The Formula for Opportunity Cost is: Opportunity Cost = Total Revenue – Economic Profit Opportunity Cost = What One Sacrifice / What One Gain

How to calculate opportunity cost with a simple formula?

How to calculate an opportunity cost. Like most pharmacy metrics, opportunity cost can be calculated using a simple formula: Opportunity Cost = Estimated return on option not chosen – estimated return on chosen option. If your opportunity cost is positive, that’s money that you forego by choosing the option with a lower estimated return.

What is opportunity cost and how to calculate it?

Opportunity cost is a component of the collective concept of economic cost. In numerical terms, the opportunity cost value is nothing but the difference between the cost of the desired alternative and the cost of the next best alternative.

When do you add opportunity cost?

When presented with mutually exclusive options, the decision-making rule is to choose the project with the highest NPV. However, if the alternative project gives a single and immediate benefit, the opportunity costs can be added to the total costs incurred in C 0.

How do you find the opportunity cost?

Some common scenarios in which an opportunity cost figure could be insightful include:

- Choosing which stock to invest in on the stock market. For investors, making a well-educated gamble on which stock to invest in can make or break their wallets. ...

- Weighing the pros and cons of one possible purchase over the other. ...

- Deciding where to allocate business funds. ...

- Measuring the value of your time. ...

What is opportunity cost of a factor of production?

The opportunity cost of a factor of production that is not owned by a firm is what has to be paid to retain it in its present use. This is also termed as the explicit cost of the firm.

Does cost of production include opportunity cost?

Costs as Opportunity Costs A firm's cost of production includes all the opportunity costs of making its output of goods and services. Explicit and Implicit Costs •A firm's cost of production include explicit costs and implicit costs. Explicit costs are input costs that require a direct outlay of money by the firm.

How is opportunity value calculated?

To calculate value per opportunity, you multiply your close rate by your average selling price (ASP). For example, if your close rate is 35% and your ASP is $10,000, then your value per opportunity would be 35% x $10,000 = $3,500.

How is opportunity cost of labor calculated?

What you sacrifice / What you gain = opportunity costs.

What is the relationship between opportunity cost and production?

Lesson 5: The law of increasing opportunity cost: As you increase the production of one good, the opportunity cost to produce the additional good will increase. First, remember that opportunity cost is the value of the next-best alternative when a decision is made; it's what is given up.

How do you find the opportunity cost of a production possibility frontier?

0:158:17How to calculate opportunity cost - YouTubeYouTubeStart of suggested clipEnd of suggested clipBecause bulldozers are capital equipment and the simple way to calculate the opportunity cost isMoreBecause bulldozers are capital equipment and the simple way to calculate the opportunity cost is simply to take the slope. Which is our change in Y over. The change in X right.

Why is opportunity cost calculated?

Opportunity cost is important for companies because it allows them to determine the best way to use their limited resources and funds. By determining the opportunity cost of a particular option or options, a business can choose which option provides the greatest or most productive return .

What is an opportunity cost example?

A student spends three hours and $20 at the movies the night before an exam. The opportunity cost is time spent studying and that money to spend on something else. A farmer chooses to plant wheat; the opportunity cost is planting a different crop, or an alternate use of the resources (land and farm equipment).

How do you calculate opportunity cost from a table?

3:324:42Calculating Opportunity Cost - YouTubeYouTubeStart of suggested clipEnd of suggested clipOne TV well you would have to divide both sides by 6 because 6 divided by 6 is 1 and then you wouldMoreOne TV well you would have to divide both sides by 6 because 6 divided by 6 is 1 and then you would get afforded by the by 6.

What is the meant by opportunity cost method?

What is the simple definition of opportunity cost? Opportunity cost is the value of what you lose when choosing between two or more options. Every choice has trade-offs, and opportunity cost is the potential benefits you'll miss out on by choosing one direction over another.

What is included in cost of production?

Production costs can include a variety of expenses, such as labor, raw materials, consumable manufacturing supplies, and general overhead. Total product costs can be determined by adding together the total direct materials and labor costs as well as the total manufacturing overhead costs.

What is not included in cost of production?

Advertisement is a selling cost and not a production cost as it is not directly related to the production of the good. Its is usually classified as a sunk cost or an indirect cost. All other costs are directly related to the production of a good.

What type of costs are opportunity costs?

What Is Opportunity Cost? Opportunity costs represent the potential benefits that an individual, investor, or business misses out on when choosing one alternative over another. Because opportunity costs are unseen by definition, they can be easily overlooked.

What are the 4 costs of production?

