When the scores are significantly different across bureaus, it is likely the underlying data in the credit bureaus is different and thus driving that observed score difference.

What things can lower your credit score?

What Has A Negative Effect on Your Credit Score?

- Making Late Payments. Whenever possible, avoid making late payments on your credit cards. ...

- Maxing Out Your Credit Card. ...

- Applying For Too Much Credit At Once. ...

- Bankruptcy. ...

- Foreclosure. ...

- Short Sale. ...

- Charge-offs Or Collection. ...

- Refinancing Or Debt Consolidation. ...

- Closing A Credit Card. ...

- Only Using One Type Of Credit. ...

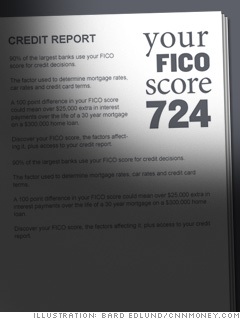

What is a good FICO score?

Those scores are broken down into five categories, though the breakdowns differ slightly. For FICO, a good credit score is 670 or higher; a score above 800 is considered exceptional. For VantageScore 3.0, a good score is 661 or higher, and a score of 781 to 850 is excellent.

What are the different credit score ranges?

- Superprime (781- 850)

- Prime (661-780)

- Near prime (601- 660)

- Subprime (300 - 600)

What are the different types of credit scores?

VantageScore also explains how different factors are generally weighted in its scoring models:

- Extremely influential: Credit utilization

- Highly influential: Types of accounts, known as credit mix, and experience

- Moderately influential: Payment history

- Less influential: Credit age and new credit

Why is my credit score so different on different sites?

There are many different credit scoring models available on the market, so your score can vary between lenders depending on which model they choose. It can also vary depending on which credit bureau the information was taken from because of differences in the information being reported to each of your credit reports.

What credit score site is most accurate?

FICO scores are used in over 90% of lending decisions making the FICO® Basic, Advanced and Premier services the most accurate for credit score updates.

Are credit score sites accurate?

The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those credit bureaus.

How can I check my real credit score?

How to access your report. You can request a free copy of your credit report from each of three major credit reporting agencies – Equifax®, Experian®, and TransUnion® – once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228.

How many points is Credit Karma off?

Credit Karma touts that it will always be free to the consumers who use its website or mobile app. But how accurate is Credit Karma? In some cases, as seen in an example below, Credit Karma may be off by 20 to 25 points.

Which is more accurate Experian or Equifax?

The main difference is Experian grades it between 0 – 1000, while Equifax grades the score between 0 – 1200. This means that there is not only a clear 200 point difference between these two bureaus but the “perfect scores” are also different, which is 1000 as reported by Experian and 1200 as reported by Equifax.

Is Experian better than Credit Karma?

Our Verdict: Credit Karma has better credit monitoring and more features, but Experian actually gives you your “real” credit score. Plus it offers the wonderful Experian Boost tool. Since they're both free, it's worth it to get both of them.

Why Credit Karma is not accurate?

The credit scores and credit reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. They should accurately reflect your credit information as reported by those bureaus — but they may not match other reports and scores out there.

Is FICO or Experian more accurate?

Experian's advantage over FICO is that the information it provides is more thorough than a simple number. A pair of borrowers could both have 700 FICO scores but vastly different credit histories.

Which is more accurate Credit Karma or Experian?

Our Verdict: Credit Karma has better credit monitoring and more features, but Experian actually gives you your “real” credit score. Plus it offers the wonderful Experian Boost tool. Since they're both free, it's worth it to get both of them.

Is Equifax or TransUnion more accurate?

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Is Experian usually the lowest score?

Credit scores help lenders evaluate whether they want to do business with you. The FICO® Score☉ , which is the most widely used scoring model, falls in a range that goes up to 850. The lowest credit score in this range is 300. But the reality is that almost nobody has a score that low.

Kathryn B Hauer Certified Financial Planner

Hi!; Thanks for writing.; The three main credit bureaus are the main entities that keep track of and report credit scores and are the main places that any entity checking your credit score will go.

Is Your Credit Karma Score Accurate

Investopedia reached out to Credit Karma to ask why consumers should trust Credit Karma to provide them with a score that is an accurate representation of their creditworthiness.

Number Of Hard Inquiries Within The Past Two Years

This is when you apply for a credit card or other type of loan and the lender pulls your credit report as part of the decision-making process. A; hard inquiry ;usually lowers your score, so the more you have, the bigger the impact.

What Is The Credit Rating Scale

Credit scores are rated on a scale of 300 850. The higher your score, the better your history of managing debt and repaying credit or loans. Whats considered a good credit score may vary by lender and type of product. Different credit cards, auto loans and mortgages can have different approval requirements.

