What is the Federal Reserve's balance sheet?

The Federal Reserve operates with a sizable balance sheet that includes a large number of distinct assets and liabilities. The Federal Reserve's balance sheet contains a great deal of information about the scale and scope of its operations.

What is the right side of a balance sheet?

The right side of a balance sheet consists of assets & the left side consists of liabilities & equity. Logically, the total of the left side (liabilities & equity) should match with the total of the right side (assets). I’ll explain this matching concept of a balance sheet later in this post.

What is a balance sheet?

What Is a Balance Sheet? A balance sheet is a financial statement that reports a company's assets, liabilities and shareholders' equity at a specific point in time, and provides a basis for computing rates of return and evaluating its capital structure.

Where does $1 500 go on the balance sheet?

Here $ 1,500 will appear on the right side of the balance sheet (under current assets) as trade receivable or accounts receivable or debtors (assuming no other transaction). Tony has been running a small business since past 10 years.

What is a balance sheet?

What is balance sheet calculation?

What is the equation for a balance sheet?

How to find total liabilities?

Why do auditors need a balance sheet?

How often should a business balance sheet be distributed?

How to analyze a company's financial position?

See 2 more

What goes at the top of a balance sheet?

Assets are on the top or left, and below them or to the right are the company's liabilities and shareholders' equity. A balance sheet is also always in balance, where the value of the assets equals the combined value of the liabilities and shareholders' equity.

Where do things go on a balance sheet?

Typically, assets are placed on the left-hand side of the balance sheet and liabilities on the left-hand side. Further, both assets and liabilities are placed in decreasing order of liquidity with equity placed after liabilities.

What are assets on a balance sheet?

An asset is an item that the company owns, with the expectation that it will yield future financial benefit. This benefit may be achieved through enhanced purchasing power (i.e., decreased expenses), revenue generation or cash receipts.

What are the three items in the heading of a balance sheet?

A typical balance sheet contains three core components: assets, liabilities, and shareholder equity.

What comes in assets and liabilities?

In its simplest form, your balance sheet can be divided into two categories: assets and liabilities. Assets are the items your company owns that can provide future economic benefit. Liabilities are what you owe other parties. In short, assets put money in your pocket, and liabilities take money out!

How do you remember the balance sheet format?

All balance sheets comprise your company's assets, liabilities and owners' equity. The common acronym to spur your memory is ALE -- just like the adult beverage of the same name. Assets are the "things" and resources your company owns, including real estate, equipment, contracts and, of course, cash.

What are the 4 categories of assets on a balance sheet?

An asset is a resource owned or controlled by an individual, corporation, or government with the expectation that it will generate a positive economic benefit. Common types of assets include current, non-current, physical, intangible, operating, and non-operating.

What assets are not on the balance sheet?

Off-balance sheet (OBS) assets are assets that don't appear on the balance sheet. OBS assets can be used to shelter financial statements from asset ownership and related debt. Common OBS assets include accounts receivable, leaseback agreements, and operating leases.

What are assets List 5 examples of assets?

Examples of AssetsCash and cash equivalents.Accounts receivable (AR)Marketable securities.Trademarks.Patents.Product designs.Distribution rights.Buildings.More items...•

What are the 5 elements of balance sheet?

The main elements of financial statements are as follows:Assets. These are items of economic benefit that are expected to yield benefits in future periods. ... Liabilities. These are legally binding obligations payable to another entity or individual. ... Equity. ... Revenue. ... Expenses.

What are the 11 assets?

Examples of assets include cash, cash equivalents, machinery, land, securities, property, factory, building, patents, trademarks, licenses, etc.

What things count as assets?

An asset is anything you own that adds financial value, as opposed to a liability, which is money you owe....What's an asset?Your home.Other property, such as a rental house or commercial property.Checking/savings account.Classic cars.Financial accounts.Gold/jewelry/coins.Collectibles/art.Life insurance policies.

What items count as assets?

An asset is something containing economic value and/or future benefit. An asset can often generate cash flows in the future, such as a piece of machinery, a financial security, or a patent. Personal assets may include a house, car, investments, artwork, or home goods.

What Is Included in the Balance Sheet?

The balance sheet includes information about a company’s assets and liabilities. Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations.

What is balance sheet used for?

The balance sheet is used alongside other important financial statements such as the income statement and statement of cash flows in conducting fundamental analysis or calculating financial ratios.

Why is a balance sheet important?

The balance sheet is an important document for investors and analysts alike. For related insight on balance sheets, investigate more about how to read balance sheets, whether balance sheets always balance and how to evaluate a company's balance sheet .

What are intangible assets?

Intangible assets include non-physical (but still valuable) assets such as intellectual property and goodwill. These assets are generally only listed on the balance sheet if they are acquired, rather than developed in-house. Their value may thus be wildly understated (by not including a globally recognized logo, for example) or just as wildly overstated.

