- The Consumer Price Index measures the overall change in consumer prices over time based on a representative basket of goods and services.

- The CPI It is the most widely used measure of inflation, closely followed by policymakers, financial markets, businesses, and consumers.

- The widely quoted CPI is based on an index covering 93% of the U.S. ...

What is the formula for Consumer Price Index?

What is the formula for Consumer Price Index? December 7, 2021 Answerthirst Editor The index is then calculated by dividing the price of the basket of goods and services in a given year (t) by the price of the same basket in the base year (b). This ratio is then multiplied by 100, which results in the Consumer Price Index.

What does the consumer price index reflect?

The Consumer Price Index measures the average change in prices over time that consumers pay for a basket of goods and services. It is the most widely used measure of inflation. The CPI statistics cover a variety of individuals with different incomes, including retirees, but does not include certain populations, such as patients of mental hospitals.

How do you calculate price index?

So How Exactly Can a Retailer Calculate The Price Index?

- Collect fresh and accurate competitive data on prices and stock. To get a reliable result, you need to use reliable raw data. ...

- Apply Formulas From the Previous Paragraph. ...

- Build a Chart. ...

- Add All Your Sales Data. ...

- Discover the Exact Activity That Affected Your Sales. ...

What makes up consumer price index?

You can find out about price changes for 11 CPI groups:

- food

- housing and household utilities

- health

- recreation and culture

- education

- communication

- clothing and footwear

- transport

- alcoholic beverages and tobacco

- household contents and services

What does monthly CPI measure?

The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

What does the Consumer Price Index CPI measure quizlet?

The consumer price index (CPI) is a measure of the overall cost of the goods and services bought by a typical consumer. CPI is used to find the inflation rate. The CPI affects nearly all Americans because of the many ways it is used.

What is the Consumer Price Index CPI and how is it calculated?

The Consumer Price Index expresses the change in the current prices of the market basket of goods in a period compared to a base period. The CPI is usually computed monthly or quarterly. It is based on a representative expenditure pattern of urban residents and includes people of all ages.

Why is CPI measured?

The Bureau of Labor Statistics (BLS) produces the Consumer Price Index (CPI). It is the most widely watched and used measure of the U.S. inflation rate. It is also used to determine the real gross domestic product (GDP).

Does CPI measure inflation?

The CPI is the most widely used measure of inflation and is sometimes viewed as an indicator of the effectiveness of government economic policy.

For which of the following is the CPI used?

The CPI is used for indexing payments. The CPI is used to calculate inflation, it is also used when setting an inflation target. However, the CPI does not track prices of all final goods and services included in GDP, it is NOT used to calculate real GDP from the nominal GDP.

What is included in CPI calculation?

The CPI represents changes in prices of all goods and services purchased for consumption by urban households. User fees (such as water and sewer service) and sales and excise taxes paid by the consumer are also included. Income taxes and investment items (like stocks, bonds, and life insurance) are not included.

How do you calculate the CPI?

How to calculate CPI?Gather prices for common products or services in the past. ... Collect prices for current products or services. ... Add the product prices together. ... Divide the current product price total by the past price total. ... Multiply the total by 100. ... Convert this number into a percentage.

What is the Consumer Price Index and why is it important?

Broadly speaking, the CPI measures the price of consumer goods and how they're trending. It's a tool for measuring how the economy as a whole is faring when it comes to inflation or deflation. When planning how you spend or save your money, the CPI can influence your decisions.

Is CPI the same as inflation?

Inflation is an increase in the overall price level. The official inflation rate is tracked by calculating changes in a measure called the consumer price index (CPI). The CPI tracks changes in the cost of living over time. Like other economic measures it does a pretty good job of this.

What does a high CPI mean?

Decreases in purchasing power and increases in the CPI mean that consumers' price for goods has increased. The US economy is structured in a way where a small increase in prices is normally on a year-over-year basis.

