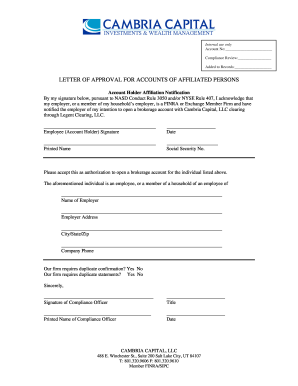

A 3210 letter—formerly known as a 407 letter—refers to the written permission that an employer gives for certain member employees to hold investments. Firms can also request to receive duplicate account statements so that they can see the securities held in a member’s personal investment accounts.

What is a 407 a 3210 letter?

A 3210 letter—formerly known as a 407 letter—refers to the written permission that an employer gives for certain member employees to hold investments. Firms can also request to receive duplicate account statements so that they can see the securities held in a member’s personal investment accounts.

What is rule 3210 and why does it matter?

Rule 3210 aims to govern accounts opened or established by advisors and brokers at firms other than the member firm where they are employed or registered. Accounts that financial advisors and brokers have with their employer are easily monitored.

How can my employer get my 3210 letter of approval?

Firms can also request to receive duplicate account statements so that they can see the securities held in a member’s personal investment accounts. Your employer can email your 3210 letter of approval to [email protected].

What can I do with a 3210 account?

3210. Accounts At Other Broker-Dealers and Financial Institutions | FINRA.org Registered representatives can fulfill Continuing Education requirements, view their industry CRD record and perform other compliance tasks. Firm compliance professionals can access filings and requests, run reports and submit support tickets.

What is FINRA Rule 3210?

FINRA adopted Rule 3210 in 2016, which required all employees to notify their employers if they intend to open or maintain an investment account at...

Protecting Against Conflicts of Interest

A primary goal of FINRA Rule 3210 is to prevent FINRA member conflicts of interest. Your financial advisor and your brokerage firm should be workin...

Concerned That a Conflict of Interest Has Led to Investment Loss?

If you are concerned that a conflict of interest caused you investment loss, we are here to fight for your rights. When you engage an investment ad...

What is FINRA Rule 3210?

FINRA adopted Rule 3210 in 2016, which required all employees to notify their employers if they intend to open or maintain an investment account at a competing financial firm. Rule 3210 governs accounts opened by members at firms other than where they work.

What is the requirement for FINRA broker dealer records?

An important part of this rule is the written consent part. Everything must be in writing under Rule 3210. Indeed, keeping written records is a requirement under most FINRA registered broker dealer rules. Maintaining a record of requests and consents is important in this case because Rule 3210 pertains to conflicts of interest.

What is a 3210 disclosure letter?

Rule 3210 requires financial advisors to make a request and obtain consent from the FINRA member firm they work for to keep their accounts somewhere else. It also requires a disclosure letter to the outside firm when a securities industry professional opens an account.

What is a 3210 letter?

This disclosure action is sometimes referred to as a FINRA 3210 Letter. Making this disclosure is one important step in preventing conflicts of interest for either firm.

What does it mean when an individual works for a brokerage firm?

When an individual works for a brokerage firm, they typically keep their assets at that firm. The firm is therefore able to monitor their trades and can ensure that the financial advisor is not frontrunning their clients in a personal brokerage account.

What is a financial advisor notification?

Giving written notification of the financial advisor’s employment at his or her brokerage firm to the brokerage firm opening the new account; and

What was the goal of the regulators in approving this rule?

The regulators’ goal in approving this rule was to prevent conflicts of interest by financial advisors and broker dealers.

What Is Rule 3210?

Rule 3210 (Accounts at Other Broker-Dealers and Financial Institutions) was approved by the Securities and Exchange Commission (SEC) in April 2016. It was rolled out in April the following year to ensure that member companies, brokers, and advisors maintain ethical standards during their employment. 2

What is the purpose of Rule 3210?

The purpose of Rule 3210 is to govern accounts opened or established by advisors and brokers at firms other than the member firm where they are employed or registered. Accounts that financial advisors and brokers have with their employers are easily monitored. It also puts conditions on accounts opened and maintained by anyone associated with members. Associated persons include people who are related to the employee such as spouses, children, and other family members.

What is the 407 rule?

The rule superseded NYSE Rule 407, a conduct rule which put conditions on the personal investment accounts of FINRA members. Under the rule, they were required to report any and all investment holdings to the New York Stock Exchange (NYSE) or Nasdaq in order to eliminate any and all instances of fraud and/or insider trading. 3

When was FINRA 3210 adopted?

