What is the Purpose of Cost Accounting?

- Quantify Productivity. The first important purpose of cost accounting revolves around the quantification of productivity. ...

- Help With Decisions. Other than productivity, according to Forbes, cost accounting is also widely used to help managers derive important decisions about the business in general.

- Minimize Production Costs. ...

- Sustainability Efforts. ...

What are the functions of cost accounting?

Objectives of Cost Accounting

- Process Of Accounting For Cost. Cost accounting is a process of recording the income and expenditure of the organization. ...

- Records Income And Expenditure. ...

- Provides Statistical Data. ...

- Helps In Cost Control. ...

- Preparation Of Budget. ...

- Comparison Of Actual With Standard. ...

- Presentation Of Correct Information. ...

- Helps In Decision Making. ...

Why cost accounting is used instead of financial accounting?

The problems with Excel as an accounting spreadsheet

- It’s not generally accepted in the business world. While Excel may work for your small business, it’s usually not accepted by the business world as a whole.

- Visualization is difficult. As mentioned in the previous paragraph, the Excel format is useful for large amounts of information.

- Lack of historical data. ...

- Manual entry. ...

- No integration. ...

What are the advantages and disadvantages of cost accounting?

- Measures and improves efficiency. Ascertaining the performance of the organization and improving it is another important role played by cost accounting.

- Identifies unprofitable activities. ...

- Price Fixation. ...

- Inventory Control. ...

- Control cost. ...

- Identifies reasons for losses. ...

Why is cost accounting so important?

Importance of Cost Accounting to Others

- Workers: One of the biggest uses of cost accounting is that it helps us calculate efficiency. ...

- Government: Costing helps the government when assessing for income tax or any other such government liabilities. ...

- Customers: The main aims of costing are cost control and improvement in efficiency. Both of these are very beneficial to the company. ...

What is the purpose of cost accounting quizlet?

A major purpose of cost accounting is to: measure, record and report product costs.

What are the 5 main purposes of accounting?

Bookmark 5 Main purposes of accounting.5 MAIN PURPOSES OF ACCOUNTING1)Record transactions2)Monitor activity3) Control4)Management of the business5)Measurement of financial performance.Introduction•Business accounting is the most important subject in business.More items...

What are two major purposes of accounting?

The main functions of accounting are to store and analyze financial information and oversee monetary transactions. Accounting is used to prepare financial statements for a company's employees, leaders, and investors.

What are the 3 main objectives of accounting?

Objectives of Accounting:The following are the main objectives of accounting:To maintain full and systematic records of business transactions:To ascertain profit or loss of the business:To depict financial position of the business:To provide accounting information to the interested parties:

What are the five users of accounting information?

Users of Accounting InformationOwners/Shareholders.Managers.Prospective Investors.Creditors, Bankers, and other Lending Institutions.Government.Employees.Regulatory Agencies.Researchers.More items...

What are the golden rules of accounting?

Real Account. ... Personal Account. ... Nominal Account. ... Rule 1: Debit What Comes In, Credit What Goes Out. ... Rule 2: Debit the Receiver, Credit the Giver. ... Rule 3: Debit All Expenses and Losses, Credit all Incomes and Gains. ... Using the Golden Rules of Accounting.

What are the 8 branches of accounting?

The eight branches of accounting include the following:Financial accounting.Cost accounting.Auditing.Managerial accounting.Accounting information systems.Tax accounting.Forensic accounting.Fiduciary accounting.

What are the benefits of accounting?

Advantages of AccountingMaintenance of business records.Preparation of financial statements.Comparison of results.Decision making.Evidence in legal matters.Provides information to related parties.Helps in taxation matters.Valuation of business.More items...

Why is cost accounting important?

The first important purpose of cost accounting revolves around the quantification of productivity. In translation, it allows companies to tangibly record their employees’ performances based on the output levels. This is extremely useful as it can be utilized for important decisions that have to be made subsequently.

How does cost accounting help?

Other than productivity, according to Forbes, cost accounting is also widely used to help managers derive important decisions about the business in general. To better understand this, consider the following scenario. If a business switches its suppliers and starts working with new raw materials, they will have to evaluate the efficiency of production using those fresh inputs. Fortunately, accountants can run fairly simple volume and price variance reports that showcase how the cost-to-benefit ratio is behaving. Thus, if the new raw materials are causing the workers to spend more time building the product, the volume variance may be unfavorable. From there, the accountant can create reports that will point the management in the right direction. In other words, cost accountancy will allow them to see actual statistics and crucial data that helps with material decisions.