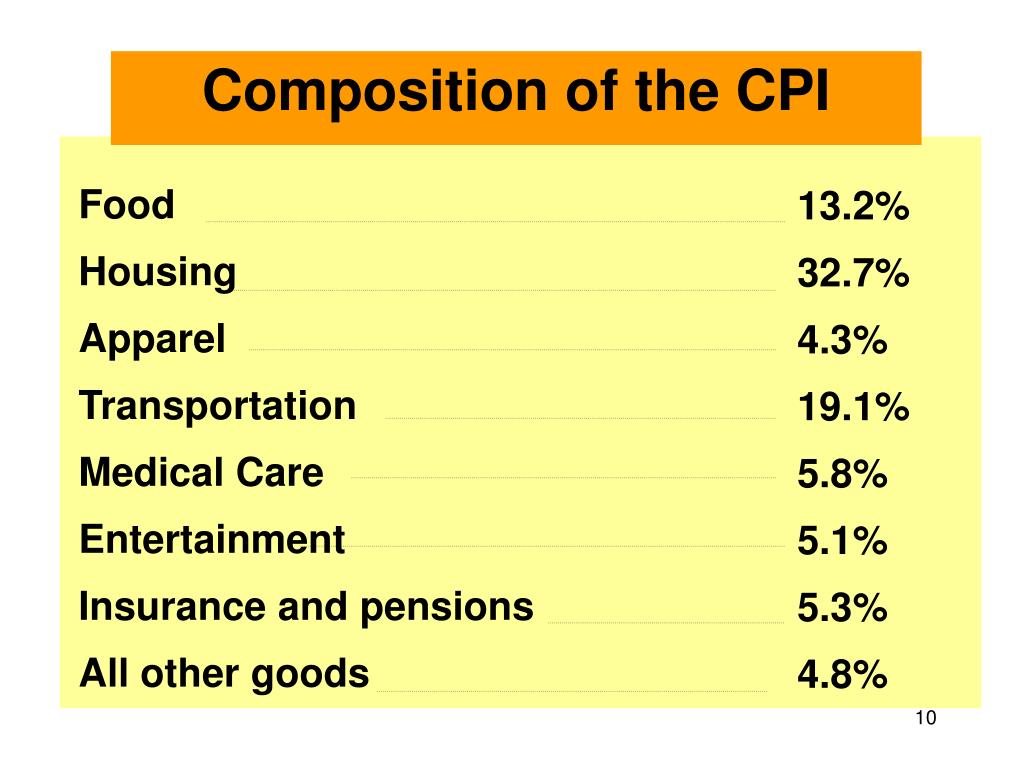

What are the three largest components of the CPI?

The three largest components of the CPI are housing, transportation, and food/beverages in that order.

Which items does the consumer price index measure quizlet?

The consumer price index shows the cost of a basket of goods and services relative to the cost of the same basket in the base year. The index is used to measure the overall level of prices in the economy. The percentage change in the consumer price index measures the inflation rate.

How is the consumer price index calculated quizlet?

how do you calculate the consumer price index? the ratio of the value of the fixed basket purchased by the typical consumer to the baskets value in the base year multiplied by 100.

What is the consumer price index quizlet Chapter 13?

-The consumer price index compares the price of a fixed basket of goods and services to the price of the basket in the base year (only occasionally does the ONS change the basket)...

What is the formula for the CPI quizlet?

(Cost of CPI market basket at current period prices ÷ Cost of CPI market basket at base period prices) × 100.

What is CPI in currency?

The CPI consists of a bundle of commonly purchased goods and services. The CPI measures the changes in the purchasing power of a country’s currency. USD/CAD Currency Cross The USD/CAD currency pair represents the quoted rate for exchanging US to CAD, or, how many Canadian dollars one receives per US dollar.

What are the limitations of the Consumer Price Index?

Limitations of the Consumer Price Index 1 The Consumer Price Index may not be applicable to all population groups. For example, CPI-U (Urban) better represents the U.S. urban population but doesn’t reflect the status of the population in rural areas. 2 CPI doesn’t produce official estimates for subgroups of a population. 3 CPI is a conditional cost-of-living measure and does not measure every aspect that affects living standards. 4 Two areas can’t be compared. A higher index in one area compared to the other doesn’t always mean that prices are higher in that area. 5 Social and environmental factors are beyond the definitional scope of the index.

