogle get?

Bogle graduated from Princeton with a degree in economics in 1951. His thesis was on the mutual fund industry, which was then still in its infancy.

When did Bogle invent index funds?

Bogle did not invent the index fund, but he expanded access to no-frills, low-cost investing in 1976 when Vanguard introduced the first index fund for individual investors, rather than institutional clients.

Where did Bogle work?

Bogle spent the first part of his career at Wellington Management Co., a mutual fund company, then based in Philadelphia. He rose through the ranks and, in his mid-30s, was tapped to run Wellington.

Where was John Clifton Bogle born?

John Clifton Bogle was born in May 1929 in Montclair, New Jersey, to a well-off family; his grandfather founded a brick company and was co-founder of the American Can Co. in which his father worked.

How did Vanguard die?

Vanguard did not provide a cause of death. Philly.com is reporting he died of cancer, citing Bogle's family.

What is Jack Bogle's legacy?

Bogle's best-known legacy is the index fund, a low-cost, diversified way to hold stocks or bonds. In an unpredictable market, few investment managers are able to consistently leave their customers, rather than themselves, better off. Jack Bogle could be said to be an exception: Compared to traditionally managed funds, index mutual funds as group save their owners billions per year in the fees deducted from returns.

When did Bogle retire?

Bogle retired as Vanguard’s CEO in 1996, but maintained an office at the company’s suburban Philadelphia campus and a busy writing and speaking schedule. His zeal for plugging the virtues of indexing and low-cost investing—and his attacks on other managers’ fees—earned him the (sometimes grudging) nickname “Saint Jack.”

Why did Bogle start the Vanguard index fund?

In fact, in Bogle’s own account, he first launched the index fund in part because it provided a contractual loophole. The Vanguard Group was born out of a battle for control for the Wellington family of mutual funds. Bogle had been fired as CEO of Wellington Management Company in 1974, but then convinced the directors of the funds to let his new company take over the back-office administration. Vanguard wasn’t supposed to manage any money on its own--but Bogle launched the index fund arguing that indexing didn’t count as managing money. The fund wasn’t picking stocks, after all. “Disingenuous, let’s call it,” he said. “But true.”

What is Bogle's thesis?

He wrote his Princeton University senior thesis on the fund industry in 1951, when it ran about $3 billion. Funds now have $18 trillion under management and, with the decline in traditional pensions, have become a cornerstone Americans’ retirement. But Bogle noted with frustration that average expense ratio generally rose as the industry grew, instead of being cut down by competition. (They did finally begin to decline after 2000, thanks in part to index funds.) “We thought mutual fund managers would be able to do better, and I think they let us down badly,” said Bogle.

What was Bogle's design for Vanguard based on?

Bogle’s design for Vanguard was based on a deeply critical, even angry, view of the financial-services business. He pointed to how the profit motive at most fund companies could put their interests in conflict with those of fund buyers. “This is a marketing, profit-making and profit-seeking business,” he said, “in which the game is to maximize return on the manager’s capital, not the investor’s capital.”

Was Jack Bogle an activist?

Bogle was not an activist but an entrepreneur. He could say that “I think capitalism has failed us the broader sense, and I think capitalism has to change.” Yet he still believed that efficiently-managed, low-cost funds could give investors and savers what he called their “fair share” in the growth of public companies. Jack Bogle did not think very highly of the financial industry; ironically, that’s what helped him to recognize and popularize one of finance’s best ideas.

How old was Jack when he had his heart transplant?

Jack was 83 then. Sixteen years earlier, after six heart attacks, he’d had a heart transplant. That was no secret. “I’ve got a young man’s heart,” he would say. “It’s wonderful.”. But now, Jack told me that his body periodically reacted against the heart, and that he sometimes needed urgent treatment.

Did Jack ask me to reveal his weakness?

After a few minutes, he faltered, and we agreed to resume the conversation a week or two later. Jack asked me not to reveal that stretch of weakness and hospitalization — or other bouts that occurred later — and I didn’t, while he was alive.

Was Jack Bogle a billionaire?

Vanguard’s Jack Bogle Wasn’t a Billionaire. He Was Proud of That. - The New York Times

Where did Bogle study economics?

Bogle, who was born in Montclair, New Jersey, on May 8, 1929 – just five months before the 1929 stock market crash – studied economics at Princeton University, where in 1951 he "hinted at the idea" of an index fund in his senior year thesis. That paper stressed that funds must operate in "the most efficient, economical, and honest way possible," Bogle recalled in an essay delivered at a Morningstar conference in April 2017

What did Bogle advise investors to do?

Bogle regularly renounced speculation and advised small investors to stay patient and invest for the long term in low-cost funds that best positioned them to take advantage of the profitability and innovation of American companies.

John Bogle Death

John passed away on January 16, 2019 at the age of 89 in Bryn Mawr, Pennsylvania, USA.

