The Best Personal Loans Available in the Philippines

- Maybank Personal Loan

- CIMB Bank Personal Loan

- Bank of Makati Power Payday Loan

- EastWest Bank Personal Loan

- China Bank Savings Easi-Funds Personal Loan

- Equicom Savings Bank Personal Loan. Applying for a personal loan is a great financing option if the purpose of getting one is because of a dire need.

Full Answer

Which bank has the lowest personal loan interest rates in the Philippines?

Prepare your loan documents and other requirements and see if you qualify from these banks with the lowest personal loan interest rates in the country. Banco de Oro; Security Bank; EastWest Bank; Rizal Commercial Banking Corporation; Maybank Philippines; Bank of the Philippines Islands; Banco de Oro

What are the different types of OFW loans in Philippines?

1. Home Development Mutual Fund (Pag-IBIG) Loan 2. Social Security System (SSS) OFW Loan 3. Bank of the Philippine Islands (BPI) OFW Loan 4. Security Bank OFW Loan 5. Philippine Savings Bank (PSBank) OFW Loan 6. BDO Unibank (BDO) OFW Loan

What is the best bank in the Philippines?

Best for Expats: Citibank. Best for OFWs: BDO. Best for Students: Bank of the Philippine Islands (BPI).

How can I get a personal loan in the Philippines?

If you have short-term money needs, a personal loan can be the answer. With no collateral needed, you can easily apply for a personal loan at any bank in the Philippines. To learn more about the basics of personal loans, we've compiled this FAQ for your convenience.

Which bank has lowest interest rate Philippines?

One of the best low interest loans in the Philippines is the Maybank Personal Loan, which offers a 1.3% fixed interest rate. You can also borrow up to ₱1 million, depending on your salary and bank approval.

Which bank is best for taking personal loan?

Bank List of Best Personal Loan in IndiaBankInterest Rate (p.a.)Processing FeeHDFC10.25%- 21%Up to 2.50% of loan amountICICI10.50%-19%Up to 2.50% of loan amount + GSTBajaj Finserv13% p.a. onwardsUp to 4% of the loan amount + taxesSBI10.30% - 12.30%1.50% of the loan amount + GST6 more rows•Aug 29, 2022

Which bank is easiest to get a personal loan from?

The easiest banks to get a personal loan from are USAA and Wells Fargo. USAA does not disclose a minimum credit score requirement, but their website indicates that they consider people with scores below the fair credit range (below 640). So even people with bad credit may be able to qualify.

Which bank is cheapest for personal loan?

Comparison of Personal Loan Interest Rates offered by Leading Banks & NBFCsLendersInterest Rate (p.a.)Processing Fee (% of loan amount)State Bank of India10.30%-15.10%Up to 1.5% (Maximum Rs 15,000)HDFC Bank11.00% onwardsUp to Rs 4,999Punjab National Bank9.30% – 15.85%Up to 1%ICICI Bank10.75% onwardsUp to 2.5%35 more rows•5 days ago

Which type of loan is best?

1. Personal loan. A personal loan is one of the most popular types of unsecured loans that offer instant liquidity. However, since a personal loan is an unsecured mode of finance, the interest rates are higher than secured loans.

What is the minimum salary to get personal loan?

When it comes to personal loans, there is no set minimum salary for your application to be approved. Some banks may keep a minimum limit (say Rs. 15,000 – Rs. 20,000 per month).

What is the maximum you can borrow on a personal loan?

Personal loans come in all sizes, with some lenders offering under $100 and others up to $100,000.

What is the easiest way to get a personal loan?

Credit unions, which are now more widely accessible, can be one of your best ways to get a personal loan with lower rates and less rigid credit requirements for members. Credit unions are member-owned nonprofits, so they can be more generous than for-profit lenders when it comes to fees and interest rates.

What's the biggest loan I can get?

The maximum personal loan amount available to the most qualified applicants is $100,000, at least among major lenders. But only a few major lenders even offer the chance of loan amounts as high as $100,000.

How much personal loan can I get if my salary is 40000?

How much personal loan can I get on a ₹40000 salary? According to the Multiplier method, on a salary of ₹40000, you will be eligible for ₹13.50 lakhs for 5 years. Going by the Fixed Obligation Income Ratio method, if you have monthly EMIs of ₹3000, you will be eligible for an amount of ₹8.80 lakhs.