What is the market basket used to compute the Consumer Price Index?

The market basket used to compute the Consumer Price Index is representative of the consumption expenditure within the economy and is the weighted average of the prices of goods and services.

What does index 110 mean?

An index of 110 means that there’s been a 10% rise in the price of the market basket compared to the reference period. Similarly, an index of 90 indicates a 10% decrease in the price of the market basket compared to the reference period.

What is economic indicator?

Economic Indicators An economic indicator is a metric used to assess, measure, and evaluate the overall state of health of the macroeconomy. Economic indicators. : The Consumer Price Index is a measure of the inflation faced by the end user. It can determine the purchasing power of the dollar. It is also a proxy for the effectiveness ...

What is the purpose of CPI?

It is also a proxy for the effectiveness of a governments economic policy. To adjust other economic indicators for price changes: For example, components of national income could be adjusted using CPI. Provides cost of living adjustments for wage earners and social security.

Does the CPI include energy costs?

Doesn’t include energy costs: A major criticism of the CPI is that it doesn’t include energy costs even though these are a major expenditure for most households.

What is the CPI?

The CPI frequently is called a cost-of-living index, but it differs in important ways from a complete cost-of-living measure. We use a cost-of-living framework in making practical decisions about questions that arise in constructing the CPI.

What is the CPI used for?

The CPI is often used to adjust consumers' income payments (for example, Social Security), to adjust income eligibility levels for government assistance, and to automatically provide cost-of-living wage adjustments to millions of American workers.

What are the two main measures of inflation?

Various indexes have been devised to measure different aspects of inflation. Inflation has been defined as a process of continuously rising prices or, equivalently, of a continuously falling value of money. The CPI measures inflation as experienced by consumers in their day-to-day living expenses; the Producer Price Index ( PPI) measures inflation at earlier stages of the production process; the International Price Program ( IPP) measures inflation for imports and exports; the Employment Cost Index ( ECI) measures inflation in the labor market; and the Gross Domestic Product ( GDP) Deflator measures inflation experienced by both consumers themselves as well as governments and other institutions providing goods and services to consumers. There are also specialized measures, such as measures of interest rates.

How does a CPI sample work?

A particular item enters the CPI sample through a process called initiation. This initiation process, typically carried out in person by a CPI data collector, involves selecting a specific item to be priced from the category that has been designated to be priced at that store. For example, suppose a particular grocery store has an outlet where cheese will be priced. A particular type of cheese item will be chosen, with its likelihood of being selected roughly proportional to its popularity. If, for example, cheddar cheese in 8 oz. packages makes up 70 percent of the sales of cheese, and the same cheese in 6 oz. packages accounts for 10 percent of all cheese sales, and the same cheese in 12 oz. packages accounts for 20 percent of all cheese sales, then the 8 oz. package will be 7 times as likely to be chosen as the 6 oz. package. After probabilities are assigned, one type, brand, and container size of cheese is chosen by an objective selection process based on the theory of random sampling. The particular kind of cheese that is selected will continue to be priced each month in the same outlet.

How is the CPI sample selected?

The outlets in the CPI sample are selected using a point of purchase survey (POPS) where respondents are asked where they made purchases. To the extent respondents of that survey report making purchases from online outlets, those outlets have a chance of being selected for the sample. As of 2017, about 8 percent of quotes in the CPI sample (excluding the rent sample) are from online outlets; this is close to the estimate of online sales from the U.S. Census Bureau’s quarterly retail sales survey. As expected, the percentage of quotes from online sources varies greatly depending on the item category.

Why is CPI seasonally adjusted?

By using seasonally adjusted data, some users find it easier to see the underlying trend in short-term price changes. It is often difficult to tell from raw (unadjusted) statistics whether developments between any 2 months reflect changing economic conditions or only normal seasonal patterns. Therefore, many economic time series, including the CPI, are adjusted to remove the effect of seasonal influences—those which occur at the same time and in about the same magnitude every year. Among these influences are price movements resulting from changing weather conditions, production cycles, changeovers of models, and holidays.