What is managerial style accounting?

Managerial style of accounting, on the other hand, is always dedicated to ranking best future alternatives in terms of cost, efficiency, and even longevity. Some other important purposes of cost accounting include the verification of proper internal procedures, bridging the gap between people charged with governance, ...

Is disrupting the production process a good way to improve operations?

After all, completely disrupting the production process by getting new inputs is not a great way to improve operations. Regardless, producers are always in search of ways to minimize the costs. Doing so allows them to maintain as much of their revenues as possible.

Can an accountant run a price variance report?

Fortunately, accountants can run fairly simple volume and price variance reports that showcase how the cost-to-benefit ratio is behaving. Thus, if the new raw materials are causing the workers to spend more time building the product, the volume variance may be unfavorable.

What is cost accounting?

Cost accounting is a form of a managerial accounting system designed to evaluate company costs for the purpose of improving productivity and increasing profit. Business owners who focus on the cost aspect of business can better understand how to reduce costs and increase profitability.

What is the difference between cost accounting and financial accounting?

One of the biggest differences between cost accounting and financial accounting is regulation and standards. Financial statements are governed by regulators and should abide by Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

How does life cycle costing work?

Unlike target costing, this costing method tracks the production costs through the life of the product. As a result, life-cycle costing can last for years longer than other costing methods. The U.S. government often uses this costing method when implementing building design and energy measures.

What is marginal costing?

Marginal costing evaluates the cost of producing each additional unit. This method is commonly used when a company wants to find the optimal point where production is maximized and costs are minimized.

What is activity based costing?

Activity-based costing (ABC) calculates costs based on the activity and effort used to produce a product or service. Unlike standard costing, this method can allocate a more accurate portion of the overhead costs to the factors responsible for increasing costs. Both fixed and variable costs can be included using this method.

Why do companies use job order costing?

Job order costing is commonly used for companies that produce products that aren’t identical. If a company builds custom cars, the cost for each car will likely be different because each customer will have a specific set of requirements. Since the product is unique, it’s easier to track the cost of each order or service on a per-project, or job order, basis.

What is process costing?

Process costing is used for companies that make uniform products, like cookies or soda. In the case of a soda manufacturer, each soda likely costs the same to produce; the production cost doesn’t change as frequently as it would for a company making bespoke products. So, companies use the process costing method to assess the cost of an entire batch of soda, then assign a cost to each soda based on that number.

Why do companies use cost accounting?

It is a common form of accounting for manufacturing businesses, as it allows them to break out costs for each product they produce . Cost accounting, when it's used appropriately, can help businesses identify areas where they can save money. The article is for small business owners looking to learn more about cost accounting ...

How does cost accounting help businesses?

Cost savings: Using cost accounting, businesses may be able to identify new efficiencies to help save money. Quicker decisions: Cost accounting can help managers respond quickly to changes in the market, such as when the cost of raw materials increases.

What is cost accounting?

Cost accounting is a method of accounting that focuses purely on a business's costs – both fixed and variable. Using the cost accounting method, companies track all of their costs and allocate them to individual processes or units of production, allowing managers to better understand the economics of their business's activities.

What is the difference between cost accounting and financial accounting?

Cost accounting focuses purely on a business's costs, while financial accounting combines this information with other items, like revenue, liabilities, and shareholder equity, to provide a comprehensive look at a company's finances.

Why are variable costs important?

Variable costs are significant for a company because they are marginal – each additional unit of production adds more cost to the company .

What is financial accounting?

Financial accounting includes cost accounting, as well as other elements – such as income, liabilities, and equity – which it combines to provide comprehensive reports and insights into the company's financial circumstances and future prospects.

What is operating cost?

Operating costs include the expenses involved with running a facility ( marketing and utilities are prime examples); it doesn't include costs that are directly tied to production.