What is a good interest rate on a personal loan?

What is considered a good interest rate on a personal loan? A good interest rate on a personal loan can be different for everyone. Considering that the average borrower qualifies for average loan interest rates between 10 percent and 28 percent, any rate below that threshold should be considered “good.”

How much personal loan can I get if my salary is 15000?

A: A salary of Rs. 15,000 generally falls in the category of a low-income borrower group. So, an instant personal loan app with a maximum approval amount of 1.5 Lakhs can be availed by the borrower with a starting salary of Rs. 15,000.

Who is the best bank to bank with?

Best national banksFinancial institutionInterest rate on savingsMinimum deposit to open savingsBank of America0.01%$100Chase Bank0.01% (Rate effective as of 8/6/21. Interest rates are variable and subject to change.)$0Discover Bank1.80%$0Alliant Credit Union1.70%$5 (deposit made by Alliant)1 more row

Which Indian bank is best?

Ans: HDFC is marked as India's No. 1 Bank in Forbes World's best bank report.

What is a good interest rate on a personal loan?

What is considered a good interest rate on a personal loan? A good interest rate on a personal loan can be different for everyone. Considering that the average borrower qualifies for average loan interest rates between 10 percent and 28 percent, any rate below that threshold should be considered “good.”

Is HDFC Bank Safe?

1) HDFC Bank If market confidence is a measure of the soundness of a Bank, then HDFC Bank takes the cake. At over Rs 11 lakh crore market capitalisation, it tops the chart, even if its assets are just a fifth of the largest Bank in the country.

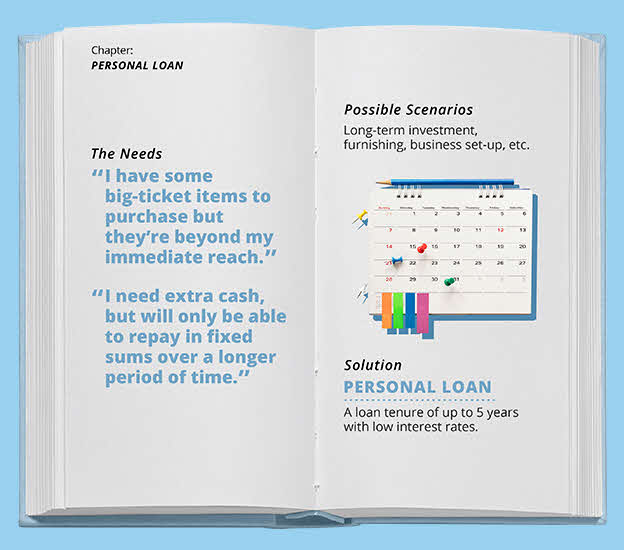

How Do Personal Loans In The Philippines Work?

When you take out a personal loan in the Philippines, you enter into an agreement with the lender (usually a bank) and promise to repay your loan over an agreed length of time (also known as the loan tenure or loan tenor). If you're taking out a secured loan, you will also need to put up a collateral.

What is the interest rate on a personal loan in the Philippines?

While standard monthly interest rates are around 1.5% to 2%, you can get lower deals for more specific types of personal loans like OFW loans or personal loan for business expansion. Depending on the specifications of your needs, you avail the lowest rates on personal loans from these banks.

What Is A Personal Loan?

True to its name, a personal loan is a loan for any personal expense. Unlike a housing loan or a car loan, you can use a personal cash loan for anything you want, be it tuition fees, travel, or anything else.

What Is The Best Place To Get A Personal Loan?

There is a type of personal loan for every financial need. To get the most out of what banks and private lending companies have to offer, applying for a specific personal loan that's appropriate for your needs (starting a business, home renovation, etc) and/or branded for your profession (OFW loan, Doctors loan). This will give you more flexibility to pay back the amount you've borrowed.

What Are The Best Online Loans?

Online loans are rising in the Philippines, and there is now a handful of providers for this type of financial product. There are various types for different needs, which means finding an online cash loan that perfectly fits your needs will depend on how much you need and when you need it. To help you sort out the different online loans in the Philippines and which one may suit you best, we listed them down for you!

How Do I Use A Personal Loan Calculator?