What is CPI in retail?

The Consumer Price Index (CPI) is a measure of the average change overtime in the prices paid by urban consumers for a market basket of consumer goods and services. 2.

What is consumer price index?

Key Takeaways. The consumer price index measures and reports the effect of inflation and deflation on the economy. The Bureau of Labor Statistics calculates the CPI and publishes percentage changes. The CPI can occasionally give false readings due to variables in the current economy.

What is the CPI used for?

The CPI is the measurement used by economists for tracking price changes in a typical "basket" of goods and services that urban consumers buy.

Why is inflation used interchangeably with CPI?

The terms CPI and inflation are often used interchangeably because inflation is the percentage increase or decrease of CPI over a certain period of time. The index shows how much prices have changed since the base year of 1982. The index was 271.7 in June 2021.

Why did the CPI not warn of asset inflation during the housing bubble of 2005?

At the same time, housing prices could rise due to increased market activity. This is why the CPI didn't warn of asset inflation during the housing bubble of 2005. 5. Conversely, rising interest rates might lead to fewer buyers in the market and falling home prices. As more people compete for apartments, rents go up.

Why is the CPI important?

The core CPI is useful because food, oil, and gas prices are volatile, and the Fed's tools are slow-acting. 9 3

What is the highest weighted category within the CPI calculation?

Housing (called shelter by the BLS) is the highest weighted category within the CPI calculation. Shelter uses the concept of "owner's equivalent of primary residence" (OER), which is how much homeowners would charge to rent their home unfurnished, without utilities. The BLS surveys homeowners in multiple urban areas every year to gather this information, replacing one-sixth of the data every year. 5

How does contractionary monetary policy affect the economy?

It uses contractionary monetary policy to slow economic growth when it recognizes that the rate of inflation is too high. It changes the fed funds rate to make loans more expensive, which tightens the money supply—the total amount of credit allowed into the market. Slowed growth and demand puts downward pressure on prices. This returns the economy to a healthy growth rate of 2% to 3% a year. 11

What is CPI in New Jersey?

A woman checks out her purchases at a grocery store in New Jersey. CPI tracks the monthly change in the cost of consumer goods and services. Michael Loccisano/Getty Images

Who compiles the CPI?

He said the Bureau of Labor Statistics , which compiles the CPI each month, collects price data from more than 25,000 businesses. Nationwide insurance Chief Economist David Berson said it is a labor-intensive process.

How does CPI affect your wallet?

The CPI can affect your wallet. Your boss may use it to calculate your next raise to keep it above inflation. And Social Security cost-of-living adjustments are tied to the CPI.

How is the Consumer Price Index calculated?

The Consumer Price Index is calculated by measuring the price in one period for this fixed basket of consumer goods and services compared to their prices in previous periods. Changes in the CPI, therefore, approximately reflect changes in the cost of living in the U.S. As such, the CPI is an economic indicator most frequently used for identifying periods of inflation (or deflation) in the U.S.

What is the CPI?

Key Takeaways. The consumer price index (CPI) is a measure of the average change over time in the prices paid by consumers in urban households for a basket of goods and services. Changes in the CPI reflect changes in the cost of living in the U.S. The CPI is an economic indicator that is most frequently used for identifying periods of inflation ...

Why is the PCE index used instead of the CPI?

6 It is used instead of the Consumer Price Index (CPI) because the PCE Index is composed of a broad range of expenditures that exceeds the limited basket of goods used in CPI.

How does the GDP price deflator work?

What this means is that the GDP price deflator captures any changes in an economy's consumption or investment patterns.

What does a CPI of 100 mean?

It is based upon the index average for the period from 1982 through 1984 (inclusive) which was set to 100. So a CPI reading of 100 means that inflation is back to the level that it was in 1984 while readings of 175 and 225 would indicate a rise in the inflation level of 75% and 125% respectively. The quoted inflation rate is actually ...

What does it mean when the inflation rate is quoted?

The quoted inflation rate is actually the change in the index from the prior period, whether it is monthly, quarterly or yearly. Changes in the CPI reflect price changes in the economy. When there is an upward change in the CPI, this means there has been an increase in the average change in prices over time.

