Will my mortgage company send me a 1098?

Your mortgage company will include in your tax return an annual financial statement, a 1098 form, and a 1099-800 form if you pay $600 or more in mortgage interest during the year. In the case of a mortgage interest of less than $600, your lender does not have to send you these forms.

Do I need to issue a 1098?

If you’re receiving interest from a corporation, partnership, trust, estate, association or company (other than a sole proprietor), you do not need to file Form 1098. If you receive less than $600 in interest payments from your borrower each year, you do not need to file Form 1098.

What is Line 10 on a 1098?

Yes - if a real estate taxes paid amount was reported to you in Box 10 of your Form 1098, this represents the amount of real estate taxes you paid on your residence during the tax year, which are claimable as an itemized deduction on your federal income tax return, on Form 1040 Schedule A, Itemized Deductions, Line 6, (Real estate taxes).

How do you get a 1098?

How do I know if I get a 1098-T?

- Students can retrieve their 1098 – T via the Student Portal.

- To retrieve, log into the Student Portal.

- The Filer’s Federal Identification Number should already be populated in the form.

- The 1098 – T is typically made available for students in the by January 31st.

How does a 1098 mortgage affect my taxes?

The 1098 form and its variants are used to report certain contributions and other possible tax-deductible expenses to the IRS and taxpayers. In particular, they cover mortgage interest payments; contributions of motor vehicles, boats, or airplanes; student loan interest paid; and tuition and scholarship information.

Do I have to file a 1098 mortgage with my taxes?

No, you don't have to actually file Form 1098—that is, submit it with your tax return. You only have to indicate the amount of interest reported by the form. And you generally only report this interest if you are itemizing deductions on your tax return.

Do I have to report 1098 mortgage interest?

If you received $600 or more of interest on the mortgage from the payer/borrower in the current year, you must report the $500 refund in box 4 of the current year Form 1098. No change to the previous year Form 1098 is required.

Who gets a 1098 mortgage interest?

Form 1098 is issued to homeowners by mortgage lenders to report mortgage interest payments and other payments like mortgage premiums. Businesses must file Form 1098 if they receive $600 or more in mortgage interest from an individual in a year.

Does 1098 increase refund?

Taxable scholarship income can be reported on 1098-T when the box 5 value exceeds the box 1 value. This could reduce your refund.

Do you get money back on taxes for mortgage interest?

Mortgage Interest Deduction All interest you pay on your home's mortgage is fully deductible on your tax return. (The exception is for loans above $1 million; the deduction on these is capped.) In other words, $4,000 in annual mortgage interest reduces your taxable income by that $4,000 amount.

Is Form 1098 considered income?

It's important to remember that the 1098-T is an information form only and does not directly define taxable income or eligibility for a credit. Students may need to provide copies of their bursar bill to their tax preparer to confirm the dates that stipends were refunded.

How do I claim 1098 on my taxes?

Deducting mortgage interest using Form 1098 You might be able to deduct the Form 1098 amounts if they meet the guidelines for that amount. Put Box 1, deductible mortgage interest, and Box 6, points, into your Schedule A (Form 1040), Line 8a.

What is the purpose of a 1098 tax form?

Use Form 1098 (Info Copy Only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an individual, including a sole proprietor.

How do you claim mortgage on taxes?

Since mortgage interest is an itemized deduction, you'll use Schedule A (Form 1040), which is an itemized tax form, in addition to the standard 1040 form. This form also lists other deductions, including medical and dental expenses, taxes you paid and donations to charity.

How do I file a 1098 mortgage interest statement?

Deducting mortgage interest using Form 1098 You might be able to deduct the Form 1098 amounts if they meet the guidelines for that amount. Put Box 1, deductible mortgage interest, and Box 6, points, into your Schedule A (Form 1040), Line 8a.

Is Form 1098 considered income?

It's important to remember that the 1098-T is an information form only and does not directly define taxable income or eligibility for a credit. Students may need to provide copies of their bursar bill to their tax preparer to confirm the dates that stipends were refunded.

How do I file a 1098 on my taxes?

Use Form 1098, Mortgage Interest Statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or business from an individual, including a sole proprietor. Report only interest on a mortgage, defined later.

How do you claim mortgage on taxes?

You cannot claim a mortgage interest deduction unless you itemize your deductions. This requires you to use Form 1040 to file your taxes, and Schedule A to report your itemized expenses.

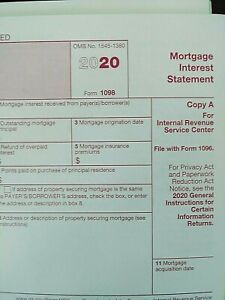

What is a 1098?

IRS Form 1098 is a mortgage interest statement. It's a tax form used by businesses and lenders to report mortgage interest paid to them of $600 or more.

Why do businesses need to efile 1098?

Businesses may want to e-file rather than submit paper statements because filing Form 1098 electronically is typically easier and helps prevent mathematical errors while carrying info over to your Schedule A, Jackson said.

Do insurance companies file 1098-T?

