What is the difference between cost driver and cost pool?

As the same indicates, costs drivers drive costs. That is they cause costs to change as the cost driver changes. Cost Pools are used in Activity Based Costing and are activities for which costs are to be measured.

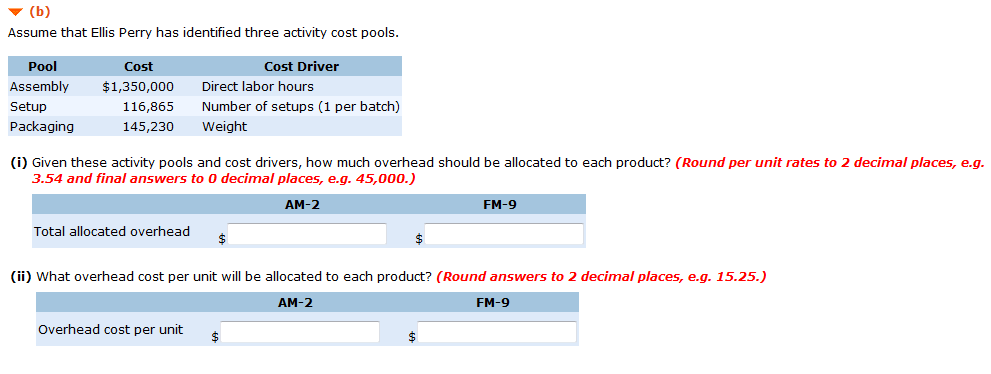

What is a cost driver rate?

(Explain and Example) An activity is considered to be a cost driver, which incurs a cost, as a result of operations and functions within the company. Similarly, a cost-driver rate is also incurred, that includes cost pool, divided by cost driver.

What is a cost pool?

Cost Pool - Definition, Examples, Uses, How to Create? A Cost Pool is a kind of cost strategy to identify the cost incurred by the business entity’s individual departments or service sectors.

What is the importance of cost pooling in costing?

It helps determine the total expenses incurred in manufacturing goods and in allocating the same to the different departments or service sectors based on some reasonable identifier known as a cost driver. Cost Pool can also be used in activity-based costing to estimate the cost incurred in performing certain tasks in a business.

What is a cost pool examples?

A cost pool is a grouping of individual costs, typically by department or service center. Cost allocations are then made from the cost pool. For example, the cost of the maintenance department is accumulated in a cost pool and then allocated to those departments using its services.

What is meant by cost pool?

An activity cost pool is an aggregate of all the costs associated with performing a particular business task, such as making a particular product. By pooling all costs incurred in a particular task, it is simpler to get an accurate estimate of the cost of that task.

What is meant by a cost driver?

Cost drivers are the direct cause of a business expense. A cost driver is any activity that triggers a cost of something else. An example of this could be how the amount of water your office uses in a month determines the price of your water bill. The units of water are the cost drivers, and the water bill is the cost.

What is the difference of cost pool cost driver and cost object?

Cost object deals with the overall cost of the product or services, whereas cost driver deals with the quantity of resources consumed by the enterprise. A cost object is more of accounting and budgeting, whereas cost driver is more of the management.

What is cost pool in total?

Cost pools are the amount of money spent on an 'activity', for instance, customer service or manufacturing. Cost pools are used in activity-based costing to accurately determine where the money is spent rather than splitting the overhead costs equally over all departments.

How do you calculate pool cost?

Assign each cost pool activity cost drivers, such as hours or units. Calculate the cost driver rate by dividing the total overhead in each cost pool by the total cost drivers. Divide the total overhead of each cost pool by the total cost drivers to get the cost driver rate.

What are the 4 types of cost drivers?

There are 3 types of cost drivers: Volume Drivers, Unit Price Drivers, and Fixed Cost Drivers (Overhead).

What are some examples of cost drivers?

Examples of cost drivers are direct labor hours worked, the number of customer contacts made, the number of engineering change orders issued, the number of machine hours used, and the number of product returns from customers.

What is another name for cost driver?

An activity cost driver, also known as a causal factor, causes the cost of an activity to increase or decrease. An example is a change in the cost of warehousing or a change in the level of production.

Why are cost drivers important?

Cost Driver is an essential source for allocating the costs. read more of the product based on the activities performed to produce that product, which helps in finding the total cost of the product.

What is the reason for pooling costs?

Using cost pooling helps a business determine the exact overhead costs for each department. This can then help the company's management to make an accurate estimate of how much every product costs to make, which can lead to a more efficient allocation of funds.

What is meant by Kaizen costing?