John Bogle Birthday and Date of Death

John Bogle was born on May 8, 1929 and died on January 16, 2019. John was 89 years old at the time of death.

John Bogle - Biography

John Clifton "Jack" Bogle, who preached buy and hold investing, was considered one of the world’s greatest investors. His index mutual fund enabled investors to achieve high returns but at lower costs than for actively managed funds. He was the founder and chief executive of The Vanguard Group, and is credited with creating the first index fund.

Overview

John Clifton "Jack" Bogle (May 8, 1929 – January 16, 2019) was an American investor, business magnate, and philanthropist. He was the founder and chief executive of The Vanguard Group, and is credited with creating the first index fund. An avid investor and money manager himself, he preached investment over speculation, long-term patience over short-term action, and reducing brok…

Early life and education

John Bogle was born on May 8, 1929, in Montclair, New Jersey, to William Yates Bogle, Jr. and Josephine Lorraine Hipkins.

His family was harmed by the Great Depression. They lost their money and had to sell their home, with his father falling into alcoholism, which resulted in his parents' divorce.

Bogle and his twin, David, attended Manasquan High School near the New Jersey shore for a time…

Investment career

After graduating from Princeton, Bogle sought a position in banking or investments. Hired by Morgan at the Wellington Fund, Bogle was promoted to assistant manager in 1955, at which time he was able to analyze the company and its investment department. Bogle persuaded the Wellington management to change its strategy of concentration on a single fund and create a new fund. Eventually he succeeded, and the new fund became a turning point in his career. After suc…

Investment philosophy

Bogle's innovative idea was creating the world's first index mutual fund in 1975. Bogle's idea was that instead of beating the index and charging high costs, the index fund would mimic the index performance over the long run—thus achieving higher returns with lower costs than the costs associated with actively managed funds.

Bogle's idea of index investing offers a clear yet prominent distinction between investment and s…

Personal life

Bogle married Eve Sherrerd on September 22, 1956, and had six children: Barbara, Jean, John Clifton, Nancy, Sandra, and Andrew. They resided in Bryn Mawr, Pennsylvania.

At age 31, Bogle suffered from his first of several heart attacks, and at age 38, he was diagnosed with the rare heart disease arrhythmogenic right ventricular dysplasia. He received a heart transplant in 1996 at age 66.

Philanthropy

During his high-earning years at Vanguard, he regularly gave half his salary to charity, including Blair Academy and Princeton. In 2016, the Bogle Fellowship was established at Princeton University by John C. Bogle Jr, Bogle's son. The fellowship sponsors 20 first year students in each class.

Awards and honors

• Named one of the investment industry's four "Giants of the 20th Century" by Fortune magazine in 1999.

• Awarded the Woodrow Wilson Award from Princeton University for "distinguished achievement in the Nation's service" (1999).

• Named one of the "world's 100 most powerful and influential people" by Time magazine in 2004.

Bibliography

• Bogle on Mutual Funds: New Perspectives for the Intelligent Investor (McGraw-Hill, 1993), ISBN 1-55623-860-6

• Slater, Robert. The Vanguard Experiment: John Bogle's Quest to Transform the Mutual Fund Industry. Chicago, IL: Irwin Professional Publishing, Inc., 1997.

• Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor (John Wiley & Sons, 1999), ISBN 0-471-39228-6

A Counterintuitive Idea

Indexing's Growth

- Vanguard is now a giant asset manager, with over $5 trillion in customer accounts. Its Total Stock Market index fund, a broader portfolio which includes smaller companies in addition to blue chips, has over $600 billion in assets as of January. As a group, index funds are nearly half of the assets held in U.S. stock mutual funds, and they are a staple of 401(k) retirement plans. Little wonder: A…

'At Cost'

- Much more important than indexing to Bogle was the Vanguard Group’s business structure. The company was owned, indirectly, by its own clients, the mutual fund shareholders. It was, and remains, an unusual way to run a fund company. “Where the hell are the other Vanguards?” Bogle would ask. “We’ve yet to find our first follower.” Bogle’s design for Vanguard was based on a dee…

Keeping Costs Down

- But even after Bogle’s departure, Vanguard has in fact kept its costs low. According to the company, its average expense ratio is 0.11%, compared with just over 0.6% for the industry. That’s not just because of index funds: Vanguard runs a number of popular active funds, including the original Wellington fund, priced at 0.25%. Costs may seem a persnickety worry, but Bogle unders…

Crusader For Investors

- Bogle’s long career coincided with the explosive growth in the money management industry. He wrote his Princeton University senior thesis on the fund industry in 1951, when it ran about $3 billion. Funds now have $18 trillion under management and, with the decline in traditional pensions, have become a cornerstone Americans’ retirement. But Bogle noted with frustration th…