Should you have an RESP or a TFSA?

Jan 27, 2022 · However the main difference between the TFSA and the RESP is that with the TFSA any money you pull out is completely tax-free, while any withdrawals beyond your contributions pulled out of the RESP are taxed in your child’s hands. You have the freedom with both the RESP and that TFSA to invest in a variety of financial instruments.

What is the difference between a TFSA and an RRSP?

Oct 01, 2021 · With a TFSA, you have the flexibility to withdraw and then re-contribute that amount again the following year. With an RESP, withdrawn contributions are not added back to your contribution room and cannot be re-contributed. If you cannot make an RESP contribution in any given year, you can carry over unused Basic CESG.

Which is better – a TFSA or a group plan?

A TFSA allows you to skip the income tax on that earned interest income in the account and grow your money tax-free. When you use an RESP, you’re also spared from paying annual income tax on any interest, investment income or grants earned in account.

Is a TFSA the best investment?

Which is better TFSA or RESP? “Besides, the investment income generated in the RESP is sheltered from tax anyway so there isn't an advantage to a TFSA. And both accounts use after tax dollars. Unlike an RRSP, there is no deduction.” The other potential downside to an RESP is that once the money is withdrawn it will be taxed.

What are the disadvantages of an RESP?

The biggest disadvantage of an RESP is that any earnings that are withdrawn but not used for post-secondary education incur a twenty percent penalty, and income taxes must be paid on the money.Oct 21, 2019

What is the difference between TFSA and RESP?

With a TFSA, you have the flexibility to withdraw and then re-contribute that amount again the following year. With an RESP, withdrawn contributions are not added back to your contribution room and cannot be re-contributed. If you cannot make an RESP contribution in any given year, you can carry over unused Basic CESG.

Is it better to invest with TFSA?

TFSAs provide the biggest benefit when you put 'high growth' investments inside of your TFSA. Don't be fooled by the name “Tax Free Savings Account” you can put almost any investment inside a TFSA. This includes stocks and bonds. Think of a TFSA like a magic box where taxes don't apply.

What are the pros and cons of a TFSA?

TFSA AdvantagesTFSA Disadvantages1. Tax-Free Investment Income1. TFSA Contributions are Not Tax Deductible2. Easy Withdrawal Process2. No Grace Amount for TFSA Over Contributions3. TFSA Contribution Room is Not Determined By Income3. Withholding Taxes Apply for US Dividends3 more rows

Is RESP a good idea?

RESPs are an excellent way to fund your child's education. Make sure your own finances are in good order and then start contributing.Mar 31, 2011

Is it worth investing in RESP?

So while RRSPs are great for retirement, when you know you'll be in a lower tax bracket, and TFSAs are great for savings goals, since the money you withdraw isn't subjected to taxes, RESPs are great resources for young people starting off in their education and their financial journey.

What are the disadvantages of a TFSA?

CONSYou can't convert existing savings accounts. ... There are limits to how much you can invest. ... Over-investing carries penalties. ... 'Leftover' contributions don't roll over. ... Withdrawals will affect your contribution limits. ... No real benefit if you earn under the tax threshold.Apr 6, 2021

Should I put money into RRSP or TFSA?

TFSA vs RRSP: the comparison. The major difference between RRSP and TFSA accounts centres around tax implications. RRSPs offer a tax deduction when you contribute, but you have to pay tax when you withdraw the money. TFSAs offer no up-front tax break, but you don't pay tax on any withdrawals, including growth.

How much does the average Canadian have in TFSA?

The average value of a tax-free savings account in 2022 is $32,234, according to estimates based on data from Canada Revenue Agency. Total contribution room alone since 2009 introduction of TFSAs amounts to $81,500. As much love as there is for TFSAs, we're not even close to maximizing their benefit.Feb 25, 2022

How risky is TFSA?

Cash Using a TFSA savings account is a low-risk option for investing. Banks in Canada are usually insured by the Canada Deposit Insurance Corporation (CDIC) at no additional cost. Return rates are generally lower but hold no risk.Jan 21, 2020

Can you lose money in a TFSA?

To summarize, yes, you can indeed lose money in your TFSA account. As long as the money you put in your TFSA was yours to begin with, you won't owe anyone money by losing money in your TFSA, but if your portfolio's overall return on investment is negative then you will have less money in your TFSA then you put in.

How much should I put in TFSA?

The annual TFSA dollar limit for the years 2019 to 2021 is $6,000. The TFSA annual room limit will be indexed to inflation and rounded to the nearest $500.

After-Tax Income

The TFSA vs RESP argument is a little easier to digest than the others because both plans use after-tax income.

TFSA Wins When It Comes To Taxation

In terms of taxation, the TFSA wins out again, being that there is no tax owed on money withdrawn from a tax free savings account! That is a pretty great little feature that the RRSP can’t even match (RRSP withdrawals get taxed at your marginal tax rate).