Kaizen costing is a system of cost reduction via continuous improvement. It tries to maintain present cost levels for products currently being manufactured via systematic efforts to achieve the desired cost level. The word kaizen is a Japanese word meaning continuous improvement.

What is the reason for pooling costs?

Using cost pooling helps a business determine the exact overhead costs for each department. This can then help the company's management to make an accurate estimate of how much every product costs to make, which can lead to a more efficient allocation of funds.

What is the overhead cost pool?

Overhead cost pools include all costs that affect a company's overall production process in a direct or indirect manner. For example, equipment or building depreciation, management salaries, property taxes, security payments for products or buildings, and similar costs all fall under this group.

What is a cost pool quizlet?

Cost pool: A grouping of individual indirect cost items. Cost tracing: the process of assigning direct costs to relevant cost object.

What is indirect cost pool?

A grouping of incurred costs identified with two or more cost objectives, but not specifically identified with any final cost objective.

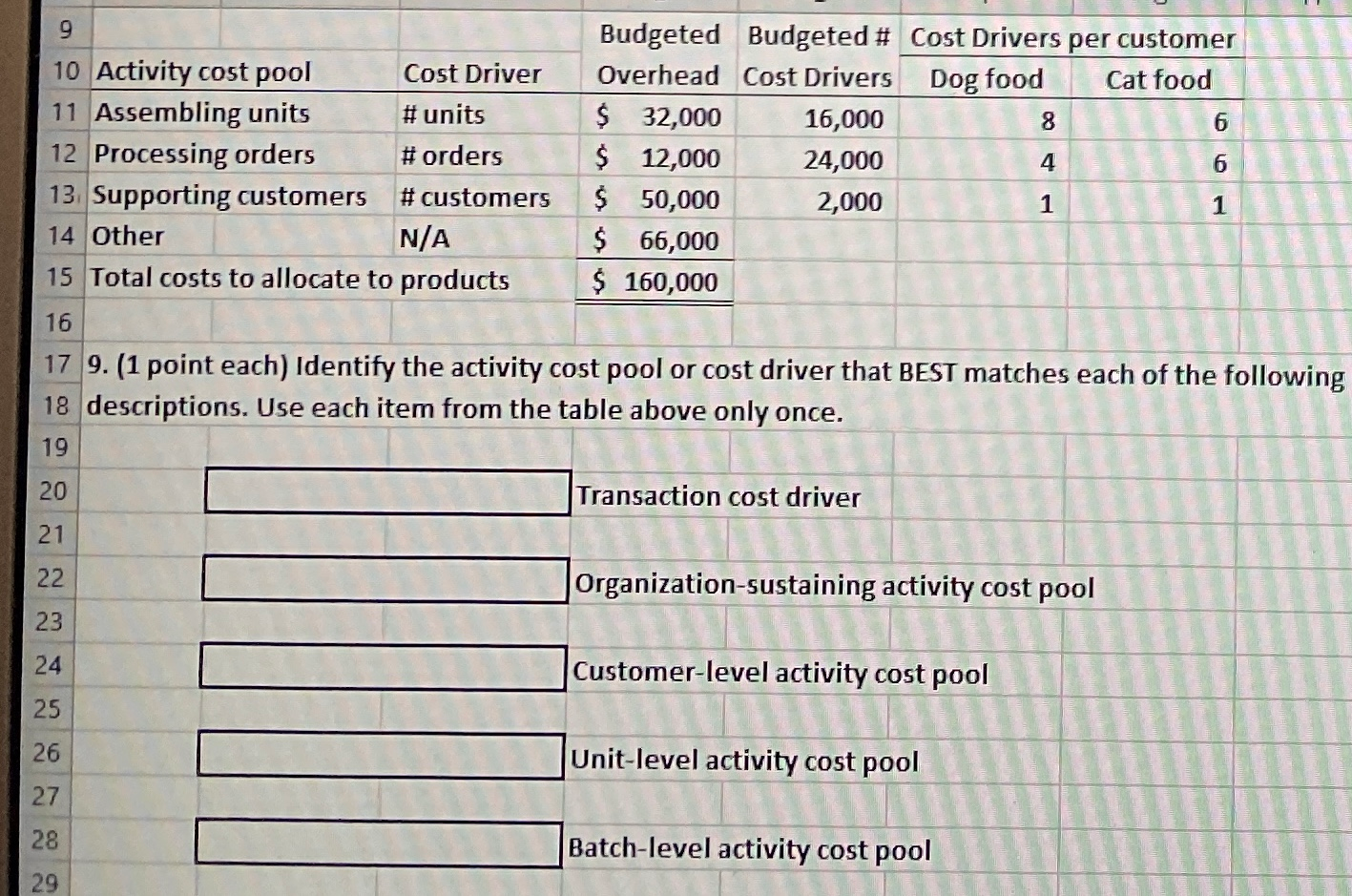

Why is grouping cost pools and cost drivers important?