Types of Costs of ProductionFixed costs. Fixed costs are expenses that do not change with the amount of output produced. ... Variable costs. Variable costs are costs that change with the changes in the level of production. ... Total cost. Total cost encompasses both variable and fixed costs. ... Average cost. ... Marginal cost.

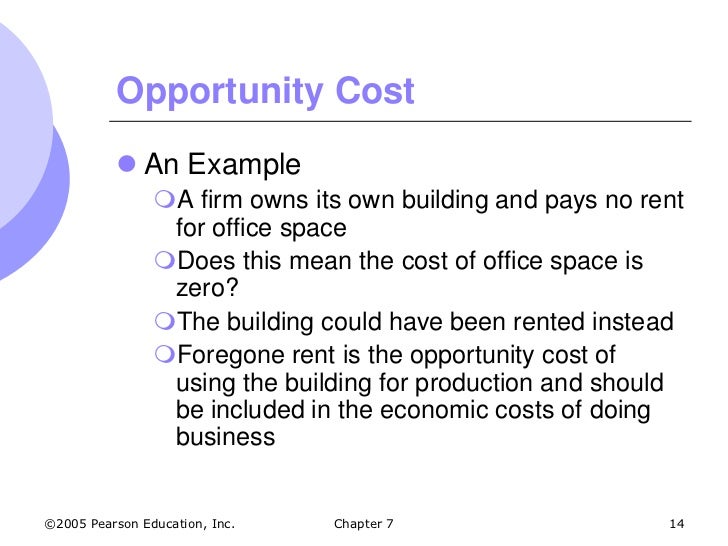

What is Opportunity Cost?

Opportunity cost can be termed as the next best alternative of a particular option which has been executed or about to execute. It can be a project foreign investment or a particular option taken by a group of people or an individual for personal purpose or for a business purpose.

How many orders does Larsen and Tubro have?

Larsen and Tubro Ltd has two order for execution, But it can undertake only one. Based on the following data choose which one to operate and the opportunity costs.

How many bulk orders does Tata Motors have?

Tata Motors have three bulk orders and it can take the most profitable one first as to strengthen its Cash Flow so has to enhance its working capital to process the rest of the two orders. Find out the most profitable and the least profitable in a descending manner in order to protect its Cash balance. (Assume that all the Sales are made on a Cash basis).

Can a commodity be used for one purpose only?

So a particular commodity or raw material can be used for one purpose only. So the best possible end product has to decide by the authority which can serve human wants in a better way. Deciding Salary or remuneration of professionals. Opportunity cost could be used during the fixation of salary for a particular job.

How to calculate opportunity cost?

To calculate opportunity cost, identify your different options and their potential returns. Do this by calculating how much interest they will earn or how much money they will save. Then, subtract the potential gain of the chosen option from the potential gain of the most lucrative option. For example, if option A could earn you $100, and option B could earn you $80, then option B has an opportunity cost of $20 because $100 minus $80 is $20. For more information from our reviewer on calculating opportunity cost, including how to evaluate non-financial resources, read on!

How many hours do you spend on laundry?

Suppose you spend 5 hours each Saturday on laundry, food shopping and cleaning. If a housekeeper came once per week to clean and help with laundry, you would only have to spend 3 hours on Saturday finishing the laundry and food shopping. The opportunity cost of doing the housework yourself is 2 hours.

What is opportunity cost?

The opportunity cost is the value of the option you do not choose. That value can refer to something personal, financial or environmental. If you choose to buy a new car instead of a used car, the opportunity cost is the money you could have saved on the used car and how you could have used that money differently.

How to figure out the cost of college?

Determine the true cost of going to college. Suppose you are going to pay $4,000 per year to attend an in-state college. The government will subsidy an additional $8,000 for your tuition. But, you must also factor in the opportunity cost of not working while you’re in college. Suppose you could earn $20,000 per year at a job instead of going to college. This means that the true cost of a year of college is the tuition plus the opportunity cost of not working.

How much higher is the median weekly earnings for a college degree?

However, consider the other side of the coin. Median weekly earnings is $400 higher for a person with a college degree than for a person with only a high school diploma. If you decide not to go to college, the opportunity cost is the value of your future increased earnings.

What happens if a company borrows money to fund an expansion?

If a company chooses to borrow money to fund an expansion, then the money used to repay the principal and interest on the loan is not available to be invested into stocks.

What is capital structure?

Establish the capital structure of your business. Capital structure is how a company funds its operations and growth. It is a mix of the company’s debt and equity. Debt can be in the form of bonds issued or loans from financial institutions. Equity can be in the form of stock or retained earnings.

