Financial statement analysis

Financial statement analysis (or financial analysis) is the process of reviewing and analyzing a company's financial statements to make better economic decisions. These statements include the income statement, balance sheet, statement of cash flows, and a statement of retained earnings.

What is financial statement analysis and its objectives?

The main objective of the financial statement analysis for any company is to provide the necessary information required by the financial statement users for informative decision making, assessing the current and past performance of the company, predicting the success or failure of the business, etc.

What is financial statement analysis introduction?

Financial analysis is the process of examining a company's performance in the context of its industry and economic environment in order to arrive at a decision or recommendation.

What is financial analysis and its types?

The most common types of financial analysis are vertical analysis, horizontal analysis, leverage analysis, growth rates, profitability analysis, liquidity analysis, efficiency analysis, cash flow, rates of return, valuation analysis, scenario and sensitivity analysis, and variance analysis.

What is financial statement analysis with the example?

An example of Financial analysis is analyzing a company's performance and trend by calculating financial ratios like profitability ratios, including net profit ratio, which is calculated by net profit divided by sales.

Why is financial statement analysis important?

It provides internal and external stakeholders with the opportunity to make informed decisions regarding investing. Financial statement analysis also provides lending institutions with an unbiased view of a business's financial health, which is helpful for making lending decisions.

What are the 3 types of financial statement analysis?

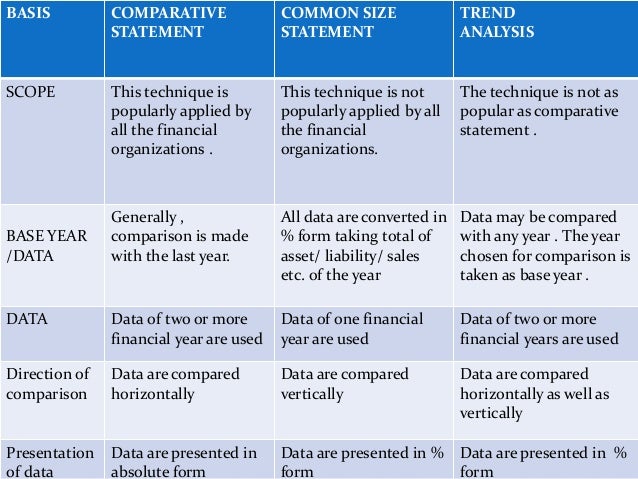

Horizontal, vertical, and ratio analysis are three techniques analysts use when analyzing financial statements.

What are the 5 methods of financial statement analysis?

Five Financial Statement Analysis TechniquesTrend analysis:Common-size financial analysis:Financial ratio analysis:Cost volume profit analysis:Benchmarking (industry) analysis:

What are the 3 methods of financial statement analysis?

The three most commonly practised methods of financial analysis are – horizontal analysis, vertical analysis, and ratio and trend analysis.

What is financial statements PDF?

FINANCIAL STATEMENT: A financial statement (or financial report) is a formal record of. the financial activities of a business, person, or other entity.

What are the 5 methods of financial statement analysis?

Five Financial Statement Analysis TechniquesTrend analysis:Common-size financial analysis:Financial ratio analysis:Cost volume profit analysis:Benchmarking (industry) analysis:

What are the 3 basic tools for financial statement analysis?

The three major tools for financial statement analyses are horizontal analysis, vertical analysis, and ratios analysis.

What is meant by analysis of financial statements Class 12?

Analysis of financial statements is a systematic process of analyzing the financial information in the financial statements to understand and take economic decisions.

What is financial statement analysis?

Financial Statement Analysis refers to the process of reviewing and analyzing a company’s financial statements.

Who are the users of financial statement analysis?

The management, government, employees, customers, and investors are the users of financial statement analysis.

What are the tools of financial analysis?

The most commonly used tools of financial analysis are comparative statement (comparison of financial statements), common size statement (vertical...

What are the types of financial statement analysis?