Grouping your cost pools and cost drivers is useful because it will help you identify all the costs that go into the making of your product, thus giving you a more accurate overhead calculation. To unlock this lesson you must be a Study.com Member. Create your account.

Why is it important to list cost drivers?

Listing the cost drivers and then separating them into cost pools is a useful activity to help you clearly define the various costs that go into the making of your product. Doing this activity helps you find out both the costs that are clearly evident, along with the costs that are not so evident, such as the cost to set up the ice cream making machine. Activity-based costing helps to get a more accurate calculation of your overhead.

How does activity based costing work?

This method calculates your overhead by taking into consideration all the activities that are involved in the making of a product. For example, say you are in the business of making ice cream. What activities are needed in order to make the ice cream? You need not only materials, but also machines and employees. All of these different elements factor into your overhead cost. With the activity-based costing system, you are able to include all of these costs into your overhead calculation.

What are the cost drivers for ice cream?

These are called cost drivers. For your ice cream making business, your cost drivers might include: Setting up the ice cream making machine. Buying all the ingredients. Buying all the toppings. Paying the necessary amount of employees. Paying the business rent, along with the utilities.

Is a business rent part of the materials cost pool?

Paying the necessary number of employees can be part of the Personnel cost pool. Paying the business rent along with the utilities can be part of the Office Expenses cost pool.

What is cost driver?

What are Cost Drivers? A cost driver is a unit that derives the expenses and sets a basis on which a particular cost is to be allocated between the different departments and on the basis of that driver’s activity completed in that particular period the cost is allocated. These are the structural determinants of the activities on which cost is being ...

What are the cost drivers in accounting?

There are many types of cost drivers in cost accounting#N#Cost Accounting Cost accounting is a defined stream of managerial accounting used for ascertaining the overall cost of production. It measures, records and analyzes both fixed and variable costs for this purpose. read more#N#. As per traditional accounting, the manufacturing costs and indirect costs#N#Indirect Costs Indirect cost is the cost that cannot be directly attributed to the production. These are the necessary expenditures and can be fixed or variable in nature like the office expenses, administration, sales promotion expense, etc. read more#N#are allocated on the predefined rate based on the activity performed.

What is a cost object?

Cost Object is the product’s, process, department, or customer-related management term, which defines that the costs originated from or is associated with . A cost object is something that can be identified with a product, process, department, or a customer and can be tracked back to why the cost was incurred.

Why is it important to know the cost of a product before entering the market?

As mentioned above in the application of cost drivers, it is evident to know the cost of the product before entering the market to pre-identify whether the company can make profits out of the products they propose to sell.

Can every business apply cost drivers?

It is a complex process, and not every business can apply the cost drivers in its activities.

What is cost driver?

An activity is considered to be a cost driver, which incurs a cost, as a result of operations and functions within the company. Similarly, a cost-driver rate is also incurred, that includes cost pool, divided by cost driver. This is used to calculate the amount of overhead, as well as indirect costs related to a particular activity.

Why do we pool costs together?

The main concept behind pooling all the costs together is to get a closer estimate of the associated cost of the business task itself. In this regard, it is further simple to get an accurate estimate of the given cost of the task itself.

How to create Activity Cost Pools?

Creating Activity Cost Pools comprises of three major steps. These steps are as follows:

Why is activity cost pool easier?

Using activity cost pools, the segregation of costs is relatively easier, primarily because of the fact that it helps allocating costs to pools where they actually belong. For example, machine hours might not necessarily apply to the design component within the costing.

Why is activity based costing important?

The main rationale behind activity-based costing is to ensure that there is traceability pertaining to costs associated with indirect costs, so that product costs can accurately be calculated. Hence, the ABC system mainly relies on activities, which are considered to be true for any event, unit of work, or a given task with a specific goal.

What is activity based costing?

Activity Based Costing can be defined as a costing method, which assigns overhead costs, as well as indirect costs to related products and services.

What are the three cost drivers of Chris Inc?

Using the concept of activity cost pools, the accountant at Chris Inc. identified cost drivers including factory square footage, maintenance hours, labor hours and the total output produced . These three different cost pools are finalized, and the cost incurred is then appropriately dividend amongst other present alternates.