How many tablets can Lilith make?

Lilith can use one day to manufacture either 100 smartphones or 75 tablets. If she chooses to manufacture the phones, the opportunity cost is the difference in profits of producing 75 tablets.

What happens if Lilith orders the production of smartphones?

If Lilith orders the production of smartphones, she'll have to give up the opportunity to earn an extra 8%. Of course, we are assuming that there is sufficient demand for tablets to expend all Lilith's production capacity on tablets.

What does opportunity cost have to do with a business's capital structure?

What does opportunity cost have to do with a business's capital structure? If you finance your capital through debt, you have to pay it back even if you aren't making any money. Moreover, money allocated to servicing debt can't be spent on investing in the business or pursuing other investment opportunities, such as the stock and bond markets. Let's look at an example on how a business can use opportunity cost analysis to determine whether or not obtaining an infusion of capital through debt is a smart move.

What is Opportunity Cost?

Opportunity Cost = Return on Most Profitable Investment Choice - Return on Investment Chosen to Pursue

What does it mean to enroll in a course?

Enrolling in a course lets you earn progress by passing quizzes and exams.

What is capital structure?

A business' capital structure is simply how a company finances its operations. Capital structure may involve a mix of long-term debt, short-term debt, and equity. Equity is the infusion of capital into a business through the sale of shares of common stock or preferred stock to investors.

Why is opportunity cost analysis important?

Opportunity cost analysis is an important tool in making business decisions , including determining a business' capital structure, or how a business finances its operations, usually a mix of short and long-term loans, as well as equity.

What Is Opportunity Cost?

Opportunity costs represent the potential benefits an individual, investor, or business misses out on when choosing one alternative over another. Because opportunity costs are, by definition, unseen, they can be easily overlooked. Understanding the potential missed opportunities when a business or individual chooses one investment over another allows for better decision-making.

What Is a Simple Definition of Opportunity Cost?

Opportunity cost is often overlooked by investors. In essence, it refers to the hidden cost associated with not taking an alternative course of action. If, for example, a company pursues a particular business strategy without first considering the merits of alternative strategies available to them, they might fail to appreciate their opportunity costs and the possibility that they could have done even better had they chosen another path.

What is the difference between opportunity cost and sunk cost?

The difference between an opportunity cost and a sunk cost is the difference between money already spent in the past and potential returns not earned in the future on an investment because the capital was invested elsewhere. Buying 1,000 shares of company A at $10 a share, for instance, represents a sunk cost of $10,000. This is the amount of money paid out to make an investment, and getting that money back requires liquidating stock at or above the purchase price. But the opportunity cost instead asks where could have that $10,000 been put to use in a better way.

How to determine the potential profitability of an investment?

When assessing the potential profitability of various investments, businesses look for the option that is likely to yield the greatest return. Often, they can determine this by looking at the expected rate of return for an investment vehicle. However, businesses must also consider the opportunity cost of each option.

Why are opportunity costs important?

Because by definition they are unseen, opportunity costs can be easily overlooked if one is not careful. Understanding the potential missed opportunities foregone by choosing one investment over another allows for better decision-making.

How to calculate opportunity cost?

The formula for calculating an opportunity cost is simply the difference between the expected returns of each option. Say that you have option A—to invest in the stock market hoping to generate capital gain returns. Meanwhile, Option B is to reinvest your money back into the business, expecting that newer equipment will increase production efficiency, leading to lower operational expenses and a higher profit margin .

How to calculate ROR?

The formula to calculate RoR is [ (Current Value - Initial Value) / Current Value] * 100. In this example, [ ($22,000 - $20,000) / $20,000] * 100 = 10%, so the RoR on the investment is 10%. For the purposes of this example, let's assume it would net 10% every year after as well. At a 10% RoR, with compounding interest, the investment will increase by $2,000 in year 1, $2,200 in year 2, and $2,420 in year 3.

Explanation of Opportunity Cost Formula

Opportunity Cost Formula in Excel

- Here we will do the same example of the Opportunity Cost formula in Excel. It is very easy and simple. You can easily calculate the Opportunity Cost using Formula in the template provided. Profitability from First Order is calculated using Opportunity Cost Formula Profitability from the Second Order is calculated using the Opportunity Cost Formula

Recommended Articles

- This has been a guide to Opportunity Cost formula. Here we discuss How to Calculate Opportunity Cost along with practical examples. We also provide an Opportunity Cost Calculator with downloadable excel template. You may also look at the following articles to learn more – 1. Retained Earnings Formula 2. Formula for Consumer Surplus 3. How to calculate Rate of Return…