What happens if a company takes $8,000 from investors?

If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholders' equity. All revenues the company generates in excess of its expenses will go into the shareholders' equity account.

What is the purpose of income statement and statement of cash flows?

The income statement and statement of cash flows also provide valuable context for assessing a company's finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet .

What do fundamental analysts use to calculate financial ratios?

Fundamental analysts use balance sheets to calculate financial ratios.

What is balance sheet 2021?

A company's balance sheet, also known as a "statement of financial position," reveals the firm's assets, liabilities and owners' equity (net worth). The balance sheet, together with the income statement and cash flow statement, make up the cornerstone of any company's financial statements .

How are assets and liabilities organized?

The assets and liabilities sections of the balance sheet are organized by how current the account is. So for the asset side, the accounts are classified typically from most liquid to least liquid. For the liabilities side, the accounts are organized from short to long-term borrowings and other obligations.

What is the difference between assets and liabilities?

Assets = Liabilities + Shareholders' Equity. This means that assets, or the means used to operate the company, are balanced by a company's financial obligations, along with the equity investment brought into the company and its retained earnings.

What is account receivable?

Accounts receivables consist of the short-term obligations owed to the company by its clients. Companies often sell products or services to customers on credit; these obligations are held in the current assets account until they are paid off by the clients.

How many parts are there in a balance sheet?

The balance sheet is divided into two parts that, based on the following equation, must equal each other or balance each other out. The main formula behind a balance sheet is:

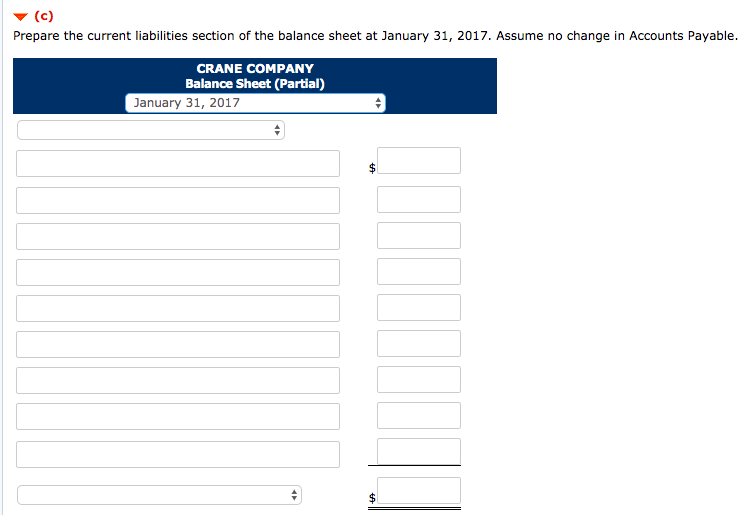

What is current liability?

Current liabilities are the company's liabilities that will come due, or must be paid, within one year. This includes both shorter-term borrowings, such as accounts payables, along with the current portion of longer-term borrowing, such as the latest interest payment on a 10-year loan.

Why do we use activity ratios?

Activity ratios focus mainly on current accounts to show how well the company manages its operating cycle (which include receivables, inventory, and payables). These ratios can provide insight into the company's operational efficiency.

What is the balance sheet of an entity?

The name “Balance Sheet” itself indicates that the total of all assets of an entity should, at any point in time, be equal to the total of equity and liabilities. No matter how many transactions a business undergoes, the two sides of a balance sheet should always tally.

How to calculate equity of a business?

The formula to calculate the equity of a business is. Equity = Total assets –Total liabilities. In other words, equity is the contributions made by the owner (s) of the business to the business. Thus in case of a sole proprietorship business, it represents the sole proprietor’s funds invested in the business.

How much is Tony's salary?

Tony paid salaries to his employees worth $ 5000 for the month of March, 2019 on 2nd April, 2019. In Tony’s business balance sheet (as on 31st March, 2019) this $ 5,000 will be shown as Outstanding salary under current liabilities (assuming there was no previous outstanding salaries pending).

Why is equality between the two sides an eternal truth in accounting?

The equality between these two sides is an eternal truth in accounting because the assets of a business are the resources acquired by it with the help of the funds raised from equity and outside liabilities.

What are assets in business?

Assets are the resources controlled by a business which have monetary value and are expected to give future benefits to the business.

Why is it important to analyze the balance sheet?

The correct analysis of balance sheet is a crucial task of the management and assists in diagonising the problems that the business suffers from and to make informed decisions at right time in order to lead the business successfully.

How long does it take to read a balance sheet?

A balance sheet may look dreadful for a beginner. But, if you understand the concepts well, you can literally read any balance sheet within 10 minutes.

What is a balance sheet?