These include horizontal analysis, vertical analysis, liquidity analysis, profitability analysis, variance, and valuation analysis.

Why is financial statement analysis done?

It is done to understand the financial position, solvency, and profitability of the business, and to make better financial decisions in future.

What is financial statement analysis?

Financial statement analysis is a function that involves the evaluation of reported financial statements of an entity, to aid stakeholders and users of those statements in their decision making. It seeks to establish relationships between various financial parameters so as to gain a better understanding of the entity’s financial health and performance. Financial statement analysis benefits both internal stakeholders (like management and existing shareholders) as well as external stakeholders (like potential investors, lenders and suppliers).

Why is financial analysis important?

All in all, financial statement analysis is an extremely vital function as it has utility for both internal and external stakeholders. Generally, a large part of this financial analysis is presented in annual reports along with the reported financial statements. This is done so that the information is easily accessible by all stakeholders. However, a leader is only as good as his team; thus for financial statement analysis to be meaningful, the financial statements themselves must be accurate and the interpretations applied must be meaningful.

What is ratio analysis?

Ratio analysis involves evaluating relationship between various line items of financial statements like income statement and balance sheet. This is done by calculating various financial ratios and comparing them with some set standards. On the basis of this comparison, management can take corrective steps and other stakeholders can make informed decisions according to their specific situations.

What is profitability ratio?

Profitability ratios: measure the ability of a commercial entity to generate profits for its stockholders or owners. These ratios can include gross and net profit ratio, P/E ratio, EPS ratio, and return on capital employed ratio etc.

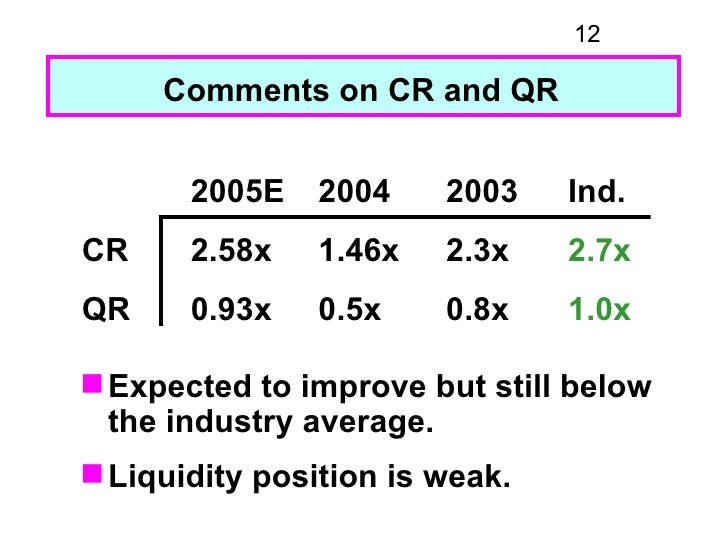

What is liquidity ratio?

Liquidity ratios: measure an entity’s ability to service its near-term debts as well as to meet its near-term fund requirements. A typical set of liquidity ratios includes current ratio, quick or liquid ratio, absolute liquid ratio, and current cash debt coverage ratio etc.

What is horizontal analysis?

Horizontal analysis involves evaluation of financial statements on a historical basis. Under this technique, financial data is compared across time periods. For example, the progression of sales is evaluated over the years to evaluate the sales growth rate of the entity.

What is the purpose of a performance analysis?

This analysis provides a basis for estimating the entity’s future performance as well as assists in setting benchmarks or standards for forthcoming years.

What Does Financial Statement Analysis Mean?

Financial statement analysis takes the raw financial information from the financial statements and turns it into usable information the can be used to make decisions. The three types of analysis are horizontal analysis , vertical analysis, and ratio analysis. Each one of these tools gives decision makers a little more insight into how well the company is performing.

What is financial analysis?

Definition: Financial statement analysis is the use of analytical or financial tools to examine and compare financial statements in order to make business decisions. In other words, financial statement analysis is a way for investors and creditors to examine financial statements and see if the business is healthy enough to invest in or loan to.