What is the most widely watched and used measure of the U.S. inflation rate?

While the CPI is the most widely watched and used measure of the U.S. inflation rate, many economists differ on how they believe inflation should be measured.

What is the CPI index?

The CPI computes and publishes index values, which are normalized to equal 100 in a chosen base period (1982– 84 for most indexes). Index values can be interpreted as representing an estimate of the price level relative to the base period. Percent change in the index is an estimate of the percent change in the price level over the period in question. The CPI publishes index values, along with 1-month and 12-month changes; the 12-month change is the most frequently referenced change. Note that while index values serve as a proxy for the price level, index levels

What is the CPI?

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a representative basket of consumer goods and services. The CPI measures inflation as experienced by consumers in their day-to-day living expenses.

What is the difference between CPI and Producer Price Index?

The CPI focuses on the consumer experience of inflation, therefore the price sought is typically the consumer's out-of-pocket price, including sales and excise taxes. This contrasts with the Producer Price Index, which focuses on what is received by the producer.

How does CPI work?

The CPI seeks to measure the change in the cost of living by measuring the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. For the CPI to be accurate, the market basket must correspond to what consumers are actually purchasing, and the different categories of items must be weighted to reflect their proportions in consumers' budgets. The CPI uses data from the Consumer Expenditure (CE) survey to determine the weights of the different categories of goods and services in the CPI. The CE survey collects data on the out-of-pocket expenses spent to acquire all consumer products and services. The CPI uses the CE data to identify the goods within the CPI's scope. Information about the scope of the CPI is available in the concepts section. Annual CE data are used for the CPI-U and CPI-W weights; these expenditure weights are updated biennially. For example, annual CE data from 2015 and 2016 were used to construct a set of weights that were implemented in the CPI at the end of 2017 and were used through the end of 2019. Additional information about the CE survey is available in the Consumer Expenditure section of the BLS Handbook of Methods.

How is CPI calculated?

The CPI is calculated in a two-stage process. First, basic indexes are calculated; these are indexes for specific item-area combinations. Ice cream and related products in the Chicago-Naperville-Elgin metro area are an example. These are structured by item category and geographic location. In the second stage, the basic indexes are aggregated into broader indexes, all the way up to the all items U.S. city average index. Thus, the CPI has both a geographic structure and an item structure.

Why is CPI seasonal adjusted?

A statistical process called seasonal adjustment can be done to remove typical seasonal influences , which helps economists better identify underlying trends. CPI publishes both seasonally adjusted data and not seasonally adjusted data. Seasonally adjusted data are typically used to understand and analyze month-to-month price change; not seasonally adjusted data are typically used for official purposes, including escalation of government payments and for studying longer term price movement. Seasonally adjusted data are only published at the nationwide level, and not all categories are seasonally adjusted.

How many geographic regions are there in the CPI?

CPI data are published for 23 metropolitan areas, 4 geographic regions, and 9 divisions as defined by the Census Bureau.

What is CPI?

CPI stands for consumer price index and measures the ongoing change of the costs of goods and services. This can include almost any good or service, like transportation, medical care, food or other merchandise items. Many use it to predict and determine the cost of the living and economic growth in certain areas. This is one of the more popular ways for professionals within the economic or financial industries to locate inflation or deflation periods within the economy.

What is the final consumer price index?

When calculating the consumer price index, the final consumer price index result represents the average change in prices that consumers will spend on a basket of good and services over time. This is how economic and financial professionals identify and determine inflation. They can then use CPI to determine the economy's aggregate price levels to measure the purchasing price of an entire country or a specific area. The consumer price index formula is:

How to calculate percentage of change in price?

When you divide the current product price total by the past price total, your equation is 8.50 / 6.75 = 1.26. You'd then multiple this total by 100, which would be 1.44 x 100 = 125.9. Subtract this total from 100 to receive your final percentage of change, which is 25.9%. This means there is a 25.9% change in product prices since 2018. The entire equation would be 9.70 / 8.50 = 1.26 x 100 = 125.9 - 100 = 25.9.