FINRA Rule 3210 was adopted in 2016 and rolled out the following year. Rule 3210 governs accounts opened by members at firms other than where they work. All employees must declare their intent and obtain their employers' consent if they wish to open or maintain an investment account at any other financial institution.

What is the Financial Industry Regulatory Authority?

FINRA is a non-government, independent organization that helps protects investors and helps maintain integrity in the markets.

Do brokers have to notify their employer of their intent to open a new account?

Under the new rule, advisors and brokers are also required to notify their employer in writing of their intent to open a new account as well as declare all accounts where they have a financial or beneficial interest .

Do advisors have to notify their employer of any accounts opened by associated persons with other financial institutions?

Advisors and brokers are also required to notify their employer in writing of any accounts opened by associated persons with other financial institutions other than their employer. 2

What does this mean to me?

You submitted a request for a Collection Due Process (CDP) hearing. However, your request was not filed within the 30 days of the date of mailing of the CDP notice prescribed under Internal Revenue Code (IRC) section 6320 and/or 6330.

How did I get here?

You have a balance due on your tax account. The IRS has either issued you a CDP levy notice or filed a Notice of Federal Tax Lien (NFTL) providing CDP appeal rights. You have exercised your appeal rights and made a request for a CDP hearing after the due date for a timely hearing.

If You Have Questions

If you have questions, you can contact the person shown at the top of the letter. You cannot dispute an Appeals decision regarding the collection action (NFTL filing or levy) in the U.S. Tax Court because your request was not filed within 30 days from the date of mailing of the CDP notice prescribed under IRC section 6320 and/or 6330.

Payment Options

If you can’t pay the full amount, you can consider what payment options might work for your situation. You could review information regarding the following collection alternatives and resolutions:

Agreed Collection Alternative

If you agreed to a collection alternative such as an installment agreement or offer in compromise, you’ll need to make payments based on your agreement with the IRS.

Additional Information

If you believe that you timely filed your CDP hearing request and you can provide proof of timely filing, you can file a petition with the U.S. Tax Court within 30 days from the date of this letter to dispute Appeals’ decision about the timeliness of your hearing request.

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: [email protected] < Caution-mailto: [email protected] > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

What is a ATF Form?

A Firearms Transaction Record, or Form 4473, is a form promulgated by the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) in the United States Department of Justice that is filled out when a person purchases a firearm from a Federal Firearms License (FFL) holder (such as a gun shop).

When did Form 4473 start?

Form 4473 has included a question on race since it was established in 1968. ATF amended Form 4473 in 2001 to add ethnicity to the race question.

How to sign a 3210 form?

Create an account using your email or sign in via Google or Facebook.

Why is Google Chrome so popular?

Google Chrome’s browser has gained its worldwide popularity due to its number of useful features, extensions and integrations. For instance, browser extensions make it possible to keep all the tools you need a click away. With the collaboration between signNow and Chrome, easily find its extension in the Web Store and use it to eSign rule 3210 letter right in your browser.

How to add electronic signature to 3210?

In order to add an electronic signature to a government forms 3210, follow the step-by-step instructions below: Log in to your signNow account. If you haven’t made one yet, you can , through Google or Facebook. Add the PDF you want to work with using your camera or cloud storage by clicking on the + symbol.

What is FINRA Rule 3210?

FINRA Rule 3210 requires an executing member, upon written request by an employer member, to transmit duplicate copies of confirmations and statements, or the transactional data contained therein, with respect to an account subject to the rule. This requirement applies without regard to whether the associated person who establishes ...

What is a member of FINRA responsible for?

More broadly, FINRA noted that members are responsible for establishing and maintaining systems for the supervision of their associated persons that are reasonably designed to achieve compliance with applicable securities laws and regulations, and with applicable FINRA rules. Question 2.

What is electronic means in FINRA?

Members may use electronic means for purposes of the transmission requirements under the rule, provided such transmission includes the transactional data as required pursuant to the rule. For purposes of FINRA Rule 3210, FINRA interprets transactional data to mean the data as to the securities transactions that are effected in an account ...

What does "limited" mean in FINRA?

2. FINRA has noted that “limited” means that only transactions as set forth in the Supplementary Material can be effected in the account. See Regulatory Notice 16-22.

What is MSRB Rule D-12?

MSRB Rule D-12 defines municipal fund security to mean “a municipal security issued by an issuer that, but for the application of Section 2 (b) of the Investment Company Act of 1940, would constitute an investment company within the meaning of Section 3 of the Investment Company Act of 1940.”

Does FINRA 3210 apply to spouses?