Can ratio analysis be used horizontally?

Ratio analysis cannot only be used horizontally to chart intercompany trends; it can also be used to compare different companies. For example, a small and large company can’t be compared on a pure dollar value. It wouldn’t be fair. Instead ratios are used.

What is Financial Statement Analysis?

The term ‘Financial Statement Analysis’ refers to the systematic numerical representation of the relationship of one financial aspect with the other. The activity of financial statement analysis is undertaken to analyse the company on the basis of its profitability, solvency, operational efficiency, and growth prospects.

What are the two main types of profitability analysis?

Margin Ratios and return Ratios are the two main types of profitability analysis.

What is dynamic analysis?

It refers to the analysis of financial statement figures that are dynamic in nature.

What is the common size balance sheet?

The common-size balance sheet shows the total of assets or liabilities to be assumed as 100 and the figures are expressed as a percentage of the total.

What is cash equivalent analysis?

Such an analysis helps find out the causes of changes in the cash position between the two balance sheets at two different dates.

What is the purpose of ratios in accounting?

It uses ratios to determine whether or not a company will be able to pay back any debts or other expenses.

How to assess solvency and leverage of a business?

Using the financial ratios derived from the balance sheet and comparing them historically versus industry averages or competitors will help you assess the solvency and leverage of a business.

What are the three financial statements?

Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows. These three core statements are.

What is cash flow statement?

With the income statement and balance sheet under our belt, let’s look at the cash flow statement#N#Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period.#N#and all the insights it tells us about the business.

What are the three main categories of balance sheet metrics?

The balance sheet metrics can be divided into several categories, including liquidity, leverage, and operational efficiency.

What is the Dupont analysis?

DuPont Analysis In the 1920s, the management at DuPont Corporation developed a model called DuPont Analysis for a detailed assessment of the company’s profitability. By constructing the pyramid of ratios, you will gain an extremely solid understanding of the business and its financial statements.

What are the two types of analysis?

There are two main types of analysis we will perform: vertical analysis and horizontal analysis.

What is gross profit?

Gross profit. Gross Profit Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue. It's used to calculate the gross profit margin. as a percent of revenue.

Why Is Financial Analysis Useful?

It is used to evaluate economic trends, set financial policy, build long-term plans for business activity, and identify projects or companies for investment.

What Is Fundamental Analysis?

Fundamental analysis uses ratios gathered from data within the financial statements, such as a company's earnings per share (EPS), in order to determine the business's value. Using ratio analysis in addition to a thorough review of economic and financial situations surrounding the company, the analyst is able to arrive at an intrinsic value for the security. The end goal is to arrive at a number that an investor can compare with a security's current price in order to see whether the security is undervalued or overvalued.

What Is Technical Analysis?

Essentially, technical analysis assumes that a security’s price already reflects all publicly available information and instead focuses on the statistical analysis of price movements. Technical analysis attempts to understand the market sentiment behind price trends by looking for patterns and trends rather than analyzing a security’s fundamental attributes.

What is the EPS of Discover Financial Services?

As an example of fundamental analysis, Discover Financial Services reported its fourth-quarter 2020 earnings per share (EPS) at $2.59. That was up from the third quarter 2019 EPS of $2.25. 1 A financial analyst using fundamental analysis would take this as a positive sign of increasing the intrinsic value of the security.

What is investment financial analysis?

Investment Financial Analysis. In investment finance, an analyst external to the company conducts an analysis for investment purposes. Analysts can either conduct a top-down or bottom-up investment approach.

What is the EPS for 2021?

With that, future EPS projections may also be forecast to rise. For example, according to Nasdaq.com, the estimated first-quarter 2021 EPS is forecast to come in at $2.78, up from the first quarter 2020 EPS of $1.36. 2.

Why do fund managers need financial analysis?

If conducted internally, financial analysis can help fund managers make future business decisions or review historical trends for past successes.