How do I speak to a live person at the IRS about my refund?

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040. Customer service representatives are available Monday through Friday, 7 a.m. to 7 p.m. local time, unless otherwise noted (see telephone assistance for more information).

How do I speak to a IRS agent in 2022?

Call the IRS at 844-545-5640 and make an appointment early on.

How do I get someone on the phone at the IRS?

Many of these services are available 24 hours a day, seven days a week. Copies of forms, publications and other helpful information are also available around-the-clock at the IRS Web site at www.irs.gov. You can call 1-800-829-1040 to get answers to your federal tax questions 24 hours a day.

Why won't the IRS answer the phone?

If the IRS needs more information, you will receive a letter in the mail with the request. Because of the COVID-19 situation, the IRS has temporarily suspended phone services until further notice. This suspension doesn't affect online services, refunds, or stimulus payments.

What is the best time to call the IRS?

Call at the best time. A good rule of thumb: Call as early in the morning as possible. Phones are open from 7 a.m. to 7 p.m. (your local time) Monday to Friday, except: Residents of Hawaii and Alaska should follow Pacific time. Puerto Rico hours are 8 a.m. to 8 p.m. local time.

Who do you call if you have not received your tax refund?

800-829-1954How do I get a new one? If you lost your refund check, you should initiate a refund trace: Call us at 800-829-1954 (toll-free) and either use the automated system or speak with an agent. However, if you filed a married filing jointly return, you can't initiate a trace using the automated systems.

What is the average wait time when calling the IRS?

Our representatives must verify your identity before discussing your personal information. Telephone service wait times can average 13 minutes. Some telephone service lines may have longer wait times.

What phone number is 800-829-0922?

How to contact IRS customer serviceTOPICIRS PHONE NUMBERBalance due questions800-829-0922; 800-829-7650; 800-829-3903Taxpayer Advocate Service877-777-4778Self-employed taxpayers with account or tax law questions800-829-4933Missing child tax credit payments800-908-418437 more rows

What phone number is 800 829 0922?

How to contact IRS customer serviceTOPICIRS PHONE NUMBERBalance due questions800-829-0922; 800-829-7650; 800-829-3903Taxpayer Advocate Service877-777-4778Self-employed taxpayers with account or tax law questions800-829-4933Missing child tax credit payments800-908-418437 more rows

Can you chat with an IRS agent?

IRS unveils voice and chat bots to assist taxpayers with simple collection questions and tasks; provides faster service, reduced wait times.

How do I speak to someone at the IRS 2022 Reddit?

– How to talk live to a representative. Dial 800-829-1040 ~ Press 1 (English) ~ Press 2 ~ then 1 ~ then 3 ~ then 2… then enter the PRIMARY (whose listed 1st on your return) Social Security number…it will confirm the correct entry… After that…DO NOT PUSH ANY MORE OPTION BUTTONS…you will be connected to an agent shortly.

Why is my refund still processing?

Reasons Your Tax Refund Can Be Delayed Missing information. A need for additional review. Possible identity theft or tax fraud. A claim for an earned income tax credit or an additional child tax credit.

What is the IRS phone number?

IRS Phone Number: Customer Service and Human Help. The main IRS phone number is 800-829-1040, but these other IRS phone numbers could also get you the help you need. Many or all of the products featured here are from our partners who compensate us.

How to find IRS tax help number?

To see their local addresses and phone numbers, click on your state on the list of Taxpayer Assistance locations. Note: you can’t just show up at a local IRS office any time. You have to make an appointment. That IRS number is 844-545-5640.

What time do you call the IRS?

You're welcome to call the main IRS number (Monday through Friday, 7 a.m. to 7 p.m. local time), but one of these lesser-known IRS phone numbers might get you help faster.

What is tax evasion?

Here's where to get free tax software, free tax preparation and free tax help this year. Tax evasion means concealing income or information from tax authorities — and it's illegal. Tax avoidance means legally reducing your taxable income.

Is the IRS recalling workers?

However, the IRS has been recalling workers in phases. For questions that aren't about stimulus checks, you can also try calling the Taxpayer Advocate Service, which is an independent organization within the IRS set up to help taxpayers work with the IRS. You can see the phone numbers for Taxpayer Advocate offices here.

How to contact the Bureau of Fiscal Service for refunds?