An accounting balance sheet is a snapshot of your company’s financial situation. It helps with financial planning and allows a business to see the owner’s equity. It’s one of the three fundamental financial statements that every business owner needs to have in order to perform financial modeling and accounting—the other two documents being an income statement and cash flow statement.

What is balance sheet calculation?

According to Harvard University: “A balance sheet is a financial statement that communicates the so-called ’book value’ [assets - liabilities] of an organization, as calculated by subtracting all of the company’s liabilities and shareholder equity from its total assets.”.

What is the equation for a balance sheet?

Practically every balance sheet boils down to the following equation: Assets = Liabilities + Shareholder’s equity. In addition, this equation is tied to a particular date, known as the “reporting date.”. Although it depends on your business, in most cases, a balance sheet should be prepared and then distributed at least on a quarterly basis, ...

How to find total liabilities?

Add up the current liabilities subtotal with the long-term liabilities subtotal to find your total liabilities.

Why do auditors need a balance sheet?

For external auditors, a balance sheet can help them confirm that the company is complying with reporting laws.

How often should a business balance sheet be distributed?

In addition, this equation is tied to a particular date, known as the “reporting date.” Although it depends on your business, in most cases, a balance sheet should be prepared and then distributed at least on a quarterly basis, if not monthly. Larger businesses will often create monthly balance sheets, while small businesses or startups typically create them quarterly.

How to analyze a company's financial position?

At its essence, an accounting balance sheet is one of the most accurate ways to analyze the company’s financial position. When fleshed out, a balance sheet can show you: 1 What the business owns 2 What the business owes 3 How much has been invested into the company

What Is a Balance Sheet?

- The term balance sheet refers to a financial statement that reports a company's assets, liabilitie…

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial rati… - A balance sheet is a financial statement that reports a company's assets, liabilities, and shareho…

The balance sheet is one of the three core financial statements that are used to evaluate a business.

How Balance Sheets Work

- The balance sheet provides an overview of the state of a company's finances at a moment in tim…

Investors can get a sense of a company's financial wellbeing by using a number of ratios that can be derived from a balance sheet, including the debt-to-equity ratio and the acid-test ratio, along with many others. The income statement and statement of cash flows also provide valuable con… - The balance sheet adheres to the following accounting equation, with assets on one side, and li…

This formula is intuitive. That's because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity).

Special Considerations

- As noted above, you can find information about assets, liabilities, and shareholder equity on a co…

Each category consists of several smaller accounts that break down the specifics of a company's finances. These accounts vary widely by industry, and the same terms can have different implications depending on the nature of the business. But there are a few common component…

Components of a Balance Sheet

- Accounts within this segment are listed from top to bottom in order of their liquidity. This is the …

Here is the general order of accounts within current assets: - Cash and cash equivalents are the most liquid assets and can include Treasury bills and short-te…

Marketable securities are equity and debt securities for which there is a liquid market.

Importance of a Balance Sheet

- Regardless of the size of a company or industry in which it operates, there are many benefits of …

Balance sheets determine risk. This financial statement lists everything a company owns and all of its debt. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to mee… - Balance sheets are also used to secure capital. A company usually must provide a balance shee…

Managers can opt to use financial ratios to measure the liquidity, profitability, solvency, and cadence (turnover) of a company using financial ratios, and some financial ratios need numbers taken from the balance sheet. When analyzed over time or comparatively against competing co…

Limitations of a Balance Sheet

- Although the balance sheet is an invaluable piece of information for investors and analysts, ther…

A balance sheet is limited due its narrow scope of timing. The financial statement only captures the financial position of a company on a specific day. Looking at a single balance sheet by itself may make it difficult to extract whether a company is performing well. For example, imagine a c…

Example of a Balance Sheet

- The image below is an example of a comparative balance sheet of Apple, Inc. This balance shee…

In this example, Apple's total assets of $323.8 billion is segregated towards the top of the report. This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts. A brief review of Apple's assets shows that th…

Why Is a Balance Sheet Important?

- The balance sheet is an essential tool used by executives, investors, analysts, and regulators to …

Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. The balance sheet can help users answer questions such as whether the company has a positive net worth, whether it has enough cash and short-term assets to cover its obligations, …

What Is Included in the Balance Sheet?

- The balance sheet includes information about a company’s assets and liabilities. Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities suc…

Who Prepares the Balance Sheet?

- Depending on the company, different parties may be responsible for preparing the balance sheet…

Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. The balance sheets and other financial statements of these companies must be prepared in accordance with Gener…

What Are the Uses of a Balance Sheet?

- A balance sheet explains the financial position of a company at a specific point in time. As oppo…

A bank statement is often used by parties outside of a company to gauge the company's health. Banks, lenders, and other institutions may calculate financial ratios off of the balance sheet balances to gauge how much risk a company carries, how liquid its assets are, and how likely th…

What Is the Balance Sheet Formula?