By its terms, the requirements of FINRA Rule 3210 would apply with respect to each spouse vis-à-vis his or her respective employer member and the relevant executing member or other financial institution. As a consequence, among other things, associated persons and employer members should be aware that the presumption of beneficial interest, as set forth in Supplementary Material .02 of the rule, would apply to each spouse with respect to the account or accounts of the other spouse.

Does Rule 3210 preclude an employer member from requesting information as to such accounts and transactions from an executing member?

Rule 3210 does not preclude an employer member from requesting information as to such accounts and transactions from an executing member, and the rule does not preclude an executing member from providing the information, provided that the executing member acts consistent with Regulation S-P and other applicable requirements. Question 7.

What is FINRA 3210?

The SEC has approved new FINRA Rule 3210 (Accounts at Other Broker-Dealers and Financial Institutions) which is a consolidated rule governing accounts opened or established by associated persons at firms other than the firm at which they are employed. The goal of the new rule is to help facilitate effective oversight of such accounts by member firms. New FINRA Rule 3210 replaces NASD Rule 3050, Incorporated NYSE Rules 407 and 407A and Incorporated NYSE Rule Interpretations 407/01 and 407/02.

What are the obligations of a FINRA member?

FINRA member firms have specified obligations with respect to accounts held by associated persons that are consistent with the prior rule. Specifically, upon written request by the employer member, other member firms holding accounts of associated persons of another member firm, are required to transmit duplicate copies of confirmations and statements, or the transactional data contained therein, with respect to an account subject to the rule.

Does FINRA 3210 apply to unit investment trusts?

As with the prior rule, FINRA Rule 3210 requirements shall not apply to transactions in unit investment trusts, certain municipal fund securities as defined under MSRB Rule D-12,14 qualified tuition programs pursuant to Section 529 of the Internal Revenue Code and variable contracts or redeemable securities of companies registered under the Investment Company Act, as amended, or to accounts that are limited to transactions in such securities, or to Monthly Investment Plan type accounts.

What is a child of the associated person?

a child of the associated person or of the associated person’s spouse, provided that the child resides in the same household as or is financially dependent upon the associated person; any other related individual over whose account the associated person has control; or.

Can an employer obtain copies of a FINRA statement?

With respect to an account subject to the rule at a financial institution other than a FINRA member firm, the employer member must consider the extent to which it will be able to obtain, upon written request, duplica te copies of confirmations and statements , or the transactional data contained therein, directly from the non-member financial institution in determining whether to provideits written consent to an associated person to open or maintain such account.

When did the FINRA rule come into effect?

The effective date of the rule is April 3, 2017 and as such FINRA member firms need start planning on the revisions necessary to their processes and procedures related to out side brokerage accounts.

Can a spouse have a beneficial interest in a child's account?

However, the rule makes allowance for rebutting the presumption as to specified accounts. Specifically, Supplementary Material .02 provides that, for purposes of spouse and child accounts as set forth in (a) and (b) above, an associated person need not be presumed to have a beneficial interest in, or to have established, an account if the associated person demonstrates, to the reasonable satisfaction of the employer member, that the associated person derives no economic benefit from, and exercises no control over the account.

Documentation

Some employers require us to send copies of your monthly or quarterly statements to them for compliance review. The only way we can currently send these is through the mail. Your employer can email your 3210 letter to [email protected], and we’ll mail statements to your compliance department per the instructions in the letter.

Letters

A 3210 letter—formerly known as a 407 letter—refers to the written permission that an employer gives for certain member employees to hold investments. Firms can also request to receive duplicate account statements so that they can see the securities held in a member’s personal investment accounts.

Overview

What Is Rule 3210?

- Rule 3210 (Accounts at Other Broker-Dealers and Financial Institutions) was approved by the Se…

The purpose of Rule 3210 is to govern accounts opened or established by advisors and brokers at firms other than the member firm where they are employed or registered. Accounts that financial advisors and brokers have with their employers are easily monitored. It also puts conditions on …

Requirements Under the New Rule

- This rule replaced Rule 3050 which was enforced by the National Association of Securities Deal…

The new rule focuses on external accounts with other broker-dealer firms. It requires all licensed employees to declare investment accounts held with other financial institutions. Under the new rule, advisors and brokers are also required to notify their employer in writing of their intent to op…

What Does Rule 3210 Mean for Advisors and Brokers?

- The new rule works in conjunction with standard transaction review and investigation practices …

Member firms can request that employees provide copies of account documentation, such as transaction confirmations and account statements, at any time. Therefore, advisors and brokers should keep records of all account information and transactions .