For more information on these non-IRS refund offsets, you can call the Bureau of the Fiscal Service (BFS) at 800-304-3107 (toll-free). Additional Information: Instructions for Form 9465, Installment Agreement Request (PDF) Subcategory: Refund Inquiries. Category:

What to do if your tax refund exceeds your total?

If your refund exceeds your total balance due on all outstanding tax liabilities including accruals, you'll receive a refund of the excess unless you owe certain other past-due amounts, such as state income tax, child support, a student loan, or other federal nontax obligations which are offset against any refund. For more information on these non-IRS refund offsets, you can call the Bureau of the Fiscal Service (BFS) at 800-304-3107 (toll-free).

What happens if you fail to notify the IRA trustee of the intended year for the deposit?

If you fail to notify the IRA trustee of the intended year for the deposit, the IRA trustee can assume the deposit is for the current year (for example, a refund received in 2021 is deposited as a contribution for 2021 and not for 2020).

How many accounts can I direct deposit my refund into?

Answer: A split refund lets you divide your refund, in any proportion you want, and direct deposit the funds into up to three different accounts with U.S. financial institutions. Use Part I of Form 8888, Allocation of Refund (Including Savings Bond Purchases) to request to have your refund split.

What are some examples of tax refunds that could be decreased?

Examples that could decrease your refund include: Math errors or mistakes; Delinquent federal taxes; State income taxes, child support, student loans or other delinquent federal nontax obligations; and. When the IRS withholds a portion of your refund while further review of an item claimed on your return takes place.

How to trace a refund check?

Answer: If you lost your refund check, you should initiate a refund trace: Call us at 800-829-1954 (toll-free) and either use the automated system or speak with an agent. However, if you filed a married filing jointly return, you can’t initiate a trace using the automated systems.

How long does it take for a bank to recover a tax return?

This allows the IRS to contact the bank on your behalf to attempt recovery of your refund. Banks are allowed up to 90 days from the date of the initial trace input to respond to our request for information. If funds aren't available or the bank refuses to return the funds, the IRS cannot compel the bank to do so.

Why You Would Need to Call the IRS

According to the IRS, the IRS website should be your first resource for help and information because of the sheer volume of calls. The IRS will not address the following issues on the phone:

Prepare Yourself

Before you call, make sure you have all of the information that you need. The agent will ask you for some key pieces of information to verify your identity and continue the phone call. They may also need some information on you to help them find a solution. This information includes:

How Can You Speak Directly With An Agent at the IRS?

Here is our secret, multi-step route to getting transferred to an agent within the IRS customer service line. Please note that the IRS may update their system, and this sequence could change accordingly. Remember that this is only one solution out of many for speaking with an actual person at the IRS.

Other Ways to Reach a Real Person at the IRS

The IRS runs local Taxpayer Assistance Center offices in every state. You can’t just show up at a local IRS office any time, but you must make an appointment ahead of time. That IRS number is 844-545-5640.

Looking for the Stimulus Check Phone Number at the IRS?

There are some great options for finding out information about your stimulus check instead of calling the IRS phone line. The IRS’s purpose-built stimulus check website is an excellent and informative resource if you need to know where your stimulus check is, find out if you’re eligible for one, or check how much you should receive.

Where are my refund checks mailed?

Undelivered Federal Tax Refund Checks. Refund checks are mailed to your last known address . If you move without notifying the IRS or the U.S. Postal Service (USPS), your refund check may be returned to the IRS. If you were expecting a federal tax refund and did not receive it, check the IRS' Where’s My Refund page.

What to do if you believe a deduction was made in error?

If a Deduction Was Made in Error. If you believe that a deduction was an error, contact the agency that said you owed money. Call the Treasury Offset Program at 1-800-304-3107 to locate the agency you need to contact.

How often do you have to update your tax return?

The systems are updated once every 24 hours. You can call the IRS to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system.