Understanding Cost Accounting

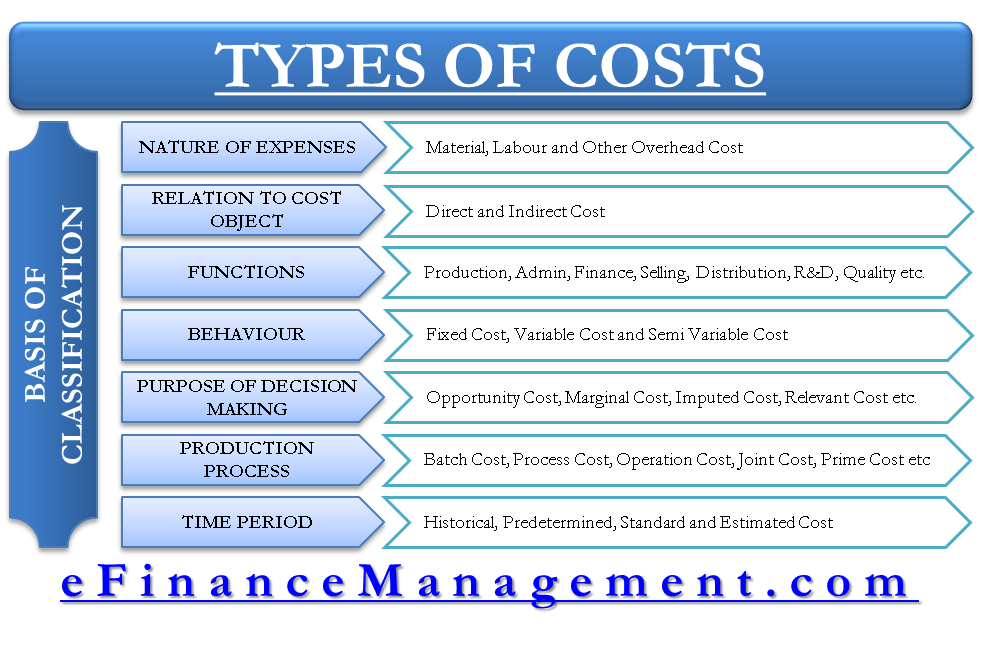

Types of Costs in Cost Accounting

- Although there are many types of coststhat businesses can incur depending on their industry, below are a few of the most common costs involved in cost accounting.

Cost Accounting vs. Financial Accounting

- Financial accounting and cost accounting systems can be differentiated based on their respective target audiences. Financial accountingis designed to help those who don't have access to inside business information, such as shareholders, lenders, and regulators. For example, retail investors who analyze financial statements benefit from a company's financial accounting. Alternatively, c…

Quantify Productivity

- The first important purpose of cost accounting revolves around the quantification of productivity. In translation, it allows companies to tangibly record their employees’ performances based on the output levels. This is extremely useful as it can be utilized for important decisions that have to be made subsequently. For instance, if the productivit...

Help with Decisions

- Other than productivity, according to Forbes, cost accounting is also widely used to help managers derive important decisions about the business in general. To better understand this, consider the following scenario. If a business switches its suppliers and starts working with new raw materials, they will have to evaluate the efficiency of production using those fresh inputs. Fo…

Minimize Production Costs

- Since the example of raw materials was mentioned, why exactly would companies try to something such as this? After all, completely disrupting the production process by getting new inputs is not a great way to improve operations. Regardless, producers are always in search of ways to minimize the costs. Doing so allows them to maintain as much of their revenues as pos…

Sustainability Efforts

- Finally, this profession also deals with the sustainability efforts related to production processes. Before explaining how, one must recognize that practically every company is looking for alternatives that will make them more sustainable and efficient. In translation, they are researching ways that facilitate lower or non-existant waste as well as higher utilization percent…

Cost Accounting Definition and Examples

- Cost accounting is a form of a managerial accountingsystem designed to evaluate company costs for the purpose of improving productivity and increasing profit. Business owners who focus on the cost aspect of business can better understand how to reduce costs and increase profitability. 1. Alternate name: Costing method Companies that implement cost ...

How Cost Accounting Works

- Because each business has its own structure, how a business's cost accounting works varies. Cost accounting is customizable, and business owners can choose a system that makes the most sense for their type of business. However, cost accounting typically comes in two forms:

Types of Cost Accounting Systems

- The beauty of cost accounting is that a company can use a combination of systems to design a costing method that works best for that business. While job and process costing are the two most common types of cost accounting, there are several others businesses may use.

Cost Accounting vs. Financial Accounting

- Unlike financial accounting, which focuses on preparing statements for company shareholders and interested parties outside of the company, cost accounting is internal. Company management and leaders use cost accounting to inform their decisions on how to improve the company’s operations. Financial accounting focuses on taking the company’s financials and presenting the…