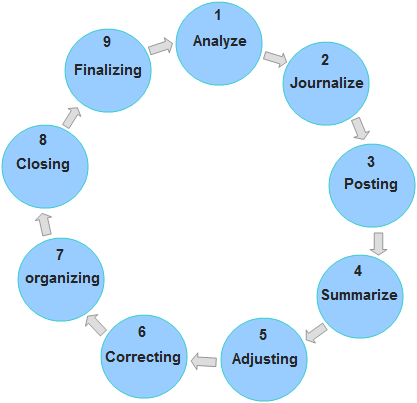

What are the 8 steps of the accounting cycle?

Share. A: All eight steps in the accounting cycle are important, since each step is necessary to complete the full accounting cycle accurately. The eight steps in the accounting cycle, in order, are: transactions, journal entries, posting, trial balance, worksheet, adjusting journal entries, financial statements and closing of the books.

What is a 4th step in the accounting cycle?

4. Unadjusted trial balance: At the end of the accounting period, a trial balance is calculated as the fourth step in the accounting cycle. A trial balance tells the company its unadjusted balances in each account.

How often does the accounting cycle repeat itself?

The cycle repeats itself every fiscal year as long as a company remains in business. The accounting cycle incorporates all the accounts, journal entries, T accounts, debits, and credits, adjusting entries over a full cycle. Transactions: Financial transactions start the process.

What is the fifth step in the balance sheet cycle?

Worksheet: The fifth step in the cycle is the creation of a worksheet, which a company uses to make any adjusting entries needed to balance the books created during the fourth step. Add all the debit balances and all the credit balances together. If the two totals are not the same,...

What is the last step in the accounting cycle quizlet?

In the accounting cycle, the last step is to prepare a post-closing trial balance. It is prepared to test the equality of debits and credits after closing entries are made.

What are the steps of the accounting cycle quizlet?

Terms in this set (10)The Steps in the Accounting Cycle. 1) Analyze transactions. ... Step 1: Analyze Transactions. ... Step 2: Journalize the transactions. ... Step 3: Post the journal entries. ... Step 4: Prepare a worksheet. ... Step 5: Prepare financial statements. ... Step 6: Record adjusting entries. ... Step 7: Record closing entries.More items...

What is the 5 step accounting cycle?

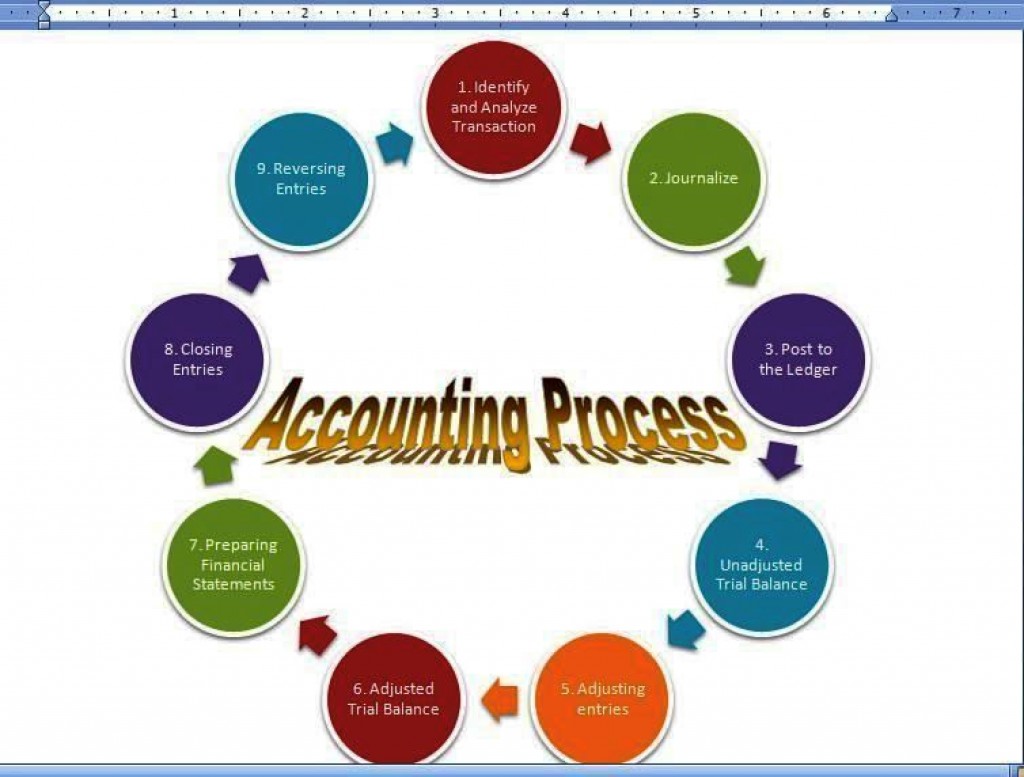

Explaining Accounting Cycle in Context Defining the accounting cycle with steps: (1) Financial transactions, (2)Journal entries, (3) Posting to the Ledger, (4) Trial Balance Period, and (5) Reporting Period with Financial Reporting and Auditing.