Insurers also file the 1098-T if they made any refunds or reimbursements to students for qualified tuition and education expenses. 4

Can Form 1098 Be E-Filed?

Yes, businesses and lenders can e-file Form 1098. The company must have access to software that generates a file according to the specifications in IRS Publication 1220. The IRS doesn’t provide a fill-in form option for businesses. 7

What is a 1098-E?

1098-E Form. Paying for college is expensive, but luckily you can get a tax break on the interest you’ll be paying for what may seem like the rest of your life. Each year, from each of your student loan servicers, you’ll receive a 1098-E detailing how much interest you paid that year.

When do you send a 1098-T to a dependent?

If you are or one of your dependents is currently in school, the school will send a 1098-T at the end of the year detailing all fees that were paid to it for tuition and other necessary educational expenses. Use this form to calculate education-related tax deductions and credits, such as the tuition and fees deduction, ...

What form do you use to donate a vehicle?

1098-C Form. If you donate a vehicle to a charitable organization (this also includes boats and airplanes), you’ll receive a 1098-C from the charity. These vehicles are frequently given to needy individuals, or sold to them at below-market rates.

Does 1098T show up on taxes?

The amounts on the form encompass all money you paid to the school, even if you paid in advance – the payment appears on the tax form for the year in which it was actually paid. For example, if you pay your spring semester tuition in the winter, it will show up on the prior year’s 1098-T. These amounts include any money used from loans to pay ...

Can you deduct mortgage interest on a refinance?

Deducting this interest requires you to itemize your deductions. So, if your mortgage interest is below your standard deduction, you may not want to itemize unless you have other deductions that, including your mortgage interest, add up to exceed the standard deduction for your filing status. You can also deduct any points paid when you get a new mortgage, either when purchasing a home or as part of a refinance, and those are reported on this form as well.

Who Can File Form 1098 mortgage interest statement?

For the previous year, if you paid $600 or more in interest and points on a mortgage, your lender will send Form 1098 to you. you will not receive Form 1098 if your payment was less than $600.

When do you need a 1098?

A 1098 form is required when you want to claim a mortgage interest deduction while filing taxes. There are four types of 1098 forms.

How many 1098 forms are there?

There are a total of four forms that have the number 1098. Form 1098 Mortgage Interest statement is one of.

What is a home in the IRS?

A home is defined by the IRS standards as a space that has basic living amenities: cooking and bathroom facilities and a sleeping area for which you pay mortgage interest.

What is box 4 in mortgage?

Box 4: It shows any mortgage interest that was refunded because you overpaid.

What is mortgage interest statement?

The Mortgage Interest Statement is used by taxpayers to submit the total amount of interest and other expenses paid on a mortgage.

What is prepaid interest on a home loan?

To improve the rate on the mortgage offered by the lending institution a prepaid interest is made by the borrower on a home loan which is referred to as points .

What To Do With Form 1098: Mortgage Interest Statement

In addition to the money you paid in mortgage interest, the form is also used to report mortgage insurance premiums and points to the IRS and taxpayers. If you refinanced and had more than one mortgage during the course of the calendar year, you’ll receive a Form 1098 from each lender.

Mortgage Interest on Rental Properties

Investors with rental properties can deduct mortgage interest as part of the expenses associated with renting out the property. You’ll file this amount on Schedule E of your Form 1040, which is used to report any income and losses from your rental properties.

The Bottom Line

If you are a homeowner who is claiming itemized deductions, you don’t need to attach a Form 1098 to your tax return – the IRS already has this information. If you do your own taxes, input Box 1, deductible mortgage interest, into line 8a of your Form 1040.

What is a 1098 mortgage?

Use Form 1098, Mortgage Interest Statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or business from an individual, including a sole proprietor. Report only interest on a mortgage, defined later.

What is a 1098?

For example, if the borrower's mother makes payments on the mortgage, the interest received from the mother is reportable on Form 1098 as received from the borrower.

What is mortgage in real estate?

A mortgage is any obligation secured by real property. Use the Obligation Classification Table to determine which obligations are mortgages.

What is the box to complete when securing a mortgage?

If the address of the property securing the mortgage is the same as the payer’s/borrower’s mailing address, either check the box or leave the box blank and complete box 8. If the address or description of the property securing the mortgage is not the same as the payer’s/borrower’s mailing address, complete box 8.

When is interest accrued on 1098?

Interest received during the current year that will properly accrue in full by January 15 of the following year may be considered received in the current year, at your option, and is reportable on Form 1098 for the current year. However, if any part of an interest payment accrues after January 15, then only the amount that properly accrues by December 31 of the current year is reportable on Form 1098 for the current year. For example, if you receive a payment of interest that accrues for the period December 20 through January 20, you cannot report any of the interest that accrues after December 31 for the current year. You must report the interest that accrues after December 31 on Form 1098 for the following year.

When to report 1098 points?

Report the total points on Form 1098 for the calendar year of closing regardless of the accounting method used to report points for federal income tax purposes.

Who is the payer of record?

The payer of record is the individual carried on your books and records as the principal borrower. If your books and records do not indicate which borrower is the principal borrower, you must designate one.