All you have to do is to specify the amount and period you want to clear the payment for it in the available fields. The online calculator will then make it easy for you by providing suitable loan packages that are available on the market, and the monthly amortizations for each one. It is worth noting that the best rates will be featured at the top.

How Can I Get A Loan For OFW?

OFWs who are overseas and are in the Philippines can both apply for a personal loan. However, there are specific types of loans for both conditions.

What are the eligible loan purposes for Citibank?

Travel, home renovation, debt consolidation, emergency loan, business, and education are just some of the eligible loan purpose of Citibank.

What to look for when borrowing money from a financial institution?

Of course, there are other important things to consider, such as loan repayment terms, collateral/guarantor requirements, approval time, and income requirements, among others.

How long does it take to repay a Citibank loan?

You can repay your Citibank personal loan within one (1) to five (5) years of flexible loan terms. The monthly interest rate is at 1.26%.

How long do you have to be in business to be a borrower?

If borrower is a business owner, must have been in business for at least 3 years, and profitable for at least 2 years.

How old do you have to be to get a P250,000?

Age to be eligible must be between 21 to 60 years old. Minimum annual income must be P250,000. For employed: Must be a permanent employee for at least two (2) years. For self-employed: Must have a continuously operating business for three (3) years. For professionals: Must have at least three (3) years of practice.

Can you go wrong with a bank with low interest rates?

In terms of low interest rates, you cannot go wrong with picking one of these six banks

What is the best rural bank in the Philippines?

With these criteria in mind, we’ve chosen One Network Bank (ONB) as the best rural bank in the Philippines.

Which banks work for PayPal?

In my experience as a freelancer, the two best banks that work for PayPal are Security Bank and Unionbank.

What is deposit insurance in the Philippines?

Verifiable deposit insurance. A deposit insurance guarantees that you get back your insured deposits in case the bank fails and closes down. In the Philippines, all deposit accounts are insured with the Philippine Deposit Insurance Corporation for up to Php 500,000 per depositor per bank.

What is the BSP in the Philippines?

The Central Bank of the Philippines or the Bangko Sentral ng Pilipinas (BSP) is the governing body that has been authorized by law, through the provisions of the General Banking Act of 2000 1, to regulate all banks in the Philippines.

Which bank has the largest network of ATMs?

Both BDO and BPI have the largest network of banks and ATMs in the country. Most of these are located within a short distance from schools to make it easier for students to make transactions.

What is a good bank account?

A good bank allows you to do as many transactions in your account without charging you with incurring fees, whether it’s for withdrawing and depositing money or transferring money between checking and savings accounts.

Where do Filipinos store their money?

A lot of Filipinos store their money in banks temporarily and often withdraw them as the need arises.

Why do Filipinos need debt consolidation?

Maintaining a healthy credit record can increase your chances to avail of the best financial product out there, just when you need them most. Debt consolidation is one of the most common reasons why Filipinos apply for personal loan.

What is a BDO loan?

BDO personal loans can be used to pay for home upgrades, education, special events, medical emergencies, debt consolidation, and even furniture and appliances. Personal loan rates depend on tenor. Personal loan for 6 months has a monthly add-on rate of 1.30% while loans payable in 12-36 months has a monthly rate of 1.25%.

What is the monthly rate for a BDO loan?

Personal loan rates depend on tenor. Personal loan for 6 months has a monthly add-on rate of 1.30% while loans payable in 12-36 months has a monthly rate of 1.25%.

How much does EastWest Bank loan?

If you have an existing credit card for at least 12 months, you can borrow money with a monthly rate of 1.49% for 12 months, 1.59% for 18-24 months, and 1.69% for 36 months. If your card is less than 12 months, you will be paying a monthly rate of 1.89% regardless of the loan tenure.

What is the monthly income requirement for BPI?

BPI’s personal loan has a fixed add-on rate of 1.20 per month with a minimum monthly requirement of Php25,000 gross income for locally-employed borrowers. Overseas Filipino Workers (OFWs) should have at least a Php30,000 monthly salary and self-employed individuals should be earning a minimum of Php50,000. BPI does not charge for any disbursement or miscellaneous fees but imposes 5% of the outstanding balance for late payments.

Is Maybank a good loan?