Why Its Important To Check Your Credit Report

Checking your credit report is important, whether youre building or simply maintaining good credit. By checking your report at regular intervals, youll know exactly where your debt currently stands and can check to make sure all three credit bureaus are reporting information correctly. Errors are not unheard of.

Regularly Monitor Your Credit Health

Its important to regularly monitor your credit health based on the information found in your report. Catching and fixing inconsistencies or mistakes on your credit report early can save you from being blindsided by a sudden dip in your credit score and help you spot opportunities for improvement.;;

What Are The Different Categories Of Late Payments And Do They Impact Fico Scores

A history of payments is the largest factor in FICO® Scores. FICO® Scores consider late payments in these general areas; how recent the late payments are, how severe the late payments are, and how frequently the late payments occur.

Why is credit score important?

Lenders equate your score with the level of risk they’d take by extending credit to you. A higher score means lower risk and vice versa. This is why your credit score is so important, not only for credit approval but also for things like your credit limit and the terms of the loan.

Where can I find my credit score?

After reading this article, you’re probably curious about your own scores and credit history. Here’s where you can find them:

Why is there a 9 point difference between my Equifax and TransUnion credit score?

For example, the nine-point difference between my two scores could stem from the fact that Equifax reports a slightly longer history and more accounts than TransUnion.

What score do lenders use when applying for credit?

When you apply for credit, a lender may use a specific score (such as FICO) or an average of your various scores (FICO & Vantage). So, focus on what you can control: Factors such as your length of credit and payment history and your credit utilization.

How much does it cost to get a credit score from TransUnion?

These range in price from $16.95-$24.95/month. Check out our comprehensive list of credit and identity monitoring services.

What is the FICO score?

Since its creation in 1989, the FICO® Score has been the most commonly used assessment of creditworthiness. FICO® Scores are generated by a proprietary scoring algorithm, which empowers lenders to make informed decisions and protects borrowers from unfair bias. This is why FICO® is considered the industry standard.

What is the percentage of credit limit?

Also known as your balance-to-limit ratio, this is simply the percentage of your total credit limit in use at any given time. 30% or lower is the standard figure to aim for.

Why does my credit score vary?

Credit scores can vary because of differences in the credit scoring algorithms that each reporting agency uses. There are many distinct credit scoring formulas used by creditors, lenders, and insurers to evaluate your creditworthiness. These scores will evaluate your credit report differently in order to match the specific characteristics of the entity that is using your report. The most common credit score model that consumers are exposed to are Vantage and FICO.

What is the impact of credit score on interest rate?

When you apply for a loan or credit card, your credit score is a key factor in getting approved and will influence the type of interest rate and lines of credit you qualify for. The lower your credit score is, the more likely you are to receive a higher interest rate.

What is the most common credit score model?

The most common credit score model that consumers are exposed to are Vantage and FICO. 2. Your Creditors. For the most part, your credit report is a simple collection of data sent to the credit bureaus from your creditors.

How does credit score affect mortgage rates?

Your credit score influences your ability to secure the best interest rates on loans, helps you qualify for housing, rentals or a mortgage, and even plays a role in obtaining employment for certain types of positions.

What are the three major credit reporting bureaus?

There are three major credit reporting bureaus in the United States: TransUnion™, Equifax™, and Experian™ . Each one has its own unique mathematical method of calculating a credit score for the consumer. And each bureau may have slightly different information on how they calculate credit scores that can seem confusing.

How does credit affect your life?

Your credit score influences your ability to secure the best interest rates on loans, helps you qualify for housing, rentals or a mortgage, and even plays a role in obtaining employment for certain types of positions.

Do credit bureaus know if you paid your home loan late?

The cycle is ongoing. Also, creditors report your account information to the credit bureaus in different ways and different times throughout the month. As a result, one credit bureau may know you paid your home loan late but another bureau may not have processed or received the data yet.

How many credit score models are there?

There are dozens of credit score models and each can give you a different credit score. For example, each of the three credit bureaus uses its own model for calculating your credit score; plus, the bureaus worked together to develop the VantageScore. 1 FICO, one of the most widely known credit scoring companies, has its own credit scoring model. 2 Banks and other screening services may also have different credit scoring models.

What credit score do lenders use?

Most lenders use the FICO score developed by FICO, the company formerly known as Fair Isaac Corporation. You can purchase your FICO score based on Equifax, Experian, and TransUnion credit reports from myFICO.com .

Do credit bureaus release new credit models?

The credit bureaus and FICO periodically release new versions of their credit scoring models . Adoption rates for new models can be slow, so many lenders continue using the older models.