Either Way Both Plans Are Great Investment Vehicles

You can’t go wrong contributing to either registered plan, but to maximize your after-tax returns run the numbers for your specific situation.

How much is the RESP grant?

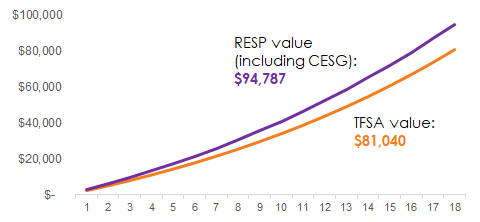

The government also provides education grants of up to $500 annually per potential student – to a lifetime limit of $7,200.

What is the NUS campaign?

File photo dated 16/07/08 of university graduates, as the National Union of Students (NUS) has launched a campaign urging colleges and universities to ban advertising by payday lenders on their campuses. Putting a child through college or university can cripple a parent’s finances.

Is a TFSA a good investment?

TFSAs are a good education-savings option because they provide more flexibility. Parents can now contribute up to $5,500 per year and the money is easy to contribute and to take out. Both moves can also be made tax-free. “You are rewarded for investing well,” says Parlee.

What is the difference between a TFSA and an RRSP?

The “best” investment is going to depend on your individual financial situation and goals. Remember: with a T FSA , you pay tax on money you’ve earned before you make a contribution; and with an RRSP you get a tax refund now on money you contribute, but will have to pay tax later, on money you withdraw from the plan. This difference, along with your income, your investment timeline, and other factors will all contribute to making the right decision for your investment dollars. You may find that you can use both vehicles simultaneously. Read on to learn more.

What is a TFSA?

TFSAs for short or medium term savings goals, like an emergency fund or buying a car. Anytime you make an investment, it’s a good idea to identify exactly what you’re saving for. Putting away money for retirement is usually on a longer timeline than, say, your child’s education fund or a home renovation.

Why is retirement planning important?

Whether on your own or with a professional, retirement planning can help validate your choices and assist you to set targets for the future.

How much money do I need to invest in an RRSP?

As a general rule, those making more than $50,000 annually will do well to invest in an RRSP.

How much can I withdraw from my RRSP?

The Home Buyers Plan (HBP) allows eligible home-buyers to withdraw up to $35,000 from their RRSP to put towards their purchase. The withdrawal is tax-free and must be repaid within 15 years. This is a great way to access a large lump sum, like for a down payment and, though it must be repaid, the “loan” is interest-free.

Is a TFSA withdrawal tax free?

The short answer: Almost always RRSPs (but depends on your income, as covered in section 1) Withdrawals from TFSAs are always tax-free, whether you’re working or retired. Withdrawals from RRSPs are always taxable.

What is RRSP money?

Your RRSP money is earmarked for your retirement. The program is designed so that when you withdraw the money you will be earning less, and therefore in a lower tax bracket and so will pay less overall tax in your lifetime. This works well for its intended purpose but does not help you with short- or medium-term goals.

What is a TFSA in Canada?

Created in 2009, TFSAs are the newest registered account in Canada. Similar to RRSPs, they can hold most investment assets including cash, GICs, mutual funds, stocks and bonds. The income earned in these accounts — bank interest, dividend payments, equities growth, etc. — is completely tax-sheltered. You never pay tax on those earnings. The interest compounds tax-free over time. Unlike RRSPs, you don’t get a tax deduction on contributions, but you also don’t pay income tax when you withdraw funds from your TFSA. Read more about The Best TFSA Investments in Canada.

How long can a child use a RESP?

An RESP can remain open for 35 years, so the child has plenty of time to make use of the money. If they decide to forgo higher learning/training altogether, you will have to pay back any grant money received, but you can transfer the rest to your RRSP if you have contribution room remaining.

How much is the bonus for Wealthsimple?

Here’s an excellent reason to sign-up: those who open a Wealthsimple Trade account will get a $50 cash bonus + $0 commission trades. All you have to do is deposit and trade at least $250. If you sign up for Questrade, you’ll get $50 in free trades as a new customer.

Is it possible to have all your allowable contribution room?

The holy grail of investing is to make use of all your allowable contribution room for all three of these registered accounts. For many, that’s just not possible. Instead, you’ll have to prioritize.

How to grow your savings?

You can grow your savings even further by investing in registered accounts, such as RRSPs, TFSAs and RESPs, as you’ll shelter that income from taxes. Last, but certainly not least, use a low-fee online brokerage or robo advisor to make sure you’re not losing a big chunk of your investment returns to management fees.

Is a job taxable in Canada?

Most income — whether it is from a job, self-employment, pension, bank interest, or investments — is taxable in Canada, with a slice of your earnings going to the government each year. There is a significant exception, however, for income earned on investments held inside a registered account, such as an RRSP, TFSA, or RESP. Think of these accounts as safe tax havens where your savings and investments can compound and grow over time to maximum effect.