What are the last three steps in the accounting cycle?

Steps in the Accounting Cycle#1 Transactions. Transactions: Financial transactions start the process. ... #2 Journal Entries. ... #3 Posting to the General Ledger (GL) ... #4 Trial Balance. ... #5 Worksheet. ... #6 Adjusting Entries. ... #7 Financial Statements. ... #8 Closing.

What are the 7 steps of accounting cycle?

The Accounting Cycle: The Crucial Steps in the Accounting ProcessIdentifying and Analysing Business Transactions. ... Posting Transactions in Journals. ... Posting from Journal to Ledger. ... Recording adjusting entries. ... Preparing the adjusted trial balance. ... Preparing financial statements. ... Post-Closing Trial Balance.

What are the steps of accounting cycle?

The eight steps of the accounting cycle are as follows: identifying transactions, recording transactions in a journal, posting, the unadjusted trial balance, the worksheet, adjusting journal entries, financial statements, and closing the books.

What is the 10 Step accounting cycle?

The key 10 steps in this continuous process involved are identifying the business transactions, recording the transactions in Journal Book, Posting such recorded transactions to relevant Ledger accounts, preparing the trial balance, identifying the errors by preparing worksheet, passing the adjusting journal entries, ...

What are the accounting cycles?

The key steps in the eight-step accounting cycle include recording journal entries, posting to the general ledger, calculating trial balances, making adjusting entries, and creating financial statements.

What are the 5 major transaction cycles?

The Transaction Cycle model is one way to view basic business processes. The purpose of The AIS Transaction Cycles Game is to provide drill and practice or review of the elements that comprise the five typical transaction cycles identified as: revenue, expenditure, production, human resources/payroll, and financing.

What are the 9 steps in an accounting cycle?

The Nine Steps in the Accounting CycleStep 1: Analyze Business Transaction. ... Step 2: Journalize Transaction. ... Step 3: Posting To Ledger Account. ... Step 4: Preparing Trial Balance. ... Step 5: Journalize & Post Adjustments. ... Step 6: Prepare Adjusted Trial Balance. ... Step 7: Prepare Financial Statements.More items...•

What is the accounting cycle quizlet?

The accounting cycle is the process of gathering, preparing, analysing and reporting the activities of the business during one accounting period so that business and other decisions can be made.

What is the first step in the accounting cycle quizlet?

The first step in the accounting cycle is to analyze business transactions. The second step in the accounting cycle is to prepare a record of business transactions.

Are any steps optional in the accounting cycle?

Reversing Entries (optional) The preparation of reversing entries is the last step of accounting cycle and it is an optional bookkeeping procedure that is not a required step in the accounting cycle. A reversing journal entry is recorded on the first day of the new period.

What is the 6th step in the accounting cycle?

Step 6: Prepare financial statements First, an income statement can be prepared using information from the revenue and expense account sections of the trial balance. A balance sheet can then be prepared, made up of assets, liabilities, and owner's equity.

How many steps are there in an accounting cycle?

There are usually eight steps to follow in an accounting cycle. The closing of the accounting cycle provides business owners with comprehensive financial performance reporting that is used to analyze the business. The eight steps of the accounting cycle are as follows: identifying transactions, recording transactions in a journal, posting, ...

What Is the Accounting Cycle?

The accounting cycle is a basic, eight-step process for completing a company’s bookkeeping tasks. It provides a clear guide for the recording, analysis, and final reporting of a business’s financial activities.

What is the second step in the cycle?

The second step in the cycle is the creation of journal entries for each transaction. Point of sale technology can help to combine steps one and two, but companies must also track their expenses. The choice between accrual and cash accounting will dictate when transactions are officially recorded. Keep in mind, accrual accounting requires the matching of revenues with expenses so both must be booked at the time of sale.

What is a general ledger?

Once a transaction is recorded as a journal entry, it should post to an account in the general ledger. The general ledger provides a breakdown of all accounting activities by account. This allows a bookkeeper to monitor financial positions and statuses by account.

How is the accounting cycle used?

The accounting cycle is used comprehensively through one full reporting period. Thus, staying organized throughout the process’s time frame can be a key element that helps to maintain overall efficiency. Accounting cycle periods will vary by reporting needs. Most companies seek to analyze their performance on a monthly basis, though some may focus more heavily on quarterly or annual results.

Why is it important to know the amount of time for each accounting cycle?