- A balance sheet is calculated by balancing a company's assets with its liabilities and equity. Th…

Total assets is calculated as the sum of all short-term, long-term, and other assets. Total liabilities is calculated as the sum of all short-term, long-term and other liabilities. Total equity is calculated as the sum of net income, retained earnings, owner contributions, and share of stock issued. - Intrinsic Value vs. Current Market Value: What's the Difference?

Market Capitalization: How Is It Calculated and What Does It Tell Investors?

Overview

- A company's balance sheet, also known as a "statement of financial position," reveals the firm's …

If you are a shareholder of a company or a potential investor, it is important to understand how the balance sheet is structured, how to read one, and the basics of how to analyze it. - The balance sheet is a key financial statement that provides a snapshot of a company's finances.

The balance sheet is split into two columns, with each column balancing out the other to net to zero.

How the Balance Sheet Works

- The balance sheet is divided into two parts that, based on the following equation, must equal ea…

Assets = Liabilities + Shareholders' Equity - This means that assets, or the means used to operate the company, are balanced by a company'…

Assets are what a company uses to operate its business, while its liabilities and equity are two sources that support these assets. Owners' equity, referred to as shareholders' equity, in a publicly traded company, is the amount of money initially invested into the company plus any retained ea…

Types of Assets

- Current assets have a lifespan of one year or less, meaning they can be converted easily into ca…

Cash, the most fundamental of current assets, also includes non-restricted bank accounts and checks. Cash equivalents are very safe assets that can be readily converted into cash; U.S. Treasuries are one such example. - Accounts receivables (AR) consist of the short-term obligations owed to the company by its clie…

Lastly, inventory represents the company's raw materials, work-in-progress goods, and finished goods. Depending on the company, the exact makeup of the inventory account will differ. For example, a manufacturing firm will carry a large number of raw materials, while a retail firm carri…

Types of Liabilities

- On the other side of the balance sheet are the liabilities. These are the financial obligations a co…

Current liabilities are the company's liabilities that will come due, or must be paid, within one year. This includes both shorter-term borrowings, such as accounts payables (AP), which are the bills and obligations that a company owes over the next 12 months (e.g., payment for purchases ma… - The current portion of longer-term borrowing, such as the latest interest payment on a 10-year lo…

Long-term liabilities are debts and other non-debt financial obligations, which are due after a period of at least one year from the date of the balance sheet. For instance, a company may issue bonds that mature in several years' time.

Shareholders' Equity

- Shareholders' equity is the initial amount of money invested in a business. If at the end of the fis…

This account represents a company's total net worth. In order for the balance sheet to balance, total assets on one side have to equal total liabilities plus shareholders' equity on the other side.

How to Read a Balance Sheet

- Below is an example of a corporate balance sheet for Walmart from FY 2022:

As you can see from the balance sheet above, Walmart had a large cash position of $14.76 billion in 2022, and inventories valued at over $56.5 billion. This reflects the fact that Walmart is a big-box retailer with its many stores and online fulfillment centers stocked with thousands of items r…

Analyzing a Balance Sheet with Ratios

- With a greater understanding of a balance sheet and how it is constructed, we can review some …

Financial ratio analysis uses formulas to gain insight into a company and its operations. For a balance sheet, using financial ratios (like the debt-to-equity (D/E) ratio) can provide a good sense of the company's financial condition, along with its operational efficiency. It is important to note … - Looking at Walmart's balance sheet above, we can see that the debt-to-equity ratio for 2022 was:

D/E = Total Liabilities / Total Shareholders' Equity = $152,969 / 83,253 = 1.84.

What Can You Tell From Looking at a Company's Balance Sheet?

- Balance sheets give an at-a-glance view of the assets and liabilities of the company and how they relate to one another. The balance sheet can help answer questions such as whether the company has a positive net worth, whether it has enough cash and short-term assets to cover its obligations, and whether the company is highly indebted relative to its peers. Fundamental analy…

What Are the Main Things Found on a Balance Sheet?

- The balance sheet includes information about a company’s assets and liabilities, and the shareholders' equity that results. These things might include short-term assets, such as cash and accounts receivable, inventories, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable to v…

Does a Balance Sheet Always Balance?

- Yes, the balance sheet will always balance since the entry for shareholders' equity will always be the remainder or difference between a company's total assets and its total liabilities. If a company's assets are worth more than its liabilities, the result is positive net equity. If liabilities are larger than total net assets, then shareholders' equity will be negative.

The Bottom Line

- A balance sheet, along with the income and cash flow statement, is an important tool for investors to gain insight into a company and its operations. It is a snapshot at a single point in time of the company's accounts — covering its assets, liabilities, and shareholders' equity. The purpose of a balance sheet is to give interested parties an idea of the company's financial positi…