Do credit bureaus share credit information?

Credit bureaus collect data independently of each other and they typically don't share it. Not only that, your creditors and lenders might report data only to one or two of the credit bureaus. So, your Equifax, Experian, and TransUnion credit reports might all look different from each other depending on the information contained in each credit report. 3

Can you ask your lender to use a credit bureau?

You can ask your lender from which credit bureau it purchases credit scores (they may or may not tell you), but you typically can't request that your lender use a certain credit bureau to retrieve your score. Most lenders use the FICO score developed by FICO, the company formerly known as Fair Isaac Corporation.

Can credit scores match online?

For example, there's an auto insurance score, bankruptcy prediction score, and mortgage credit score. These scores won't match anything you purchase online because they're adjusted for that industry. The generic credit scores you get online are for informational purposes only.

Is it normal to have different credit scores in 2021?

Updated June 30, 2021. If you've ever purchased a three-in-one credit score or retrieved your free credit scores from multiple sites in a single day, you might have noticed that your credit scores are different for the three credit bureaus. Having different credit scores is normal; here's why that happens.

WalletHub, Financial Company

This answer was first published on 02/02/17. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Kathryn B. Hauer, CERTIFIED FINANCIAL PLANNER (TM)

This answer was first published on 02/22/17 and it was last updated on 04/28/20. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Linda L. Jacob, Certified Financial Planner (r), Accredited Financial Counselor (r)

This answer was first published on 04/08/16 and it was last updated on 04/03/20. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Dmitriy Fomichenko, President, Sense Financial

This answer was first published on 02/11/17. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Dmitriy Fomichenko, President, Sense Financial

This answer was first published on 06/05/15. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Mike Daxler, Member

This answer was first published on 03/26/18 and it was last updated on 04/28/20. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Why is there a difference in credit score?

When the scores are significantly different across bureaus, it is likely the underlying data in the credit bureaus is different and thus driving that observed score difference. However, there can be score differences even when the underlying data is identical as each of the bureau's FICO scoring system was designed to optimize the predictive value of their unique data.

How to compare credit score?

Keep in mind the following points when comparing scores across bureaus: 1 Not all credit scores are "FICO" scores. So, make sure the credit scores you are comparing are actual FICO Scores. 2 The FICO scores should be accessed at the same time. The passage of time can result in score differences due to model characteristics that have a time based component. Comparing a FICO score pulled on bureau "A" from last week to a score pulled on bureau "B" today can be problematic as the "week-old score" may already be "dated". 3 All of your credit information may not be reported to all three credit bureaus. The information on your credit report is supplied by lenders, collection agencies and court records. Don't assume that each credit bureau has the same information pertaining to your credit history. 4 You may have applied for credit under different names (for example, Robert Jones versus Bob Jones) or a maiden name, which may cause fragmented or incomplete files at the credit reporting agencies. While, in most cases, the credit bureaus combine all files accurately under the same person, there are many instances where incomplete files or inaccurate data (social security numbers, addresses, etc.) cause one person's credit information to appear on someone else's credit report. 5 Lenders report credit information to the credit bureaus at different times, often resulting in one agency having more up-to-date information than another. 6 The credit bureaus may record, display or store the same information in different ways.

What is predictive FICO?

A predictive FICO scoring system resides at each of these credit bureaus from which lenders request a FICO ® Score when evaluating a particular consumer's credit risk. The FICO scoring system design is similar across the credit bureaus so that consumers with high FICO Scores on bureau "A's" data will likely see a similarly high FICO Score at the other two bureaus. Conversely consumers with lower FICO scores at bureau "A" will likely get low FICO Scores at the other two bureaus when the underlying data is the same across the bureaus.

Is the information collected by the three credit bureaus similar?

While most of the information collected on consumers by the three credit bureaus is similar, there are differences . For example, one credit bureau may have unique information captured on a consumer that is not being captured by the other two, or the same data element may be stored or displayed differently by the credit bureaus.

Do lenders report credit information to credit bureaus?

Lenders report credit information to the credit bureaus at different times , often resulting in one agency having more up-to-date information than another.

Can you apply for credit under different names?

You may have applied for credit under different names (for example, Robert Jones versus Bob Jones) or a maiden name, which may cause fragmented or incomplete files at the credit reporting agencies. While, in most cases, the credit bureaus combine all files accurately under the same person, there are many instances where incomplete files ...

Can you compare credit scores across bureaus?

Keep in mind the following points when comparing scores across bureaus: Not all credit scores are "FICO" scores. So, make sure the credit scores you are comparing are actual FICO Scores. The FICO scores should be accessed at the same time. The passage of time can result in score differences due to model characteristics that have a time based ...