Whether you are planning for local or international travel or you just want to prepare your home for the rainy season, Maybank’s personal loan is a good choice. Affordable and flexible, Maybank’s loans also have a competitive rate of 1.3% per month for both employed and self-employed borrowers.

What is a Bank Loan?

When you get a bank loan, you’re basically borrowing money from a bank of your choice. There are terms and conditions of the loan that you agree on with the bank, and you’d have to pay interest either monthly or annually. These can either be secured (with collateral) or unsecured (no collateral).

Types of Bank Loans in the Philippines

Before applying, always, always look up the different types of loans that are suited to your needs. Here are some of the popular bank loans you can find in the country.

What is the Lending Interest Rate for loans offered by Banks in the Philippines?

The average lending interest rate for banks in the Philippines was 7% in 2019, with the latest report being 6.54% in December of 2019. The BSP did not release data on the lending interest rate for the years 2020-2022.

Pros and Cons of Bank Loans

Low interest rates – Banks are among the institutions able to offer low interest rates due to their high standards for loan approvals and meticulous processes. If you’re one of the lucky few to get one, you can enjoy this for yourself.

Bank Loan Requirements in the Philippines

Before you even think of applying for a bank loan, luv, you need to make sure you are eligible and also have all the requirements that you need to show. This is so banks can gauge your stability and financial capability of paying a loan back. Here are common requirements of traditional banks for borrowing money.

How to Apply for a Personal Loan

Assess your financial capabilities – Again, we want to remind you that a loan is a commitment. So, before anything, you need to check if you’re financially ready for that. Check how much you earn every month and how many expenses you’re accountable for, and then see if a loan is something you can get and responsibly pay off.

Bank Loan FAQs

It would really depend on the type of loan you get, but the lowest amount you can borrow from a bank would be around PHP 20,000 (banks like Citibank and BPI offer loan amounts this low), while the maximum amount is around PHP 2 million.

Which bank offers home loans to OFWs?

Those who are earning P40,000 monthly can apply for Home Loans and those earning P50,000 monthly can apply for Auto Loans. 5. Philippine Savings Bank (PSBank) OFW Loan. Credits: Wikimedia Commons.

How much can I borrow on a BPI loan?

BPI Personal Loan: This loan is unsecured and can be used for any personal expenses. It requires no collateral and can be borrowed up to three times your monthly income. You can borrow up to three times your gross monthly income, or PHP 1,000,000. It is subject to the bank’s approval. If you pay it off early, there are no early termination fees.

How old do you have to be to get a BPI loan?

Moreover, BPI also offers home loans for OFWs who earn a minimum of P40,000 per month. To be eligible for this loan, OFW members must be 21 years old and no more than 60 years old on loan maturity.

What is Metrobank car loan?

Car Loan: Metrobank Car loan is available to individuals with good credit history who are looking to purchase a vehicle or to replace their existing one. The loan amount is usually 75% of the vehicle’s net selling price.

What is a BDO loan?

BDO Personal Loan: This loan is ideal for people who want to pay for various expenses, such as education or home renovation. It has a low interest rate and flexible loan term.

How long is a PBCom loan?

Get a quick response when you apply for a Personal loan with PBCom. This multi-purpose loan allows individuals to borrow up to PHP 1,000,000.00 with a 12-mont h loan term and a maximum loan term of 48 months.

What is the PAG IBIG fund?

The Pag-IBIG Fund is the only government institution that offers affordable housing loans to OFWs, who have contributed for 24 months or more. To avail of a housing loan for OFWs, the borrower should be 65 years old and below, without any outstanding, defaulted, or foreclosed Pag-IBIG loans .

What is a personal loan?

A personal loan is a type of installment loan received in lump-sum amount and repaid with fixed interest rates. Its payment terms can range between 1 to 3 years.

How personal loans work

Most of the loan types we know are reserved for specific uses. A home loan can be used to buy a house, while a car loan can be used to upgrade or buy your first vehicle. You also need collateral to avail of these two loans.

Why should you avail a personal loan?

These are possible reasons why you may be interested to apply for a personal loan:

Five ways to manage debt

People often veer away from having debts as it presents a negative stigma. However Metrobank believes that debt is not something to be scared of, because when managed well, a personal loan can improve the quality of your life.