Importance of Investment Appraisal

- General Feasibility. A capital investment appraisal will reveal the project's general feasibility. ...

- Alternative Possibilities. A proposed investment almost never exists without alternatives. ...

- Financing. One critical aspect of the investment appraisal assesses capital resources. ...

- Authorization. ...

- Uncertainty. ...

- Strategic Fit. ...

Why is Investment Appraisal important for traders?

Why is investment appraisal important for traders? Investment appraisal is important for traders because it is a form of fundamental analysis and, as such, it is capable of showing a trader whether a stock or a company has long-term potential based on the profitability of its future projects and endeavours.

What is an example of an investment appraisal?

Investment appraisal definition portrays it as the techniques used by firms and investors to determine whether an investment is profit-making or not. The examples include assessing the profitability and affordability of investing in long-term projects, new products, machinery, etc.

Why is it important to have a Strategic Appraisal?

Such an appraisal is important for several reasons. The investment usually involves committing substantial resources. In addition, the decision requires an understanding of the feasibility of both strategic and tactical objectives.

What is an investment appraisal review?

In some cases, this kind of review reveals that a project that seems otherwise feasible will cost far more than anticipated because of the difficulty and expense of obtaining necessary authorizations. Advertisement Uncertainty Another important function of the investment appraisal concerns uncertainty.

What is the purpose of capital investment appraisal?

Abstract. Capital budgeting or investment appraisal is concerned with organizational management decisions about which projects or assets to invest in and how to finance them to achieve corporate goals.

What does investment appraisal depend on?

Qualitative influences on investment appraisal Product quality and customer service. Consistency of the investment decision with corporate objectives.

What is the investment appraisal process?

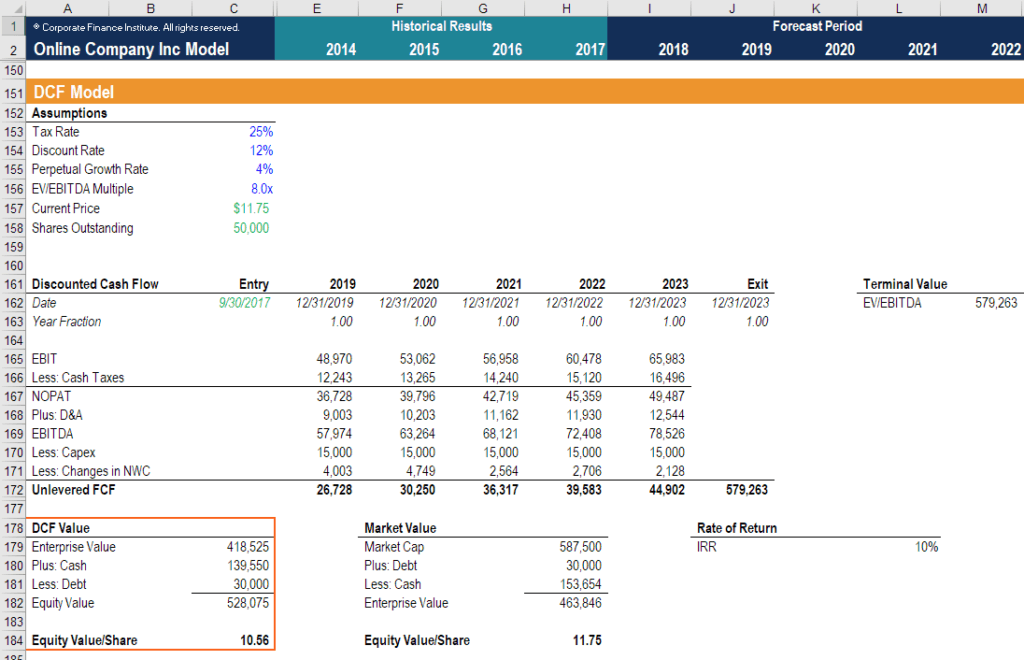

What is an investment Appraisal? This is where the user looks at the financial aspects of the change, by considering the tangible costs and benefits. There are two main measuring methods used in producing an investment appraisal; the Payback Calculation and Net Present Value (NPV)/Discounted Cash Flow (DCF).

When would a business use investment appraisal?

As expenditure is made in anticipation of long-term benefits, it also involves an element of risk. To ensure the best decision is made when new capital investment projects are considered, investment appraisal should be carried out.

What are the 3 methods of investment appraisal?

The methods of investment appraisal are payback, accounting rate of return and the discounted cash flow methods of net present value (NPV) and internal rate of return (IRR).

What is the best investment appraisal technique?

Net Present Value It is the most popular method of investment appraisal. Net present value is the sum of discounted future cash inflows & outflows related to the project. This method lays importance on the time value of money and is in line with the company's objective to maximize shareholders' wealth.

What kind of decision making is investment appraisal?

This method of investment appraisal calculates the expected profits from the investment, expressing them as a percentage of the capital invested. The higher the rate of return, the 'better' (i.e. the more profitable) is the project. The ARR is therefore based on anticipated profits rather than on cash flow.

Why is investment appraisal important?

Investment appraisal is important for traders because it is a form of fundamental analysis and, as such, it is capable of showing a trader whether a stock or a company has long-term potential based on the profitability of its future projects and endeavours.

What is investment appraisal?

Investment appraisal is a way that a business will assess the attractiveness of possible investments or projects based on the findings of several different capital budgeting and financing techniques. For traders, it is a form of fundamental analysis as it can help identify long-term trends as well as a company’s perceived profitability.

What is net present value?

Net present value (NPV) is the difference between the current value of cash inflows and the current value of cash outflows over a determined length of time. NPV is used to calculate the estimated profitability of a project and it is a form of capital budgeting which accounts for the time value of money.

What happens if a company invests in long term projects?

If a company is involved in a number of long-term investment projects, there is also a greater risk that revenues, costs and cashflows might be damaged. This is something that a trader will need to consider before they take a position on a company’s shares.

What does it mean when a project has a positive NPV?

If the NPV is positive, then it indicates that a project’s predicted earnings or profits are greater than the anticipated costs. If the NPV is negative, then the reverse is true, and the project or investment might not be pursued by the company.

What is ARR in capital budgeting?

The accounting rate of return (ARR) is a ratio used in capital budgeting to calculate an investment’s expected return compared to the initial cost. Unlike NPV, ARR does not account for the time value of money, and if the ARR is equal to or greater than the required rate of return, then the project is deemed to have acceptable levels of profitability.

Why is it important to do an investment appraisal?

When you choose an investment, you want it to make you as much money as possible. Careful investment appraisal lets you figure out which opportunities are a great deal and which ones you should avoid like the plague. Investment appraisal gives you a realistic sense of the potential risks and rewards.

What is a good appraisal?

A good appraisal considers the risks of things going wrong. If the company's is fighting a patent infringement lawsuit, ask what happens if the company loses. If corporate strategy is built around the patents, that may raise the level of risk higher than you can accept.

When you compare the benefits of two or three possible investments, the decision may come down to which of them offers the best

When you compare the benefits of two or three possible investments: If they all look like winners, the decision may come down to which of them offers the best return. Depending on your financial plans, your priority may be whichever investment offers the quickest return or gives you the highest annual rate of return.