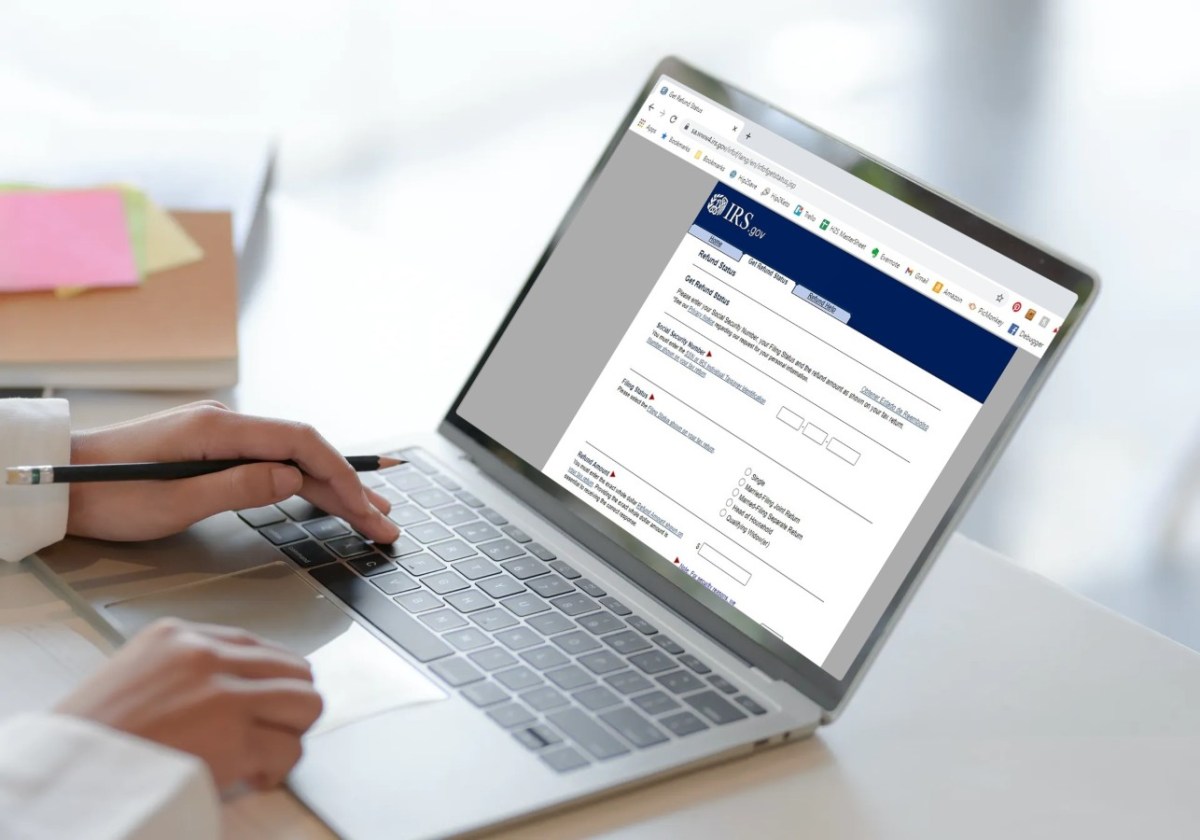

How to check IRS refund status?

You can use the IRS refund tracker to check the status: https://sa.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp

How long does it take to get a refund?

According to the IRS, most refunds are issued in less than 21 days. Paper returns will take longer. Refunds from amended returns take 16 weeks.

What is the number to call to verify identity?

If you receive this letter, call the toll-free IRS Identity Verification telephone number at 800-830-5084. When you call, you must have: This letter.

What documents are needed for each year's tax return?

Any supporting documents for each year’s return, such as Forms W-2 or 1099, Schedules C or F, etc.

What is the IRS phone number for refunds?

If you do not have internet access, call IRS's Refund Hotline at 1-800-829-1954.

How to contact IRS about refund?

If you do not have internet access, call IRS's Refund Hotline at 1-800-829-1954. Caution: Don't count on getting your refund by a certain date to make major purchases or pay other financial obligations. Even though the IRS issued more than 9 out of 10 refunds to taxpayers in less than 21 days, it's possible your tax return may require more review ...

Where's my refund?

Where's My Refund? - One of IRS's most popular online features-gives you information about your federal income tax refund. The tool tracks your refund's progress through 3 stages:

How long does it take to check on your tax return?

It's Fast! - You can start checking on the status of your return sooner - within 24 hours after we receive your e-filed return or 4 weeks after a mailed paper return. It's Up-to Date! - It's updated every 24 hours - usually overnight -- so you only need to check once a day.