Who uses CPI?

Professionals who will typically use CPI in their position include: Store managers: Those who manage a store may calculate consumer price index on past products to approximate how much to charge for the products within the business for the upcoming year.

How to find past product prices?

You can research specific product prices from past years online. If you've kept any receipts, invoices or other documents detailing the prices for products or services you've purchased in the past, you can gather these up as well. Make sure whichever documents you're looking at have dates on them to prove the years are accurate.

What is consumer price index?

The consumer price indices are normally based on prices collected from outlets around the country, supplemented by information collected centrally over the internet and by phone. As a result of the coronavirus pandemic, we collected all prices centrally in April 2021, but our price collectors have resumed in-store collections from May 2021.

What is CPI inflation?

The CPI is a measure of consumer price inflation produced to international standards and in line with European regulations. The CPI is the inflation measure used in the government’s target for inflation.

What is CPIH in Figure 2?

Figure 2 shows the extent to which the different categories of goods and services have contributed to the overall Consumer Prices Index including owner occupiers’ housing costs (CPIH) 12-month inflation rate over the last two years.

What is the inflation rate for 2021?

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 2.9% in the 12 months to September 2021, down from 3.0% to August. Annual inflation rates at this time are influenced by the effects of the coronavirus (COVID-19) lockdowns in 2020. The Office for National Statistics’ (ONS) blog Beware Base Effects describes how relatively low prices for some items during and after that period influence current inflation rates. In particular, in August 2020, many prices in restaurants and cafes were discounted because of the government’s Eat Out to Help Out (EOHO) scheme, which offered customers half price food and drink to eat or drink in (up to the value of £10) between Mondays and Wednesdays. Part of the easing in the September 2021 12 month inflation rate is because of price increases last year following the end of this temporary scheme.

How much will restaurants contribute to the CPIH in 2021?

The contribution from restaurants and hotels fell to 0.34 percentage points in September 2021, down from 0.65 percentage points in August. This was the largest contribution that this division had made to the CPIH annual rate National Statistic series, which began in January 2006.

How are item indices imputed?

For the first month in which they become available again, item indices are imputed using either the monthly movement in the all-available-items index or, for a smaller number of seasonal items, the annual movement in the all-available-items index. The aim is that the indices for returning items have a negligible impact on the all-items inflation rate in the first month of return, reflecting the fact that these services are available only as price levels and do not have price growth associated with them (relative to the January base). Collected prices then start to influence the index in the following month.

When will the RPI be discontinued?

The UK Statistics Authority and HM Treasury launched a consultation in 2020 on the Authority’s proposal to address the shortcomings of the RPI. From 2030 (at the earliest), as outlined in the response to the consultation, the CPIH methods and data sources will be introduced into the RPI, and the supplementary and lower-level indices of the RPI will be discontinued.

Understanding The Consumer Price Index

- The BLS collects about 94,000 prices monthly from some 23,000 retail and service establishments. Although the two CPI indexes calculated from the data both contain the word urban, the more broad-based and widely cited of the two covers 93% of U.S. population.1 User f…

How Is The CPI presented?

- The monthly CPI releasefrom the BLS leads with the change from the prior month for the overall CPI-U as well as its key subcategories, along with the unadjusted change year-over-year. The detailed tables show price changes for a variety of goods and services organized by eight umbrella spending categories. Subcategories estimate price changes for everything from tomato…

How Is The Consumer Price Index (CPI) used?

- The CPI is widely used by financial market participants to gauge inflation and by the Federal Reserveto calibrate its monetary policy. Businesses and consumers also use the CPI to make informed economic decisions. Since CPI measures the change in consumers' purchasing power, it is often a key factor in pay negotiations. The CPI and its components are also used as a deflato…

Critiques of CPI Methodology

- Because the CPI Index is so crucial to economic policy and decision-making, its methodology has long been controversial, drawing claims it either understates or overstates inflation. A panel of economists commissioned by Congress to study the issue in 1995 concluded the CPI overstated inflation, and was followed by calculation changes to better reflect substitution effects. More rece…