Overall, determining the amount of time for each accounting cycle is important because it sets specific dates for opening and closing. Once an accounting cycle closes, a new cycle begins, restarting the eight-step accounting process all over again.

When is adjusting entries needed for revenue and expense matching?

In addition to identifying any errors, adjusting entries may be needed for revenue and expense matching when using accrual accounting.

How many steps are there in the accounting cycle?

If an investor can understand these nine steps of the accounting cycle, it would be clear to her how she should approach the company and its progress or decline. The knowledge of this cycle will help her decide whether she should invest in the company or not. And at the same time, she would get a concrete idea about the financial accounting

What is the penultimate step in the accounting cycle?

Closing the books. This step is the penultimate step in the accounting cycle. Closing the books means that all financial statements are prepared, and all transactions have been recorded, analyzed, summarised, and recorded. After closing the books , a new accounting period.

What is the Accounting Cycle?

Accounting Cycle is a process of identifying, collecting and summarizing financial transactions of the business with the objective of generating useful information in the form of three financial statements namely Income Statement , Balance Sheet and Cash Flows. It starts with an accounting transaction and ends when the books of accounts get closed.

What is a closing balance in general ledger?

Closing balances of the general ledger accounts prepare an unadjusted trial balance. In this trial balance the debit side records the debit balances, and the credit side records the credit balances. Then the debit side is totaled, and the credit side is also totaled.

What is financial accounting?

Financial Accounting Financial accounting refers to bookkeeping, i.e., identifying, classifying, summarizing and recording all the financial transactions in the Income Statement, Balance Sheet and Cash Flow Statement. It even includes the analysis of these financial statements. read more

What is an adjusting entry?

The adjusting entries are typically related to accrual adjustments, periodical depreciation adjustments, or amortization adjustments. These adjusting entries are required to prepare an adjusted trial balance. Creating adjusted trial balance. After passing the adjusting entries, it’s time to create a new trial balance.

Why is it important to record journal entries?

Recording the entries in the journal is essential since if there is any error at this stage of recording , it will linger on in the next books of accounts as well. Recording the journals into the ledger accounts.

What is post closing trial balance?

The postclosing trial balance shows that the general ledger is in balance after the closing entries are posted. It is also used to verify that there are zero balances in revenue, expense, and drawing accounts.

What is an adjusting entry in a worksheet?

Use the worksheet to journalize and post adjusting entries. The adjusting entries are a permanent record of the changes in account balances shown on the worksheet.

Why do we use financial statements?

Use financial statements to understand and communicate financial information and to make decisions. Accountants, owners, managers, and other interested parties interpret financial statements by comparing such things as profit, revenue, and expenses from one accounting period to the next.

What happens after revenue and expenses accounts are closed?

a. After the revenue and expenses accounts were closed, there was a zero balance in the Income summary account.

Which accounts have zero balances?

a. The asset, liability, and owner's equity accounts have zero balances.

Why is accumulated depreciation listed as liabilities?

On the balance sheet, accumulated depreciation is listed under liabilities because it has a credit balance.

How long does it take for a company to sell real estate?

A company buys and sells real estate property as its main business activity. Each piece of property is sold for cash within one year after it is bought. What type of asset is the property?

Did ABC make a profit in 2016?

Company ABC performed well in year 2016 and made a large amount of net profit. On December 31, 2016, the company used the income summary account to close the revenue and expense accounts.

Learn the eight steps in the accounting cycle process to complete your company's bookkeeping tasks accurately

The accounting cycle is eight basic steps that ensure a business fulfills its bookkeeping tasks accurately.

What is the accounting cycle?

The accounting cycle is a comprehensive process designed to make a company's financial responsibilities easier for its owner, accountant or bookkeeper. The accounting cycle breaks down a bookkeeper's responsibilities into eight essential steps to identify, analyze and record financial information.

Modifying the accounting cycle

Companies also modify the accounting cycle's steps to fit their business models and accounting procedures. One of the major modifications is made according to the type of accounting method a business uses. Companies may follow cash accounting or accrual accounting, or choose between single-entry and double-entry accounting.

The accounting cycle's 8 steps

Here's an in-depth look at the eight steps in the accounting cycle. Once you check off all the steps, you can move to the next accounting period.

Accounting cycle time period

A business's accounting period depends on several factors, including its specific reporting requirements and deadlines. Many companies like to analyze their financial performance every month, while others focus on quarterly or annual reports.

Accounting cycle vs. the budget cycle

The accounting cycle is not the same as the budget cycle. While an accounting cycle focuses on events during a specific period and makes sure financial transactions are accurately reported, a budget cycle is associated with future performance and helps plan future transactions.

Automating the accounting cycle with accounting software

Accounting software helps automate several steps in the accounting cycle and allows you to specify cycle dates, receive reports automatically, identify inaccuracies, and